Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

I have just recently renewed my Allianz All Trips Premium yearly travel insurance policy and paid via PayPal on my Chase Freedom card to get 5x because for only the month of December, they are offering the increased points deal (ends today, FYI).

(The Chase Freedom is no longer open to new applicants. But you can apply for the Chase Freedom Flex®, which is pretty much the same thing. All information about the Chase Freedom Flex® was collected independently by Eye of the Flyer and not reviewed by Chase.)

While I do not like paying $485 for my wife and I each year (pricing as of today’s post) I do like the reassurance the policy gives me when out and about all over the world. While it does not cover everything I may encounter, I seem to get enough value every year to almost break even, and some years come out ahead.

Plus, there is the peace of mind, when things go wrong, that I can remove one bit of stress in my travels. Let me give you a recent example.

Coming back from my latest Norwegian Cruise Lines VIVA transatlantic crossing my wife and I flew home from Houston Texas after arriving from the Galveston cruise port. The weather was really cold (for Texas) with temps near freezing but other than that there was nothing to impact our flights.

Famous last words….

You see our inbound aircraft that was to take us from Houston to Minneapolis MSP was delayed out of Newark’s LGA due to bad weather in the New York area. We had around 4 hours to make our connection in MSP so I was not all that worried. I really should have been!

The inbound bird was delayed again and again and again (triggering free food vouchers that I loaded to Doordash since I was in the Amex Centurion in Houston). Then I bet you can maybe guess what happened next? Yup! The crew timed out. Ugh. Our flight did, at long last, make it to Houston but we ended up landing in MSP about an hour after our connection took off back home to South Bend SBN.

Halfway through the flight, I could see we were not going to make it. Delta had not offered us a hotel for the night and I knew even if they did it would require a shuttle bus at near or even after midnight and then another one before our early rebooked AM flight. Thanks to Allianz I jumped on my IHG app via Delta’s fast free wifi and booked, for $331, a night at the Intercontinental hotel all but attached to MSP so we could just walk in and get a few hours of sleep before the next day’s adventure in travel.

This is one of the reasons I pay for this policy because I could make my very sleepy wife happy and that is worth a lot after nearly 40 years of marriage! I did not want to end this amazing journey with a cranky wife after all right?

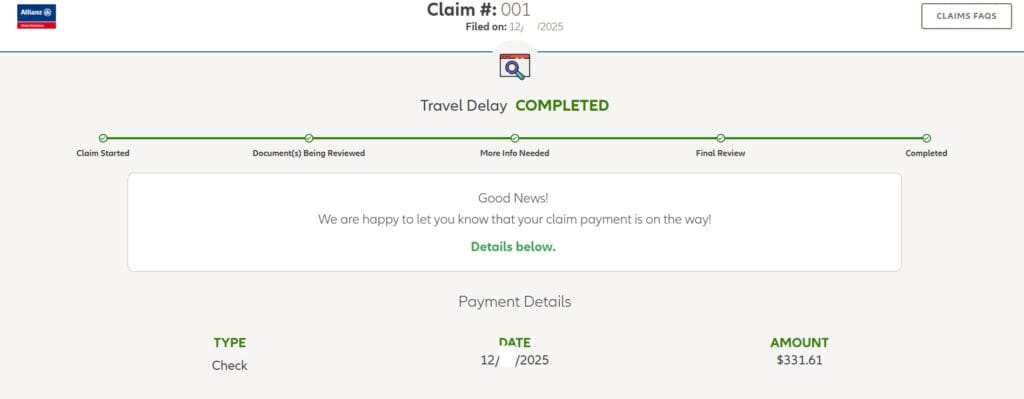

It took, even during the holiday period, about a week for my claim to be fully approved after submitting the necessary documents about the missed flight and the bill from the hotel with a check on the way to me.

I had one more claim during the year that I will also cover in another post that really did make a big difference for my trip and I did not even bat an eye on what it would cost me because I knew I was covered. That, and clearly the cash back, is so worth it to me to have my yearly policy in place. – René

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

If you were in the Centurion Lounge because of the Amex Platinum card doesn’t that card cover a hotel in the case of that flight delay?

@Thomas – I visited the Centurion before my flight (inside 3 hour window) and then was delayed over and over. I did not pay for the flight with my Amex card as I normally use my CSR that also has travel protections but for me the simpler and faster option was my Allianz. Had Allianz NOT covered the hotel I would have gone to plan B if you will and tried with Chase.

That makes sense.

So does the strategy here have a sort of “safety in numbers” principle by employing multiple providers for travelers, with Allianz as primary for [all] travel insurance coverage(s) and either Chase [Sapphire Reserve] (CSR) or [Platinum] American Express as secondary when facing an applicable scenario? (The consumer would have to weigh its worth for themselves in considering the cost of benefit on their expected annual travel lifestyle.)

Thank you for this timely article. I appreciate the opportunity for reflection upon possible ways of planning to insure travel in the new year.

Best to all for such coverage in semiquincentennial celebration, re

@Rex – The main reason I hold the Allianz is peace of mind. The fact that they offer 50k medical (hope I never need it) and such simple payments when things go wrong over a full year makes it worth it to me. Plus, as a scuba diver, not having to pay for a separate policy is worth a ton (never dive without a dive master and never go deeper than 120 feet). Clearly the cheaper way to go is with CSR or AMEX Platinum and I have seen MANY good reports of them paying without much stress when things have come up. As you say I like having a backup plan and if Allianz says no I can go to plan B.

“semiquincentennial celebration”

Note to self: never play Scrabble with Rex! 🙂

@Rene (1.) I think you mean *New York’s* LGA. (2.) Is your annual Allianz premium $485 per person or for both?

@Rick – Yes and total for both of us. Great value coverage of all trips one year. Even scuba as long as w/dive master and not under 120 feet

Rene,

Can you tell us more about this insurance? More in details and what should one look for in a travel insurance plan if one were to travel 2 mths out of the year. Thank you!

@Kay- It is the “All Trips Premier” plan. You can tweak it but I go with the lowest levels. Some go higher for more for full cruise fee coverage.

Thank you so much!