Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

I hold the Citi BANK Prestige card. My wife also holds one as well. It is one of these cards like the non-Delta AMEX Platinum card or the non-Delta AMEX Platinum business Card that I could not spend a dime on each year other than paying the fee and get HUGE value year after year.

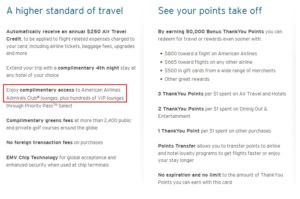

Right now, as you can see from the back of my card and on the application landing page, the card not only gets you Priority Pass (with two guests free unlike most other cards) but also when you are flying AA you get into AA lounges. The latter really is meh. AA lounges are not “that” great and if you are a frequent AA flyer you should have the AAdvantage Executive card anyway. The loss of this next year is really not “that” big of a downgrade folks! (HT to M2M)

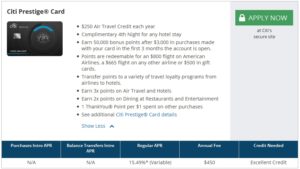

Beyond this change there is talk of a change to the offer. Not the 50,000 bonus points (I am told that is staying the same) but the spend is going up from 3k to 5k. Again, if you are mega upset over this change on the way you either cannot order VDGCs from GiftCards.com (starting at TCB) or you don’t have a CVS or Walgreens near you or you don’t live near a Simons Mall. For the rest of us, who really cares about an extra 2k more in spend to get bonus points?

Lastly, if you are a golfer, this card pays for itself over and over and over and that does not count the $250 back you get each year in travel credits (lowering the net cost for the card to just $200).

Folks there are cards you hold and pay the fee even if you don’t use it (you should when booking airline tickets and it has great transfer partners as well). This could be one of those cards for you but the changes on the way really don’t matter one bit to me. You? – René

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

I have to disagree with your statement that:

“AA lounges are not “that” great and if you are a frequent AA flyer you should have the AAdvantage Executive card anyway. The loss of this next year is really not “that” big of a downgrade folks!”

For AA flyers who also hold the Prestige Card, this is a big deal. It doesn’t matter how meh a lounge is, it often is still better than sitting by the gate area. (And AA’s lounges typically are not as crowded as DL SkyClubs, in my experience.) The Admirals Club agents can also be lifesavers during IRROPS.

I also disagree that most AA flyers should have the Citi Executive Card. That card isn’t particularly distinctive in terms of reward for spend (the only bonus category is 2x on AA purchases), and not everyone needs the EQMs after 40,000 annual spend. And not everyone needs yet another card with a $450 annual fee!

@DWT – If you are a monthly AA flyer this card is NOT the “main” card for you. This perk in no way makes the card less valuable to most flyers. Sorry, there is just way to much value here for this to be a big loss. Also, the Executive card perk of access when flying any airline is much better and you can add-on users free. Huge value for AA flyers.

AA lounges are not great. They are pretty cheap and offer you crackers for free. Having access to Amex lounges and Priority Pass for my entire family I couldn’t care less about Admiral’s Club access. And yes, if you are a AA hostage than this card is not the right one for you.

@Santastico – Agree.

This is a big downgrade for me. I will still continue to hold the card, but it is most definitely not *meh*. I fly on AA most frequently and canceled the executive card years ago because it was unnecessary with my prestige. I am also a golfer and absolutely get my value out of this card, but this is still a big negative. Being a Nashville flyer, I have enjoyed having a quick meal or snack before my flight. As someone else mentioned, the agents in the club have been invaluable during IRROPS. If I have to get the executive card for AA lounge access, then I guess this is a $450 downgrade for me. I find it interesting that you think this change *probably* doesn’t matter for your readers. It is still a valuable card, but it definitely lost quite a bit of value to a lot of cardholders.

