Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Several credit cards feature statement credits for restaurant reservations and payment platform Resy — and the perk is easier to use than you might imagine.

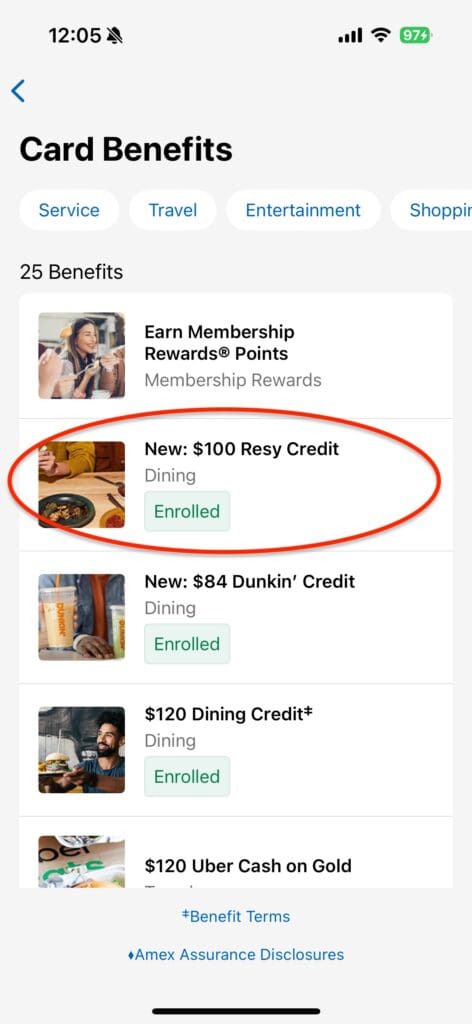

The American Express Platinum Card® is the most high-profile product now giving all cardmembers the chance to earn statement credits for eligible purchases made at restaurants participating in the Resy program.

(Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.)American Express Resy Credits

Five American Express cards offer members statement credit when they use their eligible card to pay their checks at U.S. restaurants participating in the Resy program or make other Resy purchases. (Enrollment is required and terms apply.)

- American Express Platinum Card®

- Up to $400 Resy credit each year: Earn up to $100 in statement credit each calendar quarter

- American Express® Gold Card:

- Up to $100 Resy Credit each year: Earn up to $50 in statement credit from January through June and up to $50 from July through December

- Delta SkyMiles® Reserve American Express Card

- Earn up to $240 each calendar year (up to $20 per calendar month)

- Delta SkyMiles® Platinum American Express Card

- Earn up to $120 each calendar year (up to $10 per calendar month)

- Delta SkyMiles® Reserve Business American Express Card

- Earn up to $240 each calendar year (up to $20 per calendar month)

- Delta SkyMiles® Platinum Business American Express Card

- Earn up to $120 each calendar year (up to $10 per calendar month)

How to Use the Amex Resy Credits

Unlike platforms such as InKind (which we still like and use), you don’t need to pay with the Resy app. All you need to do is ensure that you activate the feature in your Amex card’s account — and use that card to pay your tab.

Visit Resy’s website or use their mobile app to find participating restaurants nearby. Unless there’s something I’m missing, you don’t need to make reservations through Resy in order to enjoy the credit. Let me put it this way: I’ve earned hundreds of dollars in Resy credit — and only reserved a table once through Resy.

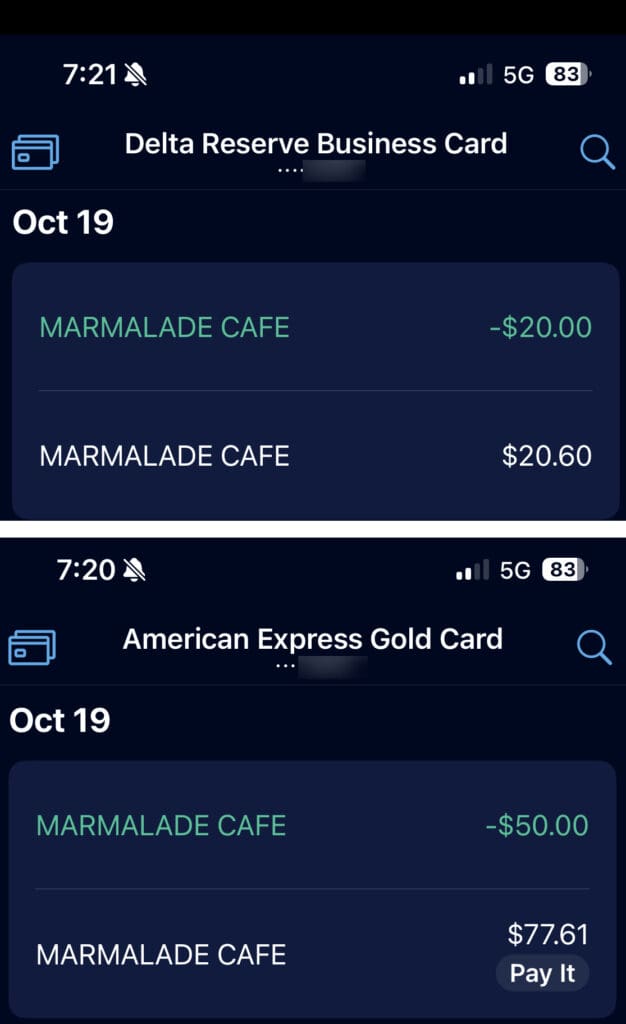

I took my wife and daughter to Marmalade Cafe in Calabasas, California. That’s a participating Resy restaurant. I split the bill using my Delta Reserve Business Amex‘s monthly $20 credit and my Amex Gold Card‘s semi-annual $50 credit.

