Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

A year-end tradition is fully underway here at the blog.

We’re hearing from readers who are concerned about reaching their Delta Amex Status Boost/bonus MQM thresholds before the clock strikes midnight on New Year’s Eve. Even if you didn’t qualify for status this year (or last, I guess), you might still be chasing MQM because all of them roll over to next year — regardless of Delta status level.

And here’s where problems are creeping up.

Status Boost Totals vs Actual Qualified Spending

Please, please, please do not use the Status Boost counter on your Delta Amex Platinum or Reserve’s account page on American Express’ website as the be-all, end-all when it comes to your eligible spending.

![]()

We wrote earlier this year that Amex was having problems getting the darn thing to work. It appears that the tool still might not be up to snuff. My Status Boost totals are off by over a thousand dollars. (Other readers are in the same boat.) I hit my spend thresholds a couple of months ago — and always go over by about $1000-$15000 (painful as that is) just in case something wonky happens. (I have authorized users on my cards who sometimes forget to tell me when they return things late in the year.)

I treat the Status Boost counter as a good guideline. But I don’t depend on it for my actual spending numbers.

(In fact, I logged into my Amex account the other day and it said my Delta SkyMiles balance was zero. So that bell and whistle were off by hundreds of thousands of points. So that’s why I don’t take too much stock in those counters.)

Keep in mind that annual fees, late fees, cash advance fees and charges, and interest charges do not count toward eligible spending as far as Status Boost is concerned. People have burned themselves in the past by not realizing this.

So here’s what I recommend doing now:

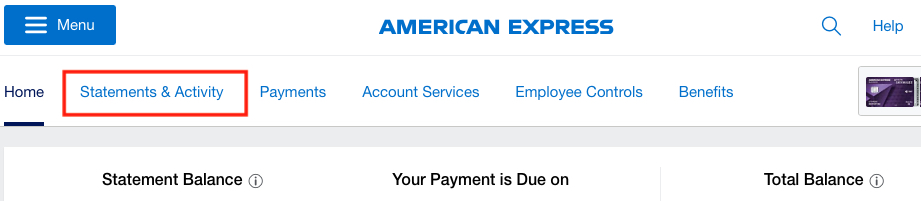

Log on to your Delta Amex account at American Express. Select “Statements & Activity”

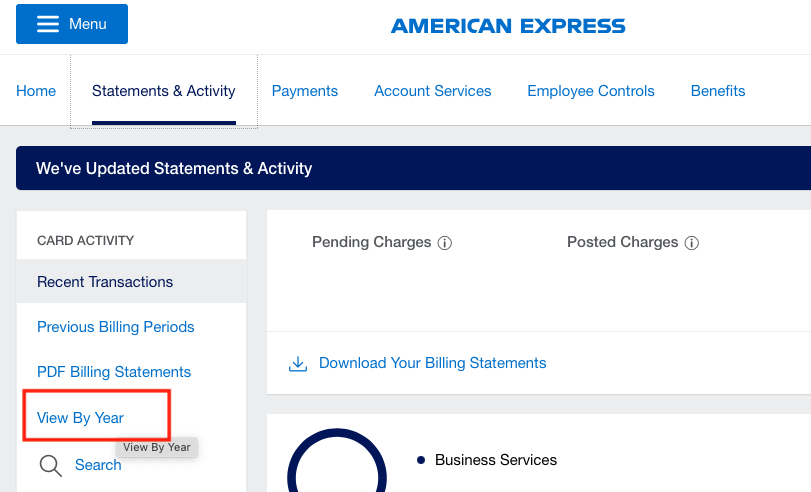

Select “View by Year”

