Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

I have never been a blogger who has assigned a hard numerical value to any kind of travel points (other than cash back, clearly) because the real value of points has always been so subjective depending on how you spend your points and in what class of service. Back when Delta posted and used real award charts, I felt there was more logic to point values as you could solidly compare the value – today not so much.

I had a long conversation with someone who no longer works for Delta but while at the company was intimately involved with the award program and shared that when Delta was switching over from fixed award charts to floating charts the “suits” at the company were scared to death that Skymiles would be perceived as only worth 1 cent each. That fear is now clearly gone.

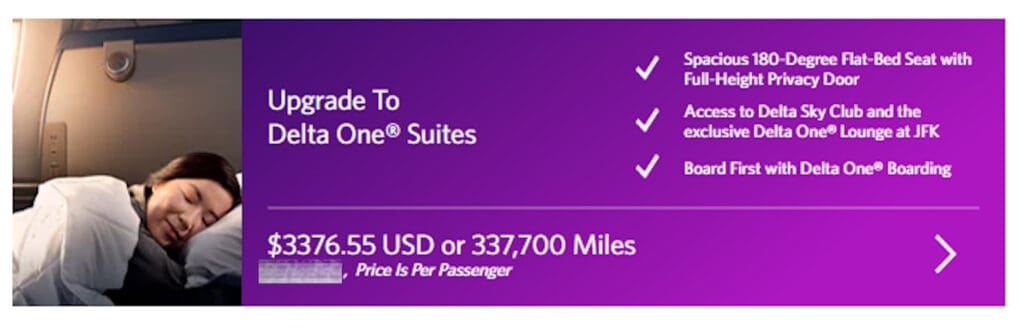

I have a flight booked in Delta Premium Select (aka premium economy) and the above is what Delta.com is displaying as the upgrade price. Beyond being mind numbingly disgusting in price you can see Delta is telling me a SkyMile is simply worth 1 cent each. I find this interesting because for a long time the displayed price for these kinds of upgrades were almost always cheaper in SkyMiles than the cash price, that is, Delta was saying SkyMiles had a superior value than cash.

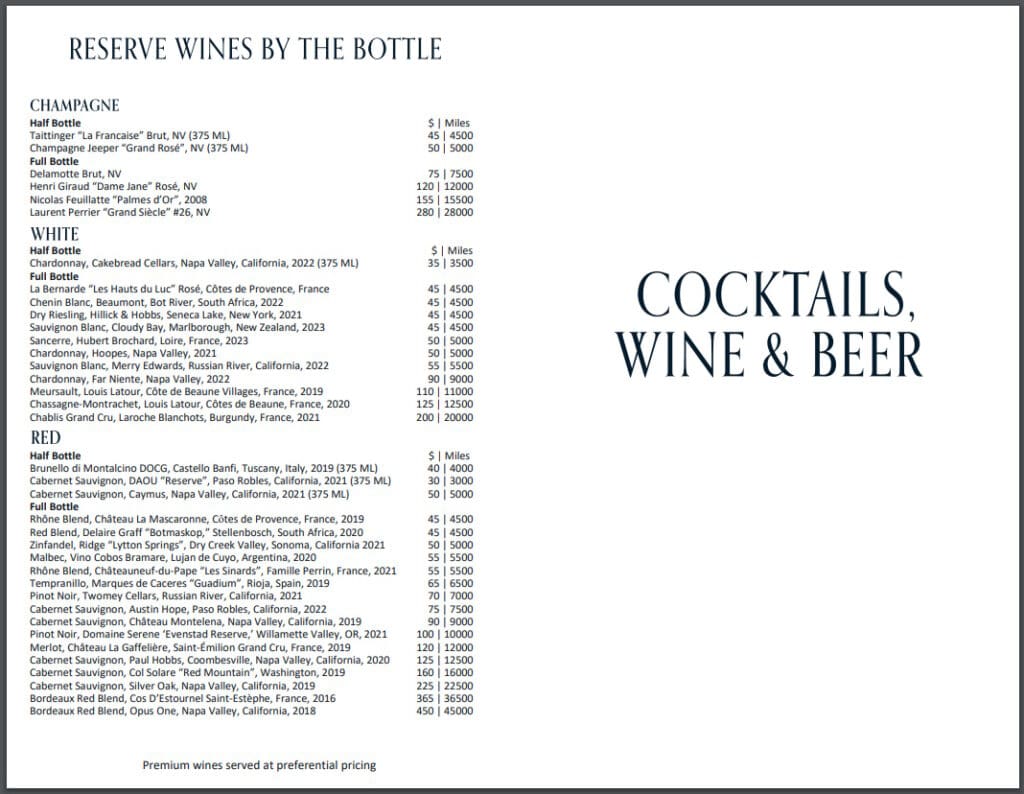

The same also goes with the drink menus for the brand new Delta One Lounge, where the drink price in cash vs. SkyMiles is pegged at 1 cent each.

