Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

We all know this history of Frequent Flyer loyalty award miles programs and how American, so many years ago, started what has become the monster of miles that has fallen so far below the mark of rewarding loyalty that we have today.

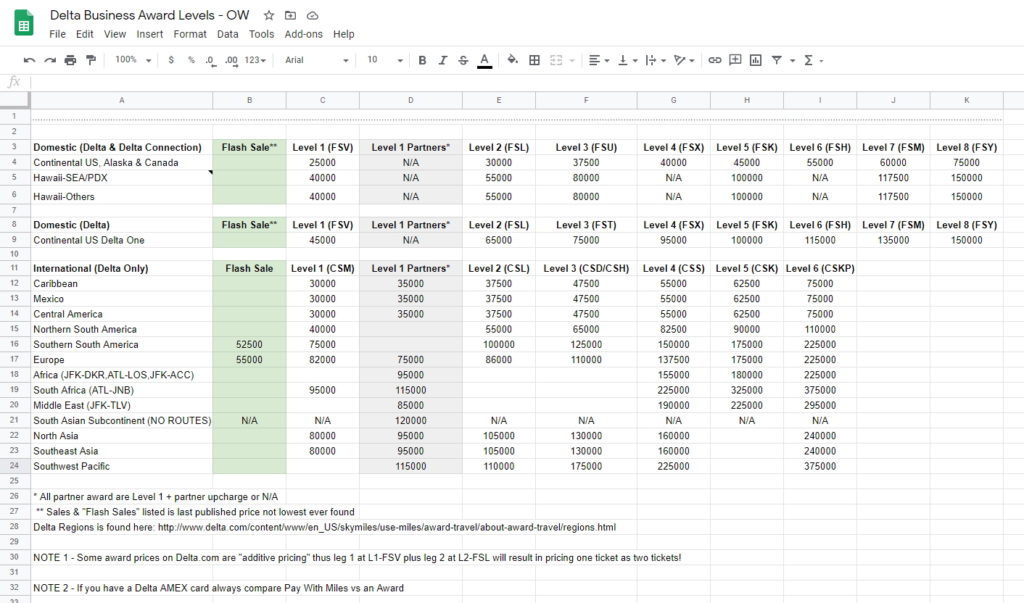

Delta, in what seemed like a brilliant idea at the time, changed from the well-known (and much loved, BTW) award chart way of issuing frequent flyer tickets to a hybrid of charts (non-published but used nonetheless) that have pushed the value of SkyMiles near or sub-1 cent.

This is a MAJOR problem for Delta and American Express!

Once everyone figures out that it is stupid to earn SkyMiles, worth ONCE CENT (or less) when they could earn CASH of 2% on any number of cashback cards – the spending choice becomes simple. There is no way Delta and Amex can pile on enough card perks to justify USING (not holding) a travel card to earn such low rewards.

OK. So SkyMiles is hopelessly broken. Now what?

I have a brilliant solution and Delta (we all know you read the blog) you have my fee-free permission to take this template and implement it at the airline (you can thank me later 😉 ). Here is my brilliant, revolutionary, and simple fix for SkyMiles.

- Step one – DUMP all the award charts.

They are so convoluted and broken and simply make flyers SO MAD they want to walk away from Delta. Instead, it is time to think outside the box. OK, how?

- Step two – SkyMiles will be worth a FIXED value.

Delta has always wanted “the price is the price” model for tickets — and we can do that with SkyMiles as well. But the fixed value of a SkyMile will depend on the massively profitable partnership with Amex. Take a look:

If someone holds the Delta Amex Reserve personal card or the Delta Amex Reserve business card, the value of a SkyMile is FIXED at 3 cents for redemptions.

If someone holds the Delta Amex Platinum personal card or the Delta Amex Platinum business card, the value of a SkyMile is FIXED at 2 cents for redemptions.

If someone holds the Delta Gold Amex personal card or the Delta Gold Amex Business card, the value of a SkyMile is FIXED at 1 cents for redemptions.

If someone holds the Delta Amex Blue card, the value of a SkyMile is FIXED at .75 cents for redemptions.

If someone holds NO Delta Amex co-branded card then the FIXED value for a flyer is at ½ a cent!

It really is that simple. It would be a revolutionary change in the frequent flyer world, set Delta Air Lines apart from ANY of the other airlines on Earth, and truly drive someone to WANT to spend money on their Delta Amex Cards!

