Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Welcome to a regular feature on Eye of the Flyer! This blog series covers in a “rookie” way either a Delta or travel-related theme and attempts to break down each topic to a basic level topic. You can read up on all the previous posts HERE. Now on to this featured subject.

I have around 21 open credit cards in my name right now (René has about the same number)

I applied for all of them or gave my blessing to be an authorized user. No identity theft was involved. 🙂

Some of you will gasp and say one of two things:

- “That’s a lot of credit cards!”

- “Pfft! Amateur!” 😉

If you’re in group #1, you’re probably thinking, Yeah, but I bet his credit score is horrible!

Nope.

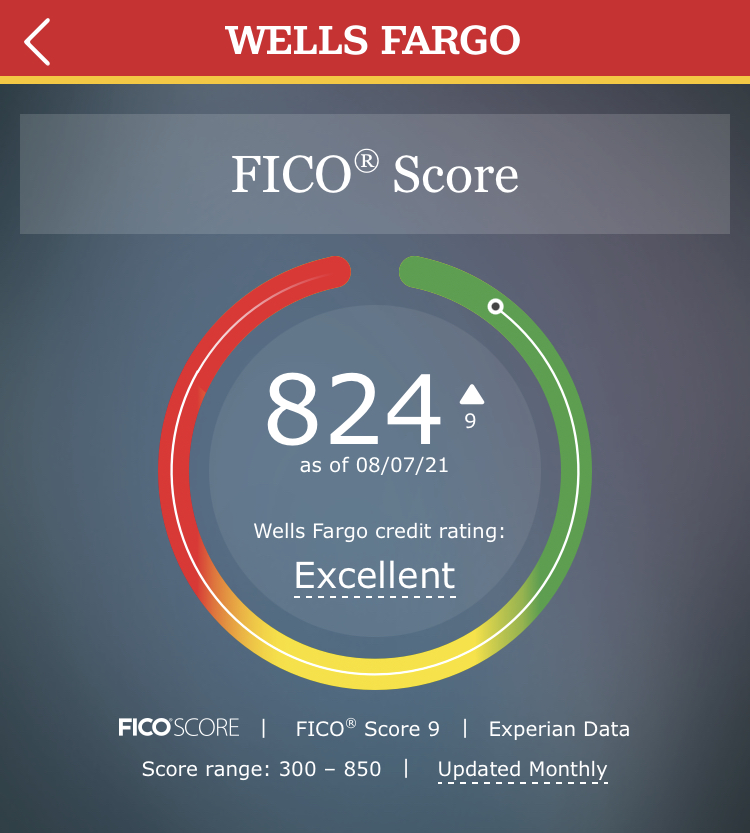

When talking about travel points and miles credit cards, I’m almost always asked about my credit score: what the number is, if all those credit cards hurt my score, or several other questions.

I frequently hear, “I’ve always wanted to get into points and miles. But I’m afraid credit cards will hurt my credit score.”

If you’re responsible and only charge what you can pay off in full each month (and never, ever pay any credit card interest), then you’ll be just fine in the credit and miles/points worlds. You will enjoy what I say is the best kind of “FICO”:

“Fly International, Coach Optional.” 😉

So let’s tackle some credit questions.

For the record: I am not a certified investment advisor or financial planner. The material below is based on personal experience and research. I am not telling you what to do.

And personal experience is how I learned a very brutal lesson.

A Cautionary Tale

My mother died when I was 24. I inherited some money — nothing huge but it changed my life – for the worse.

And that was at a time when things weren’t going well in the first place.

So what happened?

I blew through the inheritance.

Not once, but twice over!

Some people drink, do drugs, or overeat when grieving. I spent money. A lot of it. Recklessly.

I took friends to dinners, bought rounds of drinks, purchased computers and gadgets and phones, bought lots of DVDs and CDs (this was the early 2000s), and — honestly, I don’t really remember the rest.

I paid for all this with a combination of credit cards because I wanted to earn rewards: a Northwest card; some 1% cash back card (because it was cash back, of course!); an Old Navy card (because the store was giving something away that day); a Delta Amex; some Capital One card. And others I can’t even recall. As you can see, it was bad.

Those points, miles, 1% cash back, and Old Navy store giveaway were anything but free. They cost me about $6000 on top of what I already spent.

My credit score tanked. I had negative balances in my bank accounts. I almost filed for bankruptcy — well before I was 30 years old.

A couple of family members much wiser about investments and finances loaned me money to get out of debt. It took me five years to pay back — at thousands of dollars a year. Those were years of staying in on weekends, rarely eating at restaurants, and eating lots of cheap, unhealthy food.