What changed between then and now? I have a few ideas.

First up time and constant devaluations. Delta has been on a tear for years charging more and more for awards so folks are somewhat used to the reduced value of the currency. The CEO has also stated many times over the years during the DAL quarterly earnings meetings the airline is indifferent if we pay with cash or SkyMiles. This also tells me they also view a SkyMiles as equivalent to 1 cent each.

The big question, at least in my mind, if we all have come to the same conclusion that SkyMiles are really SkyPennies (as I have been stating for a while now) then why does anyone put any real spend on Delta SkyMiles® American Express Cards? Clearly, folks are as Delta is always bragging just how massive the yearly spend is on the co-branded cards. Heck when I was last in a Sky Club I overheard several folks bragging up to those they were flying with that they just keep dumping massive spend on their Delta cards.

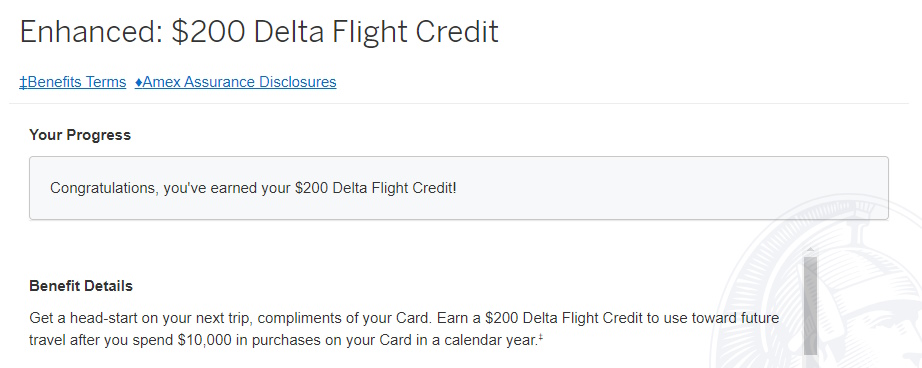

I myself only spent $10,000 on my Delta SkyMiles® Gold Business American Express Card because with the $200 bonus voucher I counted this spend as the same as a 3% reward card (at least to that point). But since that I have not put another penny on the card nor will I because any of my 2% cash back cards win vs. Delta Amex cards.

You tell me. Do you keep spending on your Delta Amex cards to earn SkyPennies or have you shifted your focus over the years to other cards? – René

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Other than a couple of subscriptions that I have found impossible to transfer to different cards, I haven’t spend more than $50 a month on my Delta-branded AmEx Reserve since Delta unveiled the horrible 2023 changes to lounge access, elite status and the overall program. I wonder if the recent quarterly drop in revenue is a reflection of customers who went elsewhere. It would have taken a couple of quarters to show up. I also no longer fly as much as I used to. There’s no incentive for me to take an unnecessary trip or book a trip with an extra segment since frequency and distance are no longer measures for Delta status.

who cares about the certificate. The only way to stop the devaluation is to stop using their amex

@Jason – When you can buy things at the right price I find a 3% net return to be a value to me. After that I agree no reason to spend more.

No idea why people use Delta cards; have lots of friends who do so, despite me telling them there is a better way. I don’t understand the logic of how a $200 flight credit is better than 2x on VenX or AX Biz Blue+.

For example, with a transfer to Virgin from AX MR, that $10k in spend is worth at least 20k Virgin points (and up to 28k Virgin points with a bonus). 28k can easily get you a return booking through Virgin for a Delta flight that is worth way more than $200 e.g., I have a trip coming up that I booked for 20k through Virgin where Delta’s cash price was more than $646, a 6.5% return on $10k of spend. Even with the further devaluation recently, it’s still way better than a $200 Delta flight credit.

That said, I’m still burning through Skypesos earned years back. There’s still some good value using Delta on partners where you can easily get in excess of 1.5c / skymile

I travel weekly so I need to hit $75k spend for unlimited SC access next year. And after I spend $150k on my DL Corporate Reserve I get 1.5 miles/$ spent which is pretty good in combination with it allowing me to hit the $28k in MQD for DM GUCs plus 3 other CBs.

