Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Several years ago, I used my Delta SkyMiles® Reserve American Express Card card to charge a co-payment at a doctor’s office.

The receptionist eyed the then-midnight-blue-and-silver-plastic-card (since refreshed to a purple, metal version). She’s barely five-foot-nothing and about 75-years-old. But she’s also a tough, New Yawk broad. Very old school. You might know the type. Like, Chuck Norris would ask her help to cross the street in a rough neighborhood at night.

She knew I’m a points-miles-travel nerd.

“Listen, mister points guy —” she said.

“Actually, The Points Guy is someone else—“ I started before her glare reminded me I should know better than to interrupt people. Especially her.

“What? Whatever. Can this Delta whatchamahoosits credit card get me a free trip?”

“Probably,” I said. “It depends where you want to go. And how fancy of a seat you want.”

She suddenly softened.

“I just want to visit my family in New York and Boston,” she said. “I’d love a free trip. Even in coach.”

“So not Europe? Italy? Australia? Hawaii? Florida?” (I know Italy is in Europe. But I swear on my mother’s grave: those are the “four” destinations people ask me about the most. Even though Italy is in Europe.)

“Nah,” she said, dismissively waving a hand. “I don’t need that first class stuff.”

I told her she absolutely could get a free trip with a credit card. And perhaps she didn’t even need a new credit card. Maybe she already had a bunch of points or a great credit card and didn’t know it. Or if she needed some more points, there was probably an easy to way to make it happen.

“I just miss my family and friends,” she said, “and want to see them again before it’s too late.”

And that’s where some people seem to freak out and worry about redemptions.

If you read this blog on at least a semi-regular basis, you know that I stress everyone’s travel goals, budgets, and spending habits are different.

Every year, I redeem tens of thousands of points at a Holiday Inn in the suburban Twin Cities area for a special weekend. My wife, daughter, and I join about a dozen other friends and family members. We celebrate birthdays, eat pizza by the pool, and watch our kids swim. Grandma and Grampa babysit the kids at night — while we parents stay up way past our bedtimes. (You know, like 11 PM or so 🙂 )

Yet people rail on me because I stay at IHG hotels with some regularity (well, at least for now.) And I care zero.

But you could use those points towards a night at a luxury hotel in some magical foreign destination! some people have correctly pointed out. There’s a nicer hotel a few miles away!

Absolutely. But if the chic hotel doesn’t have a pool and play area where my daughter and her cousin can have fun, that five-star is worth zero stars to the kids. And they’ll spend every single minute of the trip letting us know.

Watching our daughter explore various destinations, visit friends and family, and enjoy being a kid is our happiness right now.

Would I love to splurge a quarter-million points and take my wife to Paris or Tokyo or Maldives for a few days and stay at a luxury hotel? Oh my goodness. Yes, yes, yes! A thousand times yes. But that ain’t happening for a while. So we might as well do what we can and enjoy our travels instead of being bitter.

Now, that might not work for your travel plans and schedule. (And, for heaven’s sake, please have a drink for us when you’re on your luxury vacation!)

There will always be people with more and fewer points than you. (Isn’t that pretty much how life goes?) Not everyone has the time, job, familial situation, and points balance to sit in Emirates or Singapore first class while visiting some amazing destination.

But it’s okay to use your points for travel that doesn’t involve exotic locations, luxury hotels, and first class transportation.

This is what’s important: if you are happy, save some money, and enjoy trips that create great memories, that’s what counts. (But people who use debit cards to pay for things and wonder why they can’t afford free trips — oy, don’t get me started! 😉 )

My One Caveat

I love American Express cards. I love Amazon.

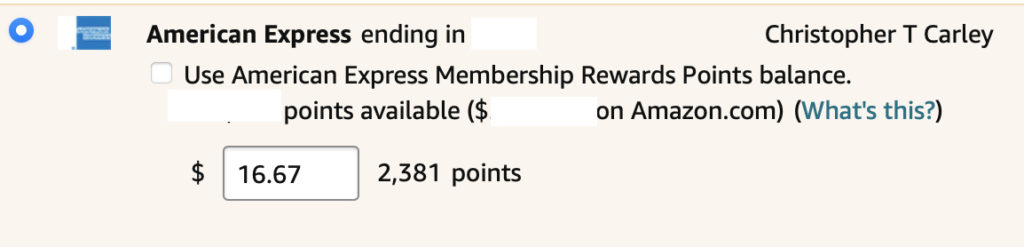

But redeeming Membership Rewards points for Amazon purchases literally makes my stomach churn. The redemption rates are horrible. And that’s a kind way of phrasing it.

In the above example, we’re getting about .7 cents per point. That’s worth less than Delta SkyMiles 😉 . So this is one example where I will say, “Please don’t use points this way.”

That being said, I know someone who was happy as a pig-in-poop because he redeemed Membership Rewards points for a new iPod. Clearly, this is several years ago.

So when he asked my honest opinion if that was a good deal, I told him no.

After a long pause, he said, “But I still saved some money. And I’m happy. Isn’t that what counts?”

Yes.

Now, this person travels a lot and could’ve gotten much better redemptions from his Membership Rewards. But, hey, live and let live.

If It Makes You Happy, It Can’t Be That Bad

Here is my unsolicited advice. And I know I’ll probably get roasted for it but meh.

If your point redemptions make you happy, that’s what counts. But please make sure it’s worth at least a penny per point. Preferably more.

Delta Pay With Miles? Great.

1% cashback? If it works for you and brings you some joy, then it’s awesome.

One of my friends swears by his Costco Anywhere Visa Card by Citi (learn more about cashback rewards cards). He loves Costco and loves the annual Costco cashback certificate the card gives him. He occasionally takes my advice on getting various new credit cards. But having two Delta credit cards doesn’t fit his lifestyle. It works for mine and maybe yours. But his? Nah. And he’s happy as a proverbial clam.

Now, if you ask our honest opinion about something, we’ll give it to you. If you get in touch and say, “Did I get a good deal?” and we don’t think you did, we’ll tell you.

But don’t get too caught up with what others think of your points and how you use them. Just make sure you’re getting a reasonable and realistic monetary value from them — and enjoying the trips, cashback, or merchandise you receive.

Final Approach

There will always be people more and less fortunate than you. But the time you spend worrying about other people’s trips — and what they may think of yours — is much better spent creating fun memories.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

That’s EXACTLY the way the game should be played. Thank you.

I’m in St Paul, MN…a Delta hub, so we fly Delta almost exclusively from MSP. My spouse and I like to travel so we decided to get a card that will allows us to leverage our spending and pay us back, so we could travel more. We’re spending money daily anyway, why not get something for that? We chose the AmEx Delta Skymiles card and leveraged it by moving 99% of our purchases to the card, using it to pay for absolutely anything that accepts AmEx from groceries, utilities, cable, mobile phone, Amazon, daily incidental purchases…everything unless they don’t take AmEx, then I use a backup Visa debit card. The trick here is we pay it off monthly, don’t carry a balance (unless absolutely necessary and then pay it off ASAP) and we don’t use any other credit card.

We’ve moved up from the Delta AmEx Gold to Platinum card, enjoy 1-free coach tix annually saving 50% on airfare. Then we earn enough miles to garner free airfare for the both of us every couple years…this year it was enough to fly to Hawaii, a bucket list destination for us. Use your points how you like. We like the return on the cost of airfare, but there’s also the Skymiles marketplace and avenues to redeem miles. Regardless, get a card now, and put your spending to use for something you enjoy.

Nicely done! Thanks for the comment, Erica!