Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some of the links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Delta flyers: we need to talk.

I know many of us are American Express loyalists. After all, Amex offers seven co-branded Delta American Express cards that offer some great benefits for SkyMiles members. Plus, American Express Membership Rewards points can be transferred to Delta.

So using another credit card company like Chase, Citi, or Capital One makes some people a little skittish.

But Capital One just disrupted the premium travel benefits and rewards credit card world. How? It introduced the Capital One Venture X Rewards Credit Card.

I know, I know. Capital One has, to me, been a company with fairly meh credit cards. Nothing bad — but nothing too exciting. And Sam Jackson yelling about what’s in my wallet didn’t do anything for me. The ads featuring (the very kind) Jennifer Garner were a little too corny for me. (And I love corny and schmaltzy!)

But the Capital One Venture X Rewards Credit Card will be the next card for which I apply. And Delta people, you really should consider it. Not necessarily to replace our beloved American Express or Chase cards. But as a solid complement.

I sense some sweaty palms and lip-chewing going on. Keep calm and read on about these five reasons why the Capital One Venture X Rewards Credit Card card belongs in your arsenal.

“What’s the Annual Fee?!”

We’ll get this out of the way first. The Capital One Venture X Rewards Credit Card carries a very recoupable (and then some!) $395 annual fee. But the statement credits and bonus points are travel-oriented — and simple to use. In fact, you should end up earning at least $400 back each year.

Before you get into a tizzy, read through the below points.

Welcome Offer: Over 75,000 Points (Very Helpful for Flights — Especially Partner Mileage Runs!)

The Capital One Venture X Rewards Credit Card offers new cardholders 75,000 bonus points when they spend $4,000 total on purchases within three months of card membership approval.

Consider, too, that each purchase earns a base 2X points. So even if you don’t spend a penny in the bonus categories (we’ll talk about that in a second), that $4,000 earns you 8,000 points.

Combine those 8,000 points with your 75,000 bonus: you’re 83,000 points richer, my friend.

Those points can be redeemed at a penny each through the Capital One travel booking site. So 83,000 points is worth $830 in travel.

That makes a heck of a dent in — or completely covers — many Delta partner mileage runs.

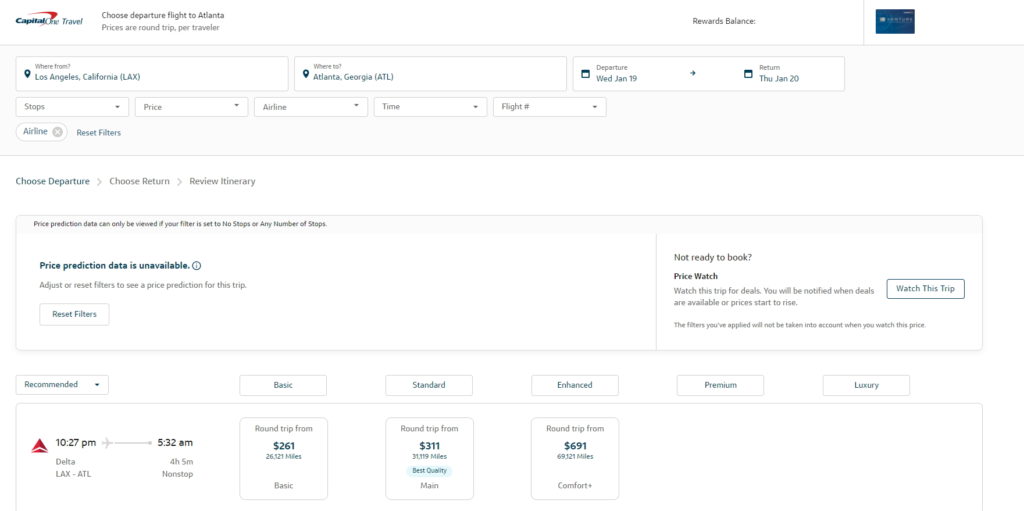

You can also book Delta flights through Capital One. Again, redeem the points for a penny per. Apply your SkyMiles number to your reservation and you’ll earn MQD and redeemable SkyMiles.

