Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

My wife and I each hold dozens (literally) of credit cards. A bunch of them have no annual fees, but several others carry a yearly fee. Now that I am no longer chasing Delta Diamond status, I have chosen to dump what I at one point held, which is four Delta Amex cards: a personal Delta SkyMiles® Reserve American Express Card and Delta SkyMiles® Reserve Business American Express Card and personal Delta SkyMiles® Platinum American Express Card and Delta SkyMiles® Platinum Business American Express Card. If I were chasing status, it would be worth it for all four of these cards to net an amazing $10,000 ($2,500×4) MQD credit to lower my yearly need for Delta ticket spend down to $18,000 to keep Diamond status.

I also hold a bunch of small annual fee cards that yield things like a free hotel night (hello IHG cards) or cards that they will have to pry out of my cold dead hands like my Chase Sapphire Reserve® card that gives me 1.5 cents when booking a cruise (I cruise a lot) and other travel. The annual fee is so worth it with the massive $300 travel credit lowering the fee into something palatable. I could go on and on and go over every single card I hold but that is not the point of today’s post.

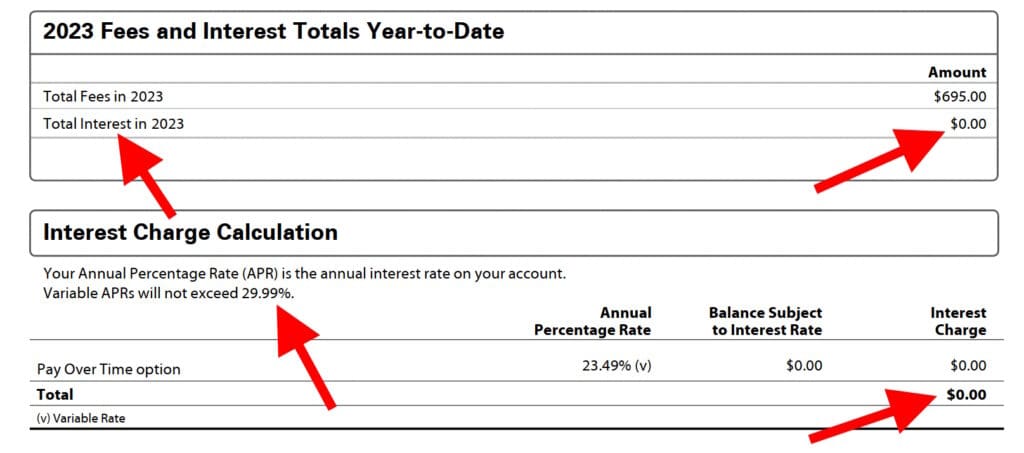

I mentioned in the post title there are some folks who should not be going for travel cards. Who are those folks? Well, take a look at the screen shot from my 200,000 bonus Membership Rewards points after you spend $20,000 on eligible purchases on the card within the first three (3) months of being approved for card membership. Terms apply. card (not the Delta one, BTW). While I am paying a large yearly fee for this card the perks and the many, many, many yearly credits for all kinds of travel perks (and offers) help wipe out the mega fee. But did you notice the most important part of the yearly summary?

I PAID ZERO IN INTEREST!

For not just this card but all of the dozens of cards both my wife and I hold – neither of us during 2023 paid a single cent in interest. I mean, again, looking at the arrows in the screenshot above, if you are paying Amex 29.99% in interest, you need to be hospitalized for clinical help, as that is beyond crazy and insane. As a comparison, I am THRILLED to have a CD paying nearly 6% and would love to have something paying me nearly 30% interest, but I get that is not gonna happen.

The point is that if you ever pay a single penny in interest, you should not be going for or holding travel cards. The rewards we are going for are sometimes as low as 1-2% net after fees depending on the deal (yes often much higher like 4-6% or more if you know what you are doing) but the point is you simply MUST be able to 100% pay off your cards in full either before the statement bills or well before the due date to ensure you never EVER pay any interest because if you do you are blowing the rewards down the drain. Let’s look at another.

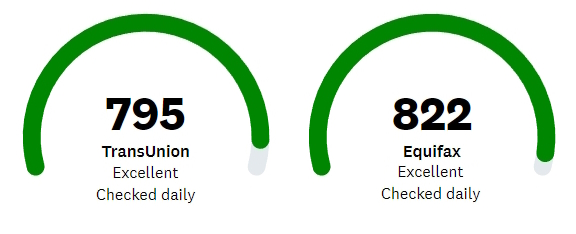

Holding dozens and dozens of credit cards and hundreds of thousands in available credit at my disposal helps my credit score high rather than hurting it. As you can see in the shot above of a recent look at my score I almost always hold around or over an 800 credit score. Keeping this high score results that when I choose a day to go for a bunch of new cards they almost always result in approval after approval after approval and a huge haul of points adding to my points portfolio. But this may not be you.

If you do not have a strong credit score (say well north of 700 and maybe near or over 750) you should not be going for a bunch of cards per year. It is better for you to get a few cards per year and work on building up your score to make you much more likely to be able to go for a bunch of cards per year with instant approval on all or almost all of them every time you try.

The last point in this post, that is somewhat off topic but worth mentioning: is if you have never gone for any you really should consider doing so. They’re great tools and another avenue to earn plenty of points you can turn into even more travels.

Any questions? Feel free to fire away in the comments below. – René

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Credit cards borrow money. Never borrow money unless you make a profit. Always make your profit nontaxable.

Hi Rene,

Great advice, I too have several cards and have never paid any interest.

Question for you, I know Delta has done away with MQM’s but I haven’t seen my role over MQM’s that we are supposed to be able to convert to Miles or MQD’s, do you know when that is supposed to happen? or am I not looking in the right place?

Thanks,

We should see the rollover MQM hit our accounts sometime around February 28.

That credit score screenshot looks an awful lot like Credit Karma. If that’s the case, it’s pertinent to note that CK offers VantageScore 3.0 scores. This is good for a rough look at score, but know that almost all issuers describe in their terms that they base credit evaluation upon FICO 8.0 or similar FICO calculation. VantageScore and FICO weight things a bit differently in their calculations. Still, I completely agree that potential applicants should be aware of their scores prior to chasing travel cards.