Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some of the links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

I have returned to booking cruises with my favorite cruise line, Norwegian or NCL. My first one I locked in, as I blogged about here, is the better part of 2 years away. To say I am excited is an understatement as I can not wait to get back on the sea but only when it is safe to do so (i.e. the risk of COVID is over).

But I was not content these past few weeks to book only one cruise. Oh no – I have now booked two! What I have done is book something I have always wanted to do but never have had the time or circumstances to get done, that is, to book two longish cruises back-to-back!

And that brings me to today’s post that is all the things you need to do before you book your cruise with NCL. The considerations are many, but they can save you a ton of cash so let’s dive in.

The first of the two cruises I booked using something you can only get on a past NCL cruise, that is, a “Cruise Next” credit that is future credit for a sailing (with a bunch of T&C and exceptions) that is basically buying cruise money as half off. Great if you have them but what if you don’t? Do not dispair. Take a look at this hidden gem:

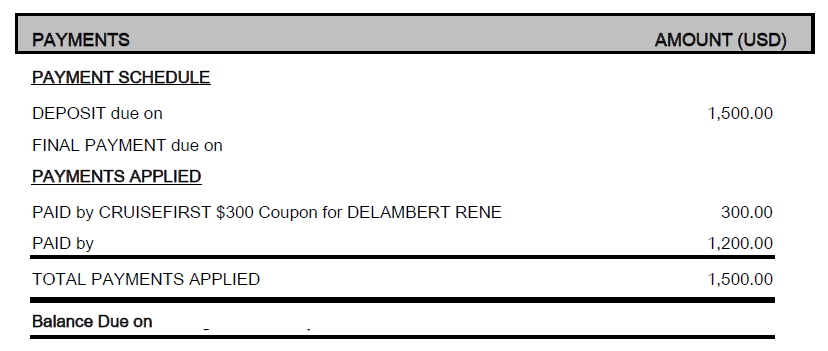

NCL has an all but hidden discount called “Cruise First“. While it also has a bunch of rules and exceptions it also gives you cruise money at half off but the neat thing is you can buy it and then immediately use it booking on a cruise as I have above ( I paid $150 and got $300 credit). You can call and buy one of these with an NCL rep and then choose how you next want to continue with your booking. Like how?

