Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

One of the things that flyers hate about Delta is the fact that they hide the award charts (that they clearly DO use btw). Why? Lack of transparency and ability to find out if they are getting real value for their SkyMiles. Plus the fact that when mistakes happen, when there are charts in place, you and a rep can manually look at the issue and fix things when IT messes stuff up.

The key part here is consistency. Last year when Delta radically changed the Diamond Amex spend waiver 10 fold to $250,000 many folks said they were done. I was ready for the challenge but flying partners was simpler and frankly a lot more fun as well. Others diligently followed my lead and have done the same.

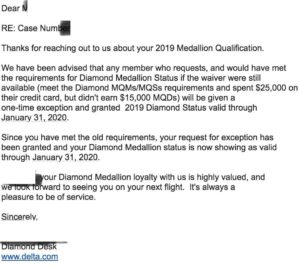

Now Delta is being inconsistent – really inconsistent. Last week I posted CONFIRMED results of those requesting an exemption from the 1/4 Million Delta Amex spend. Take a look at the following email from a reader that is a forward from the Diamond Medallion® desk:

So per the Diamond Medallion® desk folks, if you follow this advice and request the waiver, you should get it if you met the 2017 year requirements for Diamond status via MQMs and $25,000 Delta Amex spend. But what if you have already tried this and told either NO! or try back again in a few months? I asked Delta Corp if things have now changed with the above evidence in hand and was told:

“No.” – Kathryn Steele – Corporate Communications – Delta Air Lines

So officially, even though we know Delta is offering waivers left and right – officially nothing has changed. How lovely. It gets even more strange.

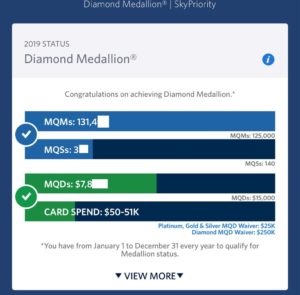

Another reader simply called the Diamond Medallion® line and was, apparently per the above directive to the Diamond Desk folks, granted the waiver as you can see in the screen shot of their SkyMiles account from the Fly Delta App.

So where does this leave us? Frustrated? You bet! Angry about inconstancy over requests? Without question! Sad that those who followed the new Delta rules, often at a cost, are now rewarded with “oh you did not really have to do all that this year!“? 100% Yes! Is there possibly a Delta / Amex / CFPB compliance issue going on now? Who knows!

Since I have already met the MQMs and MQD spend via partners I am out this year of even trying this. What I plan to do is in January 2019, in about a week or so, meet the $25,000 spend and try for the 2020 waiver. After all – if this is a one time shot granted – why not try next year after they are being so generous to many this year?

What do you think of the wishy-washy maybe yes maybe no officially no Diamond folks official yes situation? – René

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

I would have flown Delta more this year instead of sending business elsewhere if I knew I only had to do 25k in spend (that I hit in April). Their loss. Hope they get their stuff together for next year, and quickly.

I think it stinks. Why make rules and then not follow them. I meet the spend requirement within 3 months this year but will also make mqd’s by the end of the year. It’s aggravating that everyone gets the trophy for simply participating or asking for the prize. Don’t make rules DL if you plan on break them!

Maybe they should have Diamond for those who meet the threshold with the waiver allowing qualification via previous 25k Amex spend waiver and then Diamond Plus for those who qualify with the MQD or 250K Amex spend.

Since I’ve already the actual Delta spend requirement, it’s frustrating. At the very least, they should have Diamonds that only reach due to credit card spend sit in a lower upgrade tier. They already have separate tiers for folks that have the Delta Reserve card so it can’t be that hard to do.

@KC – It is the other way round. Those who spend $25k get MORE upgrades than “real” MQD spenders.

Since I passed the $25,000 spend threshold on my Reserve card a few months ago I have noticed a material increase in my upgrades x 2. The funny thing is when first class inventory is tight at the 5-day window and I do not clear then I notice that I get automatically upgraded now just before check-in (say around T-30 or thereabouts) (not at the T-120 window and not off the UG list at the gate). I didn’t know this could happen but it is happening more frequently. The Reserve card is a great deal and unfairly puts me ahead of other travelers.

