Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

I hold two American Express-branded Platinum cards: The Platinum Card® from American Express and The Business Platinum Card® from American Express. Both entitle cardholders to up to $200 in airline incidental statement credits each year. Enrollment is required and members can pick from a list of eligible airlines.

An Amex rep told me the below charges should credit back:

- Airline fee charge billed after airline selection

- Airport lounge day passes and annual memberships

- Change fees

- Checked baggage fees

- Early check-in fees

- In-flight amenity fees (beverages, food, pillows/blankets, and so on)

- In-flight entertainment fees (excluding wireless Internet)

- Overweight/oversize baggage fees

- Pet flight fees

- Phone reservation fees

- Seat assignment fees

- Unaccompanied minor fees

Here’s what is explicitly prohibited:

- Airline tickets

- Award tickets

- Duty–free purchases

- Gift cards

- Mileage points purchases

- Mileage points transfer fees

- Upgrades

Many of our readers hold Delta co-branded American Express cards and/or Medallion® status. So checked bag fees rarely are a concern. Many fly Comfort+ or First Class — where adult beverages are free.

So what’s a person to do with that $200 in airline credit?! (Such a #FirstWorldProblem, I know!)

Here’s what purchases triggered the credit (as well as ones that didn’t) across my two Platinum cards this year. (For reference, these were my 2019 results.)

YES: Onboard Beverage Purchases

My wife and I took one for the team. We sat in Main Cabin and purchased a couple of Old Fashioneds to ensure the $10 drinks would work toward the airline statement credit. (No need to thank us. And I know the picture above was taken in first class. It’s all I had.)

I can confirm those purchases credited back!

YES: Pay With Miles Cash Balances

You might want to consider this option if you’re not flying the rest of the year and want to enjoy your airline incidental credit. Though it could be a YMMV situation.

Delta’s Pay With Miles feature is available to Delta American Express cardholders. It allows you to apply SkyMiles (at a rate of one cent per point) toward the cost of an eligible Delta fare and still earn MQM — and MQD and SkyMiles for any remaining cash balance.

And that’s where the “cash balance” part gets interesting.

I bought a couple of Pay With Miles tickets this year and made sure the cash balances were under $200. Sure enough, those purchases worked toward statement credit.

This is not necessarily anything new — but I wanted to remind you about it.

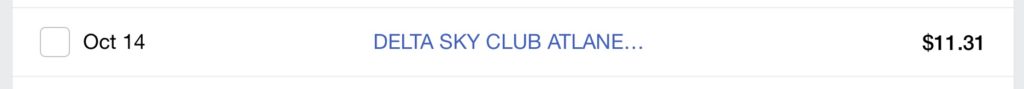

NO: Delta Sky Club Premium Beverage Purchases

Mrs. Carley fell on the sword and let me buy her a Flower District Margarita at the Austin Sky Club. And the Atlanta F Concourse Sky Club. (Side note: the drinks differed between locations. The ATL club’s had a heavier mescal pour — which Mrs. C did not enjoy.)

As we expected, those did not earn statement credit.

Interestingly, I used my Delta SkyMiles® Reserve Business American Express Card to buy a drink at a Sky Club and that earned bonus SkyMiles and counted as a Delta purchase.

What Worked for You? What Purchases Didn’t Credit?

Please share your experiences using the $200 airline credit perk! We’d love to hear about it in the Comments section below. (I’m especially curious about award ticket taxes and fees and Sky Club guest admission fees.)

To See Rates and Fees for…

- The Business Platinum Card® from American Express, please visit this link. Terms apply.

- The Platinum Card® from American Express, please visit this link. Terms apply.

- Delta SkyMiles® Reserve Business American Express Card, please visit this link. Terms apply.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Hi Chris –

I recently paid a domestic short flight (~2 hours) for my child and brought the cost to just under $200 and that worked. Checked in luggage cost also worked.

I wonder if paying for a ticket on another airline to get it under $200 would work?

One time passes for UA lounges work, though obviously not the airline of focus for this blog.

Thanks for the data point!

Thanks for the heads up! I booked several last minute flights on Delta using Pay with Miles option and everything under $200 qualified. I didn’t get a chance to test anything above $200.

I bought Delta Comfort+ for my previously purchased tickets and Amex rep told me that Delta coded my purchase as “upgrade fee” , I didn’t receive the incidental credit. In my mind, paying for Delta Comfort+ was paying for seat selections so I found this very annoying. Amex rep offers me a good will 1500 MR points though. I like CSR format much better.

I have had success in purchasing a Coach seat on Delta (not Basic Economy) and then “purchasing a more comfortable seat closer to the front of the plane” (C+). It isn’t an automatic credit. I wait about two weeks and then use the chat function to explain that I purchased “a more comfortable COACH seat closer to the front of the plane.” DO NOT use the upgrade word. This worked for me in 2021 and 2022. It is considered a “seat assignment fee” and that is covered. Again – do not say you “upgraded” from Coach to C+.

Wow — great data point, Patrick. Thank you!!

Could you do all pay with miles & cash , get the airline fee credit and then cancel the flight later and get an ecredit to use whenever?

I haven’t tried miles and cash — just Pay with Miles and then charging the balance to my Amex Card. And, yes, if you have to cancel a flight, you should receive the entire amount as a credit.