Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

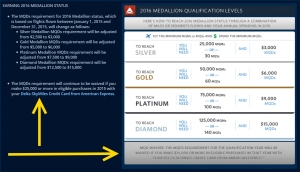

Ever since Delta implemented MQDs or Medallion® Qualifying Dollars, that is minimum spending with Delta to keep your status, on top of MQMs or Medallion® Qualifying Dollars, they have also allowed exemption via two methods.

One is you don’t live the USA. Now if you would rather not move to say Europe (or risk having your account shut down for just saying you live outside the USA), then the other very popular choice each year is to spend $25,000 on a Delta AMEX card(s)<-LINK. Any of them work and if you happen to have personal and business cards it is the combined spending from both that counts. If you have additional users on your primary account, their spending counts toward your exempt total.

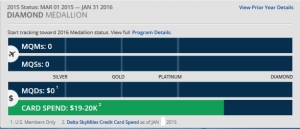

But just what DOES count. The T&C are very specific, but most of us should know that in real world tests the facts on the ground are not always just the same as what is spelled out. Last year I tested a bunch of different kinds of spending and am going to do that same again this year since it is a new year and things may have changed. At the end of each item I will label it as CONFIRMED or PENDING or NOT-WORKING. My statement does not close till after the 1st next month so I will update this post throughout the month and after the 1st of February as the results post as well as my chart on Delta.com (often times spending does update on Delta.com more than once a month). So here we go:

- AMEX personal gift cards starting at shopping portals. This is one of the best choices to me. You can order cards with your name on them and then either spend them, purchase other things like VDGCs or take them direct to Redbird if you have a Target near you. Results = CONFIRMED

- AMEX business gift cards starting at shopping portals. I broke out only because this year this is coding differently on AMEX. I expect it will be just the same as the above. Results = CONFIRMED

- VDGCs or MCDGCs at stores. Buying Visa or MC Debit Gift Card that can have a PIN set and then loading them to BlueBird at Walmart is a great choice for me. Results = CONFIRMED

- Buying Delta e-Gift cards. This will NOT code, or has not in the past, coded for 2x Skymiles as a ticket purchase. But it has counted as yearly spend and that is the point of the post. Results = CONFIRMED

- Lending to Kiva.org via Paypal. If you can have your money tied up for 3-6 months at a time and earn nothing other than the spend (there is a VERY tiny risk of loss), then this is a good choice. Results = CONFIRMED

- Buying Walmart gift cards. There really is only one good reason to do this. You are somewhat lazy and don’t want to start buying AMEX gift card but have a SAMS CLUB you shop at and want to use your AMEX card there. So, you buy Walmart gift cards with your AMEX and then spend the gift cards at SAMS (they are almost always right next door). Results = CONFIRMED

Things to keep in mind about all of these choices and more. We have all year, that is charges for everything must POST before 31DEC2015 to count as spend just like every year. There is no problem prepaying some things just to get your spend up if you need it, now if you like, or later in the year. For example, want to pay your cable bill for 6 months you can do that and you will just have a credit for a while on your statement. The charge will post NOW and count for this billing cycle. I am not saying your Delta AMEX card is the best choice for your cable bill as other cards pay higher points – but it is just an example that does work. Same goes for other bills that you can prepay for a few or many months should you so chose to do so (or set them to auto-bill to your Delta AMEX card over the year).

I have already talked about paying your tax bill with your AMEX and have no need to reconfirm this one as it has worked for many years without any issues and you can see THIS post to see if that is a good choice for you. EDIT: I made an estimated quaternary tax payment and this now is also: Results = CONFIRMED

There are also other choices that I have no interest in trying or testing. There are things like “square” or other similar ones that you can accept payments on your phone for some set fee or even variable fee. There are real problems with all of these methods / choices. The first and foremost is they cost too much in fees to be worthwhile. Next, you tend to get shut down quickly if you are only running charges on one card (yours) or only a few cards (yours and say your wife’s card on your account).

The bottom line is you are “ONLY” talking $2,084 a month posted to your Delta AMEX card(s) each month to be MQD exempt. With so many choices that can and do work, IMO, no one should ever have to worry about this part of keeping and meeting whatever Delta status level you are shooting for. – René

.

Editorial Note: This content is not provided by American Express. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by American Express.

Gold-Platinum-Reserve Delta SkyMiles®

Credit Cards from American Express®

Click HERE for more info

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

I bought $2,800 of American Express and Starbucks gift cards at Wal-Mart on 31 December.

I guess that most of you have more spending (or manufactured spending) that you can do because of owning a business, but frankly tying up $25,000 a year on a card that at best pays 2x/dollar spent – typically 1x for me – is not a good deal for me.

I typically do not exceed $4,000 of credit card spending a month (I use my credit cards for everything except places that only take cash) and I am not wiling to resort to measures to use my credit card to pay my mortgage, so I guess that limits what I can do.

@Ms. M – The point is not the best deal, it is the best price to MQD exempt. THAT is the point. If that is of GREAT VALUE to you, this is how to do that at the lowest cost. Clear?

