Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Anyone who is a regular blog reader knows that I truly am a Frequent Floater. I always have a bunch of cruises booked and am looking for what I could book next. I also love long cruises and by the time you are reading this I am recently back from 22 days onboard — doing two back-to-back 11-day cruises (more on this later).

I am also laser-focused on trying to, one way or another, use every little tip I can to both lower the cost of my cruise and improve the overall experience. This often means using points, and stacking many types of points, to accomplish these goals.

But there is one thing I really have not given much serious thought about until now: what credit card I choose to enter as my default onboard account charges credit card. Why does this matter? First, let me break down the simple reason and then the one that I just learned about from another passenger that has freaked me out and from now on this has changed my thinking in a BIG way.

I am a mega fan of NCL (Norwegian Cruise Lines) having well north of 400 nights credited to my Latitudes account. Some of these nights were bonus nights from suite bookings but I still have a bunch of nights at sea with NCL. One of the ways I save some money on NCL is buying “Cruise Next” credits onboard that, in a nutshell, let you buy cruise deposits at 50% off face value. When I happen to hold an NCL card (I get them when they have the 30k new card bonus, cancel after a year, wait 48 months, and go again) I have tended to use that card to pay as I get 3x points for NCL charges.

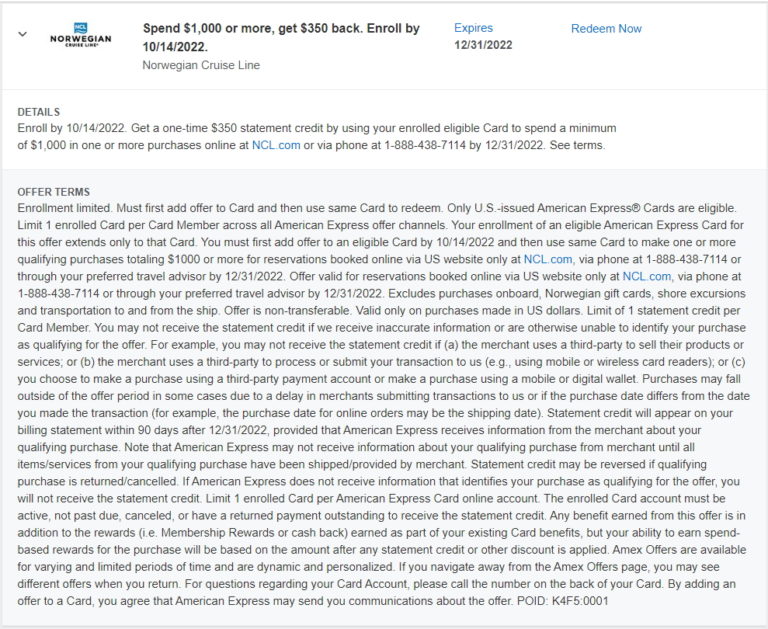

Now here is the thing – I never end a cruise with a balance due. In fact, I always have to go to the guest services desk the last full day of the cruise to get cash back because I always load $1,000 in refundable money to my onboard account before the cruise to get either bonus points or some kind of an Amex Offer if I spend $1,000 I will get $200-$350 back and loading my onboard account works for this. In the past I have often just left that Amex card as my default onboard card because it was simple and it did not “really” matter since I would never charge anything to it anyway.

Well, not any more – in fact never again!

According to the INDEPENDENT a man from Minnesota, Mike Cameron, won a free cruise on Norwegian and sailed on the Encore on January 5th this year. Unfortunately, he came down with a severe case of the flu that ended up with him spending many days in the ship’s medical center that included him hooked up to IVs as part of his treatment.

Yikes!

For those not aware, any visit to the ship’s medical center for treatment can be expensive, and that is one of the reasons I always carry a yearly travel insurance plan that covers my wife and me up to $50,000 in medical expenses if needed. But what I had not thought about is the nightmare that could happen should I ever really need this. Here is what happened to Mr. Cameron.

