Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some of the links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Two weeks remain in January. This is especially important for cardholders of the personal/consumer Platinum Card® from American Express and the Business Platinum Card® from American Express.

Why? Because this month is when existing cardholders may change their preferred airline for their card’s (or cards’) annual airline incidental credit. (New cardmembers applying later in the year can select their airline upon receiving their card.)

Which cards get how much credit each year? Does every airline participate? What charges are eligible? Let’s tackle those questions!

You must pay with the eligible Amex card (i.e. the Platinum Card® from American Express) in order to receive the statement credit. In other words, you can’t pay for inflight drinks with your American Express® Green Card and receive airline incidental credit from your Platinum card.

Plus, purchases must be paid directly with the airline.

How Much Airline Incidental Credit Does Each Card Receive Annually?

![]() Personal/consumer Platinum Card® from American Express: $200

Personal/consumer Platinum Card® from American Express: $200

Business Platinum Card® from American Express: $200

So if you hold all three cards, that’s $500 worth of statement credit you can use each year.

Is the Incidental Credit Valid for a Calendar Year or “Anniversary Year”?

The credit may be used during the calendar year (January through December).

For example, if you get one of the eligible cards in December, you have until December 31 to use the entire $200 credit ($100 for the Gold Card).

Is the Incidental Credit Valid for One Purchase? Or More?

The $200 can be used on one or more transactions throughout the year. You might use all $200 in one fell swoop (several checked bags or maybe you buy cocktails for 20 people on your flight, whatever). Or you might spread it out across the year. It’s up to you.

Will the Credits Automatically Apply to My Amex Account?

Yes. Generally within a few days. Amex says, “Please allow 2-4 weeks after the qualifying incidental air travel fee is charged to your Card Account for statement credit.” But I’ve always received it within a week-ish.

Does Unused Credit “Roll Over” to the Next Year? Or Does It Expire?

Sorry. Unused credit expires on December 31 each year.

From Which Airlines Can I Choose?

- Alaska Airlines

- American Airlines

- Delta Air Lines

- Frontier Airlines

- Hawaiian Airlines

- JetBlue Airways

- Spirit Airlines

- Southwest Airlines

- United Airlines

Can I Switch My Chosen Airline?

Yes! Amex allows you to change your preferred/chosen airline during January.

Can I Use the Incidental Credit on More Than One Airline?

Each card’s airline incidental credit can be used on only one eligible carrier selected by the cardholder. So you if you choose Delta Air Lines, you won’t receive that card’s statement credit on, say, Southwest Airlines.

However, if you have the personal Amex Platinum and business Amex Platinum, you could select one airline (let’s say United) for the personal card and a different one (maybe American) for the business flavor. (I used Platinum cards for that example but the Gold Card would work fine for one of them.)

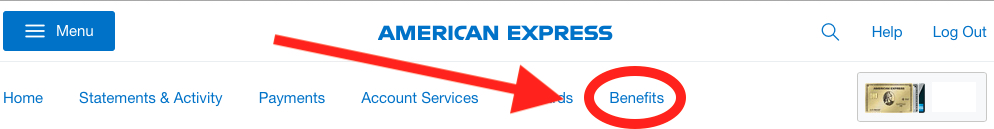

Where Can I Select My Airline?

Log in to your Amex account and select the “Benefits” tab.

You can also call the phone number on the back of your card. A customer service rep can assist you.

Do I Need to Manually Renew My Airline Choice Each Year?

No. It will default to your previous year’s selection.

What Purchases Will Be Credited?

“Incidental fees” is the official Amex terminology. Checked luggage and inflight food and beverages are the big ones Amex touts.

However, I had luck last year with SkyMiles Select, the Miles Boost for a Delta flight, and the guest fee for my daughter when my family used a Delta Sky Club.

Award ticket fees are often credited back, as well.

What Purchases Will Not Be Credited?

Per Amex: “This benefit doesn’t offer credit toward airline tickets, mileage points purchases or mileage points transfer fees, gift cards, upgrades, duty–free purchases, or award tickets.”

However, mileage point purchases and award ticket fees have been successfully credited in the past.

Sadly, gift card purchases no longer receive airline incidental statement credit.

Airfare, inflight WiFi, upgrades, and premium food and beverage purchases at Sky Clubs didn’t trigger the credit for me.

Do Purchases Made by Authorized Users Count?

Yep!

Qualifying purchases made by authorized users (or “Additional Card Members” in fancy pants Amex speak) are covered. However, they apply against the primary cardholder’s $200 annual credit. In other words, authorized users don’t each get their own $200. (But, wow, that would be amazing if they did!)

Which Airline Should I Choose?

One on which you’ll spend the most incidental fees.

This is easier said than done for airline elite flyers. Most enjoy complimentary checked bags; upgrades mean they rarely pay for food or alcohol on board.

But think outside the box a little.

If you’re a loyal Delta Medallion but know you’re going to be on American flights a little this year, then choose American. You get the point.

Maybe you love flying JetBlue — but your employer sticks you on United every so often. You could — not that I explicitly advocate this 😉 — choose United. Use your card to pay for checked bags and anything else reimbursable. See where I’m going with this?

Data Points? Questions?

Share or ask in the Comments section!

“Rookie” posts are a regular feature on the Eye of the Flyer blog. This blog series covers in a “rookie” way either a Delta or travel related theme and attempts to break down to a basic level each topic. You can read up on all the previous posts HERE.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some of the links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I don’t think January is a drop dead date to change. If you do NOT use any of the benefit you can call in and change later in the year as well.

@Christian: That’s the first I’ve ever heard of that. Amex writes on the benefit’s page, “You can change your airline selection online or by phone once a year in January.” I’ll set a reminder for February 1 and call Amex to see if I have the option to change mine.

@Christian – There are many things you can ask/beg for but as Chris points out they tend to stick with what is in print as official T&C.

What is the difference between Delta platinum AMX and a regular AMX platinum?

@Bonnielee Bruns: Many, many things. 🙂 Annual fees, points earnings, Delta benefits, companion certificates, and more.

Perhaps I’ll create a post about this in the coming weeks.

Don’t forget this applies to the Hilton Aspire Amex as well.