Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Welcome to a weekly feature on the Renés Points blog. Each week this series covers in a “rookie” way either a Delta or travel related theme and attempts to break down to a basic level each topic. You can read up on all the previous posts HERE. Now on to this week’s feature.

First of all, you might want to know why you would want to go through what I am about to show you! With an American Express Bluebird account funded with Vanilla Reload cards, you can pay bills with funds charged to a credit card that you would otherwise either write a check for or have to pay a fee in order to pay with a credit card. Confused? Don’t be. This is a way to meet all sorts of different spending needs. First let me walk you through the steps.

Signing up for a FREE Bluebird account is where to begin, and it’s pretty simple with no annual fee and there is no credit pull for the card. Once you complete all of the information for an account they will send you a card with your account number on it. It takes about 14 days for the card to arrive in the mail. Please be sure to remember your logon name and password you created.

When you receive the card in the mail you have to go back to the website to activate the account with information from the actual card. Now your account is ready for use, but you have to fund it to have a balance to pay bills from. This is where the credit card spend comes in because you can fund your Bluebird account with Vanilla Reload cards which you can purchase with a points credit card of your choice.

To fund your Bluebird account with a Vanilla Reload card that you get from say your local CVS store, that you purchased using your point credit card (2x$500 per transaction max allowed) and looks like the photo above, you have to go to the Vanilla Reload site, and the address is also on the card. There you enter your Bluebird card number (be very careful to enter the right number) and then the pin code from the back of the Vanilla reload card you have purchased, and your funds are now transferred to your Bluebird account. You can verify the transfer by logging in to your Bluebird account and checking the balance. You can load a max of $1000 per day to your Bluebird account this way.

If you do not have a reliable source for these little gems, please take the time to review our fellow BoardingArea.com blogger Greg, The Frequent Milers post HERE about buying gift cards with PIN option to use them to load your Bluebird at a Walmart.

Now you’re ready to use your Bluebird account to pay bills and you have a couple of options on how you can do that. You can use the bill payment feature to send electronic payments to registered payees, or if your payee is not registered then a check will be mailed and it will just take a few more days for the payment to get to your payee. The date the payment will arrive is shown so you can see just how long each payment will take to arrive.

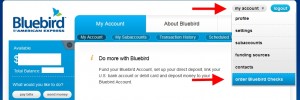

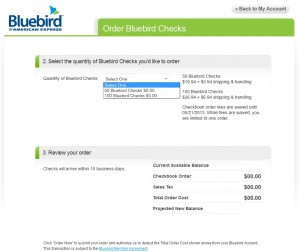

You can also order checks from Bluebird, right now they’ll send you the first 100 checks for free if you order by May 21, 2013 [edit: reports say now until 01JAN2014] (click on the “My Account” and order checks is the last menu item).

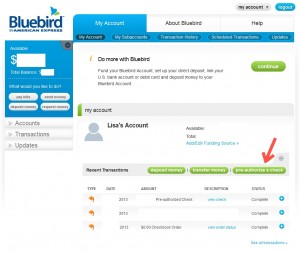

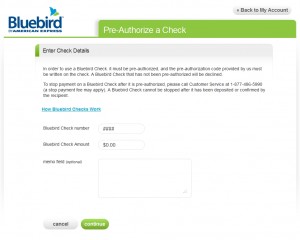

These checks work a little differently than the checks you get with a regular checking account. These checks must be pre-authorized before you can actually use them, but it’s a really simple process. Once you receive your checks, you just log on to your Bluebird account and click on “Pre-Authorize a Check”

On the next screen you fill in the check number and amount, then verify the information and enter your PIN. The next screen will give you a pre-authorization code, which you write on the check in the space provided for it. Then you just fill out the rest of the check normally and sign it and send it to whoever you are paying with it. The funds are withdrawn from your balance immediately when you pre-authorize the check, and then your account is updated when the check is paid.

There are some limitations with a Bluebird account you should know about as you jump in! You are only allowed to pay out a maximum of $5000 out of your Bluebird account each month to unregistered payees. The entire list of fees and limits is available on the site under FAQs.

This really is a great way to say pay your mortgage, car loan, insurance or whatever bill does not take a credit card. It makes spending the large amount to get say your $30,000 spend done on your Delta AMEX Reserve card a whole lot simpler and faster! – Lisa

EDIT: Be sure to see THIS updated post about Bluebird!

▲Delta▲ SkyMiles® Credit Card

RESERVE/PLATINUM/GOLD

from American Express®

Click here for more information

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

I think a more important post would be- How to find some Vanilla! 🙂

@MWT – Come to Indiana! We have SBN airport, ND Football and all the Vanilla your can buy! 😉

Lisa,

Nice to know about the Bluebird checks. I have tried to make electronic payments from the credit card side and they have been refused. his actually caused my credit card accounts to be placed on hold because of a cancelled payment. I have started to use the MyVanilla Debit card which has many fewer restrictions as far as loading and monthly amounts to up my credit card meet requirements.