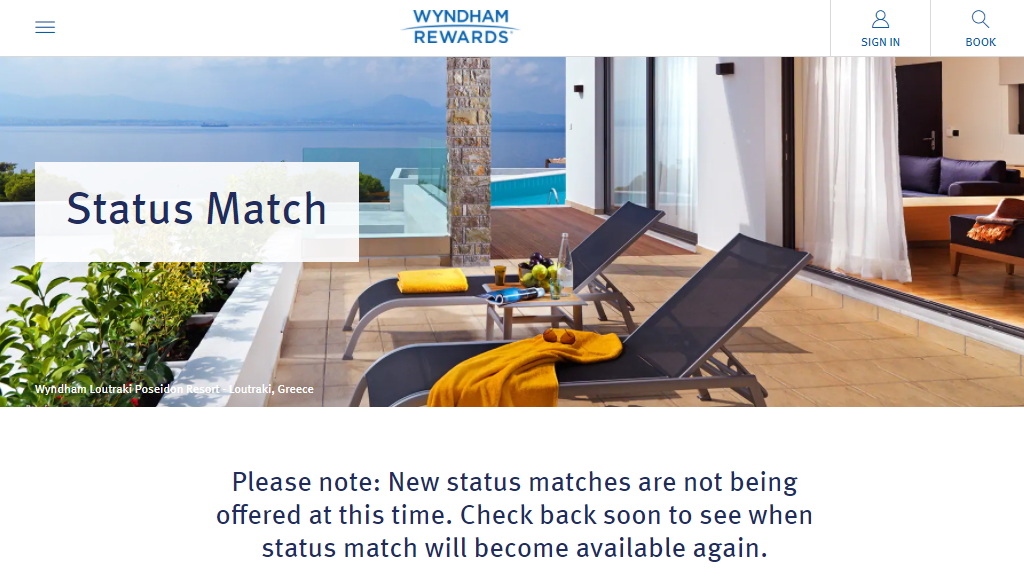

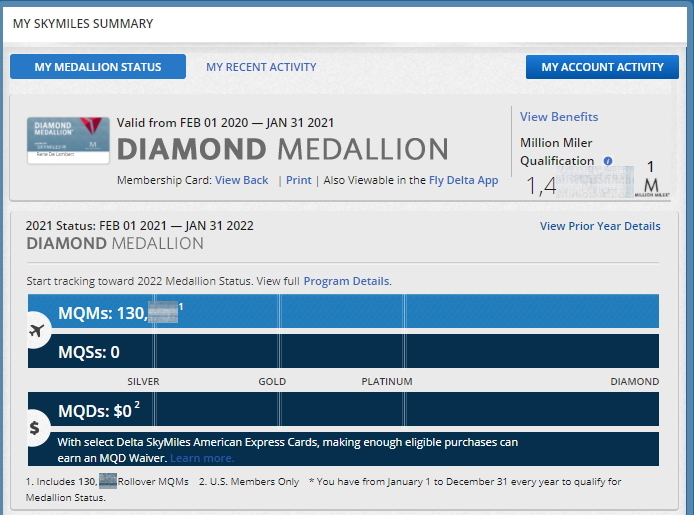

In my previous post I outlined the amazing perk being a Caesars Diamond gives you. Unfortunately for now the chain that normally works is on pause. The normal steps would be to get a Chase IHG card that yields you instant IHG Platinum status that then can yield you Wyndham Diamond that lastly can yield you Caesars Diamond. Until it returns I would consider getting a long term hold card, that is, the Chase IHG card to be ready when it does. And there are more travel cards you must consider. Why? Just take a look:

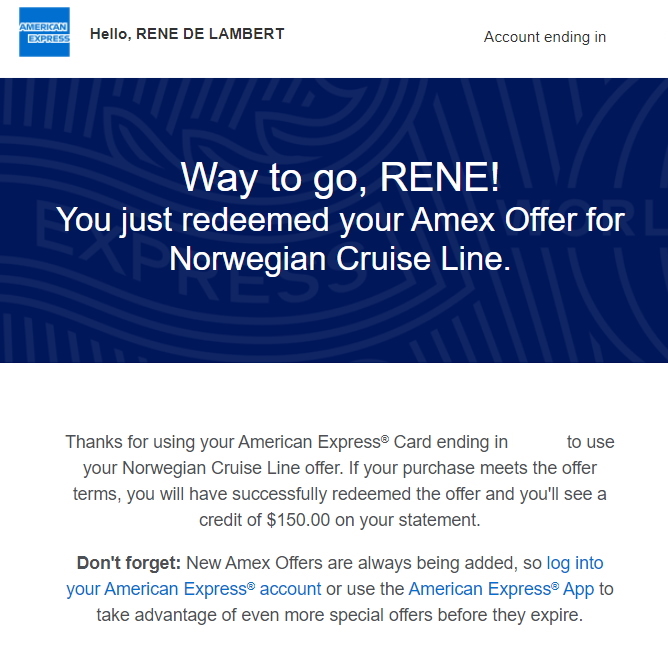

Every week I am on the hunt across my numerous Amex cards I hold for any offer that I will use that will yield big discounts on things I am going to buy anyway. By activating the offer with NCL on one of my cards I got another $150 off my NCL deposit on top of the $150 from the Cruise First credit. Saving $300 on a $1500 payment right out of the gates is sweet right! But there are so many more things to consider before you book.

