Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

The $895 annual fee showed up on The Business Platinum Card® from American Express‘s monthly statement (See Rates and Fees.). So, you know what that means: time to place a retention call!

I recently wrote that a couple of my American Express cards are up for renewal. I placed a successful retention call for my personal/consumer Amex Platinum Card.

In 2022, I received a $100 statement credit.

Last year, Amex offered me a choice: take a $350 statement credit or earn 35,000 bonus American Express® Membership Rewards® points if I sent $5,000 in eligible purchases within three months. (I opted for the latter.)

What was in store for me this year? Would AmEx give me a statement credit, a spending challenge, or nothing at all?

(Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.)Reasons for Keeping the Card

I enjoy the Amex Business Platinum Card for the most part. The 35% rebate on eligible airfare purchases paid with Membership Rewards points (up to 1,000,000 points back each year; terms apply) is the main reason I hold the card. This benefit has saved me oodles of money and points during the past several years. That may or may not work for you. As I always say: everyone’s travel goals, habits, and budgets are unique.

Plus, I always use the card’s Dell statement credit feature, which allows me to earn up to $400 each year (up to $200 from January through June, then $200 from semi-annual July through December).

I also like the $10/month US wireless credit (enrollment required), which helps offset some of my cell phone bills.

Plus, I’m able to earn up to $200 back each calendar year in eligible airline incidental purchases made with a selected airline (mine is Delta, for now). Now that my daughter is almost seven years old, she is charged the $50 guest admission for access to Delta Sky Clubs after my wife and I exhaust our respective Delta SkyMiles® Reserve Cards guest passes (His: Delta SkyMiles® Reserve Business American Express Card. Hers: Delta SkyMiles® Reserve American Express Card.). Friends and family who have cards without lounge access occasionally make cameo appearances during our trips, so we’re able to guest them in with these benefits, too.

All of that amounts to how I’m able to basically come out even or ahead (as I’ve written).

But here’s the thing: it takes some work that has to be done in order to accomplish all that.

Reasons for Canceling the Amex Business Platinum Card

Before making the call, I scribbled out my grievances against the card.

Annual Fee

The card’s annual fee is $895 (See Rates and Fees.) I pay several thousand dollars a year in AmEx annual fees (though I find ways to earn them back).

Airport Lounge Access Changes

This was number one on my list of gripes.

I first noted that Delta and Amex are eliminating unlimited access for Amex Business Platinum cardholders (and, well, all eligible Amex cardholders). That’s a biggie.

Plus, I’m not thrilled to now pay $50 a pop each for up to two guests (i.e., clients traveling with me) to center Centurion Lounges with me.

Overlapping Benefits

In addition to the airport lounge access, several Business Amex Platinum benefits overlap with several of my other cards:

- Delta Sky Club access

- Centurion lounge access

- Available with The Platinum Card® from American Express

- Honorable mention: Delta SkyMiles® Reserve Business American Express Card. (Here’s why I say “honorable mention.”)

- Available with The Platinum Card® from American Express

- Earn up to $200 statement credit for incidental purchases made with an eligible airline you select

- Available with my The Platinum Card® from American Express ($895 annual fee. See Rates and Fees.)

- But I’m able to stack this and make it work

- Priority Pass access:

- Contracted lounge access at several airports. I get this with my Amex Platinum Card and Capital One Venture X Rewards Credit Card Plus, I get that and select airport restaurant benefits with my Chase Sapphire Reserve®. Amex got rid of that feature a few years ago. Never mind.

- Marriott Gold and Hilton Gold Status (enrollment required)

- Also available with The Platinum Card® from American Express

- Global Entry or TSA PreCheck Application Fee Credit (enrollment required)

- Earn Up to $209 CLEAR® Plus Membership Statement Credit (enrollment required): The Platinum Card® from American Express. Plus, Delta’s Digital ID blows CLEAR away.

