Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

It’s funny that very few blogs brag up one of the best travel cards to hold if you happen to be a Norwegian Cruise lines frequent floater and that is the NCL Mastercard:

You see, the card although a very low-earning card, has one simply amazing feature that makes this a card I spend a significant amount on every month. If you earn 30,000 points on the card, you can upgrade from an interior to an ocean view. If you earn 60,000, you can upgrade all the way from an interior to a balcony. What I most often do is book an ocean view and then upgrade to a balcony for 30,000 points.

Here is the “simple” math on this idea. The difference between an ocean view and a balcony room, depending on the NCL cruise, could cost thousands of dollars per person. Thus putting $30,000 spend on the NCL card vs. say a 2% cash back card that would yield $600 is a HUGE win for me. But what spend and how?

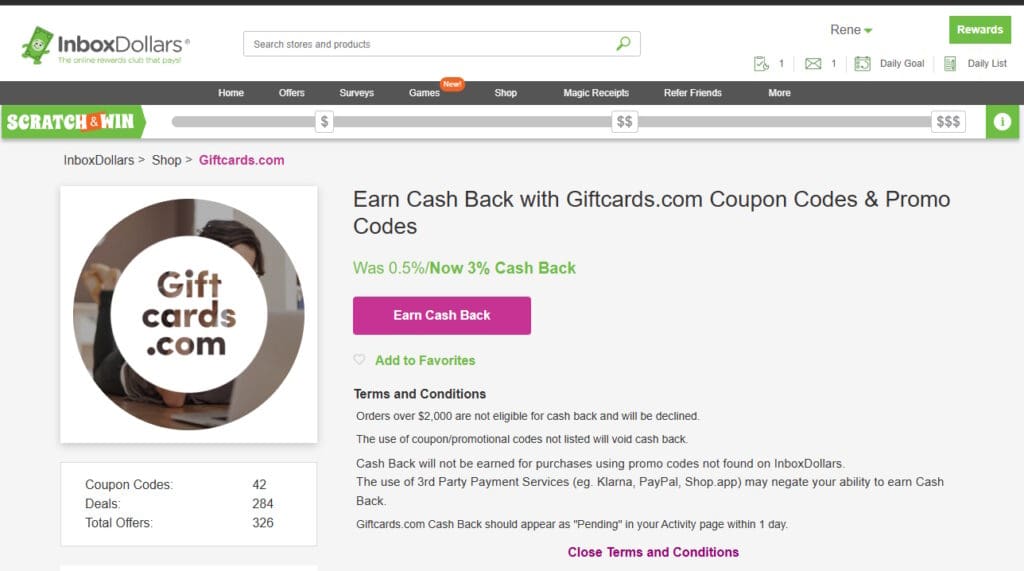

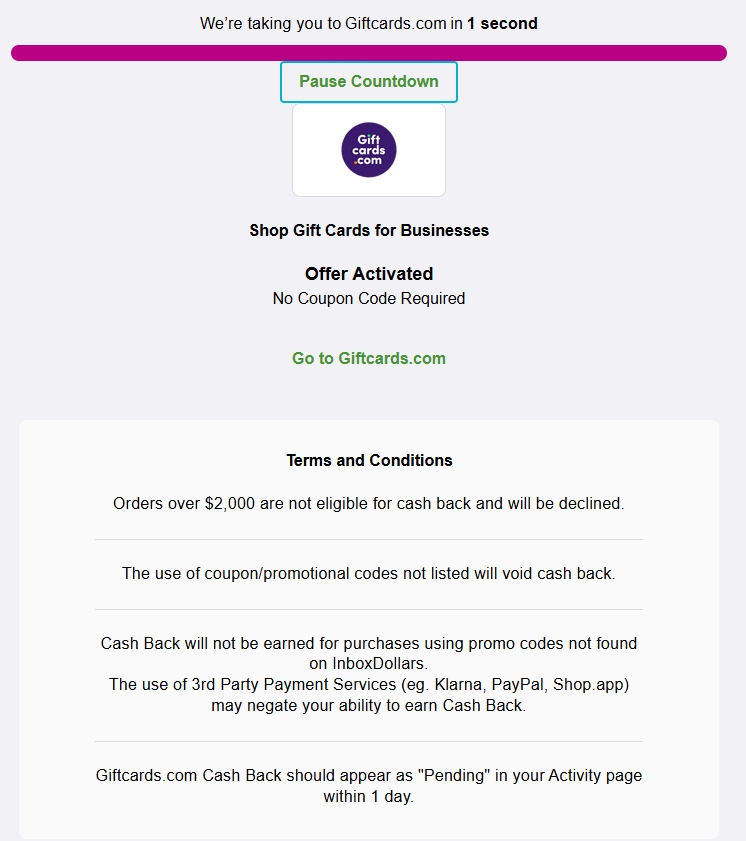

One of the best ways is buying business Visa gift cards via shopping portals. One of my favorite ones is INBOXDOLLARS ( <- Link to join free). After you have been approved for buying business gift cards on GiftCards.com (they go up to $500 per card vs. the normal ones that only go to $250) it is simple to order cards each month.