Let me give you a simple example:

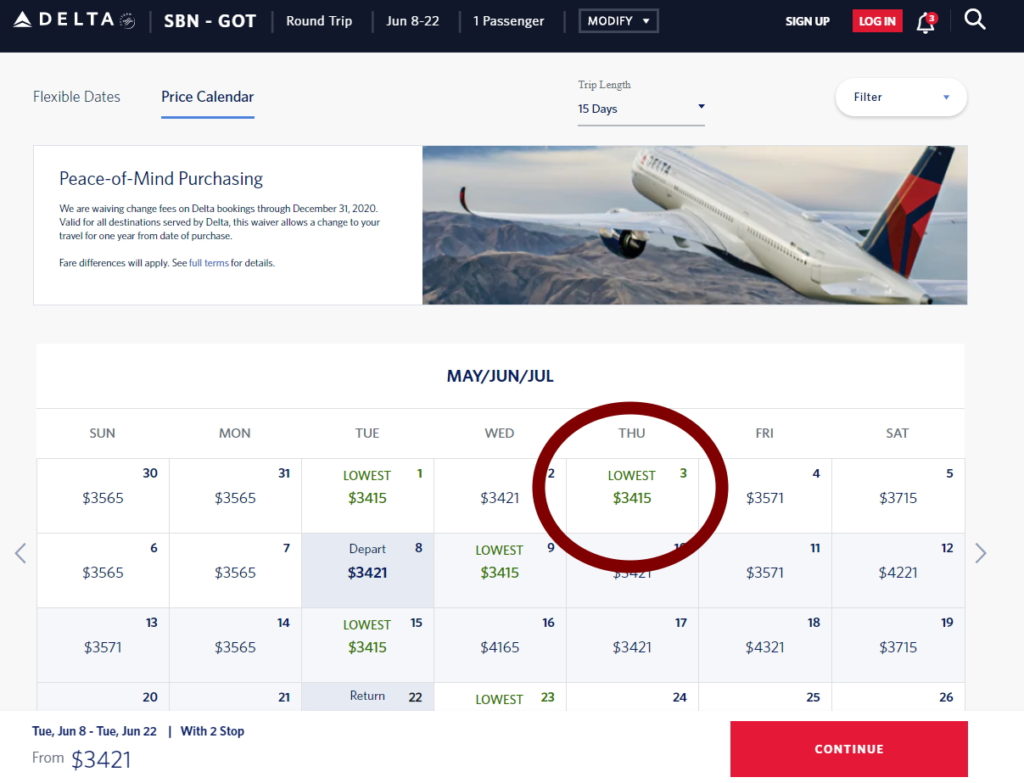

For me to fly to Sweden next summer, if we look at a two-week trip during June, in Delta One the price is shown above. If I held a Delta Amex card the price would be the following for the Skymiles redemption (round trip) at the price circled above:

- Delta Amex Reserve card holder: 113,800

- Delta Amex Platinum card holder: 170,800

- Delta Amex Gold card holder: 341,500

- Delta Amex Blue card holder: 455,300

- No Delta Amex card : 683,000

Simple, right? The price is the price and the value comes from earning SkyMiles AND being a Delta Amex card partner!

Now before you say anything, there would have to be ways to prevent gaming like just getting a Delta Amex card to get the price then dumping it. Like what?

That is up to Delta and Amex, but it would not be hard to say add that someone would have to hold the card at both the time of flight and the time of redemption to get the SkyMile value. Not just that, they could make it so if you cancel during the card member year, you have points clawed back to your current card status (or non-card status).

Amex has PROVEN as of late their RAT teams have fierce claws so gaming could be prevented with minimal effort.

Why would this straight forward model be so simple and beneficial for both Delta and Amex? Let me break it down so that even those in the Delta SkyMiles department could understand. 😉

It is simple. If I am a normal everyday person, I get that I will want to hold, despite the yearly fee, a Delta travel card that will bring me value. I will want to use the card. And when I go to buy a ticket I know all I have to do is live with the price that is the price published that someone paying cash would pay – but I get better value by being a cardholder and earning my Skymiles at a fixed value that I can quickly understand.

It is flexible. I know as a user Delta will not, as they have done for YEARS, devalue to death my SkyMiles when I go to spend them. I know their fixed value – I just have to put up with “the price is the price” to fly but so does everyone else paying cash!

It is better than the rest (I know some will flame me on this but OK). We know other airlines have copied Delta and this has not gone over well. If Delta does this change it will upend the travel industry yet again but this time for the better for everyone.

