Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Two of my all time favorite ever travel cards for years and years have been The Business Platinum Card® from American Express and The Platinum Card® from American Express. From earning full Delta points when you book with membership rewards (and get a rebate as well after the flights) to Sky Club access the day you fly Delta to Centurion Lounge access as well. Lastly, it is simple to get $200 in airline incidental credits each year lowering the net cost to hold the card for all the perks. (Enrollment required.) But my unbridled love has begun to fade a bit. Why?

- First off they cut the rebate from 50% back on points when buying tickets to 35% (up to 1,000,000 bonus points back per calendar year). Still nice but not what it once was.

- Next, we have Amex soon dumping access to Centurion lounges unless you are 3 hours before your flight.

- The $895 annual fee is high enough to consider canceling the card. (See rates and fees; terms apply.)

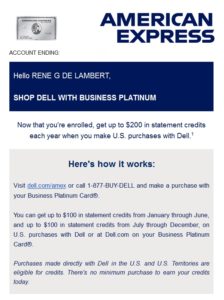

- But then they added one nice perk back (if you register first) that is $400 in yearly Dell credits for buying on Dell.com. It’s available up to $200 from January to June and then another $200 from July through December. In theory, this perk alone if used right could offset the big jump in yearly fee.

With stacking, this could work out really nice since Dell sells lots of non-Dell technology I do use and need each year. Here is how I intend to max it out and the tested results. First I registered my card for the yearly promo.

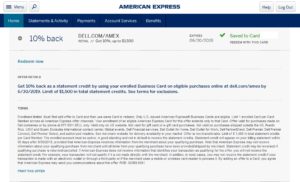

Next up, I looked to see if I had it on my The Business Platinum Card® from American Express, and “Amex Offers for You” and found the current 10% off up to $1500 in spend. I expected this would stack with the new yearly card benefit. Remember that most Amex Offers must me manually added to your card account.

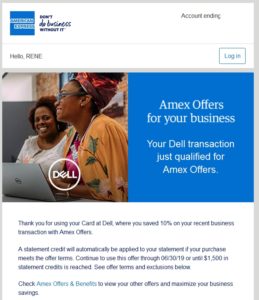

After my purchase, I did get the automated Amex email that I had used my Dell offer and now it was just wait for the credit.

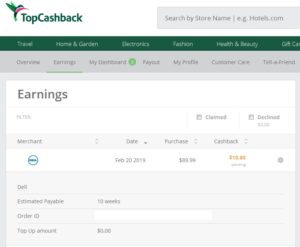

Oh, clearly I started at TopCashBack to allow them to send me over to Dell.com. Currently, as of this post, they are “only” offering 4% cash back but the day I did my buy they had a 12% Dell promotion (they have had even higher ones so just keep checking).

The next stacking in this deal is I did register for the Dell loyalty rewards dollars program as well. This is not an amazing perk and has limited time to spend but why not take the free perk even if you do not use it.

So how did it all wash out in the end? I did get the $9.63 Amex offer, I also got full $96.29 credit including tax for the purchase for the biyearly card perk, I will get $10.80 from TopCashBack and lastly $2.70 in the form of a Dell credit. Net result is a brand new free and fast wifi router is in my home and I was paid over $20 for the purchase via stacking. Oh and I also earned 96 membership rewards points worth at least $0.96 so there is that as well! 😉

Bottom line is Amex, by paying me to keep the card, has motivated me at least for 2019 to hang on to the card yet one more year. What about 2020? Amex better be as good to me then as they are now or I will be having this same cancel or keep discussion again! – René

To see rates and fees for The Business Platinum Card® from American Express, please visit this link. Terms apply.

To see rates and fees for The Platinum Card® from American Express, please visit this link. Terms apply.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Not me… don’t need a router and don’t need 595.00 fee

@Jim – As mentioned in the post, Dell.com sells all kinds of tech. Are you not buying anything tech in 2019? Also, as shown in post, “Amex Offers for You” can yield much more than the fee each year (plus the $200 in credits you can get via Delta eGift cards).

The problem with the Amex credits is that:

1. You prepay for a good or a service from a particular merchant

2. Which then induces you into buying something you may not need or want

3. From a merchant which may or may not have the lowest price.

This is why I generally value them at 50 percent of face.

I would value of the 1st year Biz platinum package at no more than $400, especially given that many of the discounts mentioned are available regardless of whether one has the Biz Plat.

@Steve – The price for the router I purchased was close to that from Amazon and others (yes, a few bucks more but not by much). I needed the item I was going to buy so would have had to pay for it anyway. But even with your math you are net paying $195 for Sky Club access when you fly Delta. Not a bad price if you use it for that alone.

Great tip Rene. I too struggle with whether to keep this card or not, as I already hold the Personal Plat, (cheaper to add authorized users who also get all the perks). But this is $200 of savings for which I will have no problem taking advantage. With that and the $200 travel credit, Amex offers etc. I’ll keep it in my wallet. (Plus I like the heavy metal feel of the card)

I’m a bit confused. Do you have to make two separate purchases with Dell, one during the first half of the year and the second during the second half of the year, or can you purchase $200 (or more) and then get the credits in due course?

@Rick – The credit is split mid year. You can get $100 Jan-June and another $100 July-Dec each year.

Rene, do I need to have two separate purchases, one in the first part of the year and the second in the second part of the year?

@Rick – Yep.

Dropped this one with the new high fee and felt it was a little too many hoops to jump through. I do like having additional clubs access on the card as the Delta Club continues to descend. One example is having to pay for my wife to join the Sky Club on every layover. Why is one entry fee not good for the same day of travel? If you have two stopovers you could pay up to three fees in the same day. Crappy policy that as a Diamond member is pretty crappy.

@Marcos – I agree that the old “day pass” was nice to buy (gone now). But a number of clubs one day is a reason to hold a card that gets you in free.

This is awesome! I got 18% from TCB a week ago too! Can you remind us the differences with the biz and personal AMEX Plat?

@Derrick – The biz has this credit (and others) while the personal has the $15×11 month and then $30×1 month (Dec) Uber credits. Also the biz has the 35% points back when you spend points to book say a Delta ticket (you earn full Delta points just like paying cash).

Good to use to buy toner for printers – Plus the Gogo passes