Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

I still remember the February 2017 phone call with René during which he gave me some of the best points and miles advice I’ve ever received.

My father was recovering from shoulder replacement surgery. In about a week, I’d fly from Los Angeles to Fargo and help him recover for a few days in between my photo editing jobs.

My wife was seven months pregnant, though — and I’d miss our second session of birthing class.

“I want to fly back to LA for a few hours and surprise her at class that night,” I told René. “Then hop on a redeye and make it back to Fargo.”

“You have The Business Platinum Card® from American Express, right?” he asked.

“Nah,” I said. “I already have The Platinum Card® from American Express. Why pay for another Platinum card?”

“Get. The. Business. One,” he implored. “Use the 50% points rebate and buy first class. And because you’re redeeming Membership Rewards points directly through Amex and they’re paying the airline –” (In this case, Delta)

Then it dawned on me.

“The trip is a cash fare,” I finished. “So I earn MQMs, MQDs, and SkyMiles.”

“The card pays for itself,” he pointed out. I applied a minute later.

As a small business owner who travels, I value the heck out of this card.

Quick Primer on Paying with Membership Rewards Points

When booking flights through AmexTravel.com, American Express Membership Rewards-earning cardholders may apply as many (or few) available Membership Rewards points as they want towards flight purchases, at a rate of 1 MR = 1 cent. (For example, a $500 flight would cost 50,000 MRs.) Pretty much like Delta co-branded Amex cardholders can use SkyMiles to Pay with Miles to earn MQM or MQS.

Except paying with MRs is way better.

Amex pays the airline — meaning you earn all the benefits of a cash fare. So using Delta as our example, that means you receive not just MQMs and MQS but:

- MQD

- SkyMiles/RDMs

- SkyBonus points (for companies that participate)

The Business Platinum Card® from American Express, though, takes it to another, higher level.

35% Membership Rewards Rebate: The Gift That Keeps Giving — and Can Offset the Annual Fee

The Business Platinum Card® from American Express members receive a 35% Membership Rewards rebate when paying with MRs for flights booked through Amex Travel that are either:

- coach tickets aboard an airline the cardholder selects annually (i.e. Delta), or

- first class on any airline flight bookable via AmexTravel.com

(The rebate originally was 50%. Alas, Amex reduced it to 35% a few years ago. Plus, up to 500,000 bonus points may be earned back per calendar year.)

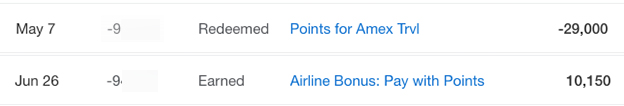

For example, I paid with MRs for my trip to review the new Austin SkyClub.

The fare was $296.30. I kicked in $6.30 cash just so the point redemption was a nice, even 29,000 🙂

A little more than a month later, the 35% credited back to my Membership Rewards.

Delta-wise, here’s what I received:

(On top of all that, I received a $600 #Bumpertunity on my way home!)

50,000 Membership Rewards can be worth over 75,000 MRs if you redeem them, say, nine times for flights. (The benefit is valid for up to 500,00 bonus Membership Rewards points per year.)

How Much Did I Earn Back on Trip (Minus the Bump)?

Say we value everything at a penny each. (And that’s being conservative-ish regarding the MRs)

The 10,150 MRs comes out to $101.50 worth of points.

The 2169 SkyMiles equals $21.69.

So I earned back — at a minimum — $123.19 worth of points.

I just booked my flights the same way but am flying first class. I’ll get back about another $300 in MRs (and earn SkyMiles) — many of the MRs recycled from other 35% redemptions.

I still have a couple of other trips to book; the rebates and SkyMiles will easily offset the $895 annual fee.

And because The Business Platinum Card® from American Express is a business credit card, its annual fee may be tax-deductible (I’m not a tax professional, so speak with yours about deductions).

**RELATED: Do you need an EIN number for business cards?**

Pool Your Membership Rewards from Other Amex Cards

Using the 35% Membership Rewards rebate is a great way to maximize points you earn from other Amex MR cards.

Some of the Amex Business Platinum’s Other Benefits

- Airport Lounge Access — which is a huge benefit to us independent contractors who don’t receive — or can save — our per diem.

- Delta Sky Clubs when flying Delta

- American Express Centurion Lounges

- Complimentary Priority Pass membership (Enrollment required.)

- Escape Lounge access

- American Express Global Lounge Collection

- Up to $120 Global Entry or TSA Pre√ Credit Every Four Years.

- I already have that taken care of through my personal Platinum Card® from American Express (learn how to apply). So I gave the Business Platinum’s Global Entry credit to my buddy Tim who loves it. (Remember, you can “gift” the Global Entry credit to anyone.)