Our total (including tax and gratuity) came to $98.21. We normally don’t splurge like that. But we decided to treat ourselves because we had Resy credits to burn. (Though we didn’t need to spend all $20 and $50, respectively, in one shot.)

Paying $28.21 out of pocket for a big lunch was certainly worth it! I also earned 312 Membership Rewards points on my Amex Gold as it awards 4X points at restaurants worldwide (on up to $50,000 per calendar year in purchases, then 1X). This includes takeout and delivery in the U.S. And I earned 21 SkyMiles. Yay.

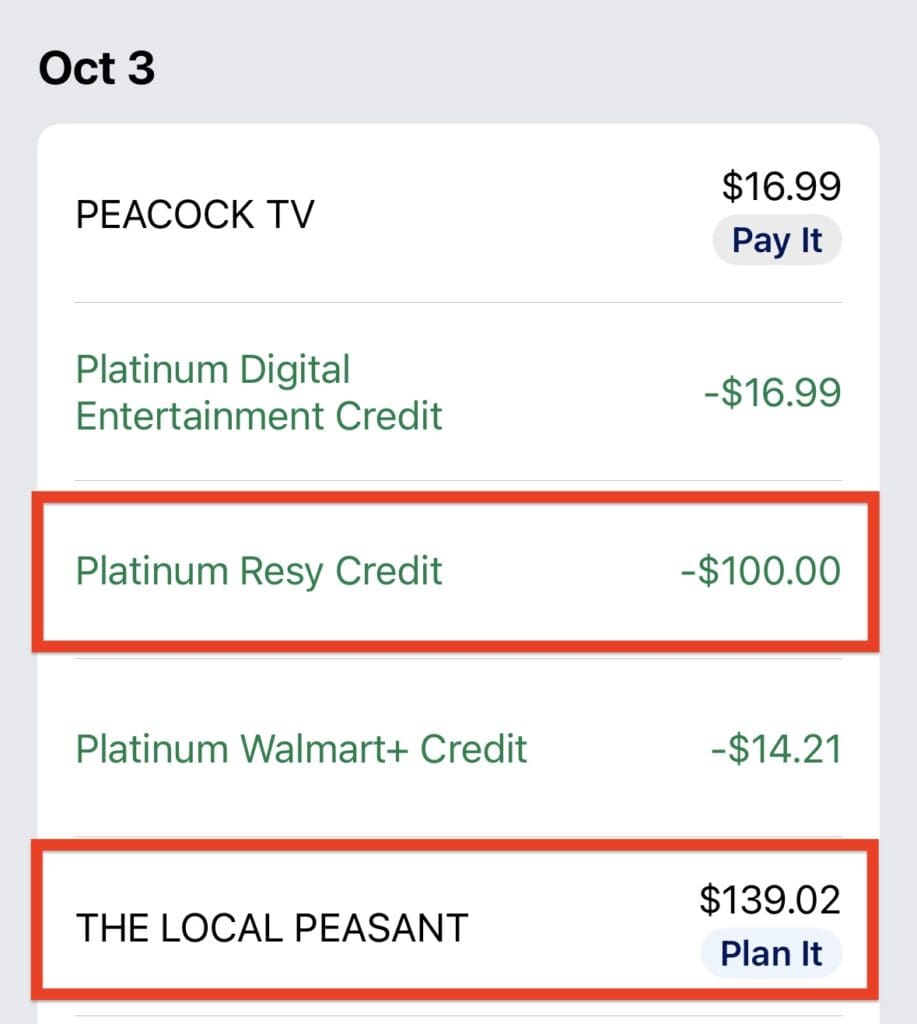

My parents recently came to visit. I took them to dinner at The Local Peasant (which makes insanely good homemade potato chips and bread pudding). My wife loved their salmon.

I paid with my Amex Platinum card.

(Not to look a gift statement credit in the mouth but it would be nice if the Amex Platinum — the lifestyle card of lifestyle cards — awarded more than a measly 1X point per buck for restaurant purchases, which fall under the “all other eligible purchases” category).

The statement credits usually take several days to show up on your account but will post for the date you made the purchase. (Keep that in mind if you’re chasing minimum spending requirements for a welcome offer, earning MQD, etc.)