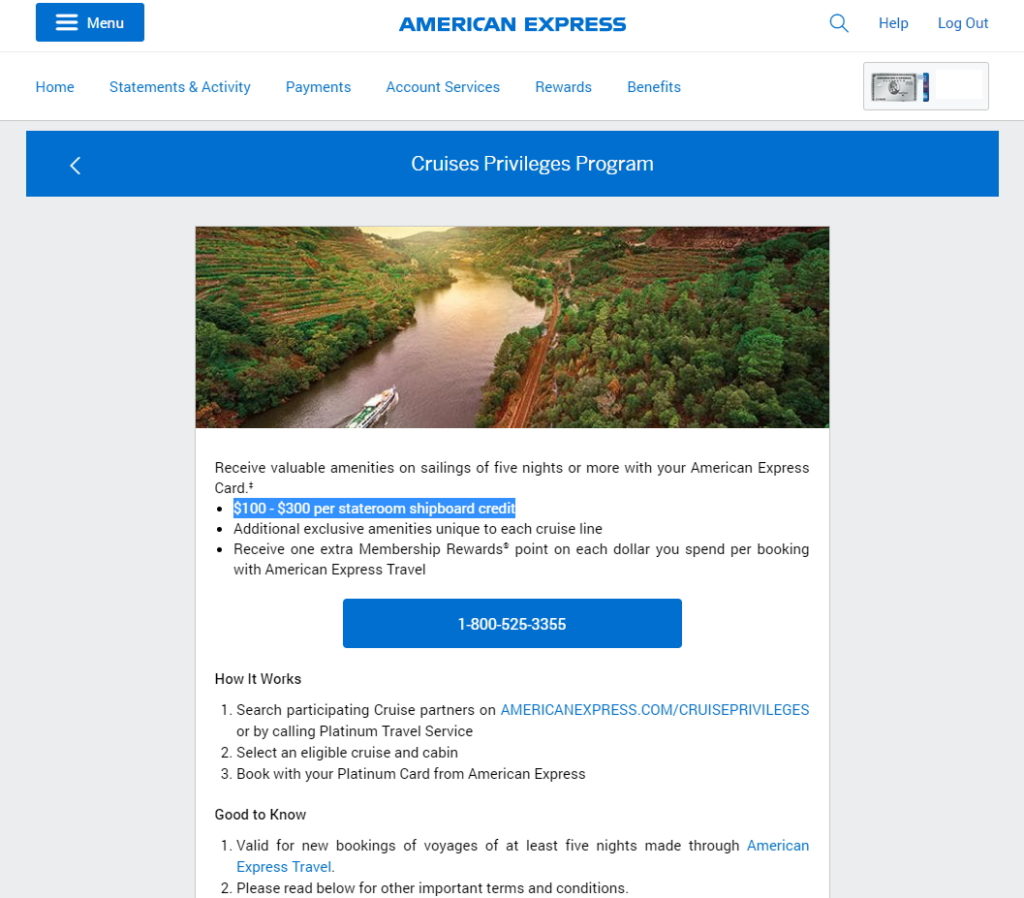

You may want to use Amex travel to book your cruise. You can still use Cruise Next or Cruise First and even the Caesars discount with this. The way you do that is first call the NCL Caesars Cruise folks and have them put the reservation on hold. Then you call Amex travel and have them transfer the reservation (with all the discounts and credit applied) to Amex travel. Then they finish the booking. In addition to onboard credit they often offer bonus things like extra nights of specialty dining and more (be sure to ask). Is this the best way? Maybe but I like other options. Like what?

I have blogged a number of times that I have done the steps above and then had Chase Ultimate Rewards® folks (run by Connections Loyalty that was just recently was purchased by Chase Bank) take over the reservation and apply my UR points to cover the cost of the cruise. There is yet another card tie-in option.

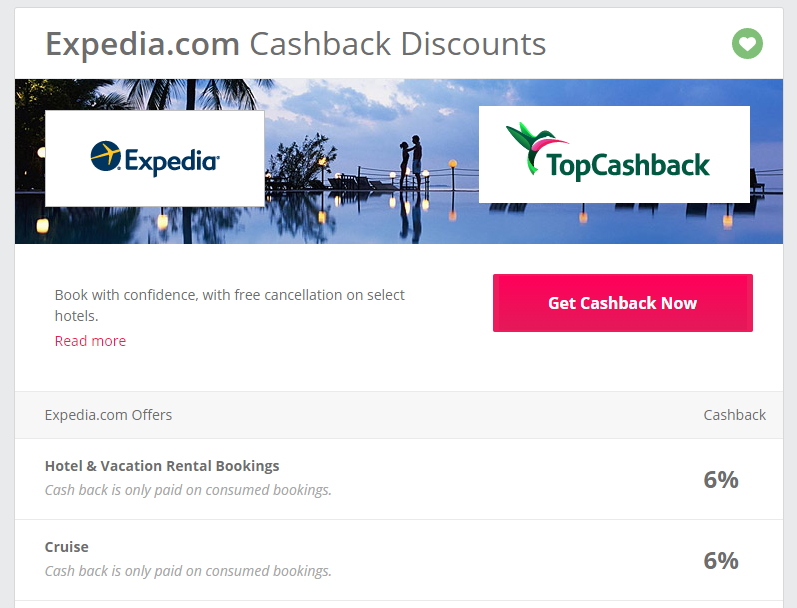

I have extensively used this chain in the past, but to me it has fallen a bit out of favor. The steps are to start at TopcashBack and then click to Expedia to book your cruise. Once it is all done and you are home – and a number of months go by – you can get a sweet chunk of cash back. The downside is you can not do so many of the other steps I love to get the cruise booked. But know it is an option. What else?