I learned my lessons — and studied up about credit. I’ve since been on the straight and narrow. I only spend what I can afford.

Trust me: “free” travel isn’t worth destroying your credit. Financial strife in the name of points and miles isn’t worth the stress and its effects on your body.

So with my personal pain and mistakes in mind — let’s talk about wise uses of travel credit cards!

Does Having Lots of Credit Cards Hurt Your Credit Score?

If you don’t pay them: big time.

However, if you pay them in full — and don’t carry a balance at all — your credit score will actually go up with many cards. Honest – it will.

Debt-to-Credit Ratio

Debt-to-credit (or “credit utilization”) ratio is very important to your credit score. You want this number to be very low.

Say you have a $12,000 credit line on a Chase Sapphire Preferred® Card. Maybe you have a $3000 balance on that card (and pay it off, of course). Your debt-to-credit ratio is $3000 to $12,000 or 25%.

You don’t want to go much higher than that. Try to use less than 30% of a card’s available credit.

But if you have several credit cards and keep your spending in check, your debt-to-credit ratio should be A-OK.

For example, if your total combined credit lines amongst five credit cards come out to $50,000 and you’re using $5,000, you’re at 10%.

That being said: don’t get a bunch of credit cards unless you know for certain you can pay them all off each month. And make sure to not lose track of your payment due dates.

With that in mind:

What Will Hurt Your Credit Score?

Enemy number one is not paying your credit cards. I cannot stress that enough.

Applying for credit cards does negatively affect your credit — but not for long. Your credit will be docked a few points for (in my experience) several weeks to a few months (think max three).

That’s why it’s best to keep credit card applications at least 91 days apart. You can absolutely apply for more than one credit card in one day. Just be ready for minimum spend requirements and any applicable annual fees.

And if there’s no way you can meet the minimum spend requirements on every card for which you’re applying, hold off. Be conservative unless you are a pro at this.

Can Lots of Credit Cards Hurt My Chances of Getting Bank Loans?

Lenders get understandably skittish If you constantly apply for credit cards; they wonder why you always need credit. They might view you as a risk.

And you can’t afford that problem if applying for a mortgage, student loan, or another major loan. Those are bigger, more important needs than travel and travel credit cards.

So, again, every 91 days (at least) is still a good rule of thumb for credit card applications — assuming you aren’t buying a house, taking out a loan for school, etc.

How Can Credit Card Companies Afford to Pay Airlines and Hotels for All Those Trips?

Annual fees and interest rates.

Can you imagine how many other people’s trips I paid for with my travel cards when I blew through all that money after my mom died? I spent thousands in penalties, fees, and interest. I probably took about $900 worth of travel with the points I earned. So my travel was anything but free.

Plus, not everyone uses their points or miles. Three times in just the last week people told me “I have all these miles but don’t know what to do with them!” There are a lot of others like that, too, who will never spend down their miles (#ProTip – if you need booking help – I have a team ready to help).

Why Is It Important to Pay Off Your Credit Card in Full Every Month?

When you don’t pay off a credit card’s entire bill, you’re charged interest. Nasty, huge, ugly interest. (Unless you have a card with a special 0% APR promotional period. But those come with some potential risks, too. And that’s assuming you don’t miss even one payment.)

Interest payments do not earn miles/points or count toward minimum spend requirements. You essentially throw away money when paying interest. Any value of the points you earned from spending is now worthless. And remember that Amex may not even credit any Membership Rewards points if you’re late paying your bill!

It’s easy to get underwater in payments — and not afford to swim out.

What About Canceling Credit Cards?

Many people seem to think canceling a credit card will somehow trigger Armageddon.

Canceling a credit card on your own initiative may slightly ding your credit score — but if done correctly, it should knock you down only a few points.

First, if your credit card has no annual fee, just leave it open and don’t use it. The issuer will report it every month as current and paid.

If you must cancel a card with an annual fee, ask the issuer to waive it or issue a spending challenge to make it worth your while.

If the issuer says no, you’ll want to shift almost all your credit line to another card with that bank. For example, say you’re closing a Delta SkyMiles® Platinum American Express Card and also hold a Blue Cash Everyday Card® from American Express card. For math’s sake, we’ll say the Delta Platinum card has a $10,000 credit line.

First, freeze your credit. Why? Some credit card issuers will run a hard pull on your credit before transferring credit lines.

We’ll shift $9000 from the Delta Platinum card over to the Blue Cash Everyday. THEN we’ll cancel the Delta Platinum credit card.

That will help your overall debt-to-credit ratio and that of the card to which you’re transferring.

Bottom line: Canceling credit cards isn’t a big deal. Credit reports will show that you opted to close a credit card.

