Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Here’s some potentially good news if you enjoy traveling and eating. (Considering you’re reading this blog, there’s a pretty good chance you love both.) One of the travel rewards cards I use to earn points each year, and whose “coupons” I actually enjoy now, features a big welcome offer. It’s a card I often recommend.

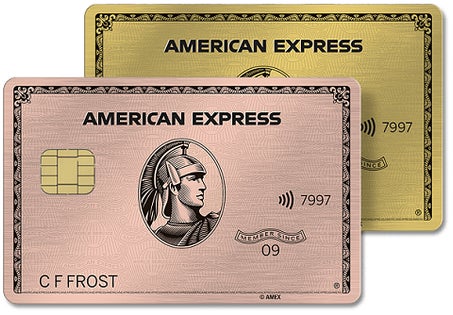

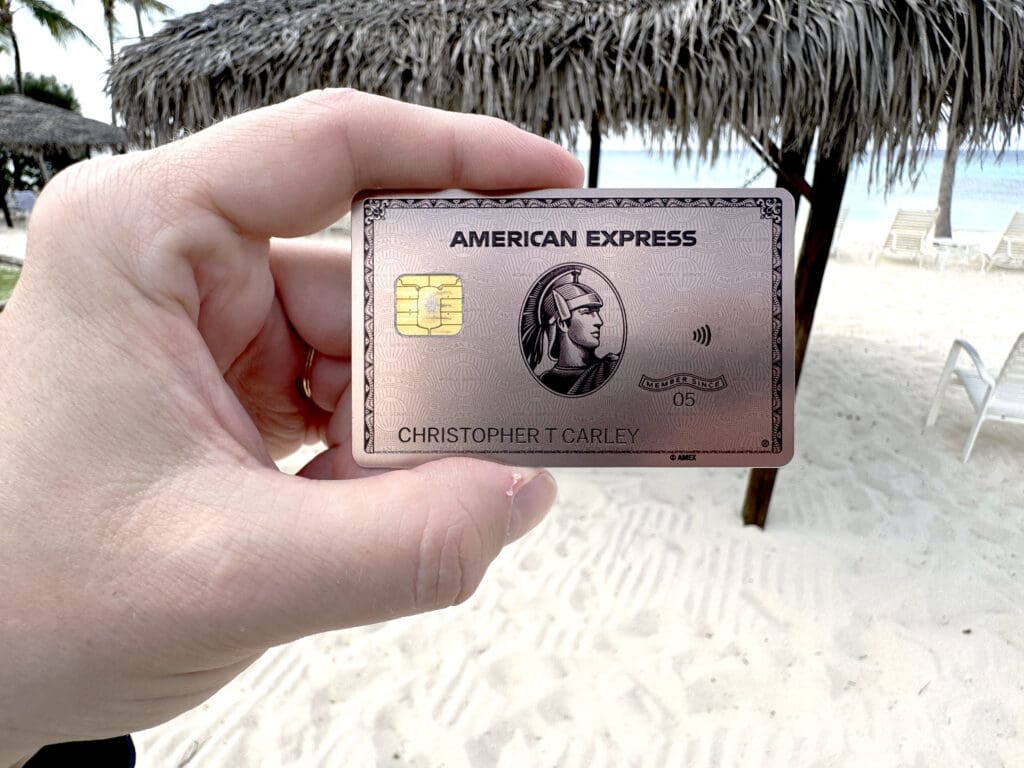

There’s no denying that cards such as American Express Platinum Card® are prestigious, loaded with lifestyle benefits, and fun to show off. I’m an Amex Platinum card member. I get it. But if you want to actually earn points, then you need to check out the American Express® Gold Card — especially right now during its new promotion.

American Express® Gold Card: As High As 100k Bonus Points

New applicants of the Amex Gold Card can earn as high as 100,000 bonus Membership Rewards points after spending $6,000 in eligible purchases within six (6) months of being approved for the card. (Terms apply. Welcome offers vary and you may not be eligible for an offer.) You can learn here how to apply for this promotion.

This is a new welcome offer model Amex rolled out with The Platinum Card® from American Express. You plug in your relevant information (name, address, etc) and then Amex presents you with an offer. Your credit score isn’t affected if you decline the offer. Only after you accept an offer might your score be affected.

The card is available in classic gold and rose gold metal cards. (Ooh, aah!)

Points Earnings

I’ve earned hundreds of thousands of points on my Amex Gold Card.

4X at Restaurants

The Amex Gold Card earns 4X points at restaurants worldwide (on up to $50,000 per calendar year spent on eligible restaurant purchases, then 1X. I wish the $50k limit were a problem for me!).

Unless there’s some gangbusters offer on another card or I’m chasing a minimum spending requirement, I usually put my dining expenses on my Amex Gold. For what it’s worth, I still earn the 4X when I reload my Starbucks app and pay for meals through the McDonald’s app (don’t judge, I love Egg McMuffins and McCafé coffee).

