Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

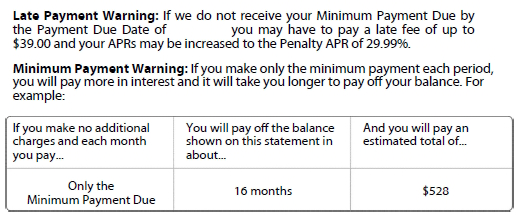

There has been a disturbing trend across the USA, that is, the staggering amount of balances many people are carrying on credit cards each month. Just think of what this means. Some are paying interest rates as high as the below APR:

This is staggering to me and so depressing that anyone could end up paying 30% interest (or more). When you consider some of the best possible CD rates, for now, are between 5% and 6% credit card issuers are crushing it on those who are not smart enough to never ever carry a balance month to month, that is, always pay off your cards in full each month.

With that info in mind, if this is you, you should NOT ever be applying for travel cards:

- You carry ANY balance on a credit card(s)

- You are paying off ANY type of high interest loan(s)

- You are spending MORE than you take in each month

While all of the above may seem basic I can promise you there are those, and I meet and talk to them at frequent flyer events, who ask me questions about what cards to get when they are in one of the three categories above. You need to get your house in order before you even think of applying for any travel cards!

Now that we have that out of the way, and you are not in the above, when should you go for new travel cards? There are two schools of thought.

The first group, that I think covers most of us, is to go for cards with a specific vacation or trip in mind. You know where you want to go and want to find the best way to fly, stay and then enjoy the location for as little as possible in the way you want – either just cheap or even luxury all the way.

If you are group one then you want to hold off on applying for cards until there is a new big bonus offer from whatever bank that the points will meet your goal. You have time so just wait and when you then see a mega offer – jump on it. Knock out the spend and wait for the next part of the puzzle to fall into place.

Then there is group two. While you are also looking for great new card offers you don’t just go for one or two cards at a time – you go for a bunch – many times a year. You are banking points and using creative spending to haul in as many points as you can so that when you want to book something you already have a large pile of points ready to go (yeah, I kinda fall into this group).

Bottom line – these are amazing times for points enthusiasts to rack up a staggering amount of points but you need to make sure you are on the winning side of the equation and that side is NOT the bank’s side! – René

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Rene, you failed to mention about the 5 in 24 rule that the big card companies have. If one opens 5 cards in the past 2 years, one will be, for the most part, declined. Is there a way around that rule? You mention applying for “a bunch of cards” several times a year for the 2nd group. Have I missed something? Thanks for all you do to help cruisers.

We’ve been hearing stories about Chase thawing a bit on 5/24 when it comes to their business cards.

@John – Hammer business cards for two years 🙂

When applying for a “bunch of cards” several times a year, do you close other accounts at the same time? Or do you keep adding to the number of open credit cards you carry? And if it’s the latter, does that negatively affect your credit score or the lending process with your bank?

@Brad – I often try to downgrade to a no fee card year 2 – if not close. Minimal impact on credit score long term. Also keep in mind having more available credit on lots of cards helps your score go up as the amount of credit you are using each month as a percentage of available helps your score!