$300 Annual Travel Credit — Starting Year One!

This is fantastic.

The Capital One Venture X Rewards Credit Card offers up to $300 statement credit for travel purchases made through the Capital One travel site. The benefit is offered each year you hold the card — including year one.

Again, you should earn redeemable airline miles if you apply your frequent flyer number (i.e. SkyMiles) to your reservation made through Cap One Travel.

10,000 Bonus Points Each Anniversary Year

Capital One Venture X Rewards Credit Card members are gifted 10,000 points each anniversary year (starting year two). So $100 worth of points plus $300 statement credit for travel = $400.

See why I’m not sweating this card’s annual fee?

5X on Air Travel Booked Through Capital One Travel

Capital One Venture X Rewards Credit Card cardholders earn 5X points on airfare purchased through Capital One Travel.

Keep in mind the high-ticket Delta Reserve Amex cards earn 3X on Delta flight purchases. (5X this year but that soon disappears.)

That could be a non-starter for some people. Remember that three Chase cards with lower or no annual fees also offer that bonus when booking through Chase Ultimate Rewards®.

- Chase Freedom Flex® (no annual fee)

- Chase Freedom Unlimited® (no annual fee)

- Chase Sapphire Preferred® Card ($95 annual fee)

10X on Hotel and Rental Car Reservations Made Through Capital One Travel

Capital One Venture X Rewards Credit Card cardmembers earn 10X points on hotel and rental car bookings purchased through Capital One Travel.

Consider that most hotel and rental car bookings through online travel agencies (OTA) such as Capital One Travel do not qualify for elite status earnings or benefits when you show up on site.

That said, I’ve gotten lucky a few times — and my elite status has been honored for upgrades and points earnings. But this is very much a your-mileage-may-vary sort of thing.

It just depends on what’s more important to you: points earnings or a potential upgrade and hotel (or rental car) points.

Honorable Mentions

Four other features make the Capital One Venture X Rewards Credit Card rather appealing.

Up to FOUR Additional Users at No Cost

Primary account holders can add up to four additional cardholders at no additional cost.

Airport Lounge Access

Capital One Venture X Rewards Credit Card cardholders receive complimentary admission to a couple of airport lounge programs:

- Capital One Lounges

- Priority Pass Select

Many Delta flyers have an Amex card giving them access to Delta Sky Clubs and/or The Centurion Lounges and Suites by American Express. So it might not be too big of a deal. But if you don’t yet have Priority Pass access, this is certainly a decent option.

Up to $120 Global Entry or TSA Pre√ Application Fee Reimbursement

Like, is a travel card really a travel card if it doesn’t offer this benefit? 🙂

Final Thoughts

I’m very impressed with the Capital One Venture X Rewards Credit Card and can’t wait for it to be in my wallet.

The Capital One Venture X Rewards Credit Card is a very good complement to your other credit cards. Use it in conjunction with your Delta Amexes and other cards.

I don’t plan to spend much at all next year on my Delta Reserve card, so I’ll get this card and love the heck out of its welcome bonus and $300 statement credit. I’m also eager to visit the new Capital One Lounge.

What do you think about the new Capital One Venture X Rewards Credit Card card? Please share your thoughts in the below Comments section!

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some of the links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Can you please explain what any of this has to do with Delta flyers. These are the basics of the new card that would apply to all applicants so what exactly is the Delta reference for?

The points and statement credit can be used to offset Delta flights and Delta partner runs purchased through Cap One Travel. The card offers 5X on airfare purchased through Cap One Travel. That’s better than any of the Delta cards.

I was hoping for a nuanced look at how Delta flyers could take advantage of this card. Just reads like a generic shill post.

As I explained to Christian: The points and statement credit can be used to offset (or completely pay for) Delta flights and Delta partner runs purchased through Capital One Travel.

