Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Well this is an interesting new travel “cash” idea. There is a startup called Venti that is offering, if you use their new booking service, to allow you to pay for travel with points you earn by depositing cash with them (more in a bit on that).

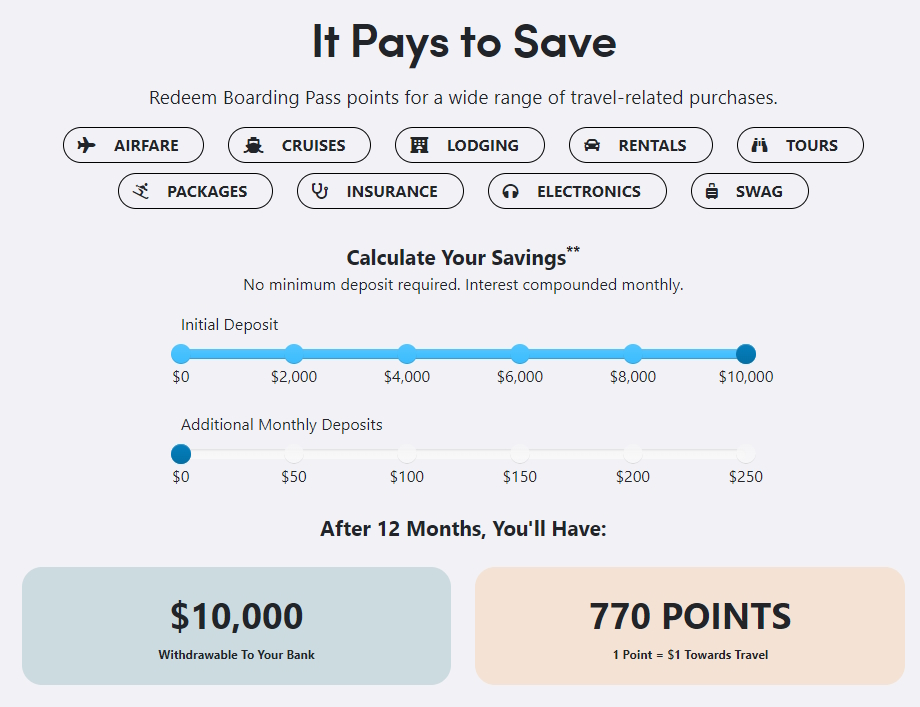

The way it works is you earn interest on your money not in the form of cash but in the form of points and the current published APY 8%, that is if you, as you see above, parked $10,000 you would earn $770 in travel cash with them. As my post title says if you parked the maximum allowed you would earn $3,850 per year! Just to be clear, I am not a tax expert but if this 8% return is considered points as opposed to cash it might be worth even more to certain individuals and Venti does not make it clear how they’re going to report the points that I can see.

Being a Frequent Floater I love having others pay for my cruises. I use Chase Ultimate Rewards® points to book cruises and stack deals and love it. To have one more option that pays me without having to do anything but park some cash is a nice idea.

They are offering anyone who signs up free VIP status and $10 for joining them (LINK) so IMO it is worth going for this even if you don’t end up parking any funds with them.

You may ask something like “I don’t trust startups like this with my cash” and you would be wise to feel that way. I almost got burned holding USDC (US Dollar Coins) at a startup paying high interest that went belly up. But Venti says they are not the ones holding your cash and it is FDIC insured. Notice below:

“Where exactly are my funds kept? Are my funds FDIC insured?

When you make a deposit onto your Boarding Pass, the funds are stored with a trusted third-party custodian that has accounts with Veridian Credit Union, Evolve Bank & Trust, and Cross River Bank. All three banks are based in the U.S. and are FDIC insured. Venti never has direct access to your funds.” – venti.co

So that looks good so far and even the cash I did have at the crypto startup I already mentioned before had a similar deal and the bank did pay out all the cash held (but it took a few months). Back to Venti. What are the fees?

“What are the fees for this program?

For those that join after our promotional period (ending December 31, 2023), we require a $39.99 a year subscription to maintain a Venti Boarding Pass. This fee can be paid via 40 points if you retain a balance of at least $500 for 12 months.

Deposits and withdrawals from your bank account via ACH are free.

Instant withdrawals from your Boarding Pass to your bank via debit card are subject to a 3% transaction fee not to exceed $50 per transaction and no lesser than $1.” – venti.co

So moving cash in an out via ACH should be simple if I need the cash for something else or something better comes along (or real cash interest rates go up a bunch more).

