Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

- Introduction: A 14 Day Atlantic Crossing on the Norwegian Escape

- Delta Air Lines Premium Select Experience (Premium Economy) – What has Changed?

- High Risk – I Flew to my 14 Day Cruise Departure City on Embarkation Day!

- Using Caesars Discount Plus Amex Offers and More to Lower the Cost of Cruising Norwegian

- Starlink Internet Performance on Norwegian Cruise Lines Escape Review

- Bidding for Haven and Suite Upgrades With Norwegian Cruise Lines is no Longer Cheap

- What is the Weather Like on Transatlantic Cruises. Will you get Seasick?

- Comparing the Norwegian NCL Vibe Beach Club to Spice H20 Experience

- The Impact of Time Change on Transatlantic Cruise Crossings – The good and the bad

- Family Balcony Cabin 15862 On Norwegian NCL Escape Review

- What to Expect from the free Main Dining on Norwegian Escape

- Entertainment on the Norwegian NCL Escape – Choir of Man is a Must See!

- Final Thoughts on another NCL Atlantic Crossing

Let me, right out of the gates, warn you that this long time amazing perk may be soon going away. At least the way to do it simply and cheaply may be going away. What I am talking about is the oversized value of getting the Wyndham business credit card that rewards you with instant Diamond status with the hotel chain.

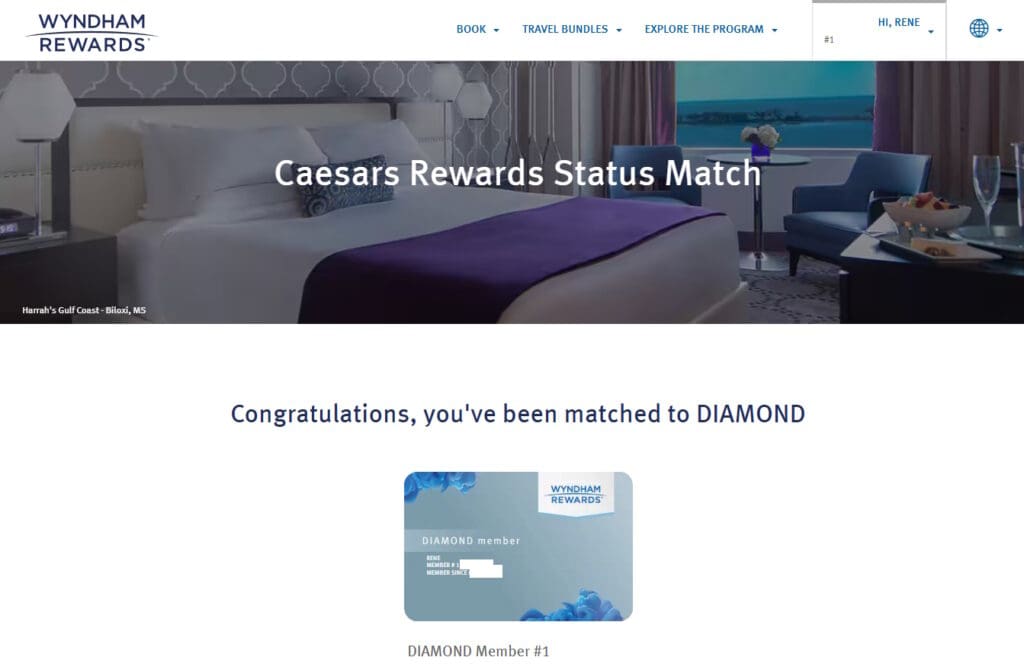

With that you have been able to match your Wyndham Diamond to Caesars Diamond without gambling one cent. As of January 1st I dropped back down to Wyndham nothing status but as you can see by the screen shot above by using my existing Caesar’s Diamond that does not expire till the end of January to get my Wyndham Diamond back in about 2 minutes time. For years now I have used the back and forth year after year to keep Diamond status with both due to the 1 month offset between the two. But as mentioned this may be coming to an end because the Wyndham site now states:

“Please note: Beginning February 1, 2025, Wyndham Rewards Platinum and Diamond members may match to Caesars Rewards only if they earned their Level by staying the necessary number of hotel nights with Wyndham. (Wyndham Rewards Platinum or Diamond members who acquired their Level solely from being a Wyndham Rewards credit cardholder will no longer be eligible to status match.)”

We shall see just how this does pan out in February when my Caesars status drops to nothing again and I attempt to match back to Diamond again. As a data point I do NOT hold the Wyndham credit card right now nor did I stay enough nights to qualify as a Diamond for 2025. So why does this matter so much to me? This is why:

