Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

My daughter recently turned seven years old. (It feels like last week when I wrote about her turning two and officially becoming an adult in the eyes of airlines!.) We threw her a party at a local Chuck E. Cheese.

So, we invited the students (and amazing teacher) of her first grade classroom and a few other close friends. (Inviting your entire class is apparently a thing these days?) Grandma and Grandpa flew out from North Dakota. It was quite the party and a good time was had by all.

When it came time to settle the bill, I paid with my Chase Freedom Flex®. The card’s second quarter 5% bonus cash back (5X bonus Chase Ultimate Rewards® points) categories were purchases made at restaurants, Amazon, Whole Foods, and hotels. (All information about the Chase Freedom Flex® card was collected independently by Eye of the Flyer. It has not been reviewed by the card issuer.)

Plus, I’d earn another 2%/2X because for the Chase Freedom Flex®‘s dining category.

Earning 7%/7X total on a Chuck E. Cheese birthday party tab for a few dozen people is quite the bonus. And Chuck E. Cheese is a restaurant — right? After all, they serve food and beverages. There are plenty of tables throughout the place. They just happened to also have a bunch of video games. It’s like a big pizzeria.

Chuck E. Cheese = Sometimes a “Restaurant”

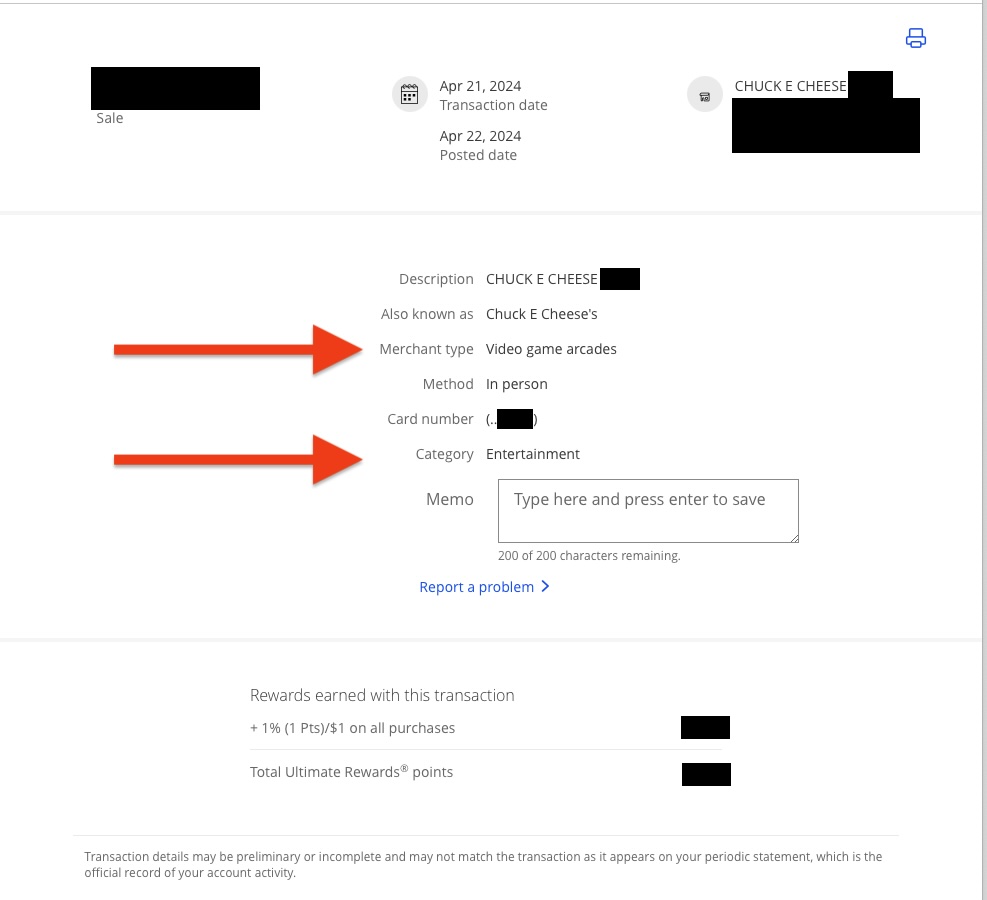

I logged on to Chase last week to see if there are any good Chase bonus spending offers available. While there, I noticed the Chuck E. Cheese charge posted to my account.

But it was not categorized as “Food and drink” (which are considered ” Restaurant” or “Dining” purchases). It was considered “Entertainment.”

Chuck E. Cheese is a “Video game arcade.” It also happens to sell food, but it’s not a restaurant with video games.

So, I earned 1X for each dollar I spent — not the 8X that I expected. Ah, well. I had to laugh. #FirstWorldProblems.

But not so fast.

