Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Other Cards in the “Earn Back the Annual Fee” Series:

I’ve held The Business Platinum Card® from American Express since just before my daughter was born. In fact, her birth played somewhat of a role in my getting the card!

During those six years, the card’s benefits have changed here and there — as has its annual fee. I believe it was $550 when I first became a card member. Now it’s up to $895. (See Rates and Fees.)

As with most cards carrying annual fees — especially those in the mid-high hundreds — some people are understandably apprehensive about getting those products.

But if you’re considering getting the Amex Business Platinum — or already hold it — and need some ideas on how to get your money’s worth, below is how I recoup my $895 each year. (See Rates and Fees.)

Please keep in mind this is my strategy. Yours may be different. In fact, there are plenty of benefits I don’t use.

Let’s take a look.

(Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.)

(I’ll state the benefit name; its quoted benefit value; the next number reflects our running total.)

35% Pay With Points Rebate: TBD (Running Total: $525)

We’ll start out with the primary reason I hold Amex Business Platinum.

Amex Business Platinum members can earn back 35% of the Membership Rewards® points they use to purchase an eligible flight through American Express Travel®. (This benefit is capped at 1,000,000 points back each calendar year. Terms apply.).

What’s “an eligible flight”?

A first or business class fare purchased with Amex Travel or on a qualifying airline you select from a list of carriers. (Enrollment is required.)

For example, Delta Air Lines is my selected carrier. Any time I purchase a Delta airfare and pay with points at Amex Travel (at a rate of 1 point = 1 cent), I earn back 35% of those points.

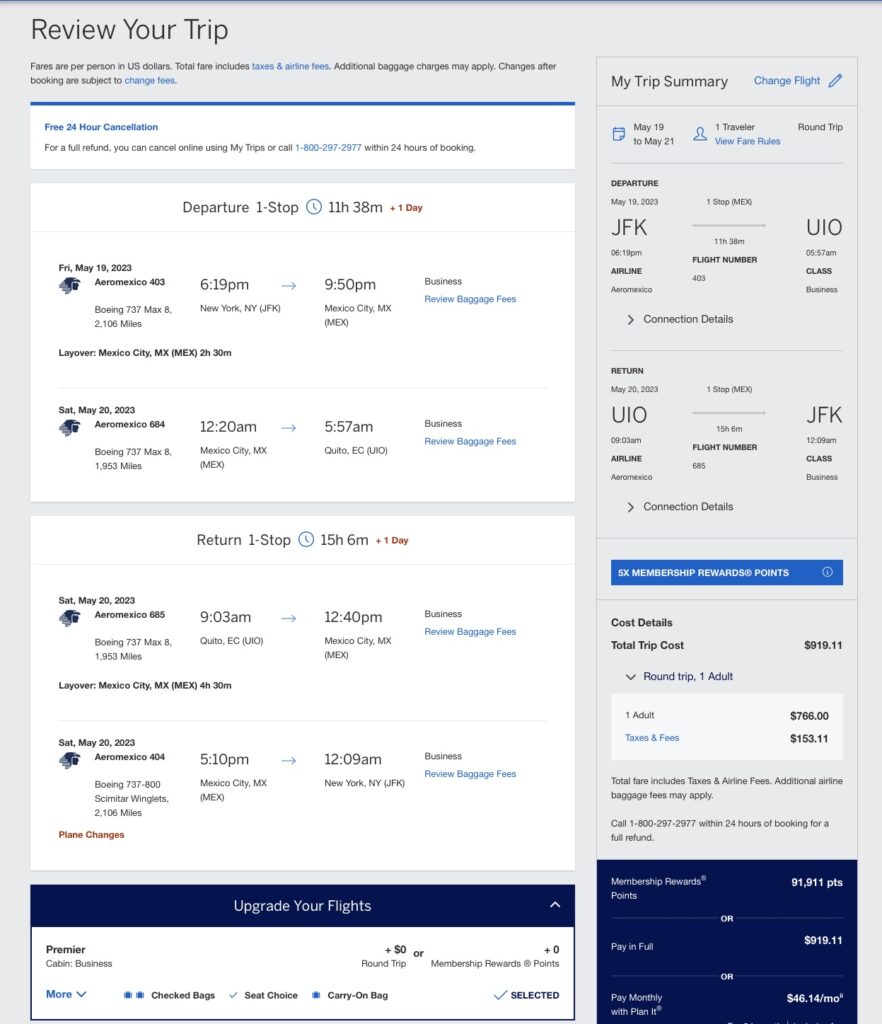

I can also buy something like the AeroMexico mileage run we recently posted and still earn back the 35% of however much I pay with points.

