Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

It is no secret that I go for lots of travel cards each and every year. In fact, for as long as I have been blogging, I have posted about the many, many, many cards I have applied for year after year. Not just cards but over the past two years I have harvested literally thousands upon thousands of dollars from new account bonus offers!

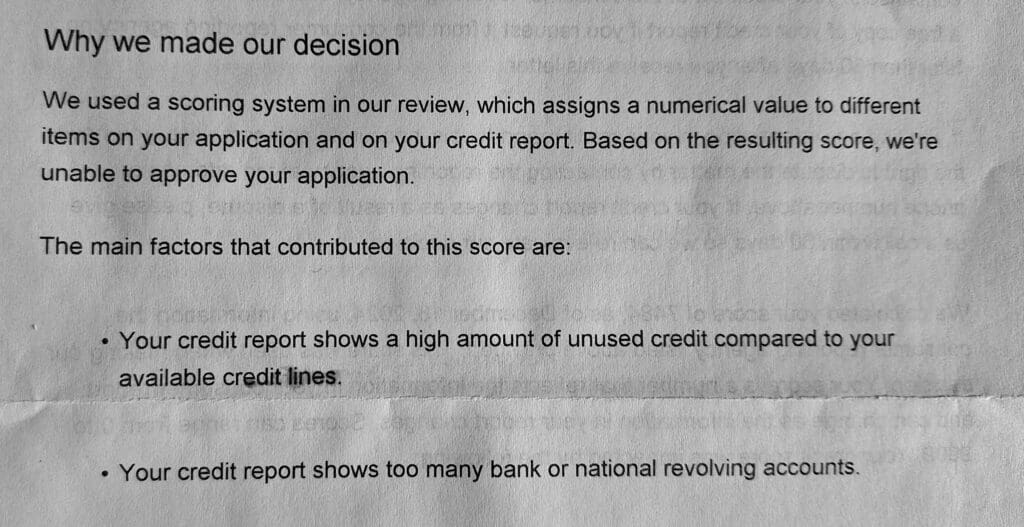

But during my most recent round of cards, I got one single denial and then in the mail got the following reason why I was turned down:

Ruh roh. This is the first time ever I have been turned down for a card for my credit really being too darn good. So why do I think this happened? First, some background on a number of things that make a credit score good.

Paying on time. One of the biggest impacts on your credit score is that you always, always, always pay your credit cards on time. This is not to say you have to pay it off in full before the statement generates but that you do pay it by the due date after the statement does generate.

- Length of credit. Having a long-term established credit and managing it well matters, and many keep the very first credit card they ever applied for a lifetime.

- Your level of credit use. In other words say you have $10,000 of credit available and you spend up $9,000 you are hammering your credit hard. However if you have say $100,000 of credit available across all cards and then in a month spend $9,000 you are only using about 10% of your credit.

- The mix of credit you have or have had. It is not just all about credit cards. Paying a home and auto loan, again on time, and over time also has a big impact on what your credit score is.

- While not the full list the above are the “big ones” that can mean if you are approved for a new travel card of if you are turned down. So now back to my situation and why I think I was turned down by a bank that sounds like city and kinda ends with ank.

The reasons for the denial are several fold. Normally I do not pay my credit card bills until the week before they are due because I keep my funds in a high yield money market and why pay bills too soon. But recently we took a long cruise and we wanted to have everything paid off so as not to worry about anything while gone. So, all our bills were at zero when we departed and that included prepaying some cards to zero.

The next item is just perhaps we went a teeny tiny bit overboard (well actually crushing it) with new checking and savings account bonus in 2024. They were very lucrative but maybe this card issuer looked at that (I am guessing here by the wording) and they included that in the decision to tell me to go pound sand.

Either way what really, in the end, surprises me is that for the first time that I can ever recall having too much credit was a bad thing. Maybe it is time to for me to take a hard look at my many dozens of cards and close just a few before my next application.

Has this ever happened to you?

– René

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

I don’t pay off my cc until it post. Once it post, it gets reported to the credit bureau. So my credit score always gets dinged. Also, I always lower my cl. Otherwise, I will have to much of it.

I had the same denial reason from Citi. It left me scratching my head, as well.

Citi did that to me. Too much unused credit. But they are now offering me credit cards since I took out a loan from them.

I’ve heard of Capital One denying lots of folks with excellent credit, particularly with very low utilization, because they want to issue cards that are heavily used and ideally carry a balance which is how they make the majority of their CC revenue.

This is a common reason for denial at Barclays and Citi.

@Jack – Low credit scores.

It was always great to have a low credit to debt ratio. Wth. That’s absurd. But I can see why they would hate people who pay off balances every month. Not changing my behavior. 🙂

Financial Institutions must take the max Line of Credit as outstanding debt when considering new credit. The reason is the borrower could max out all credit cards with no further credit review from the lender possibly leaving the borrower in financial bind. The borrower could also use one card to pay off other cards showing false credit history. This is common practice

Not wanting to have too many credit cards to keep track of …. Is there any downside to closing a credit card you don’t use to apply for a new one with a high signing bonus?

@Mark – If you close a card it does ding your score a bit. Also, never close a card inside one year as new card bonus could be clawed back.

Sounds like a capital one card. Got denied for VX with 839 score wife got approved with 769 to figure. She was far fewer accounts than me

(attack redacted)

*Unused Credit- This bank thinks you have what you need

*Too many cards – Same as above

They are saying you have too much credit…which is not a good thing at all. It is a HUGE red flag for banks. They will figure you will not use the card much.

Who publicly posts how good their credit it?

@SMR – You should re-read the post and the fact that having credit available is not a bad thing to boost your credit score.

Agreed, but you also know how having too much available credit can blow up for the bank. You can have an 850 credit score for years, but if you have a bad year when the economy goes into the toilet (which has a non zero likelihood of happening in the next 3-6 months) and blow that score up by having all kinds of bad things happen. The bank is then left holding the bag.

IMHO it’s smart risk management for them to be looking at at least reducing their increasing exposure, and I won’t be surprised if we see a wave of account closures as they look to reduce their existing exposure. Folks with great scores are likely to be less affected, but aren’t going to be exempt.

@ChuckB – But the key here is if I had say 20% of my available credit it seems they would have approved me vs having zero debt they said no.

Why not name the issuer? Or are you worried about referral credits?

@Boraxo – Read bullet point 4 again and if you can not guess the issuer… all I can say is “here’s your sign”! 😉

Ah, yes. A “credit card salesman!” hot take.

It’s Citibank.

Classic denial for Citi AAdvantage card applications.

@Jules – That was not the card I went for.

843 – Capital One cut my credit from 30k down to 10k on a card because of “unused available credit”, i tend to run in the 1% to 3% range and kinda like having large cards, I just have no use for them, i seldom spend money and have to find ways to split bills so that i can use cards at least once every 2 years or they’ve cancelled them.