@rene: On the other hand, I expect Citi to add something else or to reduce the year fee

@Santastico – That would be fantastic and had not thought about that possibility (I used to Delta who only cuts and cuts). 😉

Rene I also have to disagree with you. While the Prestige card can have exceptional value without the lounge access, for an AA flyer it a HOMERUN in its current state. Lounge access + 4th night free +$250 airline credit makes it the best card out there for an hub-based AA flyer (i’m in ORD). I’ve never used it, but using those points for $0.016 on AA is also a great benefit if Intl premium class travel isn’t your focus.

I travel enough to value lounge access. This change means to keep all the current benefits I have I will need to pay $900 in annual fees vs $450. While I see your points, I think any AA flyer who has the Prestige card will agree with me.

Disagree. I am a free agent. I will fly any airline (within reason!) with the best price and non-stop flight. In many cases, that is AA. Not having lounge access is a big deal and a definite downgrade. Plus, Citi’s customer service has fallen off a cliff (have you tried to call Citi lately?) My potential renewal is next spring. Citi better sharpen the pencil on retention offers or its adios Citibank!

@rjb – Well you only get the perk when flying AA so… Plus, as a free agent, there are PP lounges in a most places to enjoy.

Rene, you mention Simon, CVS, Walgreens. If you’re not interested in selling GCs, what else if anything can you do with them other than spend them? Are MO at WM truly viable? Just curious about my options.

@Steve – Yep. Either WM or at other grocery stores.

I’m not an AA flyer, but I used to be, and I would never have picked the Executive Card over this. If I’m an AA flyer, what do I care about AA lounge access when I’m not flying AA? Especially given that I’m based in NYC, so I’d need to go through security in another terminal if I’m not flying AA just get into Admiral’s Club. I would absolutely have only had this card over the Executive Card given the additional benefits and same annual fee.

Saying that this isn’t a loss for AA flyers is a ridiculous proposition, really – what you’re essentially saying is that an AA flyer should already have been carrying TWO $450/year fee cards instead of just carrying the Citi Prestige. Lounge access when I’m not flying AA plus free guests is not worth an ADDITIONAL $450/year.

@Bert – I pay a number of AMEX $450 card fees including the Reserve card when I already get free Sky Club access as a Diamond. If you are a full time AA flyer it is in NO WAY ridiculous to pay for both. Plus, as I have clearly shown, this card net pays you each year to hold. If you are hung up on the fee you just don’t get it.

@rene You seem to be missing the point. This can be BOTH a big loss and still be a valuable card. My comment had nothing to do with whether the Prestige is still worth it and everything to do with your thought that this isn’t a big downgrade. I never said it’s ridiculous to hold both (although I kind of think it was IN MOST INSTANCES, before this change), but I did say it’s ridiculous to say this isn’t a big loss. For AA flyers who carried this card to get Admiral’s Club access when flying AA and didn’t want to get a separate card, this is most definitely a big loss – a $450 loss, in fact.

Also, I’m glad that you carry many $450 cards. That’s pretty much totally irrelevant to this conversation. Taking your specific experiences and decisions (as a different airline flyer, no less) and trying to apply to a broad group of differently-situated people doesn’t make much sense.

In short, it’s not a stretch to say that there is a group of AA flyers that would hold this card to get lounge access when flying AA and not want/need the AA Executive Card that would see this change as a big loss. That doesn’t mean the Prestige isn’t a good value, it just means that this is also a big loss.

Quite few bad advices here IMHO. Starting with this whole AA lounge being a meh benefit and how AA flyers (I am an EXP FWIW) should have the highly inferior Executive card – inferior to Prestige and United Club/Delta Reaerve cards – paying $900 in annual fees to hold both cards is just plain silly.

The advice to merely hold the prestige and only put airline ticket spend on it is another bad advice IMHO when this card is probably one of the most well-rounded cards for everyday spend. Majority of your readers most likely have little interest in holding 10-15 credit cards and using different cards for different purchases. I personally don’t have the time or energy for this kind of stuff.

The only thing I agree with you here is the golf benefit. Great benefit.