@rene – Crystal clear. And yeah, not enough of a value to me. I was hoping I was missing something but apparently not.

What gift cards are you finding that can be easily loaded to bluebird. I’ve been looking around and can only find vanilla gift cards and my understanding is that they have to be loaded in stages of 49.99 each. Are the US Bank and Metabank Visas the best if I can find them?

@Nathan – Try to avoid the Vanilla VDGCs. They can be buggy. Kroger is a good spot as well as “Simons Malls” (not the name of the mall, the ownership name). The latter has the lowest fees. I have a local grocery store I use as well that has Metabank that works very well.

Rene, Wait! I thought I read on earlier posts that the Vanilla cards at Walmart were the real deal and a good option. Now I am confused.

@Dale – Vanilla VDGCs CAN work but not always. At some stores buggy. Work fine in mine but others reports MEH. Look for other if possible.

an FYI for anyone doing the EAT-MSP Mileage Runs…I took the opportunity to visit the Mall of America where they are selling up to $500 Visa Gift Cards for only $2 activations!

Had free shuttle to the mall, so we did this a few times…

Hmm I’m a little confused about the gift card stuff.

Why buy a $100 gift card with my delta amex to generate spend, when I could just buy whatever I’d use the giftcard on, using my delta amex directly?

What’s the difference?

@Zachary – earning money and points 🙂

Interesting. Can you elaborate?

Rene, I’m all in on the spend this year to keep Gold status for 2016. But, what cards can you buy with the AmEx? CVS won’t let me buy a Visa Debit Card of the OneVanilla Prepaid Card with my AmEx. Cash only. When I went to my local WalMart, they didn’t know how to load the Bluebird at the money center. I’ve looked through your blog posts and I’m still unsure and folks at the various stores seem unaware as well.

Thanks,

T

@Terry – See this post: http://deltapoints.boardingarea.com/2014/12/04/updated-guide-bluebird-load-gcs/

Thanks, Rene. Funny… I just found it and was coming back here to delete my post. So, I’m looking for gift cards with PINs. But then load them into Bluebird at Walmart. Seems like a fun adventure!

T

@Terry – Kroger or other local stores that sell them are good places to look.

Well, today was frustrating. 3 trips up Grape/Main and didn’t find much that worked. South side WM may have better options. Will keep trying. However, it might be nice to have some folks take pics of the particular cards that work for loading on to Bluebird.

SO many options out there. And I’ve begun looking at the prepaid REDCard, but have to go to FW to get one. That’s the closest for us.

@Terry – Indy is closest REDcard purchase location I think.

Hey @rene I just want to be clear if I spend 25k on my delta Amex card I get to earn some sort of medallion status? I’m close to hitting 25k and want to know how long it takes before the update my skymiles account. Does it matter that I didnt fly at all this year either?

@Bee – No. You need at least 25,000 MQMs AND the $25k spend. Then you are Silver Medallion®. 50,000 MQMs AND the $25k spend and you are Gold Medallion® etc… (see the photo at top of post).

@rene thanks for the reply I was under the impression the 25k spent would do it. I really want my status back but I’m not flying until later in the year how can I earn the 25k mqm without flying

@Bee – Spend $60,000 on the Delta Reserve card. That will get you, if you have the card, 30,000 MQMs and you have clearly spent over the 25k needed. If you do not have the card you will also get 10k bonus MQMs for signup and first spend. Keep in mind it has a $450 / year fee.

Rene, Thanks for this post. I have looked into both AMEX Bluebird & Serve. I live in Europe and it seems that the suggestions you offer regarding VDGCs are not an option for me. I want to spend 25K on my AMEX not for the MQD (already waived with my Euro address), but for the 10K MQMs. Any other suggestions for those of us living across the pond?

@Lisa – outside usa no mqd spend needed

Can I use my AMEX card to charge 20K in new flooring etc for my house and after it is credited, balance transfer that same 20K to my USBank account and get credit for that same 20K? I am guessing that there is a condition on balance transfers, but can’t seem to find any fine print disallowing that.

@Ward – No. And balance transfers always have a fee (almost always that is). I would avoid them.

Curious about the strategy of purchasing Gift Cards in order to get MQD Waiver dollars. Does buying a GC do something more than when you simply use your qualified credit card to make eligible purchases?

@BW or MF – I buy the VDGCs and then liquidate them various ways. I am not a mfg spending web site but there is a big thread on FlyerTalk for more on how to unload them. Yes the purchase counts as spend and towards your MQD exempt spending status.

But if the Delta T&C outline VDGC and other loadable cards aren’t allowed….can’t AMEX see if we purchase these and thus report it back to Delta any point and time?? I like the idea, but I am worried about it a tad….

@Alex or Mike – You can believe and follow the blog tested advice or not. I have tested year, after year, after year….

Oh ok! I’m new to this whole thing since I got Diamond status last year, and this MQD waiver with AMEX is good stuff. I guess I was just concerned, but if you have done it year after year I understand. Thank you for responding so quick. I appreciate it. I will be diversifying my MS but will def include this method for sure in large part to your blog and advice 🙂