Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Need an idea where to eat this weekend — but aren’t traveling? (Or even if you are…)

Many hotel credit cards offer some kind of quarterly “coupon book” credit — such as a yearly credit of $200 or $240 broken down across the year. If you are like my wife and me and have a bunch of these cards, it can be a challenge to use them all or even remember to use them all.

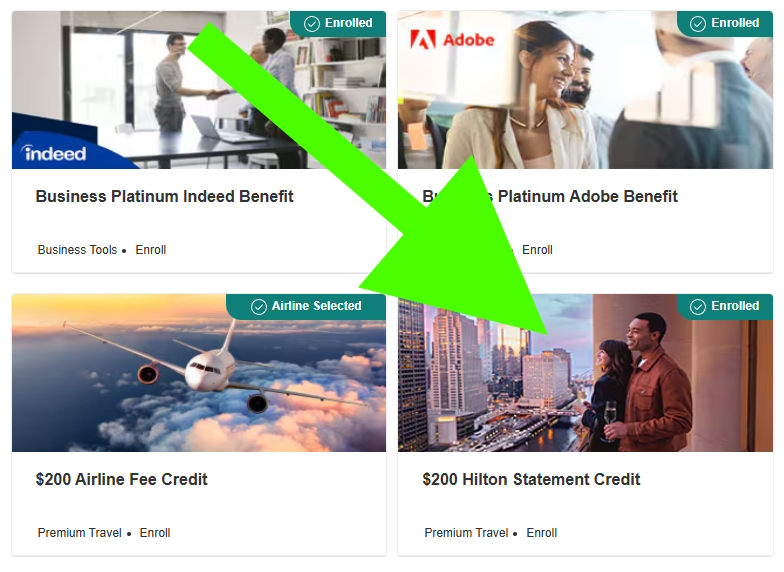

Let’s focus on some Hilton Honors statement credits that part of certain American Express cards. (Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.)

- The Business Platinum Card® from American Express

- Earn up to $200 in statement credits per calendar year (up to $50 per quarter) on eligible Hilton purchases when you enroll in the Amex Business Platinum’s $200 Hilton Statement Credit Benefit

- Earn 200,000 bonus Membership Rewards points after you spend $20,000 on eligible purchases on the card within the first three (3) months of being approved for card membership. Terms apply. Learn here how to apply.

- Hilton Honors American Express Surpass® Card

- Earn up to $200 in statement credits per calendar year (up to $50 per quarter) on eligible Hilton purchases made directly with Hilton portfolio properties

- Remember the current limited-time offer! Earn 130,000 Hilton Honors bonus points AND a Free Night Award after you spend $3,000 in eligible purchases on the card within the first six (6) months of being approved for card membership. This offer expires on April 15, 2026. (Terms apply.) Learn here how to apply.

- Hilton Honors American Express Business Card

- Earn up to $240 in statement credits per calendar year (up to $60 per quarter) on eligible Hilton purchases made directly with Hilton portfolio properties

- Remember the current limited-time offer! Earn 175,000 Hilton Honors bonus points AND a Free Night Award after you spend $8,000 in eligible purchases on the card within the first six (6) months of being approved for card membership. This offer expires on April 15, 2026. (Terms apply.) Learn here how to apply.

The Hilton Honors American Express Aspire Card ‘s statement credit benefit is semi-annual: earn up to $400 each year ($200 from January through June and $200 from July through December) for eligible purchases made directly with participating Hilton Resorts. That card also features this great offer: 175,000 bonus Hilton Honors points after spending $6,000 in eligible purchases within six (6) months of being approved for card membership. This offer expires on April 15, 2026. (Terms apply.) Learn here how to apply. (All information about the Hiltoin Aspire Card was collected independently by Eye of the Flyer. It was neither provided nor reviewed by the card issuer.)

