Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

I annually post which of my Delta Air Lines purchases work toward the airline incidental credit featured on some American Express cards.

I traditionally did this toward the end of the year. That way, I had an entire year to gather information.

My personal and consumer Platinum Card®s both have gotten workouts with Delta spending during 2023. So, I have accumulated several data points already.

More importantly, I recently realized it’s probably more helpful for everyone if I publish my results sooner than later! I still need to try a few purchase categories — but here’s what I have for you so far.

If links don’t display or you can’t click them, turning off ad blockers should enable you to see and access all the content. And you’re supporting Eye of the Flyer. Thank you!

Which Amex Cards Have the Airline Incidental Credit?

First things first. Three American Express cards give members a certain amount of statement credits to use with one airline they can select from a list provided by Amex:

- The Platinum Card® from American Express ($200 annual airline incidental credit)

- The Business Platinum Card® from American Express ($200 annual airline incidental credit)

Manual enrollment/activation is required to take advantage of the benefit. Terms apply.

Delta Air Lines is my choice for both my The Platinum Card® from American Express and The Business Platinum Card® from American Express.

Here’s a fun bonus: The Platinum Card® from American Express earns 5X American Express® Membership Rewards® points per dollar spent on flights booked directly with airlines or through American Express Travel® (on up to $500,000 on these purchases per calendar year). The 5X bonus also worked with all of the below purchases!

RELATED: The personal/consumer Platinum Card has a hefty annual fee — but here’s how to earn it back!

What Purchases are Eligible?

An Amex rep once told me the below charges should credit back:

- Airline fee charge billed after airline selection

- Airport lounge day passes and annual memberships

- Change fees

- Checked baggage fees

- Early check-in fees

- In-flight amenity fees (beverages, food, pillows/blankets, and so on)

- In-flight entertainment fees (excluding wireless Internet)

- Overweight/oversize baggage fees

- Pet flight fees

- Phone reservation fees

- Seat assignment fees

- Unaccompanied minor fees

Here’s what is explicitly excluded (or, at least, supposed to be):

- Airline tickets

- Award tickets

- Duty–free purchases

- Gift cards

- Mileage points purchases

- Mileage points transfer fees

- Upgrades

With that in mind, let’s get to the list!

YES: Food and Beverage Inflight Purchases

No surprise here. The credit came in handy several times this year during transcontinental flights when I wasn’t in First Class or Delta One. I bought Flight Fuel boxes (fruit and cheese plate for the win!) and the occasional cocktail.

Considering the Tip-Top Espresso Martini and Buffalo Trace Bourbon Cream concoction requires two separate drink purchases, the airline incidental credit can come in handy!

NO: First Class Seat Upgrades

Upgrades are on the no-no list, but seat assignment fees are okay. I hoped there was an outside chance the charge would credit back — even though it never has for me.

So, for the sake of science, I treated myself (or maybe it was my wife?) to a First Class buy-up from Main Cabin and charged it to one of my Platinum Cards.

No dice. (And please don’t tell René I did that. He’ll get mad.)

YES: Award Ticket Fees

My family bought several Delta SkyMiles award tickets this year (mainly thanks to TakeOff 15!). All of those were/are domestic trips, so we end up paying $5.60 in fees per person each way (or $11.20 roundtrip). I charged most of those fees to my Platinum Cards and received them back in statement credits.

NO: Companion Certificate Taxes and Fees

My family recently flew to Boise, Idaho. We used my wife’s Delta SkyMiles® Reserve American Express Card‘s and my Delta SkyMiles® Reserve Business American Express Card‘s Delta Amex Companion Certificates for our extended group.

The primary traveler’s airfares and companions’ taxes and fees went on my Amex Platinum Card. (Remember, you don’t need to use your Reserve card to purchase the trip.) None of those charges — even the companion’s taxes and fees — triggered the statement credit. (But, hey, I still earned 5X points per buck spent!)

Interestingly, the companion’s 9/11 security fees ($11.20 roundtrip) did credit a few years ago.

YES: Cash Balances on Reservations Partially Paid with Gift Cards

I wrote about this a few weeks ago. I like purchasing discounted Delta gift cards whenever they’re on sale at Fluz or elsewhere.

But when I applied a $500 Delta gift card to a recent reservation, I still had an $87.10 balance. I charged that to my Amex Platinum Card. The entire $87.10 credited back.

YES: Delta Sky Club Guest Admission

My wife, daughter, and I traveled together a few weeks ago. Our daughter has already used the two Delta Sky Club guest passes that come with Mrs. Carley’s Delta SkyMiles® Reserve American Express Card and the two on my Delta SkyMiles® Reserve Business American Express Card.

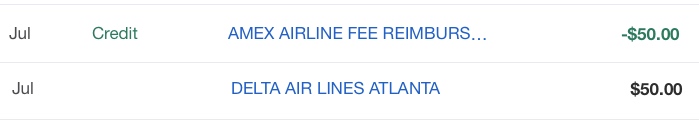

On our flight home from Minneapolis-St.Paul (MSP), we visited the wonderful G-18 Delta Sky Club. My daughter was charged the $50 guest fee.

I paid with my Amex Platinum Card. The entire $50 credited back about a week later.

What I Haven’t Tested Yet This Year

I still need to try out some other purchases, such as:

- Cash balances on Pay With Miles tickets

- Cash balances on tickets purchased with Delta eCredits

Reader Data Points

Several readers commented below on what worked and didn’t work for them.

- YES: Infant in arms fee on an international flight

- YES: Pay With Miles cash balances

- NO: Pet fees

- NO: Premium alcohol purchases

Final Approach

August is almost here(?!) — and if you need some ideas on how to earn your Amex Platinum airline incidental credits with Delta purchases, I hope my field tests help you out a bit!

