Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

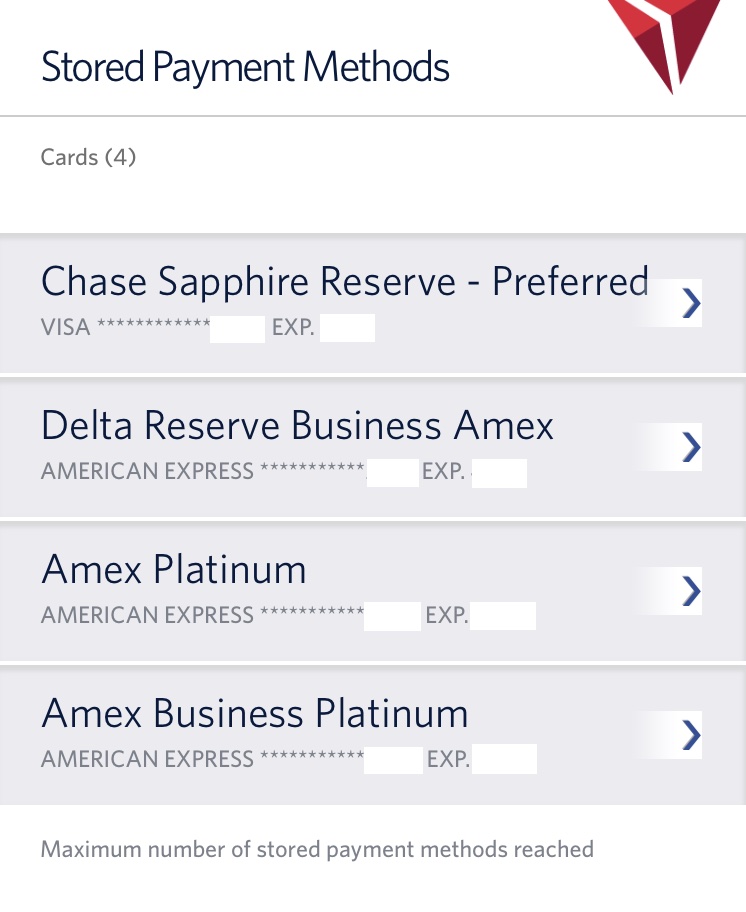

aDelta Air Lines allows SkyMiles members to keep up to four credit (or charge) cards in their virtual wallets. This speeds up airfare purchases and, overall, makes the process pretty convenient.

Plus, certain Delta American Express credit card benefits are available only if the cards are part of your Delta wallet.

Because not all credit cards are created the same, there are different reasons you may want several options in your Delta wallet.

Here are the cards I personally use for my Delta purchases — and why.

Chase Sapphire Reserve®

There are a couple of reasons I use my Chase Sapphire Reserve® card for most airfare purchases.

First, it earns 3X on all travel spend. I can redeem those points at a rate of 4.5 cents each through the Chase travel site. Or I can transfer them at 1:1 ratio to one of Chase’s Ultimate Rewards travel partners.

Why not an Amex? you may ask. Even for Delta flights?!

Yep. The Chase Sapphire Reserve® provides great trip cancellation and interruption protection. Like René, I have a blanket travel insurance policy through Allianz for my wife, daughter, and me. But I like the peace of mind being “double-covered” in the event anything happens. Plus, the Chase Sapphire Reserve® requires only a portion of your airfare be paid with the card for your trip to receive the coverage. So it’s a great option to use for cash balances on award tickets, Pay With Miles trips, or airfares involving gift cards or vouchers.

The Platinum Card® from American Express

Whenever my full airfare purchase is reimbursed (work, etc), I pay with my personal/consumer Amex Platinum card. Several American Express provide trip cancellation and interruption insurance to many of their premium card. But your trip’s entire airfare must be paid with that card in order for you to receive the benefit.

Purchases made directly with airlines or Amex Travel earn 5X Membership Rewards points per dollar spent (up to $500,00 in annual spending on those purchases). Membership Rewards points can be transferred to a number of airlines (including Delta!) or hotels.

Or, they can be redeemed at a rate of one cent each when purchasing airfare through Amex Travel. (Though Business Platinum Amex cardholders can get a 35% Membership Rewards rebate when buying premium airfares with any airline or coach fares with an airline they designate, up to 1,000,000 points back per calendar year.)

Plus, the cash portion of a Delta Amex companion certificate airfare must be paid with an American Express card. (It doesn’t have to be a Delta Amex.) I pay those purchases with my Amex Platinum card.

As an aside, my Platinum card is often targeted when Amex Offers are available for Delta purchases. In fact, it received the $100 statement credit offer a few weeks ago.

The Business Platinum Card® from American Express

The only reason The Business Platinum Card® from American Express takes a spot in my Delta wallet is that it came in handy for some of the purchases that worked toward my Amex airline incidental credits in past years. (Enrollment required.)

Purchases made directly with airlines earn only 1X on The Business Platinum Card® from American Express, so it’s far from the best available option. But again,

Delta SkyMiles® Reserve Business American Express Card

Delta American Express cards give cardholders a number of benefits — such as a free first checked bag and Main Cabin 1 “priority” boarding.

The Delta American Express card must be added to the cardholder’s Delta wallet in order to receive the checked bag and boarding benefits.

Cardholders of the personal Delta SkyMiles® Reserve American Express Card and/or business Delta SkyMiles® Reserve Business American Express Card products receive complimentary access to Delta Sky Clubs, Escape Lounges (a Centurion Studio Partner), and American Express Centurion Lounges when flying Delta Air Lines. The trip must also be paid with an eligible American Express card.

Plus, holding a Delta Reserve card serves as a tie-breaker for Medallion®s in the upgrade hierarchy. Plus, Reserve cardholders who aren’t Medallion®s are eligible for complimentary upgrades. That’s the sole reason my Delta SkyMiles® Reserve Business American Express Card is part of my Delta wallet.

But again, the Reserve card must be added to the cardholder’s Delta wallet.

What’s In Your (Delta) Wallet?

Tell us which cards you use — and why — for your Delta airfare purchases!

–Chris

To see rates and fees for The Business Platinum Card® from American Express, please visit this link. Terms apply.

To see rates and fees for The Platinum Card® from American Express, please visit this link. Terms apply.

To see rates and fees for the Delta SkyMiles® Reserve American Express Card, please visit this link. Terms apply.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

My AX Personal Platinum card which I primarily use for ticket purchases and even the taxes on award tickets.

My AX Delta Personal Platinum which was a downgrade from the Reserve a couple of years ago when I got the AX Platinum.

My AX Gold card as I used it a couple of times for airline statement credits in the past.

My AX Aspire card as I used it a couple of times in the past for airline statement credits.

I guess it’s time to re-think some of these slots. The Aspire get 7X Hilton points on air spend but the Gold and Green get 3X MR on air spend but none of these compare to the 5X I get on my platinum.

I’ll keep the DL Platinum in there because if I do lose elite status at least it will give me the free checked bag and at least some preference in the boarding process.

Amex plat in wallet let’s u get fast access to Delta SC!