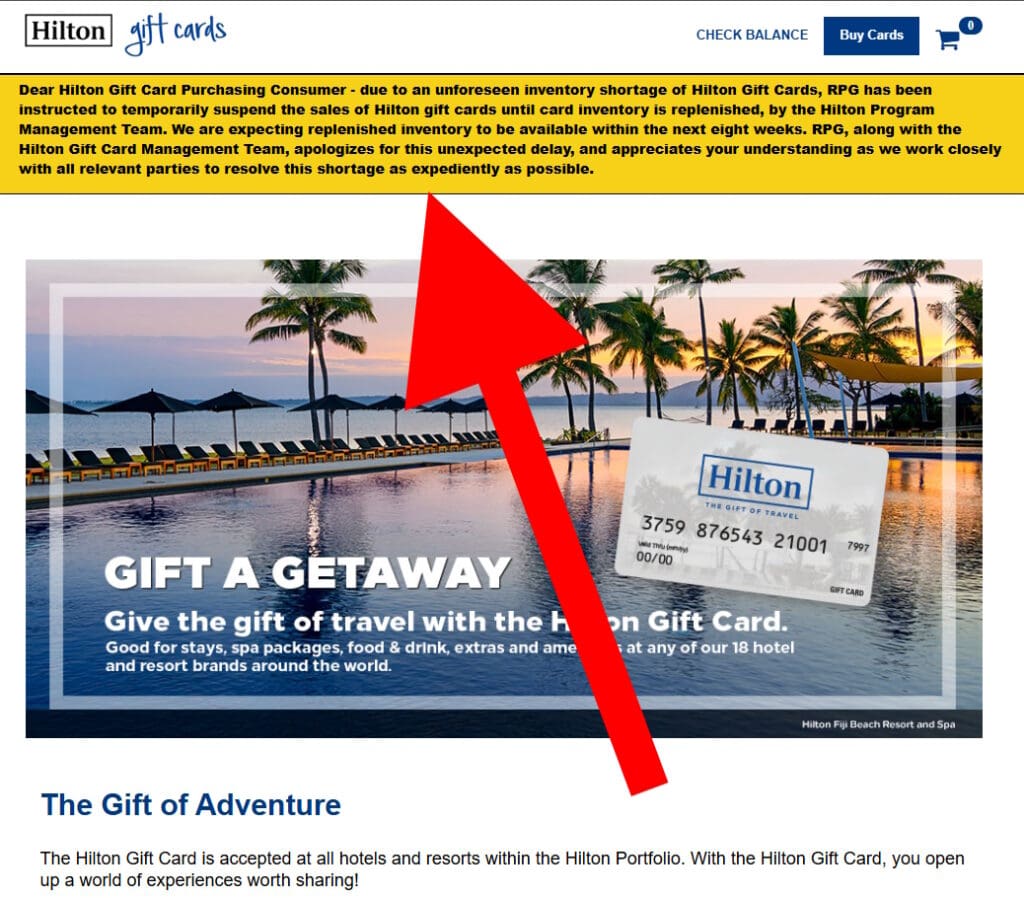

For a long time, the simplest solution was to buy a Hilton $50 gift card. You could quickly order 1x per card, get all uour cards knocked out in minutes, and not forget about these “coupons.” But those are now expressly excluded as eligible purchases.

But the Hilton gift cards have not been a perfect solution (and not just because they have been out of stock for most of 2025) because they are REALLY hit and miss if you can use them or not at Hilton properties. Because of this, they don’t hold a great value for people trying to resell them.

A number of bloggers write about how they use these credits by booking Hilton stays. That works if you are on the go all the time — but it is still a pain to pay with different cards (some maybe not in your name) for each stay until you use up all your credits. Is there a simpler option? Here is what my wife and I are doing.

One of the Hilton-affiliated properties near my home has a nice restaurant attached to the hotel. I was reasonably confident that any charges in this location would code correctly as a hotel charge. Why? When traveling, I paid for meals and drinks at Hilton hotel bars and restaurants. Those purchases triggered the credits correctly. How about locally when I’m not checked in as a guest?

One of the Hilton-affiliated properties near my home has a nice restaurant attached to the hotel. I was reasonably confident that any charges in this location would code correctly as a hotel charge. Why? When traveling, I paid for meals and drinks at Hilton hotel bars and restaurants. Those purchases triggered the credits correctly. How about locally when I’m not checked in as a guest?

