Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some of the links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Welcome to a weekly feature on the Renés Points blog. Each week this series covers in a “rookie” way either a Delta or travel related theme and attempts to break down to a basic level each topic. You can read up on all the previous posts HERE. Now on to this week’s feature.

So many posts are inspired by reader questions. As a Delta frequent flyer, I “know” the rules but I have to admit the one time I flew American last year I had a ton of rookie type questions as their program is nothing like Delta’s. So let’s dive in and knock out a ton of common rules and questions folks often ask.

First what cards can you get? Currently, and if you are reading this not on the 4th of February, today, 2015 please check as things can change on a dime, you can get the new card bonus only once ever for the personal cards. All three of the personal Delta AMEX cards are viewed as the “same” card for the new card bonus. The Delta AMEX business cards are all viewed as separate and unique products. As long as you canceled 365+ days ago, for that specific card, you can get that new card bonus again.

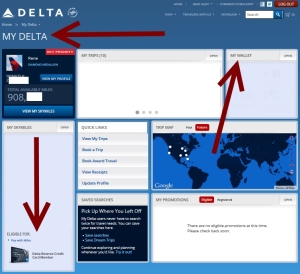

Delta, unlike many airlines, does NOT need you to actually PAY for the ticket with the Delta AMEX card for you to get the perk of a free bag for you and up to 8 more on your itinerary. The important thing is to make sure you have your card in your “My Delta” info as you see above.

Another question is if you pay for a ticket for say your sister or mom do they get your Delta AMEX card bag perks? No, unless you are flying with them. The same thing goes for priority boarding i.e. zone 1 boarding. You have to have them with you on the same PNR or itinerary to get that perk. Having said that, if you are on separate PNRs and let the gate agent know they are with you when you board zone 1 there should be no problem. For bags free, be sure to LINK reservations and I would even confirm, and print confirmation, from DeltaAssist that they are noted in the records that they are linked together.

Next question is about the new card bonus MQMs from either the Delta Platinum or Reserve card. Can you send them to someone else? No. They go to the Skymiles number entered into the card application.

Now with the Reserve card, once you do spend $30,000 and again at $60,000, you can send those BONUS MQMs to whoever you want. You have some time after you earn them to choose what to do. I have a post HERE (E18) that shows the steps. You will normally see the points available about 1-3 days after your AMEX statement closes. The key thing to look for is the bonus SKYMILES that go to you (they cannot be sent to someone else). Once those bonus Skymiles hit your account that is the alert to you that your MQMs are also ready to be redeemed.

The Platinum card, once you earn $25,000 and $50,000, again it is the number used on the card application that gets those bonus MQMs. Both the bonus Skymiles and MQMs go to that account only. You will normally see the points post automatically about 1-3 days after your AMEX statement closes.

Also, as reader Justin remind us us in the comments, the annual fee does NOT COUNT towards your yearly spending goals. Be sure to always over spend by that amount or more. Another warning, be careful with returns. If you have a return or even a AMEX warranty claim that will also count against the spend totals for the year and could leave you short of your goal!

The BOGOF or Buy One Get One Free certificate from the Platinum and Reserve cards. These are issued year two about 1-3 weeks after your year two annual fee is billed to you. You then have a little over one year to spend and fly them (i.e. you must complete the trip before the expiration date). “Officially” you have to hold the card to use them and pay with the card they came with. However there is some nice wiggle room here 😉 Lastly, you can NOT combine say a bump voucher or other voucher to pay for the BOGOF ticket. It must be paid in full with a Delta AMEX card.

As we talked about with the free bag, it is all important if you want more upgrades from holding the Delta Reserve card that it show up in your “My Delta”. I, because am overly cautious and don’t really trust Delta IT that much, have my AMEX Reserve card as the ONLY card in “My Wallet” just to make sure.

These are the main questions I often get regarding the Delta AMEX card perks and what does and does not work. Have I missed any? Don’t see the answer to your question here? Look in the comments below and I will be sure to cover them there. – René

.

Editorial Note: This content is not provided by American Express. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by American Express.