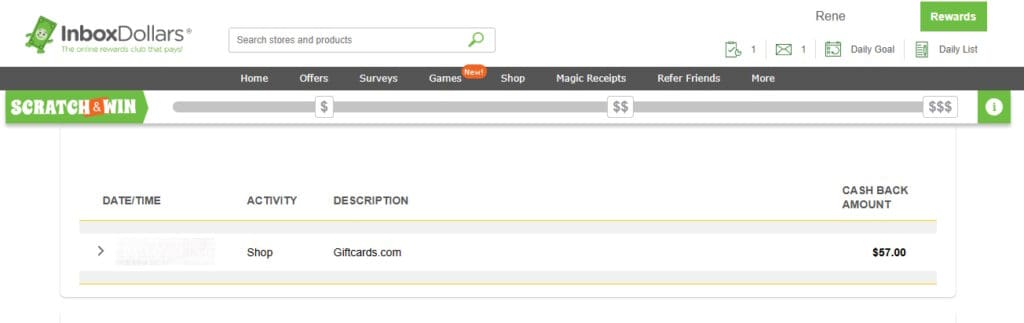

Now, yes, there are fees, and they are rather large. For example, my normal buy is four cards at $475 each, generating 1936 NCL points, including fees of $36.55 for the card fees and traceable shipping fees.

But here is the neat thing. When portals like INBOXDOLLARS is paying you 3% cash back on the base cost of the order (you earn nothing on shipping and card fees) I will get $57 cash back for my normal 4×475 buy making the points not only free but better than free.

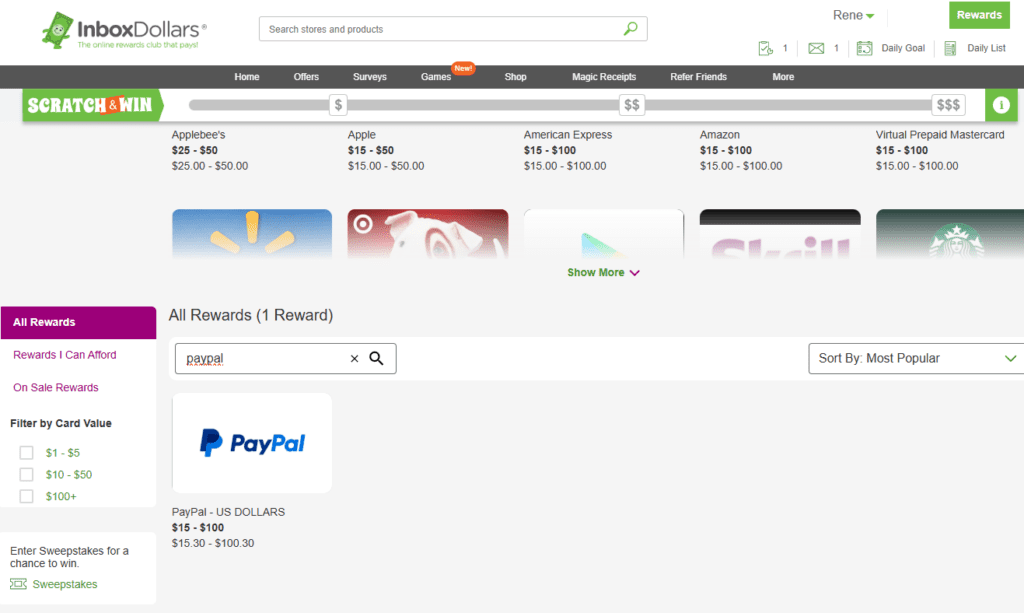

One of the nice things about INBOXDOLLARS is you can link them to your PAYPAL account for cashing out (or you can pick gift cards). There is tiny 30 cent fee for sending to PAYPAL and you can only send over amounts of $25, $50 and so on.

Keep in mind, as shown in the shots above, you can only buy $2,000 maximum every month from Giftcards.com. Also know there are other sites that sometimes offer 3% cash back with the same once a month buy terms. The ones I like that I have found reliable are:

There are other portals but some of them limit how much you can earn (think $20 max) so I avoid those. Others tend not to track as well so I also avoid those and stick to the above. On any given month many of them will have a day where they offer 3% cash back from Giftcards.com giving you a number of shots to buy profitably.

Is this a perfect system? Clearly no because once you get the card you have to have the flexibility or the creativity to get rid of all these PIN enabled gift cards. But maybe you have some big bills to pay or you have stores that let you use a PIN enabled debit cards to pay for different things… 😉

Also it can take some time to get your NCL card “used to” buying from GiftCards.com i.e. expect the first order or two will require a call in to verify that you did in fact place the order. Then after that it tends to be smooth sailing buy after buy. Bottom line, with some work, my cabin upgrades are all but free for me other than the time and effort involved to get the upgrade done and to me it is worth the effort! – René

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

So is that 30,000 points for every cruise upgrade? After you earn the upgrade, do you still have the points to use on your cruise? And is it only true for NCL, or do all of the cruise cards have this feature? Thanks!

@Cate! – You can see all the T&C here on NCL.com https://www.ncl.com/world-points

I have not taken the time to study up if other lines offers something similar but I will over the near future and post about it.

Once you have spent the points for the upgrade they are removed from you card account.

I forgot. Can you earn more than one upgrade in a year?

@Cate! – No limit that I can see.