Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some of the links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Welcome to a weekly feature on the Renés Points blog. Each week this series covers in a “rookie” way either a Delta or travel related theme and attempts to break down to a basic level each topic. You can read up on all the previous posts HERE. Now on to this week’s feature.

I always try to use points. I try not to waste points and over pay for things vs. what I personally value my points at but still the standing rule is spend them whenever I can.

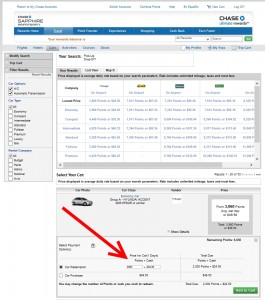

Chase Ultimate Rewards® (UR) is one of the most simple and flexible points programs to use. Sure you can send them to many programs 1 for 1 but for me I love to spend them for travel “stuff” and get 1.25 cents per point value towards say a car rental or a resort. You can just pick all points or part cash & part points or all cash to earn more points (since starting at the Chase portal). Just do what you value the most!

Having redeemed well over ½ million UR points I have learned a bunch. I have learned when it comes to cars, you will not lose your Visa Signature protection when redeeming points or points and cash for your car and blogged about it HERE.

With airline tickets, it is simple. Once you are ticketed, UR is, for the most part, out of the loop. You have with say Delta, just purchased the ticket and you deal with Delta for say a flight change or a plethora of other travel issues.

With hotels or resorts, it is another matter and you need to understand how this all works. Chase uses a travel agency to do all the bookings. It is, btw, the same one that Citi Thank You also uses.

Anyway, as a simple example let’s look at my trip to Grand Cayman at the Reef Resort. To get the 1.25 cents per point value you have to pick a resort that partners with Chase. Then, the Travel Agency (TA) books this for you. Many times it will NOT be direct. For me, the Chase travel agency used “Fun Jet” to do the booking with The Reef. You see the steps and the connections going on here. I had: Chase→UR Travel Agency→Fun Jet→The Reef. WOW! So, what if something goes wrong? You don’t call Chase, you call the UR TA. They are your go to point. But, this is not always simple. Say you have an issue with the resort, they have to answer not to you or to UR TA but to Fun Jet. Fun Jet does not deal with you, they deal with the UR TA. Now I am not saying any of this is “bad”, and when I had a major issue with this year’s booking, it all worked out very well and everyone worked hard to make it right and they did. But it did take time, stress and many many MANY e-mails to get it all worked out and I got some credit back to my card and a check for the difference as they could not put the points back into my account.

Are the extra steps worth it? You bet. I mean think about this, Chase‘s INK BOLD card or the INK PLUS card both, once you meet the $5000 in spend (thus 55,000 points), will give you $687 in travel value when redeemed at the 1.25 cents per point through the UR portal. If a husband and wife each got both cards in one year, after spend requirements on each card, you are talking $2,750 credit towards your vacation! You could even each also add a Chase Sapphire Preferred® Card Card, after $3000 spend pick up another 43,000 total points, and have another $1075 added to your totals! For me, to not have to come up with that much cash for a vacation is truly amazing and a great travel value (many will say you should ONLY redeem for premium cabins etc – if that’s what you want, fine – for others like me I like this way)!

As a Delta flyer, I will use my Delta Skymiles and fly business class, use my UR points to rent cars and pay for resorts and the result is amazing vacations year after year. How about you? – René

▲Delta▲ SkyMiles® Credit Card

RESERVE/PLATINUM/GOLD

from American Express

Click here for more information

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some of the links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I think you’re missing a big problem in that it seemed to me hotel prices through the chase TA were almost always significantly more than rates booking directly through the property. So after the savings you’d barely come our ahead making it closer to 1-1.05 instead of 1.25. For flights though I’ve found prices to equal to the nose the prices you’d find elsewhere.

@Jeremy – humm… I have not found that. Will be good for more feedback! – Rene

I thought the best use of UR’s was that of transferring to partners?

