Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

One of the most common questions I get, after I mention how many points cards I have, is just how do I keep track of all of them. I tell them I don’t! This is thanks to my Lisa, who just happens to have been a finance major in college, who takes care of all the family finances (yeah I know, it is good to be me).

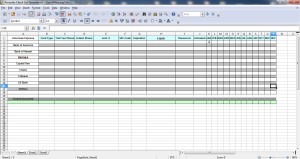

But, just how does she manage all of this in a simple way? She uses THIS excel spread sheet you can download and see if it also can meet your needs or at least be a starting point to tweak the way you like to keep track of things.

One thing you will not see, that you should PLEASE add is a password when you save it. Make sure it is a VERY good password with more than just letters. I suggest numbers and symbols and one of the letters uppercase in a random place. Do not use this, but as an example: pa$swoRd

For all our talk about “FREE” points and travel, there is work. To get the most out of this frequent flyer game takes time and organization. All it takes is paying one single month of interest on a credit card balance and you LOSE! Please never do that – always pay your cards 100% in full each month if you want to come out ahead. If you can not do that – do not do this.

Not only that, some sites make it simple or hard to track many cards. One of my favorite cards, a Master Card World MasterCard® with all the perks that come with that, is the Barclaycard Arrival World MasterCard®. Not only is it offering 40,000 bonus points when you spend $1,000 (now $3000) on purchases in the first 90 days (that equates to $400 off your next travel redemption) but then you get Get 10% miles back when you redeem for travel! There is not another card that offers the World MasterCard® perks with this much out of the gates and then pays you back when you use the points!

Have a great weekend everyone and be sure to check back at 1:PM as always on Saturday for another chance at a neat prize on SWAG Saturday’s giveaway – René

.

Editorial Note: This content is not provided by American Express. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by American Express.

Gold-Platinum-Reserve Delta SkyMiles®

Credit Cards from American Express®

Click HERE for more info

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Great template Rene! I’m new to the game and I’ve been working on something similar but this is better than what I was devising. One glitch I did catch: if you enter MM/YY in the expiration field, Excel interprets that as MM/DD. One work around is to add the last day of the month… then it’s displayed correctly. I suppose there is some way to change the formatting of the cell, but that is more advanced Excel-fu than I possess.

@john – lisa says use 4 digit year date

I get 20 percent back when I use Amex points towards travel.

I am not sure what the current signing bonus is for a new Amex platinum.

Gregg

This is useful. Couple of questions. Why are you recording the activation date? Isn’t the approval date more important? Also how are the JAN-DEC fields used?

@hevenlyjane – because at 11 months you need to call for retention points 😉

Thanks for the tip! As I mentioned, but Excel skills are rudimentary at best.

Why is there column for acitvated. What is that for. Every card will be activated so what is the significance.

Also I wish there was some place to store the image of actual card.

@Caveman – see other comment about retention bonus. Also good idea about photos but no real need when you have all info.

Thanks for the spreadsheet. A couple of items that I added were: Bonus spend categories (e.g, 5X Internet/Cable/Telecom on Ink, 2X restaurant on Sapphire Preferred) since sometimes I forget which card has what spend bonus and the minimum spend with progress for new card sign-up bonuses.

@Dan – smart. Very smart.

I use cardwatchdog.com to keep track of my cards. It has slightly different information that is stored (e.g. card benefits, image of the card, application date) but one of my favorite features is the option to receive an email at your prespecified date with a reminder to close or call for retention.

Rene, The Barclaycard you mention 40,000 Bonus Points but it is actually 40,000 bonus miles. Can these be transferred to Delta Skymiles or do you redeem them through Barclay directly? Thanks.

Will you be doing a post on best practices around retention points? What to ask for and the like?

@J. Clark – Yep – please see the Essentials Tab post E13 – http://deltapoints.boardingarea.com/essentials/