Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

I booked a couple of trips this week for my family — and the IHG One Rewards Premier Credit Card reminded us why it’s such a good fit for our travel needs.

The card’s Fourth Night Free and annual Anniversary Night benefits came in very handy — and have us looking forward to our trips even more so than before!

Here’s how everything worked.

Fourth Night Free Benefit

One of our trips involves my wife, daughter, and me. We’ve visiting family members in the Midwest — some of whom we haven’t seen in about 18 months. (Everyone but two children will be fully vaccinated then.)

We reserved a stay at a decent Holiday Inn. The kids love the pool, the hotel has a great restaurant (true story!), it’s near several other restaurants, and close to other areas we enjoy visiting.

**RELATED: Why the IHG One Rewards Premier Credit Card is Great (Especially for Families)

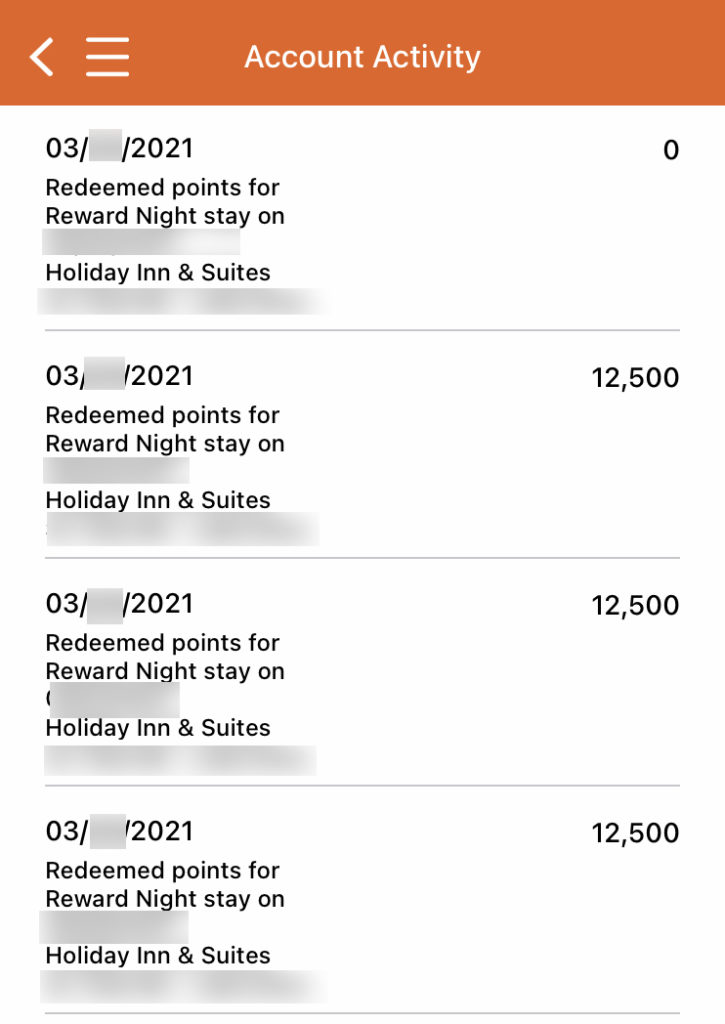

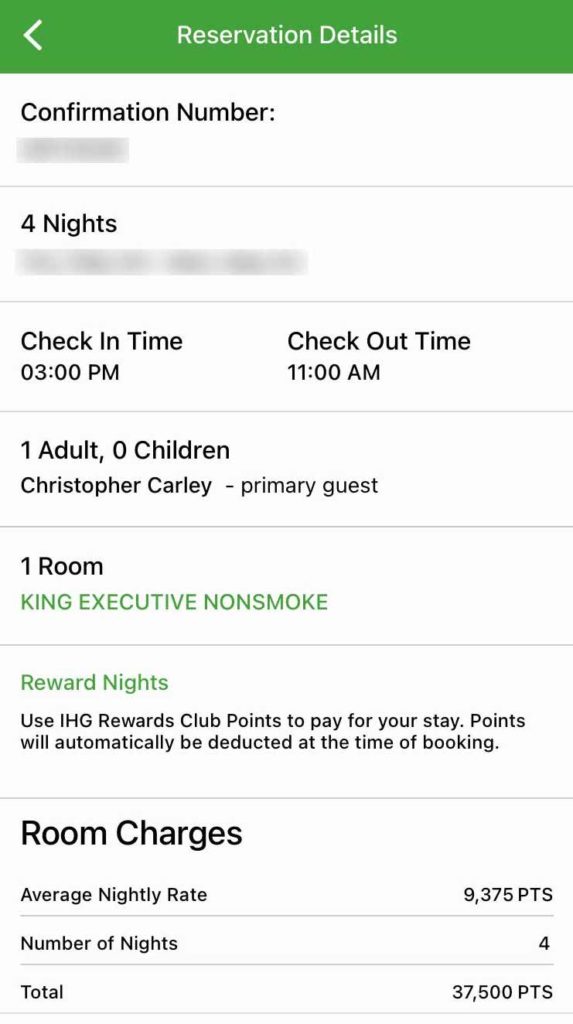

Award nights cost 12,500 points each for the dates we wanted. We’re staying four nights — which “should” run a total of 50,000 points, right?

And that’s where the IHG One Rewards Premier Credit Card came in.

Cardholders are entitled to a “Fourth Night Free” perk. This means that when you book three consecutive nights of an award stay, you’re entitled a complimentary night. We’re getting a four-night stay for a three-night redemption price. Our total room cost? 37,500 points.

This hotel is currently charging $94/night (before tax) for rooms. So theIHG One Rewards Premier Credit Card‘s $99 annual fee was already recouped — and then a few bucks more.