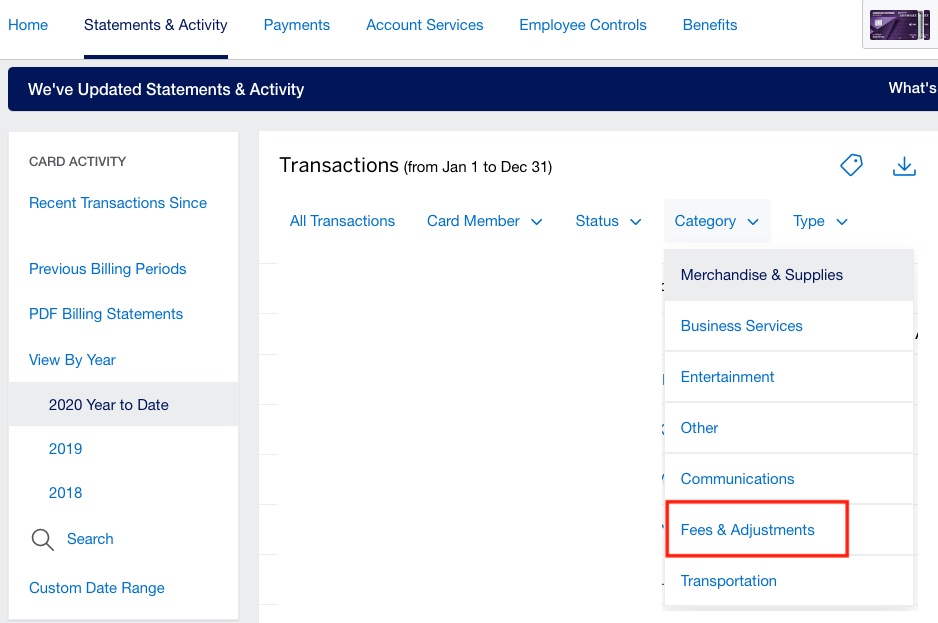

Scroll to the bottom of the page and you’ll see a sum of everything you’ve spent this year. Write down that total number. Let’s say it’s $30,300.

Then go to Category –> Fees & Adjustments

This will show you, well, the fees and adjustments you’ve paid this year. So if you have the Delta Reserve Amex and paid $550 toward the annual fee, that’ll be reflected on this page.

Get the sum of your fees and adjustments. Unless you racked up a ton of fees and interest or got Amex to knock a bunch off your account, this section should be one or two lines.

Subtract that from your Year to Date totals. In our example: $30,300 – $550 = $29,750. You’re $250 short of that $30,000 threshold. Yikes! You have to make some purchases that’ll post December 31 or sooner.

Or if you’re positive that you met the threshold and Amex is somehow wrong, give them a call ASAP.

How Can You Rack Up Spending Now?

If you find yourself short of a bonus MQM spending threshold and can afford to reach it, here are a few ideas that may save you the heartache of missing out on MQM.

- Load up your Amazon balance

- Prepay your cell phone bill

- Prepay your insurance

- Prepay utility bills

- Stock up on groceries from Instacart

- Make a donation to Kiva.org

Those are six examples that came me off the top of my head. You, of course, know your expenses, budget, and spending habits (gosh, at least I hope so). So do some quick thinking and figure out what you can right now spend.

Final Approach

For the next week, we’ll hear from readers who just missed their MQM spending thresholds. Some will ask for last-minute suggestions. Others will write to us in early January and ask “if there’s anything (we) can do” to help convince Delta or Amex to “do something just this once.” (Sorry, no. We’re not that powerful. 🙂 )

So take a few minutes right now to check your spending totals — and then enjoy your MQM!

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Thank you for this very helpful info. I had no idea this was available.

Chris – Does your total spending include pending charges?Thanks! Tom PS: What benefits if any if I hit 30,000 with Delta Reserve card?

Total spending doesn’t include pending charges. When you spend $30,000, $60,000, $90,000, and $120,000 (total) within a calendar year, you receive 15,000 MQM each time. Except during 2021, it’ll be 18,750 MQM — thanks to a special promotion they’re running next year.

Thanks Chris! Tom

Thank you, Chris!

Thanks. Going to do my check momentarily.

Question, are miles applies when the purchase is made or only when the purchase is paid off?

If I had $3000 worth of flights not paid off for three months ( I know,I know, it’s just an ramp leading) would I get the miles applied when the charge posts or the following month, or only when the charge is paid off, in this example three months later. Thanks for your help

When a purchase posts, that’s when it officially counts as spending toward a threshold. I’ve had MQM bonuses trigger when a monthly statement is issued (if your January statement contains December purchases that count toward a threshold, you’re fine. The MQM will apply retroactively.). My most recent MQM bonus hit within a day or two of my crossing a $30k mark — and that happened a week or so before my statement was issued.

Ah ok.

And is that the same for not threshold but just earning miles from the cards?

Charge $500 on flights today and payoff in 6 months. But I get the miles today? (Not condoning. Just confirming)

@Phil g – You earn when you charge and post not when you pay off. But paying interest on a CC is never EVER wise.

Thanks. This is an important and timely reminder. I would have just missed my MQM boost, because of forgetting about the annual fee.

An easy way to meet the spend is do a 2020 tax estimate using pay1040.com for a cost of 1.87% (getting MQMs for 1.87% is cheap). If doing that overpays the IRS you’ll get the money back when you file your 2020 return, so you would only be loaning them money for a short period of time. The bank interest you would lose on the money is meaningless at current interest rates (0.1%).

If you overpay your estimated taxes for 2020 to get to your MQM bonus threshold (made it to my second bonus, for the first time) you can also simply have the IRS apply your refund to 2021 taxes [as René blogged about here]. Beats taking the refund and and paying the 1.87% again when you go to pay your 21Q1 estimated taxes. If your tax payment is over $5k, depending on the card used you may also get increased points, miles, etc.