Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Perhaps you’ve seen a bunch of posts on travel and points blogs lately about various US Mint coin sales.

Why do people do this? you may wonder.

Simple: we can make pretty easy money and earn credit card points!

Buying and Reselling US Mint Coins for Profit and Points

The US Mint regularly sells coins. (Here’s their product schedule.) But some coins are very limited in quantity. And some are made with gold or silver. Hence, a few products are very valuable. And the Mint generally limits how many coins may be purchased per household. (More on this in a minute.)

That’s where buyers clubs come into the picture.

These groups enlist dozens (or thousands) of people to purchase an item. In this instance, US Mint coins. They fully reimburse members their coin purchase costs and pay a commission to people who successfully buy the coin and deliver it to the buyers club. (The US Mint ships the coin to your address. The club arranges shipping with you. We’ll talk about that.)

Plus, the US Mint accepts credit cards. So you earn points, miles, or cashback on your purchase.

How Much Can You Make?

Your commission and points/miles/cashback totals vary from deal to deal.

Since I’ve been buying and reselling coins, the most I’ve personally seen is an opportunity where people could earn about $2500 in commission, but a few thousand points/miles. That’s not bad for about 20 minutes of work.

Some deals are, like, $75 in commission and a few hundred points.

What’s the Best Credit Card to Use for US Mint Purchases?

If you have a card offering 1.5X-2X points/miles or cashback, that’s a good option to consider.

American Express says that purchases of precious metals (i.e. US Mint coins) will code as cash advances. That means fees, interest, and no points earnings. No bueno. But I’ve seen a bunch of data points recently indicating that Amex isn’t enforcing this. So your mileage may vary. I personally use a Ink Unlimited card.

How to Sign Up for US Mint Buying and Reselling Opportunities

This blog usually posts US Mint coin sales that involve reselling opportunities.

The two buyers groups I’ve personally used for US Mint deals are PFS Buyers Club and The Card Bay.

PFS generally requires its members to pre-register for deals ahead of time. The Card Bay usually doesn’t.

Can You Place Multiple Orders?

The US Mint limits each sale to one per household.

In this instance, “household” essentially means “address.”

So if you have a home address and a work address, you may be able to, basically, circumvent those limits.

Perhaps your significant other’s US Mint account can be set up for your home address. And yours can be your business’ mailing address (physical office location, post office box, etc.).

Not that I would ever encourage this, of course. 😉

Which Is Better: PFS or The Card Bay?

Their commission and shipping/delivery structures are different. The Card Bay, in my experience, usually offers better commissions. But they require you to package your coin shipment into a USPS Priority Mailing Box. They’ll provide you with a pre-paid mailing label to slap on the box once you receive it. And they also don’t insure your package. So if it gets lost in the USPS, you might be out a lot of money. (The Card Bay is based in Los Angeles, where I also live. I personally deliver my US Mint coin purchases to them.)

PFS supplies you a prepaid FedEx label that you simply affix on the box you received from the US Mint. PFS does insure their packages. In fact, FedEx once lost one of the coins I sold to PFS; I still received the entire payment and commission.

Honor Your End of the Deal

If you sign up for a deal or commit to selling your coins to a specific vendor, it’s in your best interest to finish the deal with them. I say this because there are instances when people buy a coin and then learn they can resell it elsewhere for a bigger profit.

Doing that is a great way to get yourself suspended or permanently banned from that buyers club.

PFS also adds language in its contracts that it may sell legal recourse against people who welch on a committment.

What if the Coin Sells Out?

This happens all the time: you commit to selling a coin to a specific club — but the US Mint sells out before you can successfully complete your purchase. (The US Mint’s website is infamous for its IT problems, bugs, and incredible lack of speed.) Some coins have sold out within five minutes.

The buyers groups understand this. Those requiring reservations (i.e. PFS) generally have some kind of check box on your reservation form that says something like, “The deal sold out before I could buy it.” So don’t stress.