- $200 Airline Incidental Credit (enrollment required)

- Complimentary Gold Status with Hilton and Marriott (enrollment required)

- $400 Statement Credit ($200 Semi-Annually) for U.S. Purchases Made with Dell Computers.

- I’m a Mac guy yet still use every cent of this credit. As René pointed out, Dell sells more than computers. Use your credit for mobile device cables, cases, monitors, or other accessories. And Dell is a Rakuten and TopCashback merchant, so you can make money on the credit!

- Fine Hotels & Resorts Benefits:

- Daily breakfast for two

- Resort or spa credit

- Guaranteed late checkout

- Upgrades when available

- …and more

- Amex Offers For You (individual offer enrollment required)

- Receive statement credit or earn cashback with select offers for which you register

I go more in-depth in this post.

The Amex Business Platinum Bonus Point Earnings

- 5X for each dollar spent on flights and pre-paid hotels at AmexTravel.com

- 1.5X points on each eligible purchase at US construction material, hardware suppliers, electronic goods retailers, and software & cloud system providers, and shipping providers, as well as on purchases of $5,000 or more everywhere else, on up to $2 million of these purchases per calendar year.

- 1X on everything else

Nothing special. Typical Amex Platinum benefits: non-flight spend bonuses are negligible — but the card’s travel benefits are awesome.

Should I Get the Card Even If I Hold the Personal Platinum Card?

I’ve held both cards for almost three years and make it work.

Yes, the $895 annual fee is a big chunk of change. (See rates and fees.) But it easily offsets, thanks to the:

- 35% Membership Rewards rebate

- $400 Dell credit

- $199 CLEAR Plus credit

- Amex Offers

So Was My Wife Surprised?

Seeing the look on my wife’s face when I surprised her at birthing class was amazing. Through her happy tears, she demanded, “How did we pay for this?! We have a baby coming!” I explained the welcome bonus (whatever it was at the time) and Membership Rewards rebate.

We’ve been able to afford more trips — both for our business and personally — thanks to the rebate points and SkyMiles we’ve earned through the Amex Business Platinum card.

We love this card’s benefits — and highly recommend it.

–Chris

- To see rates and fees for The Business Platinum Card® from American Express, please visit this link. Terms apply.

- To see rates and fees for The Platinum Card® from American Express, please visit this link. Terms apply.

- To see rates and fees for the Blue Business® Plus Credit Card from American Express, please visit this link. Terms apply.

- To see rates and fees for the Amex EveryDay® Preferred Credit Card, please visit this link. Terms apply.

- To see rates and fees for the Amex EveryDay® Credit Card, please visit this link. Terms apply.

- To see rates and fees for the American Express® Gold Card, please visit this link. Terms apply.

- To see rates and fees for the American Express® Green Card, please visit this link. Terms apply.

- To see rates and fees for the American Express Green Business Card, please visit this link. Terms apply.

- To see rates and fees for the Blue Business® Plus Credit Card from American Express, please visit this link.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

To do this 35% bump, do you need to book through Amex Travel?

@Pete: Yes — the website.

Finally an awesome comprehensive write up for the amex bus platinum card. This will be easy now for me to explained in to friends who do not see the benefit in having the “high priced card”. Naturally I will include the link for you.

@Flyin Bob: Thank you!!

I’m not please with Amex over the gutting of PP benefits, the AF fee hike, and the insulting rules that come with the $200 fee credit. I ditched the Amex Platinum and replaced it with the Hilton Ascend. I don’t use PP more than 10 times a year anyway, and it comes with Hilton Gold.

Chris – I had the personal Platinum AMEX card for a number of years, but ultimately cancelled a few years back as it wasn’t providing me as much value once I held the Delta Reserve (and got the Delta SkyClub benefits from that card). I’m now considering the business Platinum, so thanks for this comprehensive write-up. But, I am surprised that you hold BOTH the personal and business versions. What benefits do you get from the personal that would justify holding this if you already have a business Platinum?

@Dale R: The Uber and Saks credits help a lot. The authorized user fee is lower for the personal Amex Platinum: $175 for up to three total additional users. My wife, mother-in-law, and father-in-law are all AUs. The lounge access alone for four adults pretty much offsets the $175 AU fee (considering we’d spend about that at airport restaurants during the course of a year traveling together).

Also, the 5X points on purchases made directly with airlines is certainly nice — but not a major gamechanger.

All-in-all, it balances out.

With the traditional Amex Platinum, Amex Delta Reserve and Amex Delta Plat I feel maxed out on paying Amex fees. While I absolutely get good value using the cards strategically, adding another Amex Plat (Business) seems more than is right for my situation.

Good article though, mostly reminders but definitely a few new things to keep in mind.

@HuntingtonGuy: Thank you!