The card offers 5X on airfare purchased through Capital One Travel. That’s at least two points more than any of the Delta Amex cards (when Amex isn’t running any promotions).

The card basically pays for it for itself and then some. So it’s good to have in addition to Amex cards.

Which would be a horrendous use of points! One cent per point? Meh. I could buy Delta flights with the Chase Sapphire Reaerve or AmEx Platinum at 1 cent per point. Plus, AmEx has exclusive discounted fares on Delta flights AND you get SkyClub access with the Platinum card. This post is pure drivel.

Where can we find these “exclusive discounted fares on Delta flights”?

Membership Rewards Insider Fares

Right — but those aren’t necessarily exclusive to Delta. (Although I know the above post is Delta-related.)

Absolutely none of what you wrote makes any kind of argument towards this card not being worth it as a basically free complimentary card with added perks. And you cant possibly be talking about MR insider fares as “exclusive discounted fares on Delta flights” since they rarely even apply discounts to delta. A good 95% of those discounts are for AA flights only. You’re just posting drivel, being argumentative for kicks, and i dont even know why anyone is bothering humoring you.

Seems like a great way to get a better version of Priority Pass!

Just before the pandemic started, I dropped my non-Delta AMEX Platinum card and replaced it with a US Bank Altitude Reserve card. A big factor was 12 GoGo passes each year, but that benefit is going away in March.

The cost of the US Bank Altitude Reserve card is $400/year, but there’s a $325 credit for any travel-related charges. Points are worth 1.5 cents, any reservations made through US Bank’s portal earn 5X points, and there are 3X points for any other travel purchases and for mobile wallet purchases (which works well for grocery stores, Costco, etc.) The card includes Priority Pass select, but there is a limit of 4 free visits per year. The PP limit has not been a big deal during the pandemic, but it would be nice to have more PP visits, especially if I travel more internationally.

Given the fact that the WiFi passes are going away and I plan to travel more and it would be nice to have more PP visits, the Capital One Venture X card sounds like a great option. Do you know how long the promotion will last?

We haven’t been told when the promotion expires. Given that it’s a new card, I’m guessing it’ll be around for a while.

Will I be able to slide my regular $95 annual fee Venture card points over to the Venture X card and cancel the $95 annual fee card?

Yes

Have you personally booked with the portal and verified status was applied to flight and miles etc were added to the account? I’ve had issues where AmEx travel had the option but it didn’t end up crediting to the loyalty account I entered in the portal.

I haven’t yet booked with Capital One but haven’t heard of any problems. When you booked through Amex Travel, did your frequent flyer number port over to the airline reservation in question?

Chris,

I found this “review” of the venture X card educational. I would not have considered looking at it otherwise. I currently have a non DL Plat Amex, DL Reserve and Plat Amex as well as a Bonvoy Amex and IHG Chase card. And a citi AA card that I have had for over 20 years

I also have a regular Amex that I almost never use that also gets amex points.

I use the companion tickets from the to DL Amex cards. for instance using one to fly to vegas 1st class which was a $1200 ticket. I also got a second Reserve card for my GF so it gives her sky club access.

With the increase of the annual fee of the non DL plat amex, I was thinking of dropping it. This may be a good replacement as it has better priority club benefits.

Don’t you get more value by transferring points to the airline and booking directly? I always thought booking through these travel portals was a poor use of points. Why wouldn’t I stick with Amex platinum and transfer those points directly to Delta?

You can do that, too.

Again: this is a good “and” card. As in “Your Amex Platinum and Capital One Venture X…”

IMO the main feature of Capital One is their $1 = 2 points for everyday spend vs Delta or AMEX cards which is $1 = 1.35 point after discounts and point rebates. However that doesn’t offset the 2/1 point of spend ratio. Unless you are using AMEX Plat for the 1.5 point credit on charges of $5000+ coupled with their 35% points rebate Capital One is the better value – agnostically speaking.

Just clarifying: it’s the Amex Business Platinum that has the 1.5X on $5k charges and 35% Pay With points rebate.