Indiana must be the mecca for VR! I bought my first at a CVS in Bloomington, IN last night. This particular CVS had 20+ VR cards on the rack. No flack from the cashier, wasn’t even asked for ID (not sure if that’s a good thing or not, hadn’t even signed the back of my purchasing credit card). Not to mention we have IU football 🙁

@Michael S – Yes Hoosier=VR-Mecca (now we know what that stands for) 😉

In reading up on this, it seems others have come across some issues worth mentioning. First, each Vanilla reload has a charge – I think it’s $3.95, so you have to be able to justify this cost. Also, the stated “rules” of the VR card say you have to buy them with cash or cash equivalent – some stores apparently enforce this while others do not. That some are getting by using a credit card is great, but it seems uncertain, and the plug could be pulled at any time. If these issues are no longer a concern, or if I have stated them incorrectly, please let me know.

@russ – for such a small fee to be able to meet the spend on our Delta Amex to get MQM’s is well worth it to me.

Someone suggested elsewhere that you fill in a Bluebird check first, then get the Pre-Authorization number.

That way, if you make a mistake filling in a check, you can just discard it without dealing with the fact that funds have been removed from your available BB balance.

I’ve never seen a shortage at the 3 CVS’s in the Indianapolis area I shop at.

Presumably, one could pay their rent this way!

Thanks for the information on the checks. This is great!

Couldn’t you use this account to pay the credit card bill you incurred to fund the card? If so, isn’t this minus the recharge fee the fastest way to points (up to 10K per month per card) to free CC points since the days of the dollar coin??? Please help me see what I am missing….thanks.

@Chris – some have done that but there is some risk. I use mine for “official” things that I can not pay with a credit card already. I do not want to risk getting shut down by AMEX. So, just be very careful if you do that.

So let’s say I want to use this to pay rent, daycare, a few other things where they want checks. Pick a number say it’s $3,000 worth per month. Buy 6 VR cards that’s 3,023.70, deposit them to BlueBird. Or over the year, it’s 36,284.40.

So you’ve easily hit the first mark on the Delta Reserve MQM boost at a cost of well under 2 cents per MQM. Cheaper than any mileage run I’ve ever seen, and with less time commitment.

However, wouldn’t someone at AmEx twig to you doing $3,000 of spend every month at CVS? Would they care? I mean if you dilute the spending onto Chase cards and whatnot to gain overall points you’ve lost headway on Delta benefits.

Hmmmm…..

@Vicente – you should be fine (I do that much and more) as long as you have OTHER spend too. ONLY this and your goose is cooked I would guess!

Do I have the steps correct? 1) Set up Bluebird account 2)Use AMEX Reserve to buy VR cards 3) Load BlueBird account using VR cards 4) Use Bluebird checks to pay mortgage. Step 2 allow you to meet minmimum spend.

Please correct if wrong. Also, do you have to purchase new VR cards everytime or can you reload online using your AMEX Reserve card?

I went to my local CVS today which had a bunch of vanilla reloads in stock! I tried to use my delta amex reserve for 2 $500 and it would not go through! Buy my personal amex gold did…? Has this happenend to anyone?

A word of caution. I put $6000 on in my Bluebird account and wrote a check (pre authorization needed so they remove those funds)to fund my IRA. My investment company will not accept checks (after running it through). When I went to stop payment on the check Bluebird, after many frustrating calls, say it will be 6-8 weeks before my money is redeposited in my account. I told them I could send the check to them that was returned but they said just wait.

Sorry, I should have said my investment company will not accept checks that need pre-authorization.

If i have pretty easy and unlimited access to these (found a CVS that seems to ALWAYS have them stocked), how often should I be doing this? I can combine with other spend every month, but where should i draw the line?

@Oren – that is the 64$ question. No one 100% knows. But, this is one reason I often pass up say a 2x purchase to put MORE spend on my DL cards to mix it up.

hm. does anyone know if you can link the Target Red Debit Card to a bluebird account? Target gives back 5% if you use their credit/debit card. If you can use the debit card and have it link to bluebird, then you can spend your $3.95 for the $500 VR, spend $100 at target and get back $5. no you have $400 to spend any where you want for Free.

You can potentially use the same logice to fund PAYPAL and then move the money to bluebird.

just a thought

Having problems buying the Vanilla Reload cards using my AMEX, everywhere I’ve been so far has only accepted cash for purchasing these. TIme to keep looking…

@Adam – Could be a “fraud alert” thing. Check your account online. Had that happen to me. Called to confirm then all OK.

They didn’t even let me try, I noticed on the screen of the terminal was a little note saying too only except cash for the purchase of prepaid cards.