When it comes to the earning side of SkyMiles, Delta can tinker however they want with how many miles a Diamond, Platinum, Gold or Silver Medallion® will earn compared to a regular SkyMiles member. This part is up to them and could float depending on conditions without massively impacting the core Skymiles program itself.

What do you think? Do you like this idea? Would it motivate you to stay loyal to Delta and the Delta Amex card? Let me, and Delta, know! – René

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

You got quite creative here but as a non-US based member I don’t really like it. Under the assumption that one day it would be safe to travel to the US again it would bug me that my miles are so much less worth than other people’s miles simply because I am living in Germany.

Okay, I am of course glad that there is no such thing as MQD for me. But still I wouldn’t like it.

Although, with the weak earning since it is revenue-based and the ongoing devaluation of miles I don’t think I will ever have the chance to travel business class again.

I know that I only dislike your idea for personal and selfish reasons.

Too easy to just hold the relevant Amex card but do very little spending on it.

@Frankie – I agree. That is why Skymiles must become more valuable.

Different time zones are somewhat fun. Just submitted my previous comment and only a minute later I see it’s from 5 hours ago 😉

It is a simple, transparent solution for the customer. However, this structure looks like it will be more costly for the airline/card company and unlikely to occur in this environment.

@Eric – Neither can afford to loose the other in this environment and beyond. The two are linked. Neither can fail without nasty impacts to the other.

I think this is a great idea. I would never consider the delta cards in their current state as the value proposition is just not there. Getting 2-3cpp because of the card wouldn’t make me spend on them when I can just spend on an Amex gold and blue business and get a lot more points but I’d consider holding the delta reserve for the cert, lounge and point boost

Very creative and simple solution, Rene.

Delta will hate it! 😉

It has much merit, that as you suggest, could be useful to both AmEx and Delta, to get and KEEP cobrand card customers linked together.

Another option in the valuation could be a little bonus paid out upon anniversaries of holding a particular card ((Hi, Gary Leff!). Maybe a 3 year anniversary gets a little 25,000 SM boost to the account? Or 5 year. Something a little extra to share the love and keep people paying the annual fees, if nothing else.

I love this idea, Rene. I support this idea. Delta, I hope you are listening.

Right now I do not put much of any value on Delta miles. AMEX, are you listening?

There is a real problem, and Rene has identified a solution. This would cause me to get the Delta AMEX Reserve card. I already have two Delta Platinum cards, as does my wife. That is 4 Delta Platinum cards in my household (personal and business x2). I am getting ready to cancel all of them because they do not provide me with any value.

RENE – Delta has failed to realize “value seekers” were a disproportionate amount of spending. Value seekers want the chance to get 3-5 cent per mile on a redemption with some flexibility. I can get almost 3 cents in cash for no fees with a BofA account.

@Greg – While I see your point, “most” folks are happy with a 2% card. IMO a Skymiles perceived value of 3% would look like a 50% better deal to many.

I don’t hate the idea, but I do agree that the opportunity to get a great value is what has kept me in the Delta Miles collecting game. In the past few years I’ve been able to find international flights for less than they cost under the old fixed award chart, which has been enjoyable. However, their recent HUGE DEVALUATION due to raising the miles needed to fly on international flights with any legs on non-Delta metal is going to cause me to drop out of the Delta business as it is now. Not only did the flights I was getting ready to book increase 40-70%, but the remaining all Delta flights are increasing because everyone now needs to book those all Delta flights as the only “remotely reasonable” valuations (even though they are actually now too expensive for me to book). I think that after 12 years as a Delta miles fan, I’m done no matter what they do.

Also, I think the Delta Gold card miles would need to be worth at least 1.25 points (rather than the 1 point recommended above) in order to compete with the Chase Sapphire Preferred® Card card which has a similar annual fee and values their points at 1.25. That won’t keep me as a customer, I’ll just stay with my Sapphire Reserved, but it might keep a few people with Delta/AMEX.

Nope. Don’t like it as it completely negates actually flying an airline to earn miles. Instead, it focuses 100% on credit cards and requires me to hold a certain card in order to use my airline miles. They are two completely different products . Delta doesn’t really care which card you use to pay for your flight or how your company pays for your flight. I would have my company book me on a different airline or book myself on a different airline if I was going to be charged more to redeem my earned reward based on my personal card portfolio. At that point, I’d throw all in with a cash back card, book the cheapest flight regardless of airline and be a free agent.

@BookGirl – Not seeing a downside. Your company pays for your tickets and you earn Skymiles. Then you hold your own Delta Amex card and get perk when spending they miles you earned.

I like it and would keep the Delta Reserve for this absolutely!