Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Welcome to a weekly feature on the Eye of the Flyer blog. Each week this series covers in a “rookie” way either a Delta or travel related theme and attempts to break down to a basic level each topic. You can read up on all the previous posts HERE. Now on to this week’s feature.

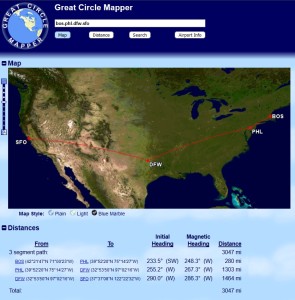

My degree from IU is not in journalism (clearly, if you often read the blog). But when it comes to award travel, I am no rookie. I have been around the “control tower” a few times if you will. I get what it takes to score an award with our beloved Delta and extract maximum value. For example take a look at this somewhat crazy route above I flew a few years ago to score a LEVEL 1 (called Low Level at the time) award.

Yep, I would have like to have flown from South Bend to Detroit, over to Amsterdam and then up to Gothenburg as that would have just been 4,572 miles of travel vs. the 6,469 and having to fly WAY south and then over to Paris before the longish coach only regional jet up to Sweden. But, as I talked about recently, I will do what it takes to get the lowest point seat to get value from my frequent flyer points – no matter what the program I am pulling them from. But notice what Emerson College Journalism professor Jerry Lanson posted on HuffingtonPost.com:

Yep, he is ready to “burn” his AA GOLD frequent flyer card. Really. You know what, Jerry, you really should and you are not the kind of person who should collect “airline” points. He goes on say:

“It’s been more than 25 years since I began piling miles onto a single Citibank American AAdvantage credit card. I bought everything from gas to groceries with it.”

OK. First off, I have a bunch of credit cards. I mean a bunch. I only spend on ANY of them if I have a purpose in mind. For example, I will spend on my Delta AMEX Reserve card, almost exclusively with a passion, until I get to $60,000 each year for my MQM bonus (it is maxed out at $60,000). Then I do not spend another penny on the card until the next year. No point. SkyMiles are clearly not worth what they once were. But even during this spending time, if I can get 5x points or if I say need SPG points I will adjust my spending. Clearly, I drive my spending pattern where I get the most reward. Putting ALL your spend on just one card is just not smart.

Next we are told how upset he was about only finding seats on some strange route when it came time to redeem his points for a trip to Europe:

“The only other option was a three-hop trip to Paris through Outer Transylvania or the equivalent. No thanks, I said.”

I see. So you expect to be able to find perfect flights on the most sought after routes for points. Humm… Maybe years ago when flights were mostly empty that was a simple option. Today, I don’t care what route I take, via “Outer Transylvania” or any other city or hub, as long as I am finding LEVEL 1 space in business class. To me, if you are enjoying business class lounges and getting good (even great at times) food and service, who cares if it takes you a strange route and a few more legs to get where you want to go.

This next bit to me is very telling about folks like Jerry:

“Finally I paid for three tickets on Icelandair — using a Capitol One Venture card, which can at least help lower the cost of seats on any airlines.”

Ah. OK. I get it now. Jerry that is the “perfect” card for a “frequent flyer” like you. You want a coach seat, cheap, and want to get the most direct route you can and are happy with 2% “travel cash” back. Put all your spend on that “One” card and be happy. That is not for me!

Lastly, as a zinger to his reason for dumping AA, he mentions some issues he had with a flight across the country. Notice what he says:

“Then the morning of our departure we got a text from American: the third flight had been canceled. We could get economy seats from Dallas on a flight two hours later.”

Really? First off, I feel for you when it comes to a downgrade. I too would have been upset over the rep you talked to at AA, but I would have been smart enough to tell that rep to leave everything as is and I will think on it and HUCB. Rep Roulette, with any airline, is something we all live with as frequent flyers. If you think the final answer is what any single reps says you should not play with frequent flyer points. Oh and here is another thing:

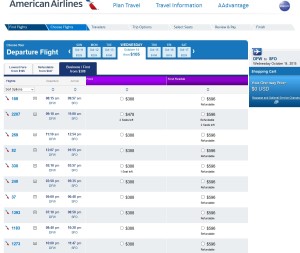

I seem to see a number of flight from DFW to SFO each day. Are you telling me there was not a single flight that did not have 1st class open to switch to (since you were booked in 1st after all). Could you not have asked for a longer layover in DFW to stay in 1st the entire route?

After all, if you were wise enough to have the American Express Platinum card you could have taken the time to go visit the outstanding Centurion Club in DFW and gotten a massage while your wife got a manicure, all free once inside, waiting for your next flight. That is what I would have done!

The bottom line of this week’s rookie post is there are those who get it. There are those who are willing to do what it takes to get real value out of frequent flyer points. They understand the “system” and are willing to do the work it takes to get value. Then there are those who are “lazy” coach travelers that just want quick and cheap. For those, stick with a simple cash back card and fly coach – I will roll with the punches and think of you as I ride in the “pointy end” of the jet enjoying my travel adventure! – Rene

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

I totally agree! I’d be more than happy to take those AA miles off his hands…..I can only dream of how I could use them. They, IMO, are the easiest to redeem for business class tickets to almost anywhere. As to club access, I love the Centurion lounges, but most lounges beat sitting in the terminal. I am going early in the day to LAX, just to try out the lounges I have access to before leaving in Business class on Virgin Australia to Auckland. That is just a bonus for me.

very well put Rene! I always hate to see all the people who think that the Capital One card is the best … Too bad more people are not aware.

Im fairly new to the points scenario, but even I would not do that!

Rene, surely you know that “flyers” like that are where FF programs make their money. Please leave him be.

There aren’t enough J or F seats to go around:)

@Geoff – well 😉

Thanks for the post, it is a great teaching experience. I myself have been at this for barely 6 months and was able to pick out two of his gaffes easily. But I’m sure the airlines love him.

Unfortunately, some of us don’t have the time to fly the extra leg of a trip that a level one award requires. I typically only fly on (the fun) business trips with my husband and he has definite times he has to be in and out. But, he flies enough that it’s okay to use 32500 miles instead of 25000. And, we typically don’t put more than $60000 on a charge card in a years time so we do use one credit card more than another. And, he flies and stays in hotels so much that the idea of doing that for vacation isn’t appealing to him so we do day trips instead. Doesn’t mean I don’t try to maximize points earned and minimize points used; just a simple fact of our travel and spending habits.

René –

Great job of taking a practical example and turning into a teaching example for your “Rookies”

At the same time, I kind of side with Geoff…really it is a competition out there in many respects. As a blogger you have certain goals that run counter to you (and the rest of us) as a flyer