Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

In my post detailing a recent Delta Platinum Amex retention call, I mentioned transferring some of my available credit from one card to another.

A few readers asked how to reallocate credit lines between Amex cards. So I figured this would be a good opportunity for a quick how-to!

So we’re all clear: this is not a balance transfer. That’s a completely different (and potentially dangerous) beast.

Why Transfer Lines of Credit Between Cards?

If you’re going to close a credit card, you might as well use its credit line to your advantage. It can be very helpful for your debt-to-credit ratio — even after you’ve canceled that card.

Or if you need to make a big purchase on another card and need more credit, you may consider reallocating some of your credit, at least temporarily. This saves you a credit check when requesting a credit line increase.

Aside from that, I generally don’t reallocate lines of credit just for grins.

Which Cards are Eligible?

Credit lines may be transferred between personal and business American Express credit cards.

But with a few exceptions. You can transfer from a…

- personal card to a different personal card (i.e. the personal/consumer Delta Platinum Amex card to the personal/consumer Delta Reserve Amex card)

- business card to a different business card (i.e. the Delta Platinum Business Amex card to the Delta Reserve Business Amex card)

- personal card to a business card (i.e. the personal/consumer Delta Platinum Amex card to the Delta Reserve Business Amex card)

You cannot, however, transfer credit from a business card to a personal card.

I used the Delta Amexes for our examples. But you can transfer between co-branded and Amex-branded cards, etc.

I’ve read the “from” card needs to be at least 12 months old and the “to” card must be at least 90 days old. But data points seem to change every so often, so YMMV.

How Much Can You Transfer?

Each card has an established minimum credit line. Amex doesn’t publish those numbers — but a rep will probably tell you if you ask nicely.

The personal/consumer Delta Platinum Amex card, for example, must have at least a $1700 credit line. Let’s say you have that card and its credit line is $10,000. You could transfer $8300 to another card(s).

(The personal/consumer Delta Reserve Amex card, I learned, requires a $3700 minimum credit line.)

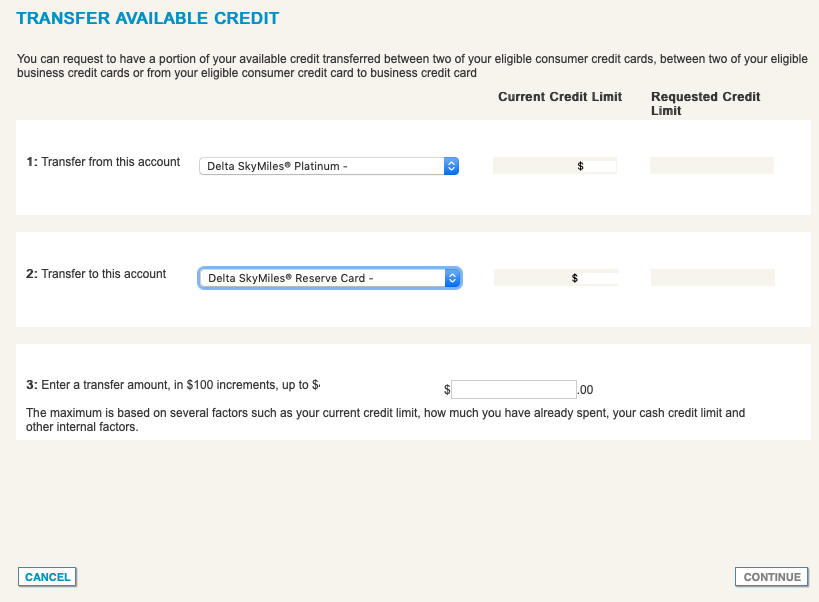

Transfers must be in $100 increments (i.e. $3000, $890, $10,200 — you get the picture).

Once you select the cards involved, Amex will tell you the maximum you may transfer. According to Amex, this figure “is based on several factors such as your current credit limit, how much you have already spent, your cash credit limit and other internal factors.”

How Do You Actually Transfer Available Credit?

This can be accomplished online or over the phone.

Personally, I’m a fan of the online option. Here’s the link to transfer your credit. (Thanks, DoC!)

Select the “from” and “to” cards from the dropdown menus. Your current credit limits will be displayed. Decide how much to transfer and then click “Continue.”

Amex will either approve your decline your request.

Questions?

This was a brief-ish how-to. But if you have questions, please leave them in the Comments section!

— Chris

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Well, that is unfortunate. I want to cancel my delta platinum AMEX business card because the only reason I kept that was to use it after I hit the $60,000 spent threshold on my reserve card.

Now that the thresholds on the reserve card are much better I don’t need the business card anymore.

I know you are correct that you can’t transfer Business to Personal. I am sure that in the past I was able to do that, a couple of years ago. I wouldn’t have been so quick transferring from Personal to Business had I known it would be so hard to change back some day. I wonder if it can be done by phone.