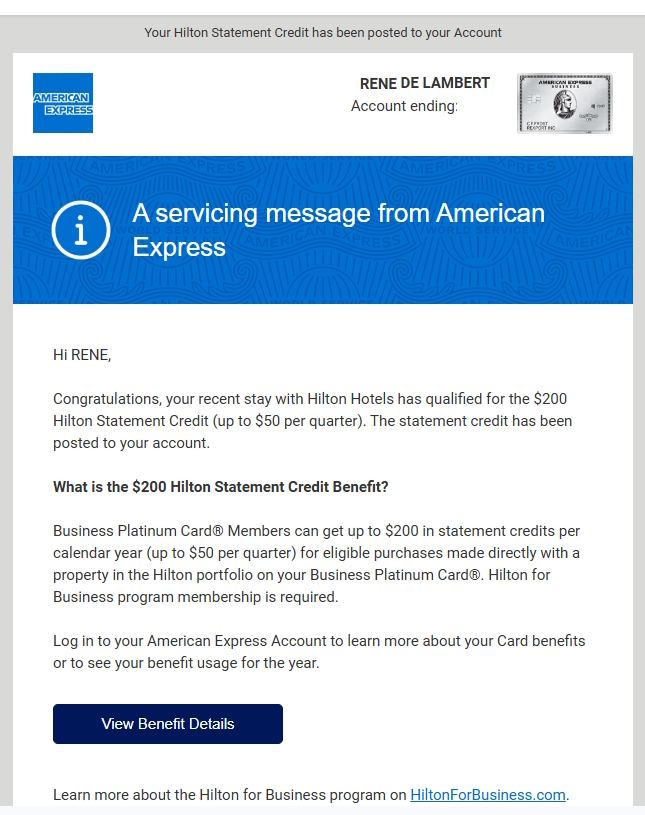

No problem whatsoever! A day or so after my dinner visit to the Hilton property — and I paid with my Amex Business Platinum Card — I received an e-mail from Amex that I had used my quarterly Hilton coupon perk and would soon receive the promised credit for the bill. Nice!

Keep in mind that you will need to enroll to receive these credits with certain cards, such as the Amex Business Platinum card. With others, like the Hilton cards, the credits are automatically active simply by holding the card(s).

For me, a dinner out with my wife is a nice way to “clip the coupon” for these quarterly Amex offers. Until Hilton gift cards return for order and fix their issues, this will be a savory and simple way to cash in on one of the many card perks they offer. – René

For rates and fees of The Business Platinum Card® from American Express, please visit this link.

For rates and fees of the Hilton Honors American Express Aspire Card, please visit this link.

For rates and fees of the Hilton Honors American Express Business Card, please visit this link.

For rates and fees of the Hilton Honors American Express Surpass® Card, please visit this link.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

How about purchasing some products like wine/beer at their shop in nearby hilton property. WIll that trigger the credit?

@Praveen – As mentioned in post, I got drinks recently in a Hilton bar and that did work.

If you’re talking about an onsite gift shop that sells alcohol and want to be our guinea pig, go for it!

If a charge is done today, last day of the month, will it count for quarter 1 or quarter 2? It will pend today, but when it changes to a charge……will it be for Q1 or Q2? It is a $50 question.

@Peggy – It should go by charge date so it “should” code for Q1 but you will not know for sure till Q2 to see if that one too works for you.

Very nice advice. Thanks!

It’s a good idea but not ALL Hilton hotel restaurants code as “Hilton” spending so it would be worth testing this if you have a local option like this.

@DaninMCI – In this FF and points game it is all about testing and learning for the win!

Brilliant Rene, thank you! Can’t wait to try this trick out on my Amex Business Platinum.

The closest Hilton by me has a restaurant inside that does not code as Hilton (I asked them about this and they said it only codes that way if you’re staying there).

@Ryan – Don’t trust what they say. Test. Have a beer or something and see.

Good advice, René. Employees are generally not well-versed in how a particular purchase would code on a card. It’s definitely worth a test.

Here’s the spreadsheet of data points of people getting credits triggered. Just ate at the Conrad today for lunch with my wife. It should trigger. Weird nobody has referenced this spreadsheet before. Enjoy

https://docs.google.com/spreadsheets/u/0/d/1bq5NQ2JN1XW3XGtXZp8ND28GFAdbIVC_5RPWu8UkSlk/htmlview

Great spreadsheet and will really help. I can add three to your Florida list from a recent stay: Daytona Beach Hilton Resort.

Hyde Park Steakhouse – No

Doc Bales Grill – Yes

Don Rico’s Sports Bar – Yes

Great spreadsheet and will really help. I can add three to your Florida list from a recent stay: Daytona Beach Hilton Resort.

Hyde Park Steakhouse – No

Doc Bales Grill – Yes

Don Rico’s Sports Bar – Yes

Glad it helps but not my spreadsheet just found it while googling.

Thanks for the article! Tried this to get my last $50! It worked at the Albany New York Garden Inn Albany Medical Location at their Recovery Sports Grill on 11/26/25! I tried adding to the spreadsheet, but not sure it worked! Cancelling my Surpass card next month after some quarters of not earning the credit. (One I booked a Hilton stay and was told I’d be charged immediately- end of June, so I could trigger the credit, and it turns out the hotel had the final say and didn’t charge me until I checked in. I missed out on the credit and AMEX wasn’t any help.) Glad this worked for dinner to get the final credit before I cancel! Thanks.