Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some of the links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

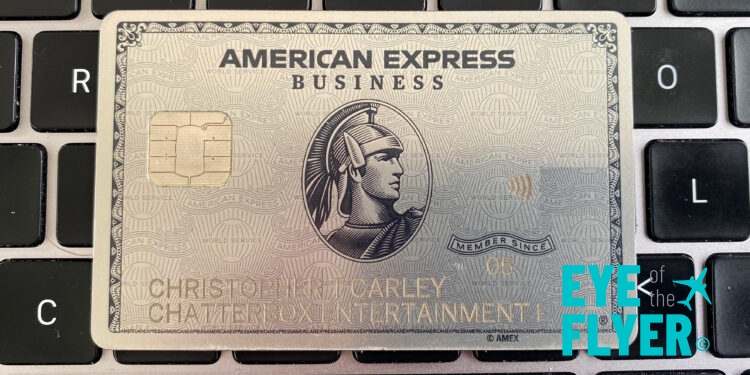

I’ve long been a big fan of The Business Platinum Card® from American Express.

First, though, let’s be honest: its points earnings aren’t exactly a selling point. You score a whopping one American Express® Membership Rewards® for each eligible dollar spent. There are some exceptions (such as 5X points on flights and prepaid hotels on amextravel.com. And another category we’ll discuss below.)

(Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.)

But some fantastic features make it one of my You-Really-Should-Have-This-Card cards.

- 35% Pay With Points. This alone is how I earn back nearly all the card’s $695 annual fee each year. (Visit this link for Rates and Fees.)

- Members can earn back 35% of the Membership Rewards points they spend using the Pay With Points feature for all or part of a flight booked with American Express Travel if the flight is either First or Business class or on any cabin on a selected qualifying airline. This benefit is valid for up 1 million bonus points back per calendar year.

- Up to $120 wireless credit

- Cardmembers can earn up to $10 in statement credits per month for wireless telephone service purchases made directly with a U.S. wireless provider.

- Up to $200 airline incidental statement credit

- Access to American Express’ vast network of airport lounges

- Enrollment required for Priority Pass Select membership.

- Last but not least is our topic at hand: earn up to $400 each year in statement credit for eligible Dell Technologies purchases!

Quick Primer: Up to $200 Each Year in Dell Statement Credits

This is like The Platinum Card® from American Express‘ Saks statement credit opportunity. (Read more about that here.) People complain and whine that it’s worthless; they can’t find anything to buy.

Folks, it’s not that difficult.

Amex Business Platinum members may earn up to $200 in statement credits each year for eligible purchases made through Dell Technologies until June 30, 2025. (Activation/enrollment is required. The credits are if-used and do not roll over. Terms apply.)

RELATED: What are the Amex Business Platinum Card’s Benefits and Features? Is it Worth It?

Plus, Dell purchases fall under the card’s “Electronic Goods Retailers and Software & Cloud System Providers” section of its “Key Business Categories. That means you earn 1.5 American Express® Membership Rewards® points per eligible dollar spent on Dell purchases.

Remember: Dell sells more than Dell computers.

Trust me. I’m a MacBookPro, iPhone, and iPad person — probably for life. (Much to the dismay of both my wife and René deLambert.) But I still spend the $400 each year — and sometimes even more. Yet I always feel like I get a great value.

You might be sweating. Why? This part of the year’s $200 will expire soon. If you haven’t used it yet, it’s time to start thinking.

So, here are some ideas if you can’t figure out how to use your Dell statement credit.

1. Get Yourself Something Pretty

I can always find ways to use my $200 Dell credit every six months.

This past winter, I bought a headset similar to this one (mine is no longer available) for Zoom production calls during remote photo editing assignments. I love the headset because it has two mute functions, great sound, and excellent battery life.

Some of my past purchases include a portable external monitor (that I love), a desktop monitor, computer and camera gear (card readers, USB hubs/switches, USB cables, mouse pads, and more.

All of those are bonafide business purchases. (How about that? Using a business card for actual business expenses? Revolutionary, I know.)

If you travel a lot without noise-canceling (really, noise-reducing) headphones, why not save $200 on a decent set?

2. Buy Travel Supplies

Dell sells travel adapters, luggage locks, and more.

3. Gift Shopping: Holidays, Birthdays, and More

Consider buying something pretty for someone else! The winter holidays such as Christmas and Hannukah will be here before we know it.

Maybe someone you know needs a new Bluetooth keyboard and mouse. Perhaps a friend or family member would love a new external monitor. Do you have any video gamers in your life?

Think about people on your gift-giving list and then put on your thinking cap.

4. Promotional Giveaways

Giving away stuff is an excellent way to draw eyeballs to your business. I bet you could find something on Dell that would make for a great giveaway.

5. Client Thank-Yous

I once worked for a company that gives thank-you gifts to certain major clients (gift cards, televisions, etc.).

Along those lines, maybe one of your clients would love a new set of headphones or desktop speakers.

6. Employee Rewards

How about rewarding the people who work for you? Knowing something about their passions outside of work might give you some ideas of items you can purchase using your Dell statement credit opportunity.

7. Donate to Charity or School Auctions, etc.

Perhaps you can use the statement credit to buy something and donate it to a worthy cause.

Check with a favorite charity or school to see if you can donate to their auction. Or maybe their facility needs somethig available on the Dell website.

I’m not a tax professional — but inquire with yours to see if your donation would be tax deductible.

Amex Offers, Amex Offers, Amex Offers!

Dell seems always to have some sort of Amex Offer available. Sometimes, it’s for bonus American Express® Membership Rewards®. Other times, it’s for a statement credit. Occasionally, you can add both to your card and make out like a bandit. (Check out this post for more details.)

And don’t worry if the Dell Amex Offers are targeted to your other American Express cards. (Or even some Chase cards!) Dell lets you split payments across multiple cards.

Don’t Forget: Start Your Purchase Through a Cashback Portal

Dell participates with most cashback merchants. That means you can earn cash back on top of what you already earn separately on your Amex statement credits! Start your shopping session through a portal such as Rakuten or TopCashback. Both portals generally run pretty great promotions during various holidays throughout the year. (Rakuten typically offers amazing sign-up bonuses for referrals, too.)

Plus, Rakuten allows you to convert your earnings to American Express® Membership Rewards® points.

Final Approach

The Dell statement credit is a great feature of the Amex Business Platinum Card. Some people complain that it’s too hard to use because they can’t find anything they want. But think outside the box a little — and you discover it’s worth its $400 value each year.

For rates and fees of The Business Platinum Card® from American Express, please visit this link.

For rates and fees of The Platinum Card® from American Express, please visit this link.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some of the links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Hey guys.

How about premium bar purchases at Sky Clubs? Thoughts?

Thx

For the Dell statement credit or the airline incidental credit? 😉

Boring, but I just buy printer ink

THANK YOU — great idea and you just reminded me that I need to buy some ink for my printer.

Dell also has smart home products. Power banks when a plug is not convenient. Super light and compact portable computer displays for the hotel room.

I once bought a Samsung TV via Dell miss that. Now I just buy printer ink!!

Yeah, I really miss the TVs, too.

I buy Samsung SmartTags. I use them everywhere.