@Geoff – that is a matter of choice. To me, I fly Delta business class, so, I like not having to spend thousands of dollars on my resort or to get a car for free etc. But as you say, that is an option if you want to do that. It is very kool to have choice with UR points and a big plus about them.

Rene – If you buy a Delta ticket with UR points, do you still get the 24 hour free cancellation benefit?

@Larry – UR uses Travelocity engine so sure: http://tinyurl.com/p7srpvh

There are many who always use this way to book to get extra points. I chose not to just in case Delta changes rules to not give full points via such a portal but for now I have not had any reports of not getting anything but full credit!

BTW here is the link to the Delta 24hr cancel page: http://www.delta.com/content/www/en_US/traveling-with-us/ticket-changes-refunds/risk-free-cancellation.html

Certainly, cashing UR points for 1.25 cents is one of the choices people are free to make. They are also free to pay $13 for a beer at a ballgame, it doesn’t mean that they’re getting good value for their money. If you like redeeming Skymiles for biz class to Sweden, why wouldn’t you consider transferring UR to United and fly SAS to Sweden? You would certainly get more value than 1.25 cents.

@DBest – I have both gone round and round on this in the post and in comments. To me, and I am right about this in my mind, if I don’t have to EARN $2500 to pay for my resort and diving, I have saved $5000! Why, I have $2500 in value and I still have the $2500 in my pocket I would have spent on the trip. To me, that is real value. Plus, I have so many points I need to burn them ASAP. I have YEARS of business class tickets to Sweden on points ( I do not need even more)! See?

Definitely every case is different, my main concern is that you are in rarefied air, most people aren’t as flush with points. Nothing wrong with highlighting this strategy, but it’s probably not a good idea to do it on Rookie Wednesdays, since they are unlikely to have as many points as you (and even I) do. Even in your case, I’d suggest that even if you have the flights covered, you would still get more value transferring the UR points to a hotel partner. I hear the Park Hyatts are pretty nice 😉

Would you suggest gettting all three cards at once? Or even two? I’m ready for a churn and would love to have 153,000 UR points in one fell swoop!

@GR – One INK and Sapphire, with a good credit score, is very possible on the same day. If you try for BOTH business cards, the first approved, the second will likely go pending (unless you say have more than one EIN or a EIN and the second with just your SSN). Then you will have to call the reconsideration line and explain why you would want and should get all 3. From what I have seen from other readers the app order would be biz, personal then biz. Lastly call when done with churn day to get 3rd card OK’ed (we hope).

.

Last bits, be sure if you meet spend with Vanilla, you mix up the spend on the cards over the months so there is no risk of not getting points!

Hi. We are very new to this. We’ve really enjoyed all your amazing tips and information. My wife and I will be getting the Chase Sapphire Reserve®. If we ever had to,….how can we book a Delta flight? Through Chase’s UR portal, could we transfer points/miles to their partner airline: Air France/KLM? Then, (since Delta is a partner airline of Air France/KLM), can we book a Delta flight off of Air France/KLM’s website…..using the points/miles? Thank you so much!

@Jordy: Hi, Jordy! Welcome! You can transfer Ultimate Rewards points to Flying Blue (AirFrance/KLM) and Virgin Atlantic from Ultimate Rewards. Then use those transferred points to book award travel.

Or you can book travel directly through the Chase travel portal — and because you’ll have the Chase Sapphire Reserve®, your points will be worth 1.5 cents each if you pay with UR points. A booking like that would code with the airline as a cash fare — earning you (using Delta as an example) MQM, MQD, MQS, and SkyMiles.

Hi Chris…..thanks for your response. If I book directly through the Chase travel portal, I do not have an option to book a Delta flight. Correct? Are you saying, I would first need to transfer UR points to either Flying Blue or Virgin Atlantic? Then, can I book a Delta flight on FB or VA’s website? Thank you.

@Jordy: You can book Delta flights through Chase’s travel portal.