Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Uber and Lyft benefits have been part of many travel and cash back rewards cards for the past few years. But starting in November, some of those perks will be modified while others completely end.

Let’s take a look.

(Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.)

Uber Cash Deposits

American Express® Gold Card and American Express Platinum Card® members can both take advantage of Uber Cash deposits.

Amex Platinum Card holders enjoy Uber VIP status and earn up to $200 in Uber Cash deposits annually. Uber Cash deposits can be used for Uber rides or Uber Eats orders. The deposits are doled out in $15 amounts each month, plus a bonus $20 in December.

Meanwhile, Amex Gold Card members receive $10 in Uber Cash deposits each month.

In both instances, the Uber Cash deposits are if-used and expire at the end of each month if they’re not used. (Enrollment is required. Terms apply. To receive this benefit, you must have downloaded the latest version of the Uber App. An Amex Card must be selected as the payment method for your Uber or Uber Eats transaction to redeem the Amex Uber Cash benefit. The Amex benefit may only be used in the United States.)

You must now use an Amex Card as the payment method for your Uber or Uber Eats transaction to redeem the Amex Uber Cash benefit. For example, you might currently use a Chase Sapphire Reserve®* card to pay for any cash balance after you exhaust your Amex Uber Cash deposits (because the Chase Sapphire Reserve® earns 3X points on travel purchases after the card’s annual $300 travel statement credit is used.)

I don’t love the change — but it’s 100% understandable and fair. It’s certainly not a deal breaker for me.

Now, you don’t need to use your Amex Platinum or Amex Gold as the payment method. (Rideshare spending earns just 1X on the Amex Platinum and Amex Gold cards.) You can pay with any ole Amex card you want.

So, which card should you use for rideshare purchases? Eh, whatever one earns you the points or miles you want. If you’re chasing SkyMiles, pay with a Delta SkyMiles® American Express Card. Want Hilton points? Get a Hilton Honors American Express Card. Knock yourself out.

Keep in mind the Delta SkyMiles® Reserve American Express Card, Delta SkyMiles® Reserve Business American Express Card, Delta SkyMiles® Platinum American Express Card, and Delta SkyMiles® Platinum Business American Express Card each offer cardholders up to $10 in statement credits each month (up to $120 annually) on U.S. rideshare purchases made with Uber, Lyft, Curb, Revel, and Alto.

If you want something a little more flexible, here are a few ideas:

- The American Express® Green Card® earns 3X points on transit (which includes rideshare services, trains, taxicabs, ferries, tolls, parking, buses, and subways. All information about the Amex Green Card was collected independently by Eye of the Flyer and neither provided by nor reviewed by the card provider.)

- The Blue Cash Preferred® Card from American Express earns 3% cash back on transit purchases. (Cash back is awarded in the form of American Express Reward Dollars, which can be redeemed toward statement credit or at Amazon.com checkout. A minimum of $25 Reward Dollars may be applied toward statement credit.)

- On the business side, the The Blue Business® Plus Credit Card from American Express and Blue Business CashTM Card are decent options. The Blue Business Plus earns 2X points on each eligible purchase on up to $50,000 in purchases each year. The Blue Business Cash earns 2% cash back on each eligible purchase on up to $50,000 in purchases each year.

Lyft Pink Benefits for Chase

This depends on when you signed up for Chase’s Lyft Pink benefits. It seems several of my friends and I did at the same time, so I’m betting at least a few readers did, too.

