Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Two big travel rewards cards were refreshed last week. One of the major updates was good. The other was one we’ll talk about today.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All information about the Chase Freedom Flex® card was collected independently by Eye of the Flyer. It has not been reviewed by the card issuer.

Frankly, I don’t love The Business Platinum Card® from American Express‘ refresh.

But — and this is a major “but” — I might be coming from a different angle than most other Amex Business Platinum Cardholders, too.

Let’s discuss.

But a quick question came up while I wrote this post and I wanted to address it:

Can You Combine Your Membership Rewards from Other Amex Accounts?

Yes. In fact, all of the people I know with personal and business Amex cards keep them under the same login/account. The Membership Rewards points go into one big pot. It’s easier than transferring them from card to card (i.e., Chase).

Now, on with the show!

The Business Platinum Card® from American Express: Refreshed

We’ll take a look at the refreshed Amex Business Platinum the same way I analyzed the impressive “new” American Express Platinum Card®.

What is the Amex Business Platinum’s Annual Fee?

Just like its consumer/personal sibling, the Amex Business Platinum annual fee jumped two hundred smackeroos to $895. (Rates & Fees for the Amex Business Platinum. Rates & Fees for the Amex Platinum.)

That’s negligible for some companies. For some ultra-small businesses, it could be a deal-breaker. I’m curious to hear your thoughts.

Is There a Big Welcome Offer for New Members?

If you don’t yet hold the Amex Business Platinum, you can earn 200,000 bonus Membership Rewards points after you spend $20,000 on eligible purchases on the card within the first three (3) months of being approved for card membership. Terms apply. Read more and learn here how to apply for this offer.

Is $20,000 in three months a lot of money? I know a few small business owners who drop that in a few days. I know others who may not spend that in six months. Or nine.

Keep in mind that small business credit cards are geared toward, you know, businesses with overhead (supplies, rent, items for resale, utilities, and other business expenses). On the same token, there’s a chance you’re already a small business and missing out on hundreds of thousands (or millions) of points.

Remember, too, the Amex Business Platinum isn’t subject to the “family rule” — unlike the Amex Platinum.

Mirror, Mirror — in My Hand?

New and existing cardholders can — for a limited time — choose a mirrored Business Platinum card. Mine should arrive any day and I’ll update this post with an image. I’ll try to keep my face out of it, don’t worry.

Are the New Benefits Available Now for All Card Members? Or Just Ones Who Pay the New Fee?

Amex is very good about letting existing card members enjoy a refreshed card’s benefits, even before an annual fee spike hits their account. True to form, we existing Business Platinum Amex members can use the new features immediately! Thanks, Amex!

What Benefits or Features Were Lost?

Amex gave us plenty of warning about this change– but it still kind of stinks.

The card’s Pay With Points feature sustained its third devaluation in about eight or nine years.

Cardmembers can earn back 35% of Membership Rewards points used to pay for all or part of an eligible flight booked with American Express Travel. (A minimum of 5,000 points must be applied per reservation and up to 1,000,000 points can be earned back each calendar year.)

That wording didn’t change. What did change was the “eligible flight” part. It used to be any class on one airline you select annually from a list of select carriers through Amex Travel and any First or Business Class flights across any airlines you book through Amex Travel.

The second part is no longer valid. Now, you’re limited to any class on one airline you select annually. Let’s say Delta is your selected airline. The 35% benefit applies only to Delta-marketed flights booked through Amex Travel. Before last week, we had that option AND, say, Business Class on Lufthansa.

It’s still a potentially very valuable perk. I generally find those bookings better than many domestic SkyMiles fares. Might just be me.

Amex pays the airline for your Pay With Points reservations — meaning they’re cash fares. So, you earn frequent flyer points/miles, and any elite status benefits and metrics.

When I got the card back in 2017, the benefit was 50%. Let’s face it: that was practically too good to be true. Several years later, Amex slashed it to 35%. Now dropping the First and Business Class ticket feature on any airlines bookable through Amex is the latest blow.