Credit card issuers and banks forcing the closure of credit cards is something to avoid. That doesn’t look good on your credit report.

“But if the APR is Low…”

A family member once called me and asked, “What’s a great travel credit card with lots of miles, no annual fee, and low APR?”

I told her there isn’t one. Because, again, annual fees and interest rates are how credit card companies pay for many cardholders’ “free” trips.

Again, cards with 0% promotional APR as part of their welcome offers are slightly different. But you must still make a minimum payment each month.

If you’re already planning to not pay off your card in full, do not get a travel credit card! In fact, you probably shouldn’t get a credit card at all. Why? Because you already plan on buying something you can’t immediately pay off. Seriously. Pay cash instead. For online purchases, use PayPal. Or consider a secured credit card (more on that in a few minutes).

”I Don’t Trust Myself.”

A client with whom I work Vegas jobs once said to me, “I just want (M Life) Pearl status with MGM (Resorts). Is that too much to ask?!”

I suggested he sign up for The World of Hyatt Credit Card. He’d receive complimentary Discoverist status, could then match that to M Life Pearl, and still enjoy the Hyatt card’s annual complimentary night. (All information related to the The World of Hyatt Credit Card was collected independently by Eye of the Flyer and was neither provided nor reviewed by the card issuer.) (That status match is no longer available.)

He sighed and said, “That sounds great. But I don’t trust myself with a credit card.”

End of conversation.

Status, points, miles, and “complimentary” hotel nights will not be free if you can’t be trusted — especially by yourself — with a credit card.

If you have the same concern, just don’t risk it.

Do Business Cards Count Against Your Personal Credit Score?

Business credit cards generally do not count against your credit score. But that doesn’t mean you can charge a massive bill and not pay it off.

Some credit card companies report to commercial credit bureaus. Not to mention, many small business credit cards require personal guarantees. So you’re still on the hook one way or another.

How Did I Repair My Credit Score?

For me, it took a long time and a lot of sacrifices. I lived with roommates longer than I ever anticipated. I delayed getting married.

I started with a secured credit card. I made a $600 deposit toward a new Wells Fargo secured card. So $600 was my monthly credit limit. I charged only what I could pay. Had I not paid off the balance, Wells Fargo would simply deduct whatever I owed from the $600 (and that never happened). Nothing would be reported to the credit bureaus.

I also worked a job that didn’t have company credit cards. So I paid for company expenses using a higher-limit card I eventually obtained. I submitted expense reports and my employer’s accountant sent my credit card company a check. (Man, those were the days!)

Quick Caveat: Credit Card Education Should Start Early

Responsible ways to use credit cards work should be taught in high school.

I’m not sure if this is still the case (it’s been a long time since I was on a college campus) but when university students show up for their first days at school, they have plenty of opportunities to sign up for credit cards.

Why?

They’ll get a free t-shirt or reusable water bottle if they simply apply. And then they can use that new credit to buy whatever they want — and probably have no clue how credit works.

So What’s the Point (Pun Fully Intended)?

Once I got my act together and sssssllloooowly reintroduced myself to credit cards, I was fine. Credit card points and miles have paid for dozens of trips, including business class flights to Europe and Asia and stays at gorgeous hotels.

If you keep track of all your cards, are respectful of your credit, don’t buy anything you can’t afford, and pay your entire bill on time every month, you might enjoy a lifetime of free (or significantly discounted) travel.

Anything Else?

Credit is impossible to encapsulate in one Rookie blog post. There are entire books about the subject. But if there’s something that isn’t clear or you have a question we didn’t cover, please ask it below. Plenty of readers know their stuff when it comes to credit and hopefully, they’ll share their tips and experience with us in the below Comments section!

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Not to be a downer but also consider how life in general is treating you before taking the plunge into multi-cards and the commitment that accompany them.

Job going ok, as in might you be be included in an upcoming layoff or are hours/salaries/bonuses stable?

Trouble in paradise? If there is a chance a marriage or relationship where co or joint financial responsibilities exist might be headed south, consider the worst (financial) case scenario. Divorces can drop significant debt (ask me how I know) in your lap regardless of how you think things might go.

Do you have a savings cushion in the event of a nasty (not covered by insurance or high deductible) roof leak or your not so reliable car goes to that great parking lot in the sky necessitating an unplanned new purchase or lease?

Life can sneak up and bite us from time to time. Loading up on travel cards and other tools of the points trade can be fun and very rewarding, but don’t allow any unforced errors to turn all of that upside down.

Just one guys $0.02

Does Having Lots of Travel Credit Cards Hurt Your Credit Score? No.