NCL, for his treatment, issued a bill for $47,000. How did they bill him? Well, they first went after all the cards he had registered for his onboard account, and billed that $20,000, and maxed out the cards. Then they billed him for the balance.

MEGA YIKES!

Here is where it gets ugly and why reading this has changed my cruise life. Mr. Cameron paid for NCL’s travel insurance — but it only covered $20,000 in medical. And get this – it will NOT pay out until things are settled to see what his personal health insurance will cover.

Now, I am not sure if you have ever had to deal with insurance companies and billing (my guess you are yelling at the screen now saying YES and some other colorful words) but it can be a wee bit of a pain in the backside and can take a long time to get anywhere.

I can not dream of what a nightmare Mr. Cameron is facing. He now has only one billing cycle to pay off the entire $20,000 to avoid paying insane interest on his credit cards that NCL billed. So is there a solution to avoid this? I think so and here is my plan.

RELATED: Looking for travel card promotions offering least 100,000 bonus points? See some of the best offers available now.

For me, who has a bunch of travel and credit cards, I am going to find one of my no annual fee cards I keep and only use once or twice a year (to help my credit score by holding a card forever) and try to reduce the credit line to a very tiny amount like $1,000 then always use this card as my default onboard cruise account card for charges. This should prevent the nightmare facing Mr. Cameron i.e. the mega credit card bill. A cruise line can bill me till the cows come home but eventually my personal and yearly travel insurance will cover me (my yearly plan has $50,000 in medical coverage).

Another possible way to avoid this kind of nasty event is to ask your card issuer if they can, for a period of time, reduce your credit limit for travel, and then after the trip, it returns to normal. This, to me, is a lot of effort, compared to having a card, which I will only use for cruises from now on. This way, even though I am always insured when traveling, if something happens onboard I can, when I get home, let as much time as needed pass by while all of the insurers I have fight it out to pay off the bill a cruise line has chosen to bill me.

There are so many bits that go into your travel adventure and planning ahead for “what if” makes a difference to reduce every bit of stress for your trip! – René

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

This February while on NCL (off the east African coast) we met an older Belgian couple with the husband having to be treated aboard for influenza for 3 days which resulted in a $10,000 hold on their shiboard account credit card which maxed out that credit account. Even a short stay in the ship medical facility can really zap your finances. My tip is to always carry multiple high credit limit credit cards with you when you cruise and consider pulling out funds from an IRA to your checking account (for a sizable emergency cash reserve ($10,000+) that can be pulled by ATM card or later be put back in another IRA as a 60 day rollover if not needed). Offship medical expenses or evacuations may require sizable amounts of ready cash.

It is nuts how much the cruise lines costs people when they have to go to the clinic…What can be donw about it???Medical ship insurance? I am surprised they do not sell that already!

Useful post, thanks.

2 questions:

1) for those that actually have meaningful on board charges and want to use a high card limit, yet still want protection against outrageous cruise medical bills, why not have your spouse switch cards at the desk from your attractive high limit card to a low credit line card once it becomes apparent a trip to medical might be needed?

2) intrigued at your mention of $50k of yearly travel insurance. Can I ask which insurer you use and it’s cost?

Thanks.

@Peter – You can, the next to the last day of the cruise, switch out your default card yes. They do not run final charges until after midnight. You can see the travel policy I use here.

That insurance link from 6 year’s ago doesn’t work. Are you still using Allianze Premier? I see the cost is now half what you paid ($242 versus the $450 you said you paid in 2019), but they now charge for the spouse. So the total $485 cost is about the same as what you paid. Have you found an interesting alternative or become aware of promotions? Thanks again!

@Pete – Will work to fix link. I paid (for two) $450 back then. It is up to $485 now yes. I still keep it but may let it laps for a few months if I don’t have much travel and then re-new when I again and traveling a bunch (for another year).