A possible sign of impending doom: none of the Business Platinum marketing materials I’ve seen include the 35% benefit. I dug into the Ts and Cs to find it. I fear that Amex will soon sunset this benefit. (Unless it’s replaced by something truly “Wow!”-worthy, that will be the final straw for me.)

The only other change was a minor one: the CLEAR® Plus Credit is now $209, a slight increase from $199. This adjusts for the CLEAR membership cost.

What Didn’t Change

In good news, the card’s other benefits remain the same:

- Complimentary access to airport lounges

- American Express Centurion Lounges when traveling with a confirmed seat on a same-day flight

- Delta Sky Clubs when traveling on a same-day Delta-operated or -marketed flight.

- Receive up to 10 Visits per year to the Delta Sky Club. A “Visit” is an entry to one or more Delta Sky Clubs or usage of the Delta Sky Club “Grab and Go” feature at one or more airports for a period of up to 24 hours starting upon the first Delta Sky Club entry or Grab and Go usage, during an Eligible Card Member’s travel on a same-day Delta-marketed or Delta-operated flight. A single Visit permits using Delta Sky Club(s) in multiple airports during the 24-hour period.

- Once all 10 Visits have been used, Eligible Card Members may purchase additional Delta Sky Club Visits (including Grab and Go) at a per-Visit rate of $50 per person using the Card. To earn an unlimited number of Visits each year, the total eligible purchases on the Card must equal $75,000 or more during a calendar year and each calendar year thereafter.

- Up to two guests may be brought in for $50 per person. (See Rates and Fees)

- Escape Lounge by Centurion Suites (with up to two guests) when traveling on a same-day flight

- Priority Pass Select membership (enrollment required)

- Access is limited to eligible card members.

- Up to $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your card. (Enrollment is required.) Read this post for more information.

- Up to $200 Hilton Credit: Earn up to $50 each quarter for eligible purchases made at Hilton properties across the globe. (Enrollment is required.)

- Up to $120 Global Entry Credit: Receive either a $120 statement credit every four (4) years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA official enrollment provider) application fee. (Terms apply.) Global Entry comes with TSA PreCheck and is the better value, in our opinion. So many travel credit cards offer this benefit — keep in mind you can “gift” it to someone else.

- Fine Hotels + Resorts: Enjoy early check-in and room upgrades (when available), daily breakfast for two (valued at up $60 total each day), a resort or spa credit (varies by property), and guaranteed late check-out. (Terms apply.)