4X on Groceries

The Amex Gold Card earns 4X points at U.S. Supermarkets (on up to $25,000 spent on eligible purchases per calendar year, then 1X).

Groceries aren’t getting cheaper anytime soon. You might as well earn a bunch of points while paying through the nose.

3X on Flights

You’ll earn 3X points on flights booked directly with airlines or on AmexTravel.com. In my experience, most purchases made directly with airlines — not just flight bookings — earn 3X. For example, onboard premium drink and food purchases, checked luggage fees, etc.

Other Points Earnings

You’ll earn 2X on prepaid hotels and other eligible travel purchases booked through AmexTravel.com.

All other eligible purchases earn 1X.

If you knock out most of your $6,000 minimum spending requirement across the 4X and 3X categories, you’ll easily come away with between 110,000 – 120,000 total points from this promotion — if not more!

Our Favorite Statement Credits: I Earn $424 Back Each Year

I use most of my Amex Gold Card statement credits. I earn back well over the $325 annual fee (Rates & Fees). That doesn’t even factor in all the points I earn.

Food delivery credits will get a workout with football season coming up — and weekly pizza deliveries on Sunday afternoons and Monday nights! (And Thursday nights. Friday nights and Saturdays for college football. And…)

Here’s how. (Enrollment is required for each benefit and terms apply.)

Up to $120 Uber Cash Deposits Each Year

Cardmembers receive $10 Uber Cash deposits each month when their Amex Gold Card is added as an eligible payment method to their Uber and/or Uber Eats account. The Uber Cash Amex benefit can be used only in the United States. Just make sure you download the latest version of the Uber app.

If I don’t use Uber Cash for rides, then I spend it on food or grocery deliveries. Uber Eats sometimes serves as room service or a gofer when I’m on the road.

Uber Cash deposits are if-used. Any remaining cash expires at the end of the respective month.

Remember that you earn SkyMiles on eligible rides when you link your Delta and Uber accounts.

Up to $120 Dining Credit

I live in a major metro area (Los Angeles) and the Amex Gold Dining Credit is super easy for me to redeem.

You can earn up to $120 in statement credits each year (up to $10 monthly) for eligible purchases made at select food and beverage merchants.

- Grubhub

- The Cheesecake Factory

- Goldbelly

- Wine.com

- Five Guys

Again, the statement credit is if-used and doesn’t roll over to the following month.

My kiddo and I enjoy Daddy-and-Daughter lunch dates at our local Cheesecake Factory every so often.

Wine.com sells more than wine — it also offers liquor. You can use your $10 credit to order beverages for yourself or others.

Up to $100 Resy Statement Credit

Gold Amex Card holders can earn up to $100 each calendar year for eligible purchases made at restaurants that participate in the Resy restaurant program. You don’t need to make reservations through the Resy app. You don’t need pay your bill through the Resy app. Just use your Amex Gold Card to pay your check.

The statement credits are available as $50 from January through June and $50 from July through December. Again, they don’t roll over and are if-used.

I always earn 4X on these purchases, too, even though they receive statement credit. That’s a great feather in Amex’s cap. (Looking at you, Chase)

Resy restaurants aren’t everywhere. However, you can likely find something if you travel to or live in major or mid-sized metropolitan areas.

(My wife and I brought our Resy-eligible Amex cards to dinner one night. When the tab came, I told the server, “I’m not paying for my wife. She’s on her own tonight. She knows what she did.” Mrs. Carley rolled her eyes. The server was like What the? Who are these weirdos?)

Up to $84 Dunkin’ Credit

Amex Gold members can earn up to $7 each month for eligible purchases made at U.S. Dunkin’ locations or on their Dunkin’ app.

I’ve lived in Los Angeles for 25 years and have seen exactly two Dunkin’ locations. When I’m on the East Coast, they’re practically everywhere. So, I use my card to load at least $7 into my Dunkin’ account every month. When my family and I were back east this year, the Amex Gold Dunkin’ benefit treated us to breakfast and coffee after a red eye from LAX.

The Hotel Collection

I’ve never used this benefit because I get better value from my Amex Platinum Card’s Fine Hotels & Resorts features.

You can earn a $100 credit toward eligible charges when using your Amex Gold Card to book a two-night or longer stay at a Hotel Collection property through AmexTravel.com.

Final Approach

I like and use my Amex Gold Card. I recommend it to plenty of people.

New applicants can earn as high as 100,000 bonus Membership Rewards points after spending $6,000 in eligible purchases within six (6) months of being approved for the card. (Terms apply. Welcome offers vary and you may not be eligible for an offer.) Your credit score won’t be affected unless you accept the offer Amex gives you. So, if you’re not given the 100k option, there’s basically no risk on your part.

You can learn here how to apply for this promotion.

For rates and fees of The Platinum Card® from American Express, please visit this link.

For rates and fees of the American Express® Gold Card, please visit this link.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.