Or just buy a lounge membership and bill it to your clients/employer as a work expense. As someone who travels every 7-10 days for work, that’s what I am doing.

But I want to make DM for the 4 GUCs.

Ever since Delta obliterated SkyMiles during Covid, I shifted to Amx MRs. I am currently midway to getting under 5/24 to start adding to Chase reward points. This has worked out well and have traveled on JAL/ANA biz/first and Condor biz.

Last time on Delta old biz was in 2018. Since then, Delta has gone down the toilet!!!

Delta’s business is to sell points to AmEx; oh.. and they also happen to fly some airplanes.

A few days ago, I booked a $850 economy class ticket for 30,000 Delta SkyMiles. That’s good use of miles. Luckily, I only have 65,000 SkyMiles. I’ve been trying to burn them for a long time.

I’m currently only spending to try to reach MQD thresholds for status levels. I don’t fly frequently enough (and the routes I do are usually lower dollar, and not FC) to rack up the MQDs (or even old MQM) for the status, so I have to do it with spend. Pre-2023 I was safely in Gold but could hit Plat with the spend. Once I did, I’d switch to other cards.

Now, even Gold is tough, and Plat is a reach. So I’m questioning what the value there is–I do enjoy the perks when I travel, but would I be able to just “buy” those with better MR or cash back earns from another card? It’s a tough one for me… I’m likely going to have enough to get Platinum one more year, but then considering giving up going forward. Or maybe just spend enough for Gold and then switch over.

What I’ve noticed is not quite in line with the author.

The skymiles seem to be worth 1 cent when upgrading or paying for any extras, however when booking a brand new flight itinerary it frequently does better than 1 cent and it improves with the 15% discount if you have their credit card.

It’s not true for all flights, but I frequently find flights that have a skymiles worth slightly more than 1 cent. But, everything else you can use a skymiles for seems to be worth exactly 1 cent. I pay for upgrades in cash and flights when the skymile is worth more than 1 cent.

As a big guy I do value the ability to get to platinum through card ownership and spending because when travel for business I do not have the option of purchasing anything than a main cabin ticket. At least with platinum medallion I can nab a Comfort+ seat (almost always) and potentially sneak into FC because flying over 2 hours with my knees jammed into the seat in front of me as well as trying to twist my body so my shoulders aren’t spilling into the seat next to me is not a fun trip. The Sky Club is a useful perk as a solo traveler (and then I’m traveling with my partner as well), but I’ve written off SkyMiles as just something extra.

Honestly the value of things as a whole has declined, and since I only have Delta and AA as my local carriers, I’ll stick with Delta in spite of the decline in value because I’ve flown AA and at it’s best is a mediocre Delta experience.

I find myself reaching for my American Advantage card with Citibank more and more. The miles are move valuable to me. I”m sitting on almost 400,000 Sky Miles because the award flights are outrageous. Only 27,000 of American miles because those I use for good value on last minute flights.

I’m looking through my rose colored glasses and I see a bright side: Delta cannot devalue the skymiles any further to less than a cent a mile; or can they???

I love flying Delta but I despise the Skymiles program.

Yes, left the card. Went to Chase for improved benefits. They used Covid to truly devalue many aspects of the program. Just using up my miles before dropping them completely.

I agree that this year I have spent little on my Reserve card. MQM rollover guarantees DM for 2025. Should earn platinum with MQDs. I have used Reserve when flying with RUCs. I also manage to get about double the card cost with companion certs to first. I scored Delta One tix from JFK to Madrid for 289K miles ($5800 was cash fare). I may get the biz reserve card next year for the 2500 MQD (and a second companion cert the next year). That should also get me another 15 days of club access. However, I have been using Chase sapphire and Chase travel for other bookings. There is a bit more hassel if Delta changes schedules, but 7.5 cents per dollar is better than 3 with reserve. Combined with 11miles per $ for being DM, its 18.5% discount off fare even at a penny per mile and even more if I can get 2 cents per mile.

I’m still stuck on having to pay for anything in the delta one lounge. What?!

Visiting it next month. Hmmm. Please don’t tell me food costs money too.

Premium alcohol seems to be the only buy up.

After this week’s Delta Fiasco, to say that Skymiles have any value is utter NonCents.

Well done, sir.

At 1-20 for mqds it seems not worth the $$$ spent to try to get DM again. And as I have been told by GA’s – DM is not an elite status anymore!!!