Right on Rene! What’s fair is fair. Those of us who jumped through hoops to meet the $15K spend threshold to maintain our Diamond status for 2019 should be granted the same “one time waiver” whenever WE decide to take advantage of it – 2020 or beyond.

Kind of sucks since I made sure I already met the AMEX spend and I am half done on MQD. I would have put those spend dollars on other cards as I do not need any more Skymiles.

I agree for this year anyone who has met MQD spend or AMEX Spend should have higher Diamond status clearance than a Diamond who has not met either for this year.

Just called in to request this waiver. Was told that it’s an offer DL will proactively provide at the tail end of the year, and that they couldn’t grant it for me today (even though I’m well over the $25k Reserve threshold). Agent was unfamiliar with the waiver discussion at first, but called the support desk and came back sounding fairly confident that such a waiver would be proactively offered at a later date. Didn’t push the issue as I think I’ll hit it via MQD anyways – though it’ll be close – so I guess worst case I have a lower spot in line for upgrades for another few months.

Dropped my two Delta cards when I read the $250K requirement. There is no need to make your most loyal customers work for ways to “job” the system. Also, slowly migrating my business as the rewards redemption process is just silly.

The problem is, that once they added the $250k spend requirement, I knew I wouldn’t go through all that effort. So I didn’t bother flying Delta much this year at all and won’t even come close to 125k MQM, heck, I might even drop down to Gold for the first time in 15 years!

Typical typical I also strategized with the Juicymiles staff (John) to reach the $15k delta spend with partners, only used Delta domestically. I left all my GU and RU cert unused because I cant depend on the meager upgrades so I just pay or spend pesos. Im so disgusted with Delta IT, and corporate spin but what other options do we have? I will stick it out and olay their game and grouse under my breath!

I was Delta Diamond for years, maybe every year since inception. I also had a personal and a business Delta Reserve AMEX, a platinum Delta AMEX and Green AMEX. When Delta announced the $250k threshold for Diamond waiver I cancelled 3 out of 4 AMEX cards and started flying Southwest.

I’ll only make Silver on Delta in 2018 (thanks to Million Miler, almost 2M, status), yet I’ve already qualified for A-List Preferred and Companion Pass On Southwest.

There is no way the $250k MQD waiver was a good call for Delta.

I just walked off a China Eastern run that I took in business to Beijing just to hit my MQD. Over 200k mqm before the run so the flights were definitely not needed. Will definitely attempt the waiver next year since I will roll over enough miles to be diamond. I will say that with a $1.6k flight in business I don’t know if I will keep flying Delta international anymore unless I can get confirmed GU at booking. I got 46k miles, 20k mqm 6k mqd. Flying Delta I would have gotten barely 1/4 of those numbers. The hard product was great, service was decent (unless you wanted something in the middle of the flight, where do the flight attendants go when everyone is sleeping?) and I love the food. Will always look to book through partner airlines before checking delta. Ironically, their push for higher dollar spend is going to cause me to spend less money on delta, but get more rewards. Stupid business model for frequent flyers.

I agree with a good portion of the sentiment in the comments above… People jumped through all these hoops, went out of their way to achieve this thing, and now others may be able to simply get the same with a phone call or email, I get it, the same would annoy me. But, maybe there’s more going on here than it appears, which is usually the case with things that tend to annoy us done by corporations people like to call stupid (but they’re typically not)… So, sure, Delta is doing it for obvious reasons, i.e. annoyed flyers who won’t qualify again via spend, flying, both, etc. But, maybe they’re prepping the FF program balance sheet or program rules for other changes. For example, maybe by granting this to a large number of people at the end of the year, they’re removing another 50,000 MQMs of what would have been rollover and subsequently a short path to re-qualifying for Platinum. Then they’ll make some egregious MQM change or Platinum qualification change in the next year or so. There are so many odd and non-obvious reasons I’d think they may want to do what they’re doing beyond what we see on the surface…

Thanks for this Rene! Amazing.

