Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Welcome to a regular-ish feature on Eye of the Flyer. This blog series covers in a “rookie” way either a Delta or travel-related theme and attempts to break down each topic to a basic leve. You can read up on all the previous posts HERE. Now on to our featured topic.

Plenty of credit cards tout 0% APR promotional offers for new applicants.

For example, the Chase Freedom Flex® offers new cardholders a 0% APR (i.e., no interest) on purchases made during the first 15 months of card membership, then 19.49% - 28.24% Variable. (All information about the Chase Freedom Flex® was collected independently by Eye of the Flyer. It was not reviewed by the card’s issuer.)

Even though you have a card offering 0% APR, you are obligated to make minimum payments. And I think that’s where some people — especially those new to credit cards and/or no-interest offers — may get confused.

I recently made a big purchase with a new 0% introductory APR card. I’ll walk you through the entire process from card selection to purchase to receiving my first bill.

Me: An Example

As some readers know, my 2019 MacBook Pro seemed to be dying an early death. I needed a new model ASAP. Even though I had the money, I didn’t necessarily want to pay the entire $3,000 right away — especially in the current economic climate.

My photo editing work was very slow because of the usual summer slowdown. But the SAG-AFTRA and WGA strikes made things even worse.

So, I really wanted a card with a 0% introductory APR.

I ended up with the Blue Business® Plus Credit Card from American Express. It carries an introductory 0% APR for the first 12 months, then 18.49% - 26.49% Variable. (See Rates and Fees.)

Great!

As I mentioned in this post, Amex also offered me 75,000 bonus Membership Rewards® points after spending $15,000 on eligible expenses within the first 12 months of card membership.

I bought my new computer (I love it!) and some accessories. I also moved almost most of my company’s business spending to the card.

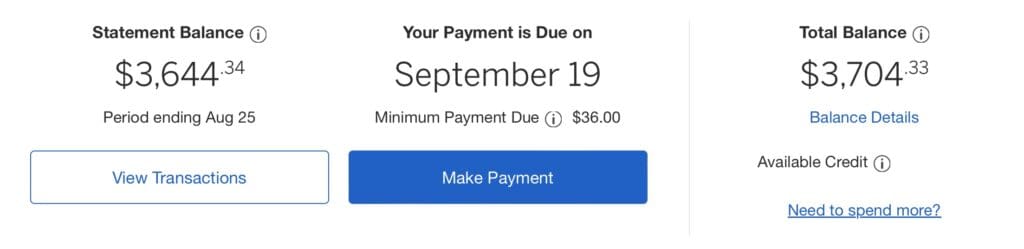

The statement arrived a few days later.

But why is there a minimum payment due? Don’t you have 12 months to pay off your balance?! you may ask.

If a card gives you a limited-time 0% APR, that doesn’t necessarily mean you won’t have a minimum payment due.

A no-interest/0% APR offer gives you time to pay off the entire purchase without paying interest — provided you make each month’s minimum payment on time. Using the above numbers as an example, I have 12 months to pay off $3,704.33 as long as I pay the minimum due every month. And if I stopped spending on the card altogether. But I’ll make many more purchases during the next several months.)

But if you fail to make the minimum payment, get ready for some ugliness. That will:

- Probably void the 0% APR offer

- Trigger an insanely high APR

- Accrue a late fee

So in my case, missing one minimum payment would be stressful and expensive.

Credit card companies literally bank on people screwing up. They know some people can’t keep up with payments — and will owe more than their statement balances. That’s true for pretty much every credit card out there.

Promotional Period

Let’s talk about the promotional periods for those no-interest offers.

A card’s running balance is covered during the promotional period. Let’s use the Ink Business Cash® Credit Card, which offers a 12-month, interest-free promotion right now. Purchases made during month 12 will have to be paid off when that period’s billing statement hits — otherwise, the current APR will trigger (which is currently 17.49% - 25.49% Variable)

So please don’t think anything you buy in that final month gets its own 12 months to be paid off.

So Should You Get a 0% APR Card?

Well, that depends on your budget and spending habits. If you have a plan to pay off your purchases, then a 0% APR card may work.

There may be bonafide emergencies when you may need a cushion for purchases you know you’ll soon get. That might be worth getting a 0% APR card (when those instances occur if you can wait a couple of days).

Don’t be that person. (©iStock.com/Jovanmandic)

It’s easy to charge a bunch of stuff — then suddenly find yourself on the hook for it. I learned the hard way about credit. If you find yourself saying, Oh, I have time to pay it off! What other fun stuff can I buy?! you might want to reconsider.

What Are Some Good 0% APR Cards?

Some of my favorite cards (that my wife or I personally have) currently running 0% APR promotional offers are:

- Chase Freedom Flex® (No annual fee)

- (All information about the Chase Freedom Flex®® was collected independently by Eye of the Flyer. It has not been reviewed by the card issuer.)

- Ink Business Cash® Credit Card (No annual fee)

- Blue Cash Preferred® Card from American Express (See Rates and Fees.)

- Blue Cash Everyday Card® from American Express (See Rates and Fees.)

Final Approach

Cards offering 0% APR promotions can be helpful and worthwhile — if you know what to expect and how to correctly use them. Make sure to have some plan how you’ll pay the charges.

Featured image: ©iStock.com/Pheelings Media

For rates and fees of the Blue Cash Everyday® Card from American Express, please visit this link.

For rates and fees of Blue Cash Preferred® Card from American Express, please visit this link.

For rates and fees of The Blue Business® Plus Credit Card from American Express, please visit this link.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

I did this once a few years ago dragging out the payments at 0% and religiously made the minimum payments on time but it hit my credit score hard that I was carrying a balance so my credit score dropped from 800 to 750. 50 points. So to me it was a mistake I will not make again. If I have the $3,000 I’d rather just pay it all upfront.

Interesting, Frankie. Thank you!

I found the same as @Frankie. Even paying minimum payments and having a perfect payment record my score dropped to less than 800 as a result of doing a few of these. Other things to beware of are if you do a balance transfer. In some cases, from then on, until you pay the balance, any purchase you then do on the card will accrue interest immediately, even if the balance transfer rate is 0%. Nevertheless if the alternative is taking the money from an IRA, and you think you will eventually have the money, even with paying the transaction fee, it’s better than paying a 10% early withdrawal fee.