See Rates and Fees; terms apply for the Hilton Honors American Express Aspire Card (All information about the Hilton Honors American Express Aspire Card has been collected independently by Eye of the Flyer.)

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Really helpful post. Thanks.

Another data point: tried an in-sky club alcohol purchase to see if it would count as a sky club purchase, but no go.

Thanks for the data point — and falling on the sword for us, Drew! 🙂

I’ve flown with my pet twice this year never triggered a credit for me. I did get the 5x.

If you need help on spending to get status on Delta, you don’t fly enough to earn it.

I’m already Platnium for 2024. I did it the hard way, flying over 85,000 miles and spending close to $13k already. I use an Amex also.

Congratulations on your Platinum status. Sorry if I’m missing something — how’s that relevant to this post’s topic?

Lots of us are already DM for 2024 and we’ve spent way more than $13k so you’re still far behind. Spending the Amex incidental credit isn’t about earning status on DL or anyone. Most of us get most of the normal incidental items for free so Chris is just sharing some things to do if you have DL as your airline for the credit.

Thanks @chris

This year I have not been successful in getting the credit on my Hilton Honors Aspire card when paying the cash balance on a Pay With Miles purchase. Both times I’ve tried I’ve made sure my remaining cash balance was less than the $250 benefit limit, but I didn’t receive any credit.

Thanks for the data point, Adam!

Well, I stand corrected:

Just after commenting I logged into my Amex account and saw that the credit for a flight I took 11 days ago just posted the other day. In the past I’ve always received the credit very quickly, so after not getting it for several days after booking the flight I assumed I wasn’t getting it. But I did: credit for $238 cash balance on a Pay With Miles ticket.

Thanks, Adam!

Acknowledging that this applies to a small subgroup: infant in arms international flight reduced fare was covered by incidental credit on Amex personal platinum.

Thanks, Greg!

Great info. I almost exclusively fly Delta. As a Platinum Medallion®, I had difficulty using the $200 credit on my Amex Platinum. Last year I upgraded to the Amex Delta Reserve and a few months ago downgraded my Amex Platinum to Gold. Even then my Delta account is laden with free drink coupons that I’ve only ever used on a last minute booked trip.

But that’s just my particular situation. I used to fully use the $200 benefit on my Amex Plat and I’m sure for most folks it continues to be a valuable benefit. I’m an exception… Most of my travel expense is for personal (vacation) purposes so I stick with Delta and use card + status to “pay” for bags, upgrades, drinks, etc

Thanks for sharing. If you choose to to an article on what counts towards the MQD waiver, I recently discovered that PayPal payments to friends don’t count, even when you pay the credit card payment fee. I thought until then that it was only Amex Send payments that don’t count and that this was because you are not being charged a fee. The only PayPal payments that count are for goods and services.

It is very hard to try to use the $200 credit..New items that count need to be allowed… Like the old days when a premium drink in the SC counted!!!

Guest admission to the sky lounge triggered the credit for me. I used the personal platinum card to get in and took my wife, two sons, and daughter. I got the full $200.00 credit about 5 days after the trip.

Thanks for the data point!

It is very hard to use so $400 out there still for the year!!!will keep trying maybe paying for guests for the club

I had premium alcohol at the skyclub in phx credited back earlier this year

Really? Nice! (What did you have?) I wonder if it varies by club? I guess I better try it out!

I think it worked at sea later that same day.

Does the incidental fee work on Air France or KLM flights? Or is it strictly Delta flights only?

If you’ve chosen Delta as your airline, then just Delta. But if you book an AF or KL codeshare *through Delta*, then the award fees, etc., should credit back.

A Delta agent accidentally converted my refundable tickets to non-refundable, sending a lot more than the expected fare difference back to my AmEx Platinum. When the next Delta agent asked me to pay the extra to make the tickets refundable once more, those charges were eligible for the AmEx Platinum airline incidental statement credit. The net result was a refund of the fare difference, plus an additional portion of my tickets became free.

Crazy!

Hi Chris,

I plan to dump my Delta-branded Reserve card in December, I just got my new AMEX Business Platinum card, and I did use your link!

I have not had a Platinum card since 2020. In that era, we could burn the incidental fee credit on Delta gift cards. But if I recall correctly, there was a sweet spot. A single $200 gift card might not trigger the credit, but a $50 gift card probably would. Above, you stated that you had luck paying with a gift card, with a reminder of $87.10 on the Platinum card triggering the credit. In the comments I see that Adam got a $238 credit with a Hilton Honors Aspire.

Do you think I would be safe trying to burn $200 credit at once by using a gift card and leaving a remaining balance of a little more than $200 for the Platinum card, or should I break it up a bit? Our prior experiences using the incidental fee credit to buy gift cards leads me to believe that the size of the credit might be considered by the algorithm that decides whether to grant the credit.

Thanks! I imagine that there are a few people dumping the Reserve card and switching to a non-Delta-branded Platinum card for 2024. As you pointed out in another thread, it’s not a bad time to do this because we can earn any credits that are based on calendar years now and get another set in January. The 150,000 point signup bonus for the AMEX Business Platinum is also too good to pass up!

I think you’re OK trying it with $200.

Thanks. I will let you know.

Just tried seat selection on a code share flight (Aeromexico). I went from main cabin to their business class product AND IT WORKED!

There was no way to select the seat in Delta’s website, but was able to chose a Premier seat over the phone (I could have chosen the seat over Aeromexico’s site, but then the charge wouldn’t have come from Delta).

Couple of days later, credit was on my statement.

I wasn’t expecting for it to work, but I’m glad I have it a shot.