@PN I agree. i don’t understand the business model unless they are becoming a bank.

I think they should have no waivers. Spend the money and sit in the seat.

@Richard – They make almost as much (if not more) from selling SkyMiles than those who spend money to sit in the seat. Their business model is to make money and reward $DAL shareholders and if that comes at the expense of those paying for tickets – so be it. (disclaimer – I never buy/sell ANY airline stocks including DAL)

The only thing that seems clear is that Delta is not going to consult with Am Ex when it comes to changing its Medallion® Program and the DM spend waiver. So much for being partners.

Denied the first try, but worked the second time! Thanks!

How SAD and UNJUST!! How can people believe what DL says! People should know the expectations and the expectations should be adhered to unless changed with proper notice–just good business practice and JUSTICE!!

Rene, any possibility of seeing if the exception will be in place for next year? Though I and many other will make it by spend, other won’t and it’s only JUST to know how things will work next year.

@Gary – Delta would not tell me if I asked. The only way I learned last year was from inside info that I doubt I can get this year. However, I am expecting a change again to be announced in October – but that is just an educated guess based on what we are seeing happen now.

Rene,

Hit 125 MQM but short on MQD. Called diamond desk for waiver and made DM for 2019. They asked where I had heard about this and I cited your blog. They were surprised since they have not announced the waiver.

@John – I tend to break a lot of news Delta would rather I would not. 😉

Seems to me that people across the board should be aware as this is very unjust having just a year ago changed the policy and with no Public indication, going back on the change!

Unjust and unfair!

Maybe we all get The waiver next year – – LOL

@John, how short were you on MQDs? How did you call the Diamond Desk if you weren’t Diamond? I’ve historically only been routed to it when I’m Diamond.

@Jarrett – As shown in the email from Delta Medallion® desk, you MUST have qualified under last years requirements ie 125,000 MQM and $25,000 Amex spend.

@John – Question still stands as shown in my original comment… How short were you on MQDs in this period when asking for the waiver? I’m checking if there’s any DPs that may be worth knowing. For example, I know of two people, similar Delta profiles, most of their fundamentals are the same, though one person got the waiver, the other didn’t. Their previous year was nearly identical, as well as this year’s MQMs. But this year’s MQD for the one that got it was at about $7,900, and for the one that didn’t, theirs was at $236, hence my question. Thanks.

@Jarrett – The MDQs do not matter. It is the qualification rules of the OLD terms.

Would love to reignite this conversation. Anyone else out there get a waiver for DM in 2019 and if so, how close were you with MQD’s? I imagine most of us will meet the MQM threshold, so I’m most curious about MQD’s. Thanks!

Sara, you might want to start a thread on flyer talk to get a conversation going. What happened with Delta and the waiver is totally unfair having changed it a year ago but going back on there change.

Since some got a free pass, maybe everyone should get one free pass!

Let us know if you start a thread on flyer talk so we can all chime in

SO.. glad this worked for some–hasn’t worked for me–I sent an email to Delta. Received reply from Diamond Desk basically saying they would review my account in Jan regarding a waiver–LOT OF GOOD that does–I need to know if I need to FLY in DEC!!!

I will meet MQM, but need $1300 to meet MQD (forget that $250,000 spending)–Of course, I let my passport expire (I KNOW)–so now guess I’ll be flying to the west coast and back somehow in DEC–

Just do not see how they can be so inconsistent.

The person I talked to at Delta Desk said she did not know about the waiver

Just got the waiver to Diamond although I am currently only Platinum. Called originally on the platinum line with no luck. Called back a few days later via diamond (on a relatives diamond account) and was granted the waiver over the phone.

Rep was unfamiliar with the waiver but after consulting with supervisor was told it is a one time waiver that can be granted this year or next year.

Oddly I have qualified for Diamond for 2019 but am still showing as Platinum.