@Golfingboy – You should hold the max perk card for the airline you fly 99% of the time. For AA the means the Executive card. For Delta the AMEX Reserve. I am not saying to hold all of them. I am saying if you fly AA day in and day out the Prestige lounge access should not be the reason to hold this card. As far as spend, those who don’t want to take the little extra effort to pull the right card for the right charge – well – maybe best to stick to a 2% cash back card for those. #JustSaying

I still don’t understand the proposition that you SHOULD hold the max perk card for the airline you fly 99% of the time. Am I missing something here? If you fly AA 99% of the time and had the Prestige (and therefore lounge access), why SHOULD you also hold the AA Executive Card? So you get lounge access that other 1% of the time?

The only other benefit is 10,000 EQMs, which I guess could be important under certain situations if you’re not earning enough EQMs through flying.

I’m not trying to be argumentative here but I feel like I must be missing something. Obviously in a year this will change, and AA flyers will need to hold the Executive Card, but for now the blanket advice that all AA flyers SHOULD have the Executive Card seems like a bad one.

Bert – The EQMs can absolutely be worth it for status as well as being able to have add-on users free who get lounge access (for them and +2) even when NOT flying AA. A huge perk. Plus all the other card perks as well.

I agree with the comments that this is a meaningful downgrade. AA is my preferred airline and I regularly use the lounges to kill some time before flights. AA lounges while not an experience like Amex’s lounges, certainly provide the comfort for 30-45 minutes when needed and I find myself using this benefit about 15-20 times a year.

I pay my share of annual fees (probably between $1500-2000 between my wife and I) but would not get the AA Exec card as I would not charge $40K on it and my company pays for all my work-related travel directly.

I will have to decide what to do with the Prestge next year once the change is incorporated, I value the lounge benefit to be worth about $100-150 to me annually

@Ash – For most, to MS 40k is not that hard if you want to. I ran 25k on my Delta Reserve card in 13 days this year to prove that point. Worst case, if you are in a big city and can not do many of those choices, KIVA.org is a simple way to knock it out over a year.

I’d still call this a good card for many flyers as well. If you’re a regular AA flyer, the value proposition has certainly been impacted…..and one might be better off with the Citi Exec card….depending on their situation. It also might make slightly more sense to just buy a membership outright if you’re happy with other cards…… Aviator Silver comes to mind, once the Prestige card loses AA club access. It just depends on your specific situation.

@rene All of your points are fair, and there is certainly some value from the Executive Card, which I have acknowledged in my posts. You seem to be arguing something that I’m not saying though – I’m not saying there’s NO value in the Executive Card or that NOBODY should have it. What I have a problem with is your blanket statement that everyone that flies AA SHOULD have that Executive Card, which I just disagree with.

If I were a frequent AA traveler for work, I would get the Prestige (at least for the next year) and not the Executive Card, as the guest privilege or ability to access AA lounges when not flying AA are both pretty much useless features for me. The only scenario I’d get the Executive Card would be if I needed the 10,000 miles to bump status, but I’m not even sure that’s worth $450 to me, and it would be hard for me to know that until the end of the year given my weird travel schedule. Because each tier is 25,000 miles, there’s only a 40% chance the 10,000 will take you to the next tier, so I’d essentially be paying $450 for a 40% shot at a bump. Maybe I’m especially unique in this sense, but other comments on this post suggest that others think similarly.

As for your comment about quickly generating 40k in MS, I think that’s another mistake of you viewing everyone else’s behavior through your own lens. Sure, there are a fair number of people in this hobby who are fine with MS, but there are also many people who do not. Assuming everyone is comfortable with MS, especially at such a high value, seems like a mistake to me.

@Bert – For those who can’t or will not MS then Kiva is a simple choice.

I am not a frequent AA flyer, but when I fly and the closest is AA lounge, I get in there. There is no reason to say you should pay another x dollars and get another card.. that is not for everyone..

Having said that this is a really bad change but does that make the card dispensable? No for me.

I am not sure I understand why you strongly believe I should have the top credit card for the airline that I travel with 99% of the time?

With respect to the AA Exec card, what advantage do I get that will boost my travel experience when flying on AA?