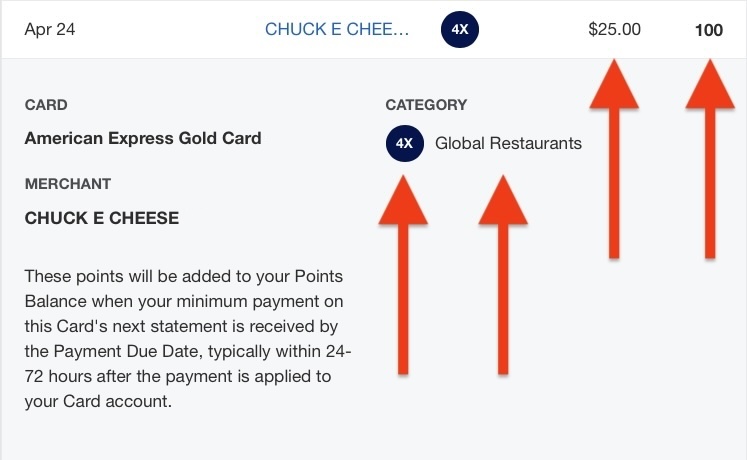

While researching this post, I found a Reddit thread that said American Express purchases made at Chuck E. Cheese code as restaurants or dining. The American Express® Gold Card earns 4X bonus Membership Rewards® points at restaurants worldwide (plus takeout and delivery in the U.S.), on up to $50,000 in eligible purchases each calendar year.

I also remembered that the Capital One Savor Cash Rewards Credit Card awards 3X on entertainment purchases. However, arcades are one of the few establishments not specifically included in the card’s lists of eligible vendor types.

So, I decided to head back to Mr. Cheese’s and buy some gift cards — just to see what would work.

”Restaurant” and “Other”

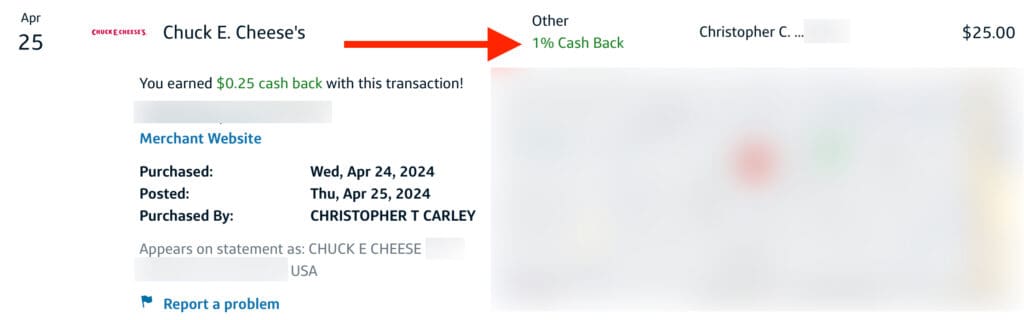

I bought two $25 gift cards. I paid for one with my Amex Gold card and the other with my Capital One Savor Cash Rewards Credit Card.

Sure enough, the Reddit thread was right: I earned 4X points on the Amex Gold!

I earned only 1% cash back on the Savor because the purchase credited as “other.” No entertainment, no restaurant, no nothing.

However, that should be expected because both the Flex and Savor Cash Rewards Credit Card are Mastercards — which use the same Merchant Category Codes (MCC). Chuck E. Cheese is apparently a restaurant under Amex’s processing. Next time, I’ll use a Visa card to see how that codes.

This situation is somewhat akin to . For example, the Chase Freedom Flex® and Chase Freedom Unlimited® earn 3% cash back (3X points) on drugstore purchases. But the pharmacy at my local Ralphs supermarket codes as a supermarket. So, it’s possible to cash in on supermarket bonuses in those situations — but you’ll lose out if you think you’ll score drugstore bonuses.

Same thing with using a cobranded hotel credit card when you visit one of their onsite restaurants. If you don’t charge the purchase to your hotel room but instead pay with your hotel credit card, you’ll earn only whatever bonus (if any) for dining purchases — not the lucrative cardmember bonus for hotel purchases.

Final Approach

I learned the hard way that Chuck E. Cheese codes as different categories across American Express and Mastercard. Because, silly me, I didn’t realize it was an arcade under my Flex Mastercard. I could’ve earned thousands more points if I had used my Amex Gold Card, which considers Chuck’s pizzeria a restaurant.

I hope this saves some parents some time and money 🙂 .

Trolls, here’s your headline: gamer got gamed at a place with games! (You’re welcome.)

For rates and fees of the American Express® Gold Card, please visit this link.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

I didn’t know Amex used different database for categories than Visa/Mastercard. This always scared me away from the Amex Gold, as I assumed the establishments showing up as “Bar/Lounge” on my Chase Sapphire statements would also be “Bar/Lounge” according to Amex.

I just realized that I have been charging a lot at restaurants on my Green Card, and they have all qualified as restaurant spend, even for gastropubs. Anecdotal evidence, but it doesn’t seem as bad as I feared.

With the Capital One SavorOne, not all “other” are disqualified from the 3% rewards rate. Our local ice rink codes as “other” for both concessions and skating time, but I still get 3% back on those payments.

If we’re not careful, credit card merchant and reward codes may become just as arcane as medical coding for insurance and billing.

I have called Amex when I felt a charge should have been coded as a restaurant that wasn’t. They usually credit me the extra points and say they will submit the merchant to their review team to be added to the database. It’s nice to know that Amex is actively managing their database and that we can play a part.

Great data point, Bob, thank you!

I never considered it a restaurant. I’ve taken my kids there for years. Being Jewish, we can’t eat there as the food isn’t kosher. I always considered it an arcade! It’s interesting how different people have different perspectives and expectations according to their backgrounds.