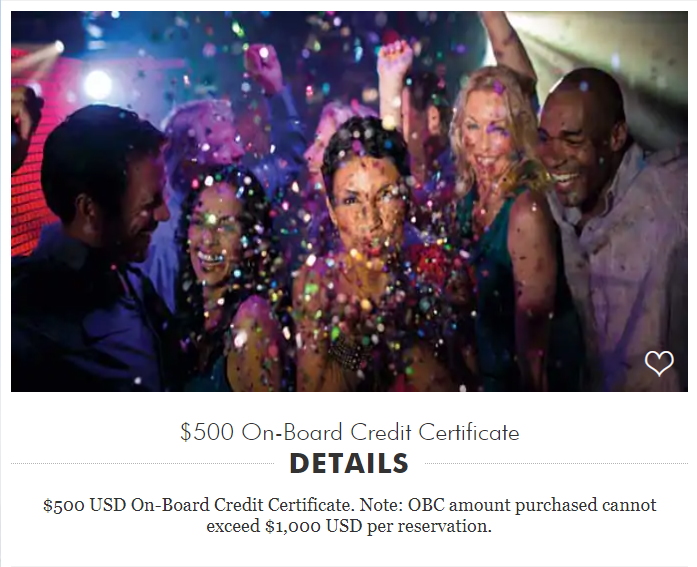

NCL, once you have a reservation, allows you to buy onboard credit up to $1000 per sailing. Now if you happen to have more Amex NCL $150 back offers on a number of cards (or other offers like 15,000 Membership Rewards points) when you spend $500 you could load in one of these to your cruise account. Whatever money you do not spend on the cruise (even if you spend none of it) you get back in CASH before you depart the ship.

Are we seeing how many deals stacked upon deals there are if you work at it? Is there anything else?

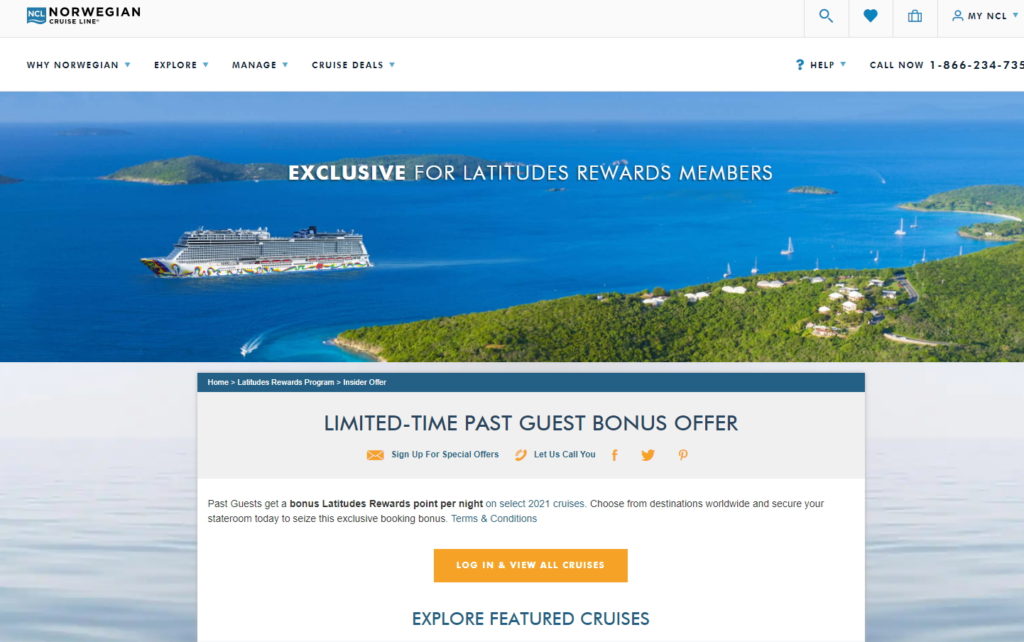

If you have ever sailed with NCL and have a Latitudes number you are eligible for even deeper than normal discounts (that can still be stacked with Caesars and others) as well as other perks like more onboard cash or more free wifi or specialty meals and so on. One of these offers I got yielded $100 credit per day for shore excursions – there were a number of shore excursion options that were less than $50 per person resulting in zero cost!