Thoughts on the Resy Credit Feature

I like that there aren’t many hoops to jump through if you want to use the Resy credits. You simply pay with your enrolled card. You can also split a check across multiple cards that feature Resy credits.

But as I’ve written before, Resy’s footprint isn’t exactly impressive. My parents live in Fargo, North Dakota, and the closest Resy restaurant is probably in Minneapolis — 225 miles away. Even the Twin Cities aren’t exactly flourishing with Resy places throughout the metro area.

Some major cities have Resy restaurants scattered throughout — and that means a drive just to use the credit. But depending on your taste and budget, it might be worth it.

What do you think about the Amex Resy credits? Have you used them?

For rates and fees of the American Express Platinum Card®, please visit this link.

For rates and fees of the American Express® Gold Card, please visit this link.

For rates and fees of the Delta SkyMiles® Reserve American Express Card, please visit this link.

For rates and fees of the Delta SkyMiles® Reserve Business American Express Card, please visit this link.

For rates and fees of the Delta SkyMiles® Platinum American Express Card, please visit this link.

For rates and fees of Delta SkyMiles® Platinum Business American Express Card, please visit this link.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

Amex Gold is already my go-to for restaurant spend, and I live outside of a big city with lots of Resy restaurants. I can just organically spend money at restaurants and eventually one of them will be a Resy one.

I get it every month! One of the easiest credits to get for me.

We don’t have many Resy-participating restaurants in our town but I buy a gift card each month (online) to one of them. I plan to redeem them all for a special dinner.

We have 5 cards that get the Resy credit for a total of $80 a month. Rather than dining and splitting the ticket we take all 5 to a particpating restraunt and buy 1 $80 gift card and split the payment. We can then dine when we want or we have also given the cards away as employee incentives. It is easy at these resturants to spend the entire amount for 2-3 people so it has worked great. We have had no issues getting the credit even though we are buying gift cards.

Did you make a Resy reservation at the restaurant to purchase gift cards so that the Resy credits were applied? How does Delta know to apply the credits if not?

Thanks

No, just walked in and bought the card. Amex dosen’t care if you have a reservation or not, just that they are on the Resy list.

Thanks. My wife and I have 3 cards between us so we have been making 2 reservations for the same time and then canceling one when we get to the restaurant. We then split the bill between the cards to get credit.

Gift cards are a lot easier and can then maximize one visit to cover multiple months credits to cover the whole charge.

Amex Gold Resy credit was pretty easy to use.

I just moved to western NY and been taking day trips to museums and other places of interest. Found a Resy restaurant nearby the Erie Naval Park had had a pretty big lunch and just put the rest down as a tip so it would equal $50.

There seems to be plenty of restaurants in the area and apparently it works with takeout too, so I’ll have to try that once the credit resets in January.

This is a useless perk for (observant) Jewish customers that don’t live in New York. There are no restaurants in the program that I can eat in (ie kosher} anywhere close to Washington DC. For a year they used to give a monthly credit for any restaurant spending up to a limit. That was a worthwhile perk.

Many of these credit card perks, like Uber and Resy, are only applicable to those who live in big cities. People in small towns don’t use or even have Uber, and restaurants don’t participate in programs like Resy.

Like Christine, I have just two local, but upscale, restaurants that participate. I just by a gift card each month and then dine at our convenience. I don’t worry about the gold card benefit because it is my go to card for dining and I like the random email telling me I earned Resy credit while traveling.

To use Resy, do you have to make a reservation using the app in Internet? Or can you just walk in, eat, and pay with the “Resy” Delta card?

Just use the Resy card. Make sure to activate the benefit in your Amex account.

I live in the Midwest so very few options for me to use this credit, even if I bought a gift card. Those restaurants are several hundred miles away from me. I try to seek out those restaurants when I travel but I have not been able to use this benefit to date.

This benefit is for big cities. One town I live in has 4 restaurants. The other has 0.

This is good news! I thought they had to use Resy Pay. Can you confirm for me? Do the restaurants have to use Resy Pay? Or just be part of Resy Generally? Thank you!

I just go on Resy, find a restaurant and pay with my enrolled card. Never had a problem. Used the benefit in Los Angeles and Chicago.

I thought American Express Resy credit is $100 per quarter.

Doh! Thanks for the catch!

As a followup to the previous comment by me, online ordering through ToastTab seemed to trigger the credit, but the restaurant I ordered from had an issue with the order so the pending order got cancelled and did get credited then removed a short time later so I have to try this again. Ordering via Tock didn’t trigger, even though it was listed on Resy.

Just ate at the Southern Spoon in Nashville. Delicious btw. Wouldn’t have gone w/o the Resy credit. So, it works out for the restaurant as well. Don’t need to use Resy to reserve. The check comes… you pay…and 2 days later you get a $20 credit. (I have the Delta Reserve) Agree…this is a fantastic monthly benefit.

How was the restaurant?

I used my Amex for Resy restaurant in San Paulo, Brasil. I am wondering if that will qualify.

It shouldn’t — US restaurants only.