So why keep the card when I access those benefits with others in my credit card arsenal? That was another argument.

Adobe Statement Credit

The Business Platinum Card® from American Express members can earn up to $150 in statement credits each year on annual prepaid plans for eligible Adobe Creative Cloud for teams and Acrobat Pro DC with e-sign for teams purchases made with the card. (Enrollment required, terms apply.)

I subscribe to PhotoShop and LightRoom for my photo editing work. That’s $9.99 each month.

The going rate for a Creative Cloud for teams annual plan is $958.88.

Yeah, the Adobe statement credit is useless for me.

Indeed Statement Credit

Cardmembers can earn up to $360 in statement credits each year for select purchases made with Indeed. (Enrollment required, terms apply.)

Do I use this feature?

Indeed, I don’t. (Oof, that was a stretch. Sorry.)

The Call Chat

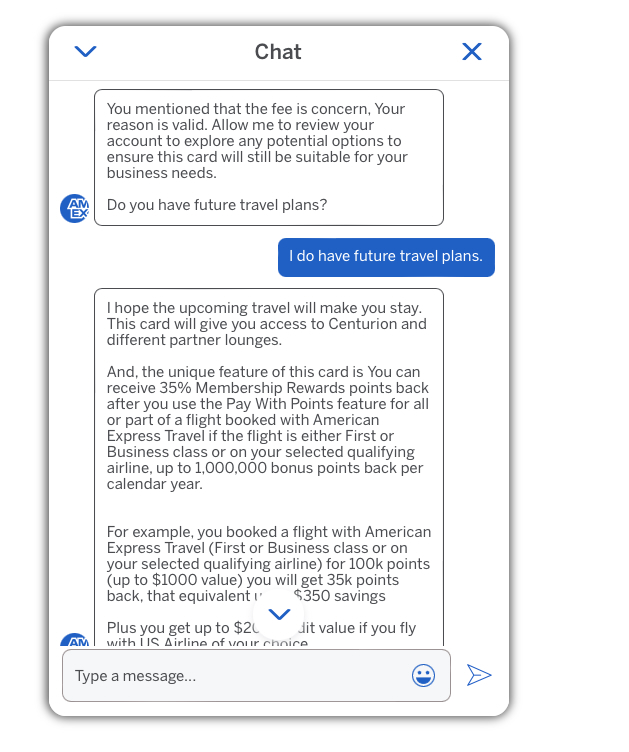

I used Amex’s chat feature, just as I did last year. The rep reminded me of the card’s travel benefits.

I was then invited to downgrade my card. I declined. I asked about any statement credits or retention offers.

No dice.

So, I said I needed to check with another one of my company’s officers (Mrs. Carley) and I’d let them know.

Hey, you don’t know until you try.

Frankly, I didn’t expect anything. Two years in a row of getting retention offers was pretty good. I don’t put a ton of spending on it — especially since I have my Blue Business® Plus Credit Card from American Express that features better earnings on nearly every purchase.

Final Approach

It was time to renew my Amex Business Platinum Card.

Even though I planned to keep the card, I decided to see if AmEx wanted to give me any reason to put more spending on the card or put my purchases on other products. My luck ran out after two years. Have you gotten a retention offer for the AmEx Business Platinum Card this year?

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

I got similar offers the last two years on both of mine (same card). I tried again this year twice on both cards, and the best I was offered was 40,000 points after something like $20,000 spend in the next three months. I declined and told them that I can’t spend that much, and even if I could, I could just spend that much on my Blue Business Plus (2% everywhere) that has no annual fee. I eventually cancelled one of my cards after maxing out my Dell and airline credits in January.

Why would they give you any sort of retention offer AFTER they’ve already charged you the annual fee. You’re still liable for it, right, just as you’re liable for any charges leading up to and the moment before you cancel any card.

Seems like the leverage window is the month before your renewal date, not after it. Or maybe I’m missing something?