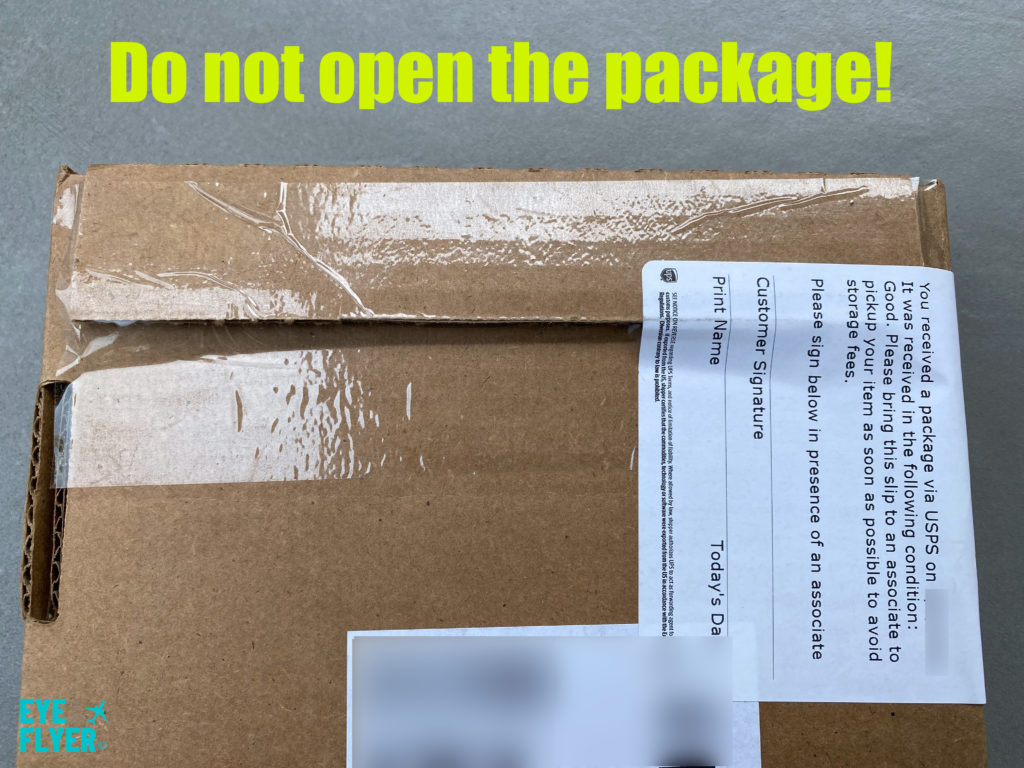

Do Not Open the Coin’s Mailing Package!

This is very important — and could end up invalidating your deal with the buyers club.

The coins generally need to be appraised by the buyers club or whoever they are reselling the coins. You know how unopened Star Wars toys and baseball card packages are more valuable than opened products? The same logic kind of applies here.

So don’t open the package. At all. Don’t break its seal. Otherwise, won’t likely receive your commission or purchase reimbursement. You’ll suddenly become a coin collector — whether or not ever wanted to be one.

Some coin shipments are larger than others. But most of mine come in packages like you see above. And here’s how they measure:

How Do I Get Paid?

You receive full payment after the buyers club receives your coin. Each buyers club has its own payment procedures. Some use PayPal or will mail you a physical check. They may also have direct deposit options.

Final Approach

Buying and reselling US Mint coins can be a fast way to make some money and score credit card points, miles, or cashback. Not every deal is a slamdunk and there are some risks involved — especially if you’ve never done it before. But the “thrill of the chase” can be fun — and getting paid is always nice, too. 🙂

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Do coin transactions with PPS generate a 1099-MISC or other tax liability?

If you receive $20,000 during a year in PayPal payments, then you’ll get a 1099 (if that’s how you get paid). But I’ve never received any tax docs from PPS.