Why? Because it’s a business class fare.

Plus, these purchases are considered revenue tickets. Amex (presumably) pays the airline for your fare. So, you still earn any applicable redeemable miles and elite status points.

I usually redeem around 150,000 Membership Rewards points each year using this perk. The 52,500 points I earn back are worth at least $525. (Let’s be conservative and keep the math simple.) And that’s before I recycle and reuse those points again. And maybe again.

Airline Incidental Credit: $200 ($725)

The Business Platinum Card® from American Express members can earn up to $200 each calendar year on airline incidental purchases made with a qualifying airline they select through Amex. (Enrollment is required.)

- Alaska Airlines

- American Airlines

- Delta Air Lines

- Hawaiian Airlines

- JetBlue Airways

- Spirit Airlines

- Southwest Airlines

- United Airlines

When I’m stuck in coach during longer flights, I generally purchase a cocktail and Delta Flight Fuel box. That counts toward my annual airline indent credit.

There are also other ways to use the benefit. (My daughter is probably going to drain it every year 🙂 ).

Wireless Statement Credit: $120 ($845)

Cardholders may earn up to $120 in statement credit for purchases with U.S. wireless telephone service providers. (Enrollment is required and terms apply.)

The perk is divvied up into monthly $10 if-used installments. I charge at least $10 of my monthly Verizon bill to my Business Platinum Card. The balance goes on whatever card I’m chasing a minimum spending requirement or my company’s Ink Business Cash® Credit Card , which earns 5% cashback (as 5X Chase Ultimate Rewards® points) on the first $25,000 spent in combined purchases at office supply stores and on internet, cable, and phone services each account anniversary year (then 1%).

Dell Statement Credit: $400 ($1,245)

The Amex Business Platinum allows members to earn back up to $400 in statement credits each calendar year for purchases made through Dell. (Enrollment is required and terms apply.)

Cardmembers can earn back $200 from January through June. Then $200 from July through December. Like the other statement credit opportunities, these are if-used and do not roll over.

Granted, Dell doesn’t sell any many goodies as they once did. But I own enough computer and photography gear that I usually have no problem burning through the $200 each half-year.

I generally need to upgrade or replace some type of equipment every few months — and that’s how the Dell credit works for me. (I’m already counting down the days until July 1!)

Keep in mind: Dell and Amex often team up for Dell Amex Offers. You can split payment across multiple cards during checkout. Maybe one of your other cards was targeted but not your Business Platinum card. So, there’s usually a way to really save yourself some money buying stuff through Dell.

Remember to start your shopping session through a portal such as Rakuten or TopCashback. Those cashback earnings stack on top of your Dell statement credits!

Honorable Mentions

There are tons of Amex Business Platinum benefits I don’t use.

Why?

Because they overlap with other cards I hold. There are others I simply don’t use. However, they might be useful for you. Let’s check them out.

Complimentary Airport Lounge Access

Airport lounge benefits are practically a hallmark of AmEx Platinum cards. Many lounges feature beverages and food buffets. These can save you a lot of money if you usually visit airport restaurants and bars.

Amex Business Platinum members may visit lounges such as:

-

- Delta Sky Clubs when taking a same-day Delta-marketed and -operated flights.

- American Express Centurion Lounges when traveling on a same-day ticket with a confirmed seat

- Priority Pass Select participating lounges (enrollment required for membership)

- I can access Delta Sky Clubs and Centurion Lounges with my Delta SkyMiles® Reserve Business American Express Card — though access rules vary across Delta and Amex cards.

Priority Pass Select membership comes with a lot of travel-related credit cards. I have it with my Chase Sapphire Reserve® because that card still includes select airport restaurants as part of the benefit. Membership is also part of my Capital One Venture X Rewards Credit Card and The Platinum Card® from American Express ($895 annual fee, see Rates and Fees).

