Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

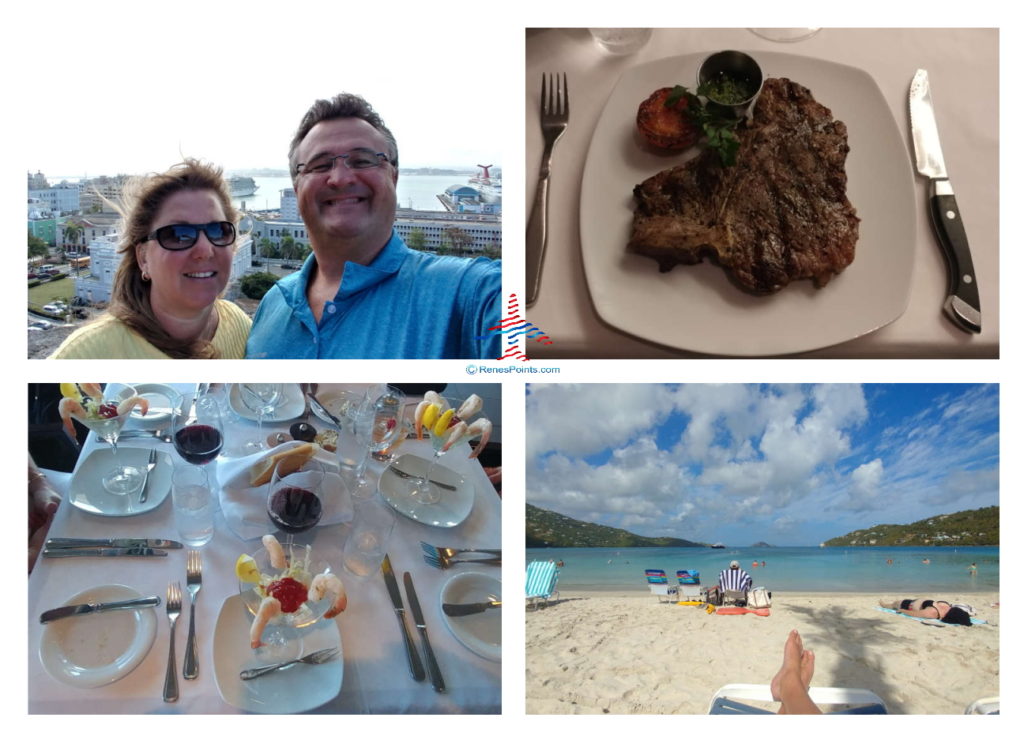

- Introduction: 10 Day Norwegian Dawn Family Suite Vacation – On points!

- American Airlines (and connection) First Class South Bend – Dallas – San Juan

- Priority Pass The Club at Dallas DFW – a good choice when Centurion turns you away?

- Hard Eight BBQ Review Coppell, Texas – A “Must Visit Spot” on a long Dallas DFW Layover

- Marriott Sheraton Old San Juan Old Town Suite Review – Across from Cruise Port

- NCL Norwegian Dawn Family Suite 12016 Forward Starboard Side Review

- IHG Intercontinental San Juan Puerto Rico Hotel near SJU Airport Review Room 1601

- Priority Pass Avianca Lounge San Juan Terminal C

- Final thoughts booking an entire vacation on points (worth it)?!

I love the sea. I love the calmness and the tranquility it brings to my heart. Needless to say, I love the simply amazing food on NCL ships and the service you receive when you are in a suite or in the Haven.

I also love the chase if you will. I love constantly learning how to squeeze absolute maximum value out of each and every point any company is willing to give me for some kind of action on my part. This booking I made a few mistakes that I have learned from and will adjust my strategy going forward.

First off, if you have not reviewed the early posts in this series you will be a bit confused so please take the time to look at them one by one. Here is what I did right to start.

Mixing points, airlines and cash. This trip I did not fly Delta because AA simply had the best flights, price and connections. While I prefer Delta I am happy to fly any airline that saves me either money or points. Also, when it comes to hotels, I am 100% a free agent and only have whatever status that a travel card “gifts” me each year for holding whatever hotel travel card (I do pay fees but most of those cards come with a free night cert so it does most years wash).

What I also did right was pay for the cruise itself with points. In my case, for this trip, I used Barclays Arrival+ points. Sadly that card is no longer available, but it was fun while it lasted. Even with some cost to manufacture a ton of points it net cost my only about 10 cents on the dollar to be in a suite. That is sweet! 😉

I also scored by pre-loading my onboard account to the limit with a travel card and was paid cash again as I left the ship. While most folks are stressed out about the final bill I had cash in hand. Love that. But there were some things I could have improved on and some may not always be worth the risk.

Waiting to book. One thing I have learned with NCL is they tend to really drop the price of a cruise as you near the 61-day window. The savings can be massive. But you also take a big risk if you book air / hotel and more and they suddenly sell out the cruise due to the price drop. I will tinker with this moving forward as long as it does not drive my wife totally nuts!

Using “better” points. In a way I am happy the Barclays Arrival+ is no more. With that option gone I have had to look at other choices to book and Ultimate Rewards points spent from my Chase Sapphire Reserve® card are worth so much more. Not only do I get a 50% bump in value booking with them but most times they are harvest from a card like my Ink Cash card that resulted in 5x points. That – Is – HUGE!

Another mistake I made was learning just where a ship docks. In my case, the hotel I chose I thought was right across the street from the ship. Yeah, not so much. There were a few other little bits that I should have taken the time to read up on before I made a choice. Not major issues but better planning would have resulted in a smoother outcome. Lessons learned.

Some of the above I have already implemented in my following booking on the NCL Star that I took transatlantic to Europe this past May. But that, as they say, is another story! – René

Ink Business Cash Credit Card

- NO ANNUAL FEE!

- Enjoy $500 bonus cash back after you spend $3000 in purchases within three months of being approved for the card!

- Receive 5% cash back on the first $25,000 spent in combined purchases each anniversary year on the following categories:

- Office supply stores

- Internet, cable, and phone services

- Receive 2% cash back on the first $25,000 spent in combined purchases each anniversary year on the following categories:

- Gas stations

- Restaurants

- Unlimited 1% cash back on all other purchases!

- Transfer points to hotel programs such as Hyatt, Marriott, and IHG! Or several airline partners!

- Read a review of the Ink Business Cash Credit Card, learn about more Chase cards, or check out other cashback cards!

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

You can also buy stock in some cruise lines and you get either a reduction in price or onboard credit. The cruisenext certificates on NCL is free money. I have a couple thousand $’s waiting to be used on the next several cruises. Book 6 mos out and use 2ea. of the $250 discounts. Generally cruise lines will refund you money if you book directly with them if the price drops. We also use cruisecompete.com sometimes where travel agents compete against each other for your business. And, each airline, Delta, AA, UA have portals for cruises and they give some multiplier of points depending on cabin and price. They then award you points in the airline portal you went through. We picked up close to 40,000 UA points a couple years ago for getting a balcony cabin on a long cruise. You probably already know most of this.