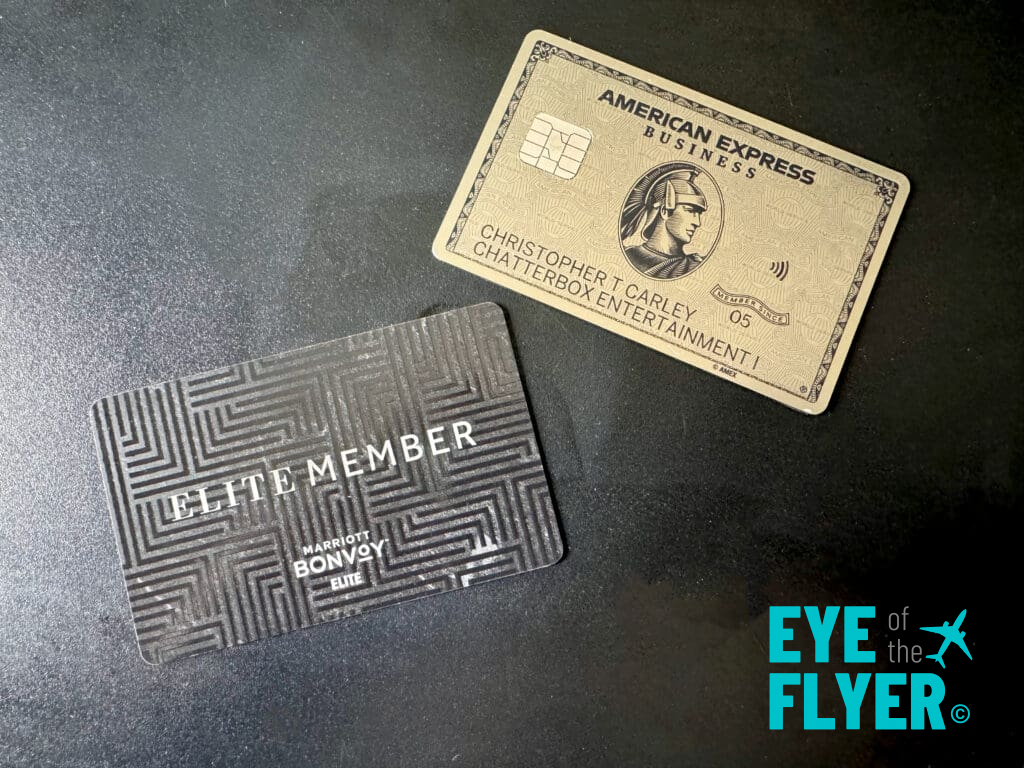

- Complimentary Gold Elite Status with Marriott Bonvoy (enrollment required.)

- Complimentary Gold Elite Status with Hilton Honors (enrollment required.)

- Up to $120 Wireless Telephone Service Credit: Earn up to $10 back in statement credits each month on eligible purchases made directly with a U.S. wireless (cell phone) service provider. (Enrollment is required and terms apply.)

- Dell Technologies Credit: Earn up to $150 in statement credits on eligible U.S. purchases made directly with Dell Technologies each calendar year. You can earn an additional $1,000 statement credit after spending $5,000 or more on eligible Dell purchases during a calendar year. (Enrollment is required and terms apply.)

- Up to $250 Adobe Credit: Earn up to $250 in statement credits after you spend $600 each calendar year on eligible U.S. purchases made directly through Adobe. (Enrollment is required and terms apply.)

- Up to $360 Indeed Credit: Earn up to $90 in statement credit each quarter for eligible purchases made with Indeed

The Main Event: $600 Fine Hotels + Resorts® Statement Credit

The Business Platinum received a potentially huge improvement with the new Hotel Statement Credit. Cardmembers can earn up to $300 back in statement credits semi-annually ($300 from January through June, then $300 from July through December) on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings through American Express Travel® when you pay with your Business Platinum Amex. (Terms apply. The Hotel Collection requires a minimum two-night stay.)

I love FHR stays. They include:

- Enjoy early check-in and room upgrades (when available)

- Daily breakfast for two (valued at up $60 total each day)

- A resort or spa credit (varies by property, usually in the $100 range per stay)

- Guaranteed late check-out.

- Complimentary WiFi (though that usually is included with most “resort” or “property” fees anyway)

There’s no limit as to how many times you can use FHR stays. Heck, you could bounce from hotel to hotel and live in FHR properties if you had the money. Plus, you can book up to three current stays on your card. So, if you need to take two employees on a business trip, you can each stay in your own rooms with your own FHR benefits, thanks to your Business Platinum Card. Same goes if you’re treating your family to a trip and want to put the grandparents and your kid in a separate room. (This is the way.)

Most FHR hotels and resorts are on the luxury (read: $$$$) side. I’ve enjoyed great deal in Las Vegas, though. The website MaxFHR.com is a great resource to help guide you along.

If you don’t hold a personal-consumer Amex Platinum, the up-to-$600 statement credit could be a game changer.

Improved-ish Points Earnings

Unlike the civilian Amex Platinum, the Business Platinum Amex Card improved its points earning levels.

Kind of.