I don’t need more EQMs (I don’t spend $40K either) and I am not going to create a bunch of AUs to get them AC lounge access as overcrowding affects me, so why should I exacerbate this problem.

I hold the Prestige for the lounge benefit (AC and Priority Pass both as I use the AS lounge at LAX often when traveling out of T6), generous travel delay protection benefits, free golf benefit, $250 travel credit, ability to purchase AA tickets at 1.6 TYP, and it’s well rounded category bonuses. I have not done a points transfer but appreciate the option to top off some accounts for an award redemption I plan to book (Etihad and SQ). Aside from the already known cuts (no more 2x dining bonus, AC lounge access) rumors are swirling that the 1.6 TYP redemption on AA might be disappearing too.

The Exec card offers me nothing as an EXP aside from AA lounge access when not flying AA and the negligible slightly reduced mileage award rates.

I see the benefit of having the DL Reserve if I were a Delta flyer for the upgrade tie breaker, companion ticket (esp for F), and fairly reachable spending requirement for extra miles + MQMs which can be rolled over. SkyClub access is just gravy on top. Can’t say the same for the AA Exec card.

I have considered a cash back card and might look into it again at some point. The Chase Sapphire Preferred® Card was my back up card and might become my primary one again depending on what Citi does.

Rene, like many here I can’t agree that this is a small change. Unfortunately if you’re a domestic flyer you can’t just say “well just use PP”. If you’re able to use the Admiral’s club lounge access then you’re most likely in a hub. Let’s look at PP lounges at some of those hubs for a moment

ORD has 2 both requiring you to go out of security and take the airtrain to the international terminal. Both lounges are also crap.

DFW-1 in the D terminal vs 4 Admiral’s clubs one in each AA terminal

CLT No PP lounge

MIA 4 vs 2.5

PHX 3 vs 1

Under the current scheme, the only big benefit of the AA card is the 10k EQM for $40k. However unless those 10k EQM make you ExecPlat, you won’t get any “stickers” for upgrades vs spending the $450 for a status run (as a vacation no less) which also gets you within 2500 eqm of getting additional stickers.

Due to my location, I end up spreading my flying enough to end up with mid-tier status on several carriers so the top tier AA card doesn’t make sense for me. I also rarely travel international, so the PP locations aren’t that great.

With a Prestige and a Amex Platinum, you had access into Centurion, PP, Skyclubs and AA when flying them (which is about the only time you’d need it), now you either go for a day pass or pony up another $450 fee.

Sorry but that’s a big impact for those of us in that boat. Does that make the card less attractive, I doubt it, the 4th night, golf and $250 credit all make it pay for itself and then some. But just because it doesn’t effect someone who’s primarily a Delta flyer doesn’t mean it’s not a big change.

I can’t tell if you’re deliberately diverting from my main point now or what. My main point was just that this change is a big loss for a subset of AA flyers that do not get value out of a second $450 card, and broadly stating that all AA flyers should carry both cards is just wrong given the varying circumstances people might be in.

As for Kiva being a “simple choice,” I don’t even know how to respond to that. First of all, I would still call this manufactured spend. For two, if having $40,000 tied up for months at a time is a “simple” choice you must be in a fantastic financial position. Not to mention their loans still default, albeit at very low rates if you pick cautiously. Maybe I’m not understanding something about this though that makes them a “simple” choice.

@Bert – I have thousands of dollars in Kiva loans with a 0% default rate. You just have to be very cautious. Money is paid out rather quickly if you choose six to eight month loans. If you take the time to learn Kiva it can be that easy.

They would either need to reduce the fee (most likely) or throw some more perks. In either case, I would be canceling one of the two Prestige cards I have.

@jediwho – Wait, you have two? Humm… FORE could turn into EIGHT (ok silly but go with it, ya got me think’in)!

Hi René. You mention GCs from places like Simons Mall. How is that you’re liquidating them somewhat easily at this point? Thanks.

@Jarrett – Read up on the FT thread on MS. WM is a quick way. But again, learn before you do.