Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Like so many points enthusiasts, I monitor and take care of both my and my wife’s points and frequent flyer accounts. This means I get Delta marketing etc. emails to my email account(s) and then choose what looks interesting for us both.

When the latest email came in I clicked on it and went to log in and see just what it was all about and maybe enroll and I got the following:

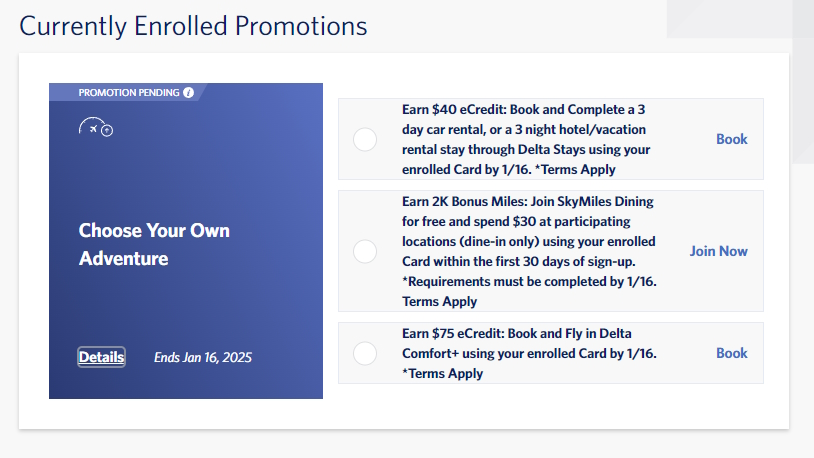

That is when I realized the marketing email was not sent to me but targeted to my wife. Delta has for a long time not allowed just anyone to sign up for offers (dumb in my opinion) and so I had to log back off and log back on as my wife to see this:

Yawn – Zzzzzzzzz!

First up I am not a fan of booking hotel stays via Delta because I value the perks of status that are almost always lost unless I book directly with the hotel chain. a $40 Delta eCredit is not nearly enough to entice me at all given these facts.

Next we have SkyMiles dining. There are a number of airlines and hotels that can get you points via dining and $20 worth of SkyPennies does not move me to spend the time to try for this one on my wife’s account.

The last one again is a snoozer because I will never pay for C+ because it is just a coach seat with a itsy bitsy tiny more room and that is not worth the price (plus I get it free for now as a Platinum Medallion®). Once I drop down to gold next year, due to my million miler status, I will be happy with exit row unless I just book Delta 1st Class or Premium Select or Delta One.

Bottom line is I guess Delta does not really need to move or incentivize folks to book with them as these promotions are lame and not open to everyone. You tell me, would any of the above wow you? – René

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Pathetic incentives…

I’m embarrassed for Delta, but not surprised. The only way I would consider these is:

1. $40 eCredit for 3 night stay: If I hadn’t downgraded away from the Delta Reserve AmEx card AND I hadn’t used to $200 Delta stays annual statement credit from that card AND I saw a hotel like Hampton Inn (Hilton) or Fairfield Inn (Marriott) or similar for $100/night or less – which is rare nowadays but still happens – AND I needed a hotel anyway. That’s a lot of stars that need to align. The net would be 3 nights for about $100, then receiving a $40 eCredit… Even optimizing as much as possible this just doesn’t sound enticing.

2. 2,000 for SkyMiles dining $30 spend: Again, it’d have to be in combination with Reserve card, the $20 monthly Resy restaurant statement credit, and a restaurant that I could aim for as little as possible beyond $30 – or that would allow me to easily split across multiple cards. In my experience, the number of restaurants that participate in both Resy and Rewards Network (which operates SkyMiles Dining) is fairly slim.

3. $75 eCredit for booking into C+: I’m also Platinum Medallion®. Booking C+ direct is a waste. Immediately after booking, I can just go upgrade my seat to C+ for free. But for the sake of trying to optimize the points game with this offer, I used to get booking-flow offers to upgrade the seat to C+ before ticket purchase for as little as $11. If I was already booking a flight AND I was able to book C+ for $11, I’d take this offer.

Again, they’re all embarrassingly uninteresting offers. They aren’t even motivating enough for me to login and look to see whether I’ve even been targeted.

But Delta has lost my attention anyway. I will not stretch at all to reach any kind of status with Delta. I also won’t book Delta unless they’re the cheapest or most convenient. That hasn’t been the case for months. My platinum medallion status expires at the end of the year, and with it goes the last bit of incentive to book Delta. I already downgraded my Reserve card to a Delta Gold AmEx card (to keep the 15% award discount) but am considering going down even further to the Blue card – just to keep the credit age and credit limit without having an annual fee.