- 5X Membership Rewards points on flights and pre-paid hotels booked at AmexTravel.com

- 2X Membership Rewards points (WAS 1.5X) on eligible purchases at:

- U.S. construction material suppliers

- U.S. hardware suppliers

- U.S. electronic goods retailers

- U.S. software & cloud system providers

- U.S. shipping providers

- 2X Membership Rewards points on eligible cruise bookings made through AmeTravel.com or by calling the number on the back of your card

- 2X (WAS 1.5X) Membership Rewards points on purchases of $5,000 or more everywhere else (up to $2 million of these purchases per calendar year)

- 1X Membership Rewards points on all other eligible purchases

The slight boost from 1.5X to 2X on eligible office-related purchases and $5k purchases (up to $2m a year) is the increase. As someone I used to work for would say, “Hey, it’s better than a kick to the head, right?”

Again, the Platinum Cards pretty suck in for earnings points. The only time they ever come out of my wallet is for using statement credits and getting into airport lounges.

For business purchases, I stick to my The Blue Business® Plus Credit Card from American Express. It has a $0 annual fee and earns a flat 2X on all eligible purchases, up to $50,000 a year in spending. (Rates & Fees.)

Several friends and colleagues love their American Express® Business Gold Card, too, to earn points on business spending.

I also love my American Express® Gold Card. I go into some detail here.

But the Platinum Cards are status symbols and luxury beneft cards. Most of the people who hold them don’t think like you and me. They like earning points, sure. But they don’t use their credit cards strategically. In other words, they don’t put non-bonused spent on a Capital One Venture X Rewards Credit Card because it earns 2X on all eligible purchases, instead of 1X on Platinium Cards. Plenty of Platinum members wouldn’t be caught dead paying a restaurant tab with a no-annual-fee Chase Freedom Flex®. A plastic card that doesn’t have airport lounge or luxury hotel benefits? That’s social suicide! What would the partners at the firm think? Imagine all the ugly tea at the country club! They’ll think I’m insolvent!

You think I’m kidding…

Why I Don’t Love the Changes — For Me (and Maybe You)

I already hold the Amex Platinum — and that’s a much better “coupon book” for me. That packs a ton of value — more than the refreshed Business Platinum. But’s that just me.

What I don’t like is the $200 annual fee jump, no notable points earnings improvements, and the 35% Pay with Points devaluation. (Rates & Fees.) Yes, the $600 FHR credit is potentially huge. I don’t know how much I’ll use it.

I wish some other benefits would’ve been improved — maybe the $10 mobile phone statement credit or some improvement to the Adobe credit. The Dell credit was devalued earlier this year, although I do appreciate the Hilton credit feature, which I might use here and there.

Final Approach

I think Amex is catching up to people who creatively use the credits to their advantage. If the Amex Business Platinum is your only Platinum card and/or you love the FHR credit, this is a big win. For me, I’ll give it a year and then reevaluate.

What do you make of the changes? What are you doing about the Business Platinum card: Getting it? Keeping it? Sending it to HR for a “Here’s a box, turn in your fob, and don’t show up to work on Monday” talk?

Tell us in the Comments section below.

For rates and fees of the American Express Platinum Card®, please visit this link.

For rates and fees of The Business Platinum Card® from American Express, please visit this link.

For rates and fees of the American Express® Gold Card, please visit this link.

For rates and fees of the American Express® Business Gold Card, please visit this link.

For rates and fees of The Blue Business® Plus Credit Card from American Express, please visit this link.

For rates and fees of the Delta SkyMiles® Reserve American Express Card, please visit this link.

For rates and fees of the Delta SkyMiles® Reserve Business American Express Card, please visit this link.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

It’s going to be tough to use the FHR credits without coming out of pocket to some extent, which is the point. As someone who pretty religiously sticks to points bookings, I don’t like that at all.

I also don’t love adding to the already long list of difficult to use, less than fully annual credits. I’m beginning to value the mental freedom of not feeling like I have to keep up with this coupon book over extracting max value from said book…meaning cancellation is probably imminent.

Smart approach! Amex perks can be great, but they definitely keep shifting the rules. Giving it a year to test the value—especially with the FHR credit—sounds like the best way to see if it’s truly worth keeping long-term.

Very much agree with your take, the consumer card got all the goodies and the business card got left behind. Not much sense for long time holders vs. other business cards anymore. On probation is a good way to think of it.