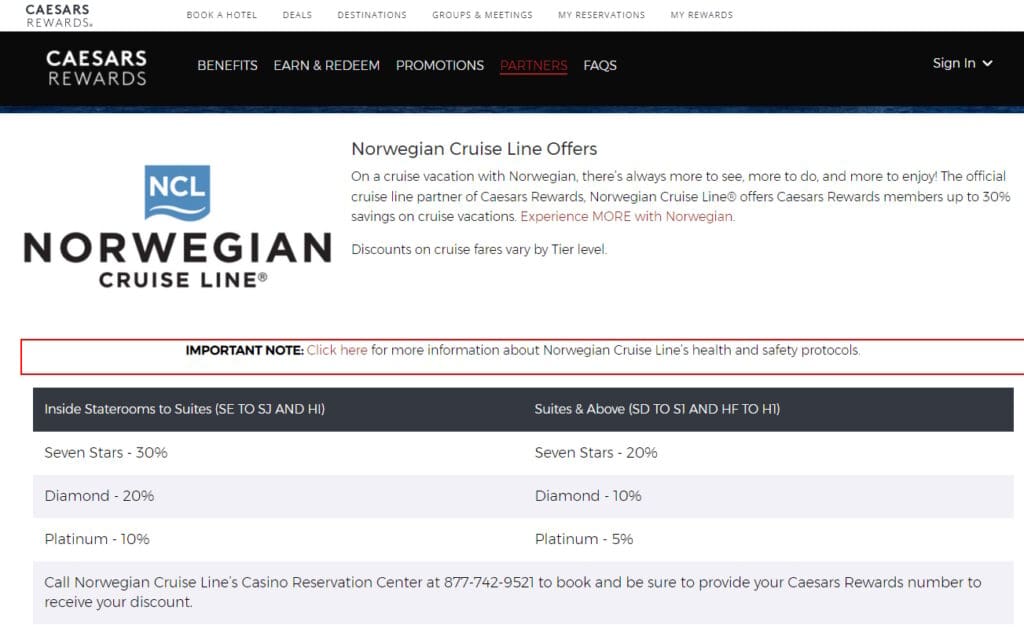

Being able to get, not just whatever sale NCL is offering, but to then get 20% off the type of cabin I most often book is a HUGE savings for me often resulting in $500-1000 (or more) discount. I hope, at least for 2025, we are able to score (no pun intended) one last year of this back and forth match bonanza! Maybe, just maybe, since I do not hold a Wyndam credit card it may be the key to keeping things going (reading the T&C).

Either way, for this post anyway, I was able to use this discount to save myself just over $450 for the Escape crossing. Not a fortune but every tiny bit helps. Next up was some help from Amex.

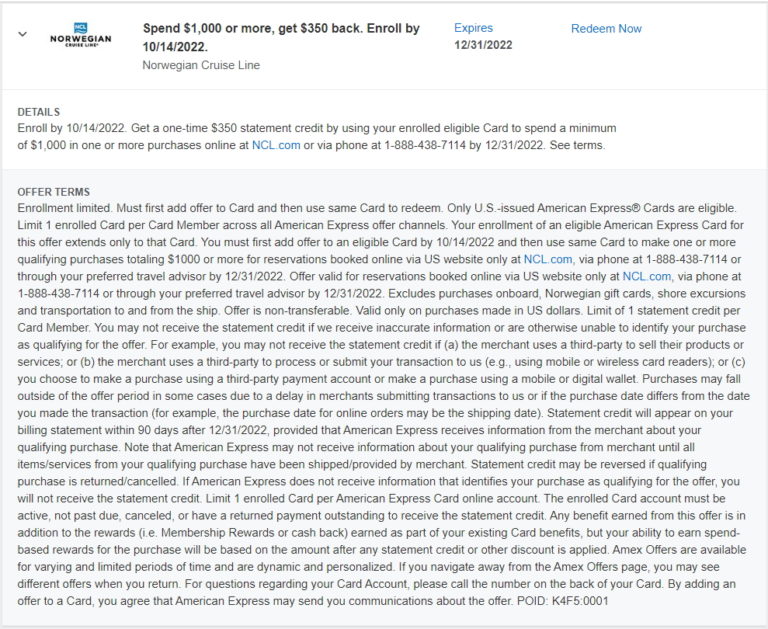

OK, the above offer is not the one I used since it clearly expired a while back. The one I used was spend $1000 on NCL and get $200 back but for some reason I never got a screen shot of the offer from Q4 of 2024 (sorry). But since you can make payments online for any amount you want I was able to use a few cards that had the offers and save even more off the cruise price.

I even was able to load $1000 onto my onboard account as fully refundable cash back and trigger yet another $200 credit thus net saving even that much more off the sailing. I actually walked off with more than $1000 cash because I ended up canceling, while onboard, one of my prepaid shore excursions we chose not to take after all.

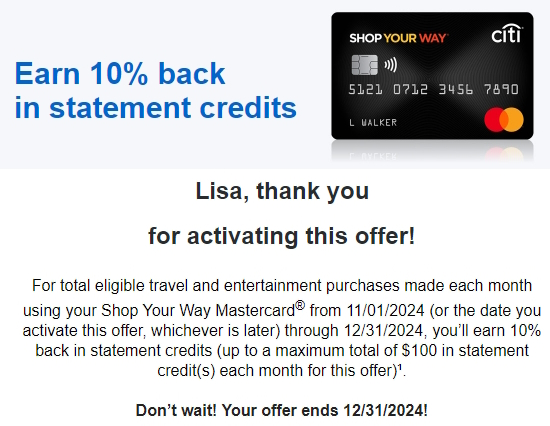

How else did I save even more? One of the hands down best cards that almost no one ever talks about is the Citi Shop Your Way card. After you hold and use the card for a while you start getting amazing offers like the one above that, much like the Amex offer saved me another $100 on my cruise for making a $1000 payment.

Lastly I always buy a few “Cruise Next” certs onboard whenever I cruise NCL because you are basically buying money at 50% off toward future cruises. I used two of the $250 ones for this cruise thus applying $500 towards the cruise for $250.

That was a lot to keep track of so let’s break if down to add up just how much was saved:

Cruise Next $250

Caesar Diamond $450

Amex Offers 2x $400

SYW Offer $100

————————————

Total Saving $1,200

That is not a bad way to lower the retail price of a $3,800 cruise down to a net of $2,600 all-in and resulting in us paying about $90 per day each for this crossing in a balcony with the drink package as well as specialty dining and more. The only thing not included in this total was our upcharge for the Vibe beach club access (more on that later) but that too was well worth it for so many sea days. – René

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Keep on cruising and letting us be a part of it through your vlog….