Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some of the links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

I recently wrote that a couple of my American Express cards are up for renewal. I placed a successful retention call for my personal/consumer Amex Platinum Card.

My next task: make a retention call for my The Business Platinum Card® from American Express. Last year, I received a $100 statement credit. Would AmEx give me a statement credit, spending challenge, or nothing at all?

(Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.)Reasons for Keeping the Card

I enjoy the Amex Business Platinum Card for the most part. The 35% rebate on eligible airfare purchases paid with Membership Rewards points (up to 1,000,000 points back each year; terms apply) is the main reason I hold the card.

Plus, I always use my $200 semi-annual Dell credit (enrollment required).

And I like the $10/month US wireless credit (enrollment required) to help offset some of my cell phone bills.

But I also had what I thought were some compelling reasons to cancel the card.

Reasons for Canceling the Amex Business Platinum Card

Before making the call, I scribbled out my grievances against the card.

Annual Fee

The card’s annual fee is $695 (See Rates and Fees.) I pay several thousand dollars a year in AmEx annual fees (though I find ways to earn them back).

Overlapping Benefits

A bunch of The Business Platinum Card® from American Express benefits overlap with several of my other cards:

- Earn up to $200 statement credit for incidental purchases made with an eligible airline you select (enrollment required)

- Available with The Platinum Card® from American Express ($695 annual fee. See Rates and Fees.)

- Delta Sky Club access

- Centurion lounge access

- Priority Pass access:

- Contracted lounge access at several airports. I get this with my Amex Platinum Card. Plus, I get that and select airport restaurant benefits with my Chase Sapphire Reserve®. Amex got rid of that feature a few years ago.

- Marriott Gold and Hilton Gold Status (enrollment required)

- Also available with The Platinum Card® from American Express

- Global Entry or TSA PreCheck Application Fee Credit (enrollment required)

- Earn up to $199 CLEAR® Plus Membership Statement Credit (enrollment required): The Platinum Card® from American Express

So why keep the card when I access those benefits with others in my credit card arsenal? That was another argument.

Dell Statement Credit

Wait, what?! you may say. He’s talking about why the Dell statement credit is a reason to cancel a few minutes after he gushed about it?

Hear me out.

Since my photo editing jobs picked up, I needed to add and replace some supplies in my kit. I’m talking essentials like card readers, ethernet hubs, various cables and cords, a mouse pad, a mouse, and stuff like that I hadn’t used since March 2020. That’s where my Dell statement credit went.

But Dell got rid of a few big-ticket items, such as televisions. I need to replace the one in my office. And other products (monitors, etc.) are cheaper on Amazon.

So that was another point to bring up.

Adobe Statement Credit

The Business Platinum Card® from American Express members can earn up to $150 in statement credits each year on annual prepaid plans for eligible Adobe Creative Cloud for teams and Acrobat Pro DC with e-sign for teams purchases made with the card. (Enrollment required, terms apply.)

I subscribe to PhotoShop and LightRoom for my photo editing work. That’s $9.99 each month.

The going rate for a Creative Cloud for teams annual plan is $958.88.

Yeah, the Adobe statement credit is useless for me.

Indeed Statement Credit

Cardmembers can earn up to $360 in statement credits each year for select purchases made with Indeed. (Enrollment required, terms apply.)

Do I use this feature?

Indeed, I don’t. (Oof, that was a stretch. Sorry.)

The Call Chat

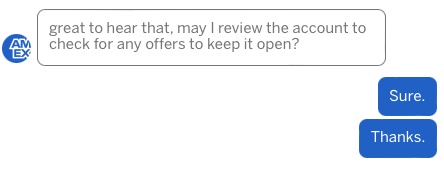

For this retention communication, I decided to try AmEx’s chat feature.

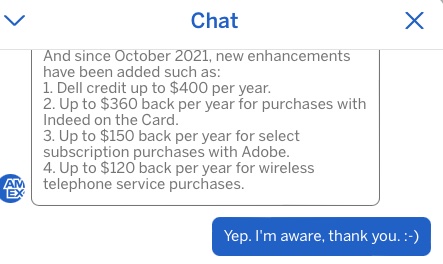

The rep predictably copied and pasted the card’s 2022 enhancements.

Then the rep gauged my interest in any possible retention offers.

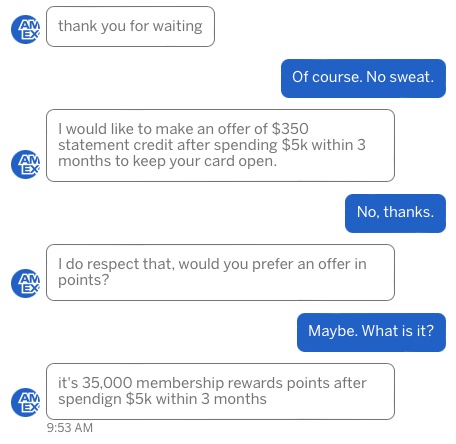

Whaddya know? Two offers were available.

Whaddya know? Two offers were available.

I can get more value from 35,000 American Express® Membership Rewards® than I can $350. So, I opted for the Membership Rewards and am hacking away at the $5,000 minimum spending requirement.

Final Approach

It was time to renew my Amex Business Platinum Card.

Even though I planned to keep the card, I decided to see if AmEx wanted to give me any reason to put more spending on the card or put my purchases on other products. I’m fairly pleased with the retention offer. Have you gotten a retention offer for the AmEx Business Platinum Card?

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some of the links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I did it through the chat last week and was offered a $695 credit. Reasons for canceling were the increased fee, new lounge access rules and annoying credits that I need a spreadsheet to track. Of course I accepted since I can take advantage of the airline (United travel bank) and Dell credit (Microsoft gift cards) a couple more times for free.

Congrats, Mike!

Amex stays in business from people who use twisted logic like this to rationalize the economically unwise decision to pay them $595 – at least better than $695 – for the privilege of keeping their shiny card for the meager benefits it offers. I was afflicted with this for 25 years but after successive annual fee increases and reduction of real benefits with quasi-coupons, I was able to cure myself of that affliction. Amex Platinum is a grossly overpriced product – even with the small retention credits – given what you really get and what you need to spend to get it.

If someone makes it work for their given budget, it’s not necessarily unwise.

I make several thousand a year just by using the card for business expenses…. not sure what’s unwise about that. If the fee is a problem the card isnt meant for you.

Better to close it and open a new NLL Biz Plat quarterly if you can swing the spend.