Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

I don’t currently hold either the Delta AMEX Platinum card personal or business (but really I should). For many, many years I have held the Delta AMEX Reserve card and paid the fee year after year. I have held the personal Gold Delta AMEX so can never get the new card bonus again (but could get the card if I wanted to).

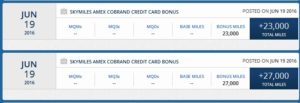

I just recently got the Delta AMEX Gold business card and my bonus points have already posted after meeting the minimum spend (yes you can hold multiple Delta AMEX cards should you wish to). But maybe, long term, the smarter choice should I wish to hold two Delta AMEX cards, will be adding a Delta Platinum card to my mix. Here is the simple math why.

First off the Delta Reserve card, especially for top elites like Diamonds and Platinums, is so important to help to improve your upgrade chances. We all should also know that both holding this card, soon according to Delta, and spending at least $25,000 on the card each year will not just continue to impact upgrade but even better your shot at more upgrades with Delta Air Lines. I have known this for YEARS and is one of the reasons I only miss a few upgrades a year out of the 100-150 segments a year I fly.

But this has nothing to do with what may be the best value of the 3 big Delta cards as far as perks, value and earnings. Let me break it down to make it so simple and this is beyond the simply amazing bonus offered for a little more than a week now (i.e. 10,000 MQMs worth a TON for those chasing status and 60,000 SkyMiles for anyone who flies Delta).

I have demonstrated how, for very little cost, you can generate your annual spend on your Delta AMEX cards including every day spending. Additionally, while no one likes paying taxes, I appreciate being able to pay them both quarterly and annually on my Delta cards to help knock out my spend goals. It really does not matter how you accomplish your spend but look at the rewards of spending $50,000 on this Delta AMEX Platinum card:

- 50,000 SkyMiles earned for the spend worth at a minimum $500 with Pay With Miles

- 20,000 bonus MQMs – valued at whatever you feel they are worth.

- 20,000 bonus SkyMiles for the spend worth at least $200 with Pay With Miles

The bottom line is if you can keep your spending cost for the $50,000 under 1 cent each you are netting $200 worth of SkyMiles that wipes out the annual $195 fee for the card. This means if you, like me, really value MQMs they end up being net FREE to you. Earning elite points for next to nothing is truly sweet.

Oh I have not included in this simple math the BOGOF cert (see E22 post Essential Tab) you get year two (not included year one of card membership). So the next year, if you again do the above, you can enjoy this perk in addition to all the points.

Now none of this includes all of the normal perks the card give you. For example, if you happen to buy a BASIC E class fare you do not board LAST like most folks. No, you get ZONE 1 by holding the card. There are the waived first bag fee and on and on. All on top of the goal for most of us that is a bunch of SkyMiles and elite MQM points.

So to sum up, yes, I am happy I got the Delta GOLD Business cards. I am thrilled with the large bonus points. But long term, when it comes to holding two Delta AMEX cards, I will look at a change that will improve my MQM totals each year! – René

Editorial Note: This content is not provided by American Express. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by American Express.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

The ▲ Platinum Amex is now the lowest AF card that still provides an annual Delta companion pass. For many people, that alone makes it the best card.

Do you also get 10,000 redeemable miles after $25,000 in spending?

@Jediwho – 10k at 25 then again at 50k

I have had the DL Plat Amex card for a number of years and since they added the MQD requirement, shifted spending to this card from my regular Plat Amex business card.

I used my companion ticket this year to take my son to his Drum Corp practice weekend in Oregon over Memorial day weekend. it was a $700 ticket.

Another benefit is the 20% (I think thats what it is) off in flight purchases (good to use after you use up the $200 Plat Amex airline benefit)

And the last one, is the discounted entry fee of $29 to get into a skyclub. This may sound redundant, since I have a Plat Amex that gets me in for free, but when you are NOT flying DL, you can still go in for $29 with the DL Plat Amex. I found this out flying to FLL-YUL this week on Air Canada (They were $300 cheaper than DL). At FLL, Air Canada uses the same terminal as DL and when I asked about getting into the skyclub, they told me this at the counter. I only had 40 minutes before my flight, so I didnt think it was worth it, but if I was sitting somewhere waiting for a connection, it may be worth considering.

Does anyone know how long it typically takes for MQMs to post once hitting spend requirement? I received my card on Saturday, immediately spent the $2k and have since paid it off. Statement closes 7/8. Will bonus post with the statement or prior as they do on some other AMEX cards?

@Bullfrog23414 – In my case it was just days after spend for the SkyMiles. However, under most conditions, MQMs are 1-3 days after statement has closed. Then, if the MQMs will bump you a medallion level, that also will take another 1-3 days to update in the Delta system.

To answer my own question: The charge was made on Sunday, switched from pending to posted on Tuesday, and today (Thursday) the MQM’s/Miles are in my Delta account.