.

Gold Delta SkyMiles®

Credit Card from American Express®

Click HERE for more info

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some of the links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I booked an upcoming work trip using the Plat BOGO certificate just last week. I was able to pay the first date and second fees with my company Non-delta Amx card.

@Gordon – 🙂 Yes.

If I had the delta platinum card last year and upgraded to the delta reserve card this year will I still get my free companion ticket from the platinum? If so I haven’t seen it yet.

@Chad – No. If you had waited until the cert hit your account, THEN UPGRADED, you would have had it. 😉

Another important note, the spending thresholds do NOT include your annual fee. The $95, $195 or $450 will not be included to hit your threshold to earn your MQM bonus. Yes, this became an issue for me.

@Justin – YES a VERY important point. YES! So important I will go back and edit post to put that in. I talk about it each year and should have included it. Txs. Also some have had a AMEX warranty claim count against them (I had that issue but had time to fix)!

Does the Reserve card still act as a tie-breaker within the same Medallion level and fare class? Haven’t seen that mentioned in a while.

@Mitch – You bet ya. One of the reasons that I, as a Diamond Medallion, will ALWAYS hold the card. I don’t like coach.

I’m diamond for the first time this year and have the reserve card, but #KeepDescending hits reality this month. Last year ATL/SFO yields 8556 miles. This year’s “improved” SkyMiles 2015 yields 4026 miles. That’s 113% more miles last year than this year for the same flight.

I used my Reserve BOGO cert. to get two F seats DTW-SAN next month for $1,100 (as a GM I am zero on getting upgrades – too PMs & DMs ahead of me).

Also to note from my experience last year, returns and credits are handled separately. So thankfully while returns do count against spend none of the AMEX Sync offer credits counted against the spend! Same with any retention credits since they are treated like the renewal fee. Any other credit types to considered? Disputes/credits I can’t remember because I lost my dispute 🙁

Hi Rene,

I’m hoping you can clarify Amex’s new member bonus policy.

I currently hold a business version of the DL Reserve card and would like to add a personal version of the same card for the first time. Given that I previously held and closed a personal DL Platinum card, would I receive the signup bonus of 10k MQMs for the personal Reserve card? The Amex reps weren’t very helpful when I called and asked.

Thanks!

@Dan – officially NO! but YMMV and if you are willing to risk the few point hit to your credit score you can try. worst case you get the card and no new card bonus. http://www.DeltaPoints.com/bpc

i have the amex delta etc card and am diamond and when i checked in the other day for a flight from aspen to msp etc it said $25 for first class(i was ) to check a bag DAAAAAAAAAAAAAAAAAA nuts really what does it take to get a free checked BAG on the way out the cargo hold had a whole so the luggage went onto another plkane to vail then aspen butdid not tell us till 30,000 feet up ?????

I’m a PM w a platinum Amex. Is it really worth it to upgrade to reserve?? Amex site makes it sound great but the comments aren’t all that in comparison.

@John – It can be if:

.

1) You want and will use BOGOF in 1st class

2) You want more UGs as it is tie breaker

3) You want Skyclub access when you fly Delta

4) You spend 60k to get 30k RDM & MQM bonus each year

.

Hi Renee,

I have a Delta Amex platinum card. I had a regular AmexGold Business card but I cancelled the regular Amex Gold Business card earlier this year after I got the new cardmember bonus. If I get the Amex Reserve, do I still get the new member bonus? And secondly, can I get MQM bonuses for BOTH the Amex Platinum and the Amex Reserve In the same calendar year?

@Rich – All 3 Delta personal cards are viewed as the SAME CARD by AMEX as far as new card bonus. A 3 business cards are unique products.

.

http://www.DeltaPonts.com/bpc

I need help hitting spending thrsholds for this year… last year I paid ahead on cable and utility bills. Our bank will not allow amex for mortgage payment. We did pay taxes with amex. I would like to pay off mortgage to get the miles if there was a way. Any help and guidance is appreciated.

@Diane – Look at the other ideas in the post. Kiva loans, Visa Gift cards and so on.