Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

If you’re depending on Delta SkyMiles® credit card spending to earn you enough Medallion® Qualification Dollars (MQD) for Medallion® status, you’d be wise to spend above and beyond what you actually need.

Why?

(Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.)Returns, Exchanges, and Refunds, Oh, My!

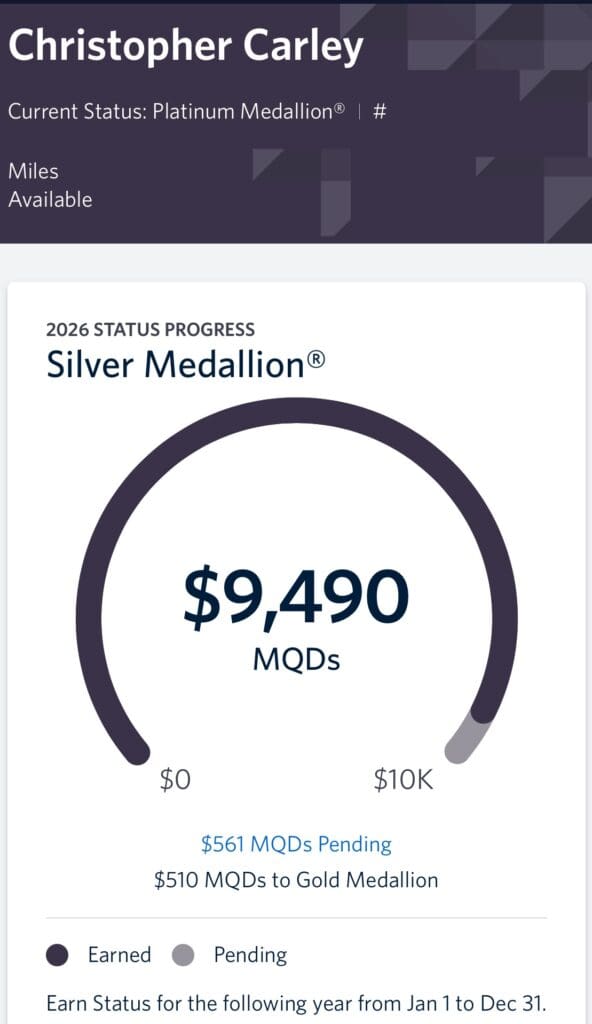

Here is my MQD tracker for 2026 status:

If all goes correctly, I’ll squeak by and just make Gold Medallion®. (Read here why I’m starting with Gold in 2026.)

But as much as it pains me (because the cards’ bonus categories are beyond disappointing), I’m spending as I can on my Delta SkyMiles® Reserve American Express Card and Delta SkyMiles® Reserve Business American Express Card. (Remember that four co-branded Delta Amex cards give cardholders $2,500 MQD just for holding the cards and eligible spending counts toward MQD-earning.)

I like to add a cushion in case a purchase is refunded — even next year. I know someone who lost their Delta status because they returned some clothing in January one year — and that dropped them below their spending threshold from the previous year.

Another example. I once paid out of pocket for an out-of-network surgeon. (Hello, 0% introductory APR credit cards!) I earned a generous welcome bonus on my new credit card. I also submitted a superbill to my insurance.

My surgeon’s office called a few months later and said, “Great news, Mr. Carley! Your insurance sent us payment! We just refunded your card (however much money it was).”

That was great news! Except I lost about thousands of points (And had a negative points balance.)

It would’ve been better if my doctor paid to me directly. But, hey, I’ll take reimbursement over nothing any day!

Get Store Credit

If you need to make returns on purchases you make with a rewards card — especially while chasing a minimum spending threshold (welcome bonus, elite status, certificate, etc.) — try to get store credit instead of a refund. I get Amazon credit all the time because, well, I use Amazon all the time.

There are times that’s not possible. But whenever you can — and you can afford it — get eCredit for online merchants, airlines, etc.

Don’t Spend Money You Don’t Have

I can’t stress this enough: do not spend money you can’t pay off. It’s not worth the status or bonus. The reason I signed up for a 0% intro APR card for my surgery was that I didn’t want to dig into my savings quite yet. Plus, I had a plan to pay it off within about nine months. I had the money on hand but chose to hold onto it for the time being.

That’s somewhat different than, “I need to spend more than my minimum requirement so I can get Delta status — even though there’s no way I can pay any entire bill on time!”

No way, Jose.

Final Approach

If you can afford it, spend above and beyond your minimum required threshold for status or bonuses. Returns might come back to bite you in the tush when it’s too late.

For rates and fees of the Delta SkyMiles® Reserve American Express Card, please visit this link.

For rates and fees of the Delta SkyMiles® Reserve Business American Express Card, please visit this link.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.