We will see what happens with this startup and if it turns out to be a brilliant idea or a pain and not worth sticking with. But for now I will take the free cash and VIP status and see what happens. – René

HT to DOC

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

That an institution’s deposits are FDIC insured does *not* necessarily mean *your* deposits will be FDIC insured.

There are qualification requirements. And the venti quote you provided seems conveniently vague — at best — on how they will satisfy the requirements.

@Ralph – I am sure they will have more firm info as they launch. For now, I am in and will follow (for no cost to me). The bigger question for me is, in regards to cruise bookings, how good their site will be and matching other offers.

Another side note – if they are willing to pay 8% for us to use there site – we can see why Delta is going so all in with SkyMiles 2025 for using their partner booking site for hotels etc.

“Points can only be used for travel-related purchases on the Venti platform.” Ah so that’s how they’re doing it – baking the commissions received from their own OTA platform into the interest rates. Probably makes sense to look at that platform and how it compares to the typical OTA like Expedia before investing anything.

I would rather stick it in an S&P 500 index fund, too many startups go broke somehow.

@john – If your funds held in FDIC insured bank then only risk is free interest points.

Not true. Your funds must be in a qualifying account. These accounts held by 3rd parties at an insured institution do not sound like qualifying. And even then the insurance would extend to the account holder and not you.

Not saying this is a bad deal. And it’s something I may do. But caveat emptor.

@Ralph – Since it has yet to launch we do not know all the details but it seems, from the wording so far, it would be FDIC protected.

It will be interesting to see how this is structured. A quick Google search reports that “FDIC insures up to $250,000 per depositor, per institution and per ownership category.” It seems like Venti would need to have you execute an agreement to act as your agent and open an account in your name, with the agreement authorizing the bank to send Venti the interest earned. This would ensure that your funds have FDIC insurance. However, I imagine that you would incur taxes on the interest sent to Venti. If Venti held your funds at the bank in their name, FDIC insurance would have little value.

I am more interested in the business model and how they plan to make money. High yield savings and CD rates are in the ballpark of 4-5% right now, and Venti is paying 8%. Does anyone know what kind of commissions a booking portal earns? I have a US Bank Altitude Reserve. Points are worth 1.5 cents. If I book travel elsewhere with the card I get 4.5% back in points. If I book using their portal, I get 7.5% back. The 3% differential is similar to Venti’s and leads me to believe Venti’s business model might be sound. On the other hand, their rate will change with interest rates.

Venti has a few more opportunities to earn money. How many people get a top-tier credit card and do not take advantage of benefits this like Dell, Uber, or incidental airline credits and let the points pile up? Many people might not use the points for a long time and forget about the account. You do not earn interest on the points, while compounding interest in a bank can add up. I’s also possible that Venti could provide stupid ways for you to burn points. They could also offer something similar to the AMEX offers to burn points.

I really should have looked at the website and read the FAQ before posting.

A few comments. Under “How it Works” the website states “You deposit funds into a secure, FDIC insured account completely controlled by you. With no lock-up period, you can withdraw every dollar from your account at any time.” However, the FAQ states “When you make a deposit onto your Boarding Pass, the funds are stored with a trusted third-party custodian that has accounts with Veridian Credit Union, Evolve Bank & Trust, and Cross River Bank. All three banks are based in the U.S. and are FDIC insured. Venti never has direct access to your funds.” These statements seem inconsistent. This “trusted third party custodian” takes my funds and sticks into some combination of the three banks. How can the the FDIC insured account be controlled completely by me?

Their FAQ question on taxes is interesting. “We consider a taxable event is created the moment Boarding Pass points are used to complete a purchase. We will provide a ledger in your account so you can track utilization history for filing purposes. We recommend you speak to a tax professional to review your individual circumstances.” If I have an FDIC insured account completely controlled by me, won’t I get a 1099-INT? I am not sure how I would report these ledger entries on my taxes.

The asterisks at the bottom are interesting. “APY is compounded and credited monthly . . . Calculated values assume principal and interest remain on deposit and are rounded to the nearest dollar.” So, the interest is kept in my account as cash and can compound, and is only removed from my account when I book travel? If I am earning interest in an FDIC insured account, it seems that I should be getting a 1099-INT.

Despite my questions, I see no harm in signing up by giving them my email address. Hopefully, there will be some clarifications before I give them any money,

One of those “banks” is a credit union. Credit unions are not FDIC insured. They are insured by the National Credit Union Association. NCUA is an arm of the government and insures deposits. So on the one hand this little startup just needs better copy writers and/or better lawyers. On the other hand it’s playing fast and loose with the truth. I guess we’ll see but color me skeptical.