@Adam – yuck – run away run away 😉

I finally bit the bullet and got my BlueBird card. When I went to buy the Vanilla cards, I have to confess I made a “rookie” mistake. There are a few cards called “Vanilla”, and since I didn’t see one called “Vanilla Reload”, I ended up buying a “My Vanilla” prepaid Visa debit card (same $3.95 fee). I found out after much trial and error, that you cannot load these directly to the BB card (even though you can “link” debit cards to your BB account, the prepaid debit cards are not allowed). I was able to take them to a Walmart and use them to fund a “cash” deposit to my BB (for a $.50 transaction fee.) So, not a bad alternative if you can’t find Vanilla Reloads.

The second thing I learned is that many CVS stores keep their Vanilla Reload cards behind the counter, and not out with the other gift cards. They explained that this was because some people just took the “blank” cards and returned later to fund them, so they would be sure they would not run out.

I have loaded all my Vanilla cards (debit and VR) to my BB account now, and set up my first couple of bills to be paid (mortgage and utility). Also ordered the (still free) first 100 checks, expected tomorrow.

So far everything is very easy and straightforward – thanks Rene, for forging the path…

Just went to CVS and Office Max. Couldn’t find a plain Vanilla reload but My Vanilla and both said I needed to pay cash and that it was a new policy. She said Gift Cards are the only thing they take credit cards for. Wonder if this is true with the basic reload card.

@Moe – no problem today for me to be VR at my C v S

@Delta Points – Went to 3 CVS’s and none had them (or Walmart) maybe it is a issue in NJ. Is there any other card I can use to load my BlueBird account ? They have MyVanilla preload cards but I am not sure it is the same as a regular Vanilla Reload

The VRs have been working great up to the $5000 limit, but is it possible to load above the $5000 limit with VISA prepaid debits w/pin # at Walmart, or is that part of the $5000 limit? Thank you for the information.

@Mancy – my understanding per the BlueBird rules is max 5k for VR or debit cards.

.

Cash (includes Swipe Reload and InComm Vanilla Reload Packs) $1,000 per day

$5,000 per month

I was checking Delta SkyMiles® Gold American Express Card and in the “Earning Miles” section they have ” Fees, interest charges, balance transfers, cash advances, purchases of traveler’s checks, the purchase or reloading of prepaid cards and purchases of other cash equivalents do not earn miles. ”

I guess I cannot use VR cards to earn miles with this card. Any thoughts?

@Elena – the T&C say one thing the facts on the ground say another.

remember that the fees u pay to ??pay ur federal income taxes are deductible on ur taxes….

The checks still appear to be free. I just ordered 100 with no fee and free shipping.

@jyee – THANKS so much for the update. That is great news!

Rene, do you know if it’s possible to use PayPal (with points card, of course) to fund the BlueBird account? That seems like it’d be much more convenient than finding a CVS that has Vanilla Reload cards and lets you bend the rules about buying them with cash.

@CarbonGuilt – you can via KIVA.org loans with about a less than 1% failure rate if you pick well. The other way is via PayPal cards at CVS etc but many get shut down that way so I personally avoid.

@deltapoints Have you tried maxing out the bluebird acct @ $5k per month and then just writing a check back to yourself or to cash? Is this possible?

@Geoff – i am always careful 😉

IIUC, there’s a $3.95 fee per $500 (max) card, so about a 0.8% charge. Is that correct? (Or can one fee buy the maximum 2 $500 cards, for a 0.4% charge?)

@Seth – yes well worth the fee. And, if you buy AMEX GCs from TopCashBack first you can offset fee in full and then some.

So, I buy 10 $500 Amex gift cards via TopCashBack. Cost is $5,039.50 plus $8.95 shipping = $5048.45.

I use those to buy Vanilla Reload cards, paying another $39.50; soon, I have $5,000 in my BlueBird account, at a cost of $5087.95. I use that to write checks (e.g. rent).

I also get $100 back from TopCashBack, so I can pay $5,000 worth of expenses at a net cost of $4,987.95, all of which is charged to a credit card (even though the expenses are paid to someone who doesn’t take credit cards).

Do I have that right?

@seth – buy larger ones up to $3000 to reduce fee. but start small to test.

Larger which? I went to their web sites (just as a trial, I don’t have my BlueBird card yet) and the Amex gift cards seem to be available only up to $500 each, for $3.95 each. Shipping is 8.95 per order (10 cards). (Actually, if I start doing this seriously, shipping is $99/year.)

Which ones are up to $3000?

I’m not happy with BlueBird’s limits; I wonder if they’d allow me to have two accounts.

@Seth – http://deltapoints.boardingarea.com/2014/03/20/24000-arrival-shopping-port-points-w-delta-amex-purchase-posted/

TopCashBack says that American Express gift cards are limited to $500; larger ones don’t get cash back. Is there a better offer around?

@Seth – yes the T&C say that but in real world test that is NOT the case with the custom cards. I have done MANY orders of 3-6k each!