Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

I really don’t want to jump into the debate concerning whether or not the new law forcing airlines to post the full price is good or not for us as flyers, but it does cover an interesting point that is talked about here in the MSNBC news video:

I really don’t want to jump into the debate concerning whether or not the new law forcing airlines to post the full price is good or not for us as flyers, but it does cover an interesting point that is talked about here in the MSNBC news video:

Recently I had a great rental experience with Enterprise during my last ski trip to Salt Lake talked about in this blog post unlike the horrible one with Budget in RSW. I loved the Dodge car, the price and the service by the staff was exceedingly professional and everyone was nice, well dressed, and had smiles on their faces and thanked me over and over for my business. Seems perfect right?

But there were a few “curve balls” tossed at me that thankfully my quick thinking mind dismissed or were prepared for. What am I talking about amidst this idyllic rental experience and in regard to the MSNBC piece? I had my reservation in hand. I had filled out that I did not want their collision coverage as I have USAA and full coverage on my vehicles and they extend the same benefit to me when I rent. This is where the reps got sneaky on me. They hit me with two good sells that I said no to and I think you should too (keep reading to see why).

# 1 was – what is your deductible, $500, oh, we can sell you a small rider to cover that so you do not have to pay anything out of pocket if something happens!

#2 was – if you pre-pay now, the price per gallon is 20 cents off per gallon over the price in the area.

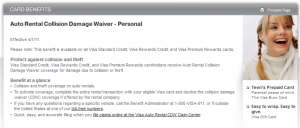

Now when you quickly hear these two, they sound reasonable. It is brilliant marketing and kudos to the one who came up with this pitch. But both are bunk. Here is why. At the bottom of my “Best Point Cards” link page I have links to Visa, MC and AMEX benefits. Now they DO VARY by card issuer so you must make sure of what your card includes. But, I paid for this rental with my Capital One Visa card. Look at this part you can reference here:

“If you have personal automobile insurance or other insurance covering this theft or damage, the Visa Auto Rental CDW benefit reimburses you for the deductible portion of your personal automobile insurance”

So, I would have been paying twice for the same coverage. Now the gas. 20 Cents off sounds like a really good deal right? If you tell them you will bring it back full and then don’t, they upcharge you a crazy per gallon fee. But think about this. If the tank is say 18 gallons, you are talking about $3.60 savings. Thus, if there was just 1 gallon remaining in the tank I was break even. 2 or 3 gallons and I was loosing money big time.

The trend to upsell is everywhere. Car, hotels you name it. So be ready. Be smart. Know your credit card features IN ADVANCE. A little planning can save you money and that is a good thing. – René

▲Delta▲ SkyMiles® Credit Card

American Express – RESERVE/PLATINUM/GOLD

Click here for more information

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Yup! Very good points to be remembered. I never accept their insurance offerings because I too have great insurance that covers damage issues. Here, the most important point may be that your Insurance Company deals with the details of any ill event, not you. That alone is reason to decline the rental agent’s sales pitch. As for gasoline, I’ve learned to have the rental agent personally verify the starting gauge reading with me and to sign the agreement or fuel statement. If it ain’t full-full, we negotiate. I can always find time to buy gas and even a slight over-buy is less expensive than a no-buy and allowing them to fill’er up! Be careful! Another ‘trick’ that I use is to avoid airport car rental locations whenever possible. Many cities/counties impose a substantial tax on car rentals *from airport locations,* and that is not imposed at city-based agencies. Where possible, Iuse public transportation or even a cab to reach off-airport rental agencies. Of course – it is not always possible or convenient. In cities that I know reasonably well, it can be a big money saver. In addition to the locally imposed taxes, many rental companies also impose significant surcharges for airport rentals. In one case of my experience, the daily rental rate at the off-airport site, less than three miles away, was HALF the airport rate. Yes, same company, same car and same details. Many who work for Big Daddy corporations simply don’t care about these detals. The travel department has bulk contracts with the rental firms and one just signs and drives. OTOH, when you are the Senior Daddy of a relatively small business, those dollars can make a significant difference, often between red and black. Yes, it can also make a big difference when renting for personal or recreational needs. Know the rules! As your own insurance agent about coverage. Buy your own gas and be able to prove it. If in doubt, ask questions and have the rental agent put the details in writing in the comments section and then sign it. The saving are worth the minimal trouble.

@ Cook – txs so much for the GREAT comment ( I should have you guest blog for me 😉 ) I did not put it in the post but what I do is take a free airport shuttle to a close hotel, tip the guy a few bucks, and have Enterprise pick me up there as they can do that but not at the airport if there is a Enterprise at the airport! – Rene

I had the same idea about renting from an off-airport location recently. However, I found the rates were higher than the airport.

I always decline any additional insurance. Had not heard the one about the deductible coverage but would certainly decline.

However, I often prepay my gas. It saves me time. Sometimes I win. Sometimes they do.

AMEX has a deductible coverage as well. I had a wreck in a differet state a year ago. My own auto insurance covered the cost, AMEX picked up the deductible. Out of pocket cost: $0. As far as prepaying gas, I never did that. One trick: you can drive 20 or 30 miles after you fill the tank with the gauge still showing at full. So I filled my rental up near the hotel rather than the airport. 🙂

@ Allen – yes – should have talked about that too. Where is my brain today. I love my DELTA AMEX but this time had the C1 points to burn up. TXS for the comment – Rene

I just use my continental chase mastercard..it gives primary rental coverage(that way your personal insurance won’t be bothered)..also like allen says amex has primary coverage which you can pay 20$ or so for per rental