Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

I personally hold dozens of travel cards. The bulk of them are no fee cards and I use them to maximum advantage each year for tons of points to offset many of my costs associated with cruising.

But I do not hold any cruise lines cards and have only had one, once, many many (did I mention many) years ago before I learned there are way better choices to consider!

Chris had a great post of why you should in fact avoid cruise lines travel cards here and if you are ever considering applying for one – review that post before you click apply!

But have both Chris and I missed the boat, if you will, on redemption opportunities for these cruise lines cards? Maybe but just for one of them.

Reader “Randy” on my post from a few years back on EyeoftheFlyer about things to consider before booking an NCL cruise said the following”

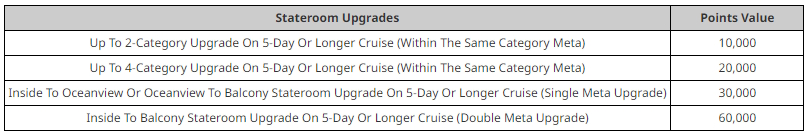

“It’s still the 20,000-25,000 points [for a new card bonus after minimum spend]. That does equate to $200-250 if redeemed for OBC [onboard credit] or statement credits, but that’s not the best way to use those points. You can cash in 30k [30,000] for a single meta or 60k [60,000] for a double meta cabin upgrade on any NCL cruise (i.e. inside to balcony). So really they’re worth potentially way more than $250.” – Randy EyeoftheFlyer reader

Wait whhhhaat?

Randy is right and we have missed a possible sweet spot for the Norwegian travel card. What he is talking about is this:

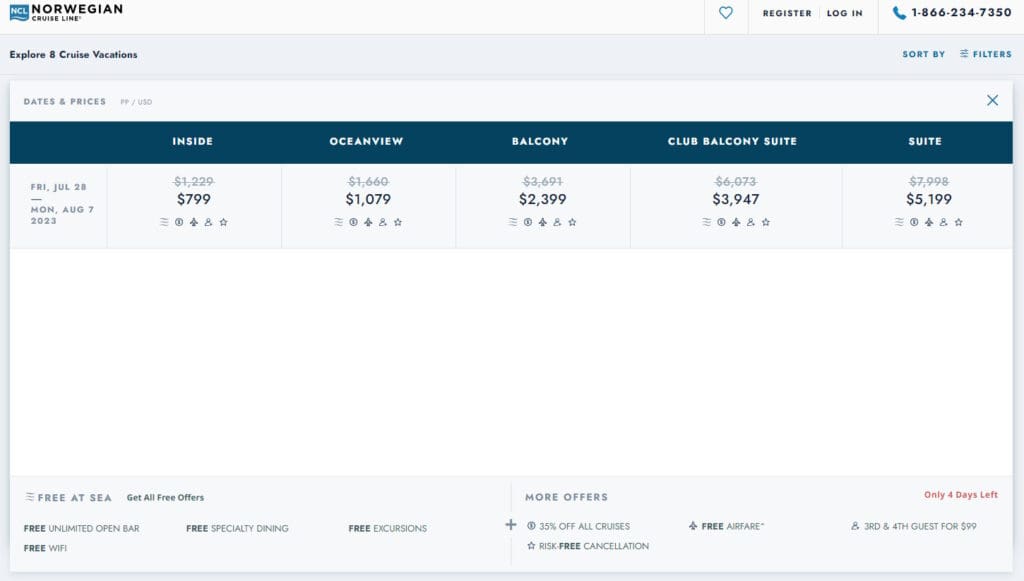

Rather than redeem your points for a very poor 1 cent per point value you book a cruise and are able to use 30,000 points to go from an ocean view to a balcony stateroom (on a 5-day or longer cruise) and that could have an outsized redemption value. Take a look at a cherry picked example below:

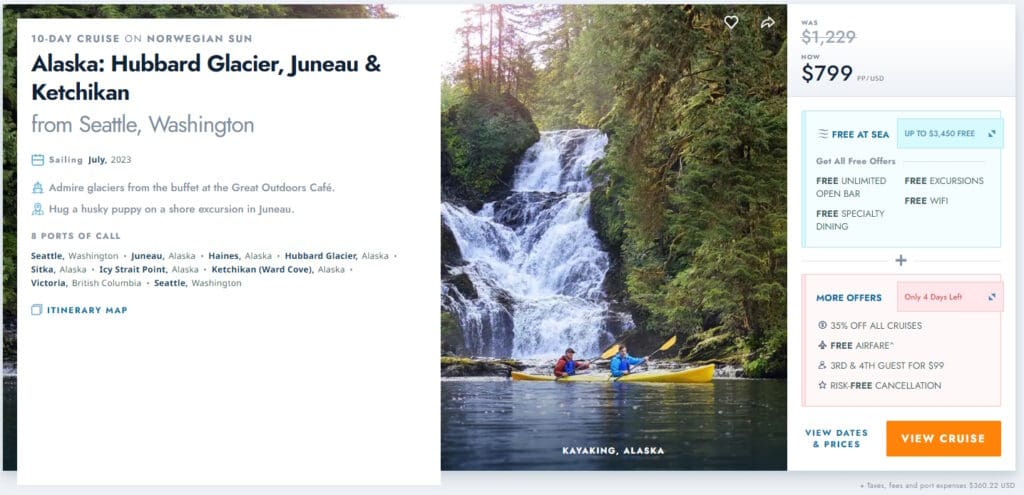

If you wanted to book, for this July 2023, an amazing 10 day Alaska cruise on NCL you could save THOUSANDS of dollars (based on double occupancy) by redeeming the points for a cabin upgrade and sailing Alaska with a balcony is cleanly very nice vs. just an ocean view.

Nice right? 🙂

But notice above I said you “could have an outsized redemption value” because not every cruise example yields this type of huge value and you would have to be very particular when you were to use this option. Still there is solid value to consider and that is saying something for a card I would never have considered holding ever before Randy’s comment so thank you!

Now that we have found this little gem what about other cruise lines cards? Really not so much and once again Chris was right in his post.

For example Royal Caribbean cruise card lets you redeem 125,000 points for a “5 to 7 night Royal Caribbean cruise, (minimum available ocean view stateroom); value of cruise vacation fare may not exceed two thousand five hundred dollars ($2,500 USD value)” – barf!

Princess Cruise Lines card run by Barclays and is a 1% earning card (2% of Princess purchases) with no other options and should be avoided – period! There are soooooo many better choices.

The Disney card is proved by Chase and has some higher earning categories with the card but once again for redemption there is nothing exciting to see and there are many other better cards Chase offers us.

I could go on and on with all the rest of the cruise lines cards but after reviewing them all none of them have either earnings options or redemption options that make them worth either A) applying for the new card bonus or B) redeeming for anything of great value.

Bottom line we have found a sweet spot and possible outsized value in getting the NCL Visa card, earning the new bonus, and using those 30,000 points for a cabin upgrade. One issue with Randy’s tip is he mentions spending 60,000 points for a double upgrade in his comment. My question for him now would be how did he get that many points? Sure getting a new card, earning say 25,000 points and spending your way to 30,000 could be a big winner but after that the return for using the card for regular spending is poor vs. other much better card choices to consider. – René

Follow Frequent Floaters on Facebook, Twitter, Instagram and our magazine on Flipboard. You can subscribe to our once a day e-mail blast here! <-LINK

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.