Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Amex just refreshed its American Express® Business Gold Card.

We all know what that means: there are some new benefits and features. A few are going away. And, of course, an annual fee change.

So, let’s break down the refreshed Amex Business Gold!

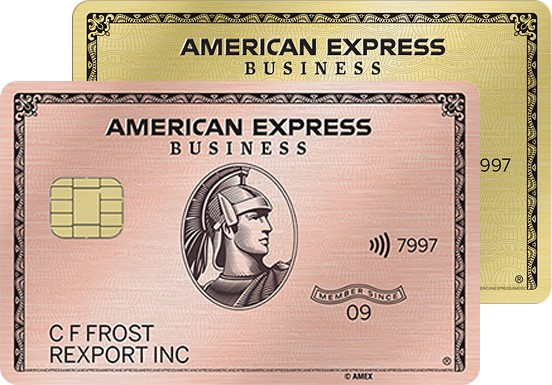

A New Card Color

The first change is an aesthetic one: the Amex Business Gold is now available in two colors: traditional Gold and now Rose Gold.

Annual Fee

The card’s current $295 annual fee increases to $375 for applications made or renewals on February 1, 2024, or later.

So, you still have a while to take advantage of the $295 annual fee.

Bonus Categories

The Amex Business Gold automatically earns 4X Membership Rewards points in the top two (2) eligible categories where a business spends the most during a billing cycle. (This applies to the first $150,000 in combined purchases each calendar year.) I like that the card makes this sort of a set-it and forget-it; you don’t need to do any work like selecting your favorite categories.

Three new eligible categories were added, effective immediately.

- U.S. wireless telephone services charges

- Transit purchases

- includes trains, taxi cabs, rideshare services, ferries, tolls, parking, buses, and subways

- Purchases made directly with U.S. electronic goods retailers or software and cloud system providers

Those join the already-existing categories:

- U.S. restaurants, including takeout and delivery

- Online, television, and radio advertising made from U.S. media providers

- U.S. gas stations

- superstores, supermarkets, and warehouse clubs that sell gasoline are not considered gas stations

I really like the wireless provider and transit additions. Cell phone-wise, though, Ink Business Cash® Credit Card still outperforms the Business Gold (unless you have a huge wireless bill).

You’ll notice two sunsetting categories: airfare booked directly with airlines and U.S. shipping services.

I know people who will be quite upset with those subtractions. Losing airfare is a bummer, I think, for most people who hold the card. The shipping service category is a major hit for some people — especially for folks who sell items online and ship them from in-house.

But they’re all live (as per the terms and conditions) right now.

Nearly $400 in Statement Credits

Amex introduced a pair of statement credit features that can yield up to almost $400 back each anniversary year.

The more lucrative is the card’s “$240 Annual Flexible Business Credits” feature. Amex Business Gold cardholders may earn up to $20 in statement credits each month when using the American Express® Business Gold Card for eligible U.S. purchases at FedEx, Grubhub, and office supply stores. This can end up saving members up to $240 each year. (Enrollment required.)

The other is a Walmart+ statement credit. Cardholders may earn up to $12.95 (plus applicable taxes) each month when using the Amex Business Gold to pay for a monthly Walmart+ subscription. (The subscription is subject to auto-renewal and enrollment is required.)

25% Pay With Points Rebate: Going Away

Longtime readers of this blog know that I love The Business Platinum Card® From American Express because of its fantastic 35% Pay With Points rebate.

The Amex Business Gold featured basically the same thing — except 25%

Now, here’s the bad news. That perk no longer exists for the Amex Business Gold. (But, unless something changes, will remain part of the Amex Business Platinum.)

Final Approach

There are a number of changes to the Amex Business Gold. Right now is pretty much the best time time to take advantage of the card: you can enjoy all eight bonus categories until they drop down to six in February. Plus, you still have the 25% Pay With Points feature in play, too.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Refreshing is fine——however, one of the largest cell phone carriers, T-Mobile, no longer accepts ANY credit cards for payment of monthly cell phone charges! That’s something AMEX also needs to negotiate!

I don’t know that just Amex can do that. I’m sure Visa and Mastercard would like a word.

With my T-Mobile account, you can still use a card (I just logged in and checked) but you will just not be eligible for the $5 autopay discount, if you have autopay set up. You must draw on a bank account for that.

Same thing with my Verizon account. They accept credit cards but not for autopay.

Interesting. I was able to set up autopay for my Verizon account using my new AMEX business Platinum card. I will lose the $5 discount, but that card will provide a $10/mo statement credit so I will still come out ahead $5/mo. BTW, the only credit card that maintains the $5 discount is the Verizon card, which also earns 2% on Verizon charges,

Je souhaite demander une autre carte American Express Card Gold

If you want to apply for a new American Express Card Gold account, we have links on this page.

If you want to apply for a new American Express Business Card Gold account, we have links on this page.

If you already have accounts and just need to add additional card members or you lost your card, get in touch with American Express (their website or app can help you).