Are we done? Just about. The one thing I warn you to stay away from is this BofA NCL credit card. The new card offer is weak compared to any number of travel cards you can choose from (or even cash back). And even if you do get it for the new card bonus the earnings levels are so poor that you can do better with almost any other card. Just avoid this one please.

Are there other tiny tips or tricks to save even more? Some cruisers have told me they have been able to buy casino chips with a cash back or travel card and simply deposit the chips back into their account and harvest the bonus from the purchase. Every time I have asked about this a 2-5% fee has been part of the purchase thus all but wiping out any value.

What do you think of all these steps? Have you taken advantage of any or all of these steps in booking your past or future NCL cruise? – René

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some of the links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Good tips. Some standard travel agents could match or beat moat of this while including most of the discounts and doing all the leg work. I would use extreme caution using the old cruise ship casino chip mfg spend trick. Amex and others have added language about this recently and are likely to claw back or shut you done in extreme cases.

@DaninMCI – Agree on the Amex RATS. They are ready to chew your leg off in a heartbeat! BTW a travel agent can use Cruise Next and Cruise First certs when booking.

Agents can book Cruise Next but they don’t get a commission on those typically. I think part of this is how agents did get some commission on these for original bookings and now are being used to carry over to new bookings. Agents can book those and also add on other promos in some cases. In addition, some agents are willing to sweeten the booking with some agency access perks. There is a current promotion where agents selling Cruise First certs can get a $50 gift card for every one they sell so that helps on the backend as it goes to the agent or they can elect to share some of this with clients I’d guess. I have access to all this due to a partnership with an agent for my tour bookings but I don’t book a lot of stand-alone cruises. I do think that using a good TA is a good way to go and helps even more with Covid due to the manual work and many phone calls involved with rebooking canceled cruises. Agents also have access to block and group space in some cases which can be cheaper than the market-facing promos.

Rene, We have 2 cruises on NCL booked next fall. One 9 days, the other 18 days. We also got the $150 Amex thing for both our cruises and also got applied 2ea. Cruise Next certificates for each cruise. I tried the Caesar thing but it was a no go there.

For each of our cruises we started at cruisecompete.com. We have gotten very good discounts and I like that the various agencies bid on the cruise.

This, however, is the first time I have read or heard about the First Cruise deposit.

Thanks for the tip.

Good overall info for cruising..Thank YOU

You aren’t flying but think cruising is safe? Way too risky for me and I’ve been flying regularly over the past year. COVID will be with us for years to come. iMO, cruising is like a salad bar or a handshake, it’s never coming back.

@Mitch – Fly is NOT safe right now. Period!

As to cruising, if you took the time to read the post, my booked sailing is about 2 years away. If we do not have COVID under control by then I will clearly not be flying to get to the ship (since, like now, flying is not safe) nor get on the ship.

My latest Amex NCL offer ($125/12500 pts), which I have on 2 cards, states only one offer across all eligible cards.

You can utilize multiple AmEx offers if you setup your CCs under different logins.

If you put them all under (1) account/login, you will only be able to use a single offer.

DW prefers the single account but then only gets 1 offer while I have multiple logins and offers.

I know you say to avoid it, but I’m looking at the double class upgrade offer on the NCL BofA card that I could earn enough points for after just the initial bonus and paying for my existing cruise. That would be a significant – thousands of dollars – savings on my next cruise. With no yearly fee, I’m not seeing the down side.

@Randy – This highest ever BofA NCL card offer I have ever seen is $250. What is your offer?

It’s still the 20,000-25,000 points. That does equate to $200-250 if redeemed for OBC or statement credits, but that’s not the best way to use those points. You can cash in 30k for a single meta or 60k for a double meta cabin upgrade on any NCL cruise (ie. inside to balcony). So really they’re worth potentially way more than $250.

@Randy – Really?!?! You may have just really opened my eyes on this one. I will study up. HUGE thanks for this.