But, wait! There’s more!

Anniversary Night Certificate Redemption

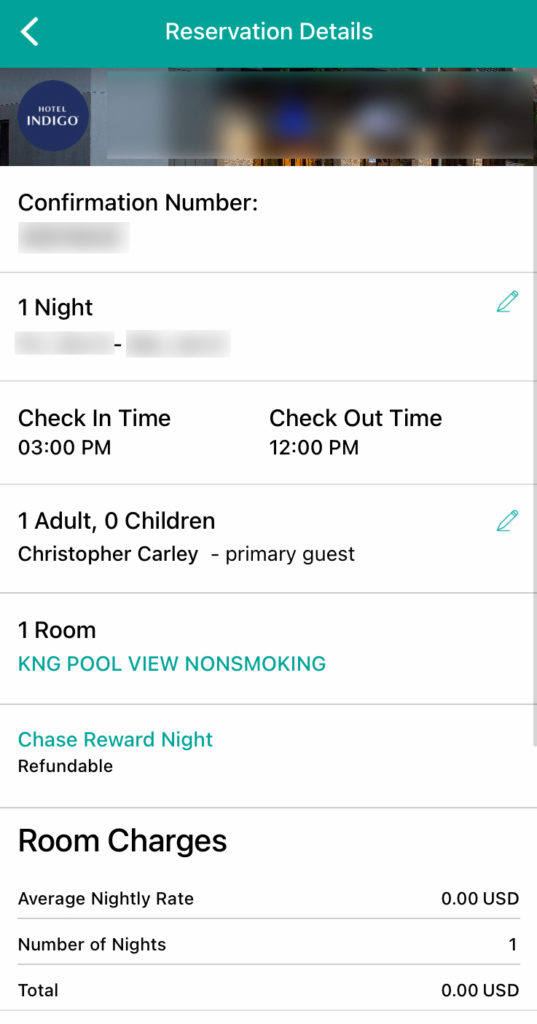

My wife and I booked a quick weekend getaway for a weekend this summer.

Both of us have IHG credit cards (the Premier Card and the O.G. Select card). So we each used an annual anniversary night to book one-night stays at a Hotel Indigo.

Rooms at this hotel are going for $135 night before tax. So, again, we came out well ahead of the card’s $99 annual fee.

IHG One Rewards Premier Credit Card

Aside from room charges during IHG stays and the occasional Chase Offer, we don’t really put any everyday spending on our IHG One Rewards Premier Credit Card .

Why?

We still have a bunch of points from the IHG MasterCard mail-in promotion a few years ago as well as the IHG One Rewards Premier Credit Card ‘s big welcome offers. And paid work trips end up getting us a few points, too.

So why do we even bother holding the card? Its perks make it a must-have for us:

- Complimentary IHG Platinum Elite status

- Room upgrades (when available)

- Guaranteed room availability

- Complimentary Internet

- Priority check-in (when available)

- Late check-out (when available)

- Welcome amenity (usually 500 points or a free alcoholic beverage)

- $30 In-room spa credit (where available)

- Free anniversary night at IHG properties valued at 40,000 or fewer points. (Benefit available beginning the second year of card membership.)

- Fourth night free on award stays

- $100 Global Entry or TSA Pre√ application credit every four years.

- No foreign transaction fees

Given IHG’s massive global footprint, it’s not hard finding properties for us to enjoy.

Final Approach

Again, this about why the IHG card works well for my family. I fully expect people to jump down my throat after IHG made some “What the…?!” devaluations. I truly hope the company rethinks its pricing here — especially because it said it’s all about focusing on the mid-tier hotels.

The IHG One Rewards Premier Credit Card is fantastic for my family’s travel needs. The Fourth Night Free and annual anniversary night benefits absolutely make holding the card worth the $99 annual fee. Our family almost always enjoys our stays at IHG properties — and when we can do so using just points and certificates, that’s even better!

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Chris….slightly off topic but can my 19 year old daughter get the TSA pre-check using my wife’s Premier card? My wife already has TSA pre-check so don’t know if non-card holder can use it for this purpose. $100 Global Entry or TSA Pre√ application credit every four years.

Hi, Steve! Yep! My wife and I have “gifted” Global Entry to several friends and family during the past few years. Your daughter needs to sign up for Pre√ Or Global Entry — and then just use your wife’s Premier card to pay the application fee.

@Steve L – Also slightly off topic but it also works with Amex cards. I have paid for any number of friends Global Entry fees and always get credit: https://eyeoftheflyer.com/2016/04/05/why-not-pay-for-your-siblings-friends-global-entry-fee-and-get-paid-for-earning-points-yep-i-did-that-too/

Chris, did you snag these redemptions before or after the massive IHG devaluation of the past few days? Since IHG has been radio silent, still hoping its a glitch, but if not it makes these cards much less valuable.

Hi, Kurt! I made them just before the devaluation. But I checked the properties late Saturday and the prices were still the same as they were earlier in the week.

Thanks guys….appreciate the feedback.

Just want to add that my wife and I each have the OLD Select card $49 AF along with the Premier card $89 AF. So we get 4 nights of free certs per year. Plus the Premier gives you the 4th. night free and the Select gives you 10% back of points that you redeem.

Of course the Select card is no longer offered so it’s not something that you can get now but there are many of us that have both cards.

Still I’m not happy with the devaluation but I do have several IHG properties (IC and Kimpton) booked before the devaluation and they are coming in at just under 1cent per point redemption.

Thanks for the comment, Michael. My wife and I have the same “IHG card arsenal” (if you will) as you and your wife.

We really hope IHG reverses course and comes to its senses on the devalued redemptions at some properties.