Indeed Statement Credit ($360)

Cardholders can earn back up to $90 per quarter (up to $360 each year) on eligible purchases made through Indeed. (Enrollment is required.) The benefit is worthless for me — only because I don’t use Indeed.

Adobe Creative Solutions Statement Credit ($150)

Amex Business Platinum members may earn up to $150 each calendar year on eligible annual prepaid business plan purchases with Adobe on Creative Cloud for teams or Acrobat Pro DC with e-sign for teams. (Enrollment is required.)

Those are too expensive for my budget — even with the statement credit benefit. My business doesn’t need them, either.

I subscribe to Adobe Photoshop — and use my U.S. Bank Triple Cash Card to pay for that monthly tab.

CLEAR Plus Statement Credit ($199)

I love CLEAR.

The Business Platinum Card® from American Express members can earn back up to $199 each year for CLEAR Plus membership fees charged to their card. (Enrollment is required.)

My membership is charged to my Amex Platinum. (But one of my family members charged her CLEAR membership my Amex Business Platinum.)

Global Entry or TSA PreCheck® Credit (Up to $120)

You probably hold at least one card that comes with this benefit.

Cardholders may earn back up to $120 in statement credit every four (4) years when charging a five-year membership Global Entry application fee to their card. Alternatively, they can earn back up to $85 every 4.5 years when charging a five-year membership TSA PreCheck® application fee to their card. (Enrollment is required for the respective benefit.) Keep in mind you can pay for someone else’s application fee and still earn the credit — it doesn’t have to be for you!

My Amex Platinum covers my Global Entry membership. That benefit also comes with other cards such as my Chase Sapphire Reserve®, Capital One Venture X, and Delta Business Reserve.

I gifted those cards’ Global Entry and TSA PreCheck benefit to family and friends.

Fine Hotels + Resorts

You may find Amex’s Fine Hotel and Resorts program an excellent value. (We’ve written about it run the past — this post may help.)

I get FHR benefits through my Amex Platinum — which also comes with a yearly statement credit of up to $200 or The Hotel Collection bookings with American Express Travel when paying with my Platinum Card®.

Complimentary Hilton Honors and Marriott Bonvoy Gold Status

Cardmembers are entitled to complimentary Gold elite status with both Hilton and Marriott. (Enrollment required.) This is also a benefit of my Amex Platinum.

This benefit’s value is very subjective. To be honest, I’ve never gotten much value out from these Gold statuses. Maybe a couple extra bottles of water here and there. I enjoy an extra hour or so of time before check out. (And that really can be valuable — when you really need it.)

Premium Private Jet Program

I can’t afford private jets. So, I’m not an expert on this one. 🙂

Final Approach

The Business Platinum Card® from American Express‘ $895 annual fee certainly isn’t cheap. But there are statement credit benefits that make it worth my while.

Do you hold the card? How do you use the benefits? Please share your thoughts in the below Comments section!

For rates and fees of The Business Platinum Card® from American Express, please visit this link.

For rates and fees of The Platinum Card® from American Express, please visit this link.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Nice template

$200 for bags and extra legroom, $400 Dell credit (although I’m running out of things to buy), $120 in cellular, Centurion Lounge and Delta Lounge when flying Delta (although I don’t travel that much I do use these some. Plus the AmEx offers are decent. I’ve gotten a lot of months of free showtime, paramount+, discounts at Dell which stack with the credit, Fedex discounts. I already have CSR which covers the better Priority Pass benefits. So it’s great as long as I can keep finding things to buy at Dell.

Slash’s point being that we’re seeing a lot of the following lately “Now it’s up to annual_fees. (card_name.)”. There are at least 3 in the first couple of paragraphs.

Come on, Chris, proofread your work.

@ChickB – post is fine – upgrade your internet speed and will display correctly.

I’m sure Slash thanks you for being his spokesperson. What you’re seeing are scripts that automatically populate certain information provided by our credit card affiliate. It’s a new system being implemented by that company.

I hope you feel better for blasting my “not proofreading” instead of just asking what was going on. As a longtime reader, I’d like to think you know that we’re fairly approachable.