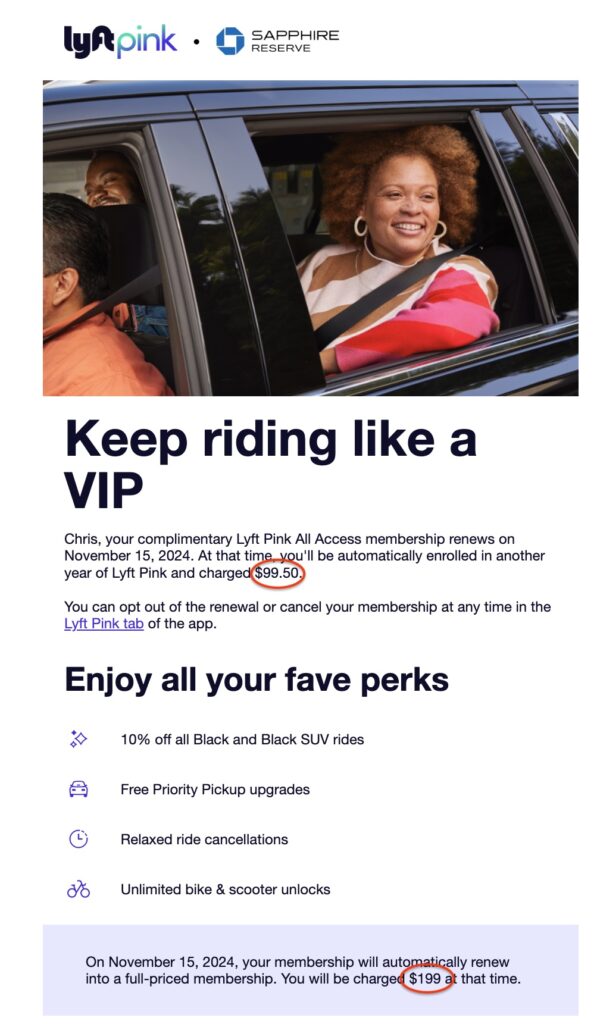

My Chase Sapphire Reserve®’s* complimentary Lyft Pink membership expires in November. I received this rather interesting email last week.

Yeah, no. I turned my renewal off. I don’t use Lyft very much; their app is buggy, and customer service is rather wonky.

Final Approach

Uber benefits changed for Amex Platinum and Amex Gold Card members. The Capital One and Uber partnership ended. And check to see if your complimentary Lyft Pink membership is about to expire.

For rates and fees of The Platinum Card® from American Express, please visit this link.

For rates and fees of The Business Platinum Card® from American Express, please visit this link.

For rates and fees of the American Express® Green Card, please visit this link.

For rates and fees of the American Express® Gold Card, please visit this link.

For rates and fees of The American Express Blue Business Cash™ Card, please visit this link.

For rates and fees of The Blue Business® Plus Credit Card from American Express, please visit this link.

For rates and fees of the Delta SkyMiles® Reserve American Express Card, please visit this link.

For rates and fees of the Delta SkyMiles® Reserve Business American Express Card, please visit this link.

For rates and fees of the Delta SkyMiles® Platinum American Express Card, please visit this link.

For rates and fees of Delta SkyMiles® Business Platinum American Express Card, please visit this link.

For rates and fees of Blue Cash Preferred® Card from American Express, please visit this link.

*All information about this card was collected independently by Eye of the Flyer. It was neither provided by nor reviewed by the card issuer.

Advertiser Disclosure: Eye of the Flyer, a division of Chatterbox Entertainment, Inc., is part of an affiliate sales network and and may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. Some links on this page are affiliate or referral links. We may receive a commission or referral bonus for purchases or successful applications made during shopping sessions or signups initiated from clicking those links.

I checked my Lyft Pink and it does not expire until Dec 2025 (enrolled 12/2023) but I cancelled the auto renew now, I rarely use Lyft so why not. Thanks for the heads up, Chris.

Question. What if I have a large balance of Uber credit. If the full fare is less than my credit balance, will Uber still pull the Amex credits? It seems like I would have to use an Amex card to trigger the credit but Does that mean looking for a short ride, use Amex and the reset to use credit balance?

I believe the Amex Cash deposits are used first and then anything else is taken from the from your other credit. Just select an Amex card as your method of payment — that’s pretty much as a backup payment source. Just make sure your reservation shows you’re paying with Uber Cash.

Lyft is awesome. It is 10x better than Uber. More reliable and usually cheaper. That said these companies are smoking crack if they think customers will pay $199 per year for a tiny discount and priority service that is maybe 1m faster if at all. I predict many Pink cancellations including me and you.

It is the same with Uber One. These companies think people are stupid. If they want to increase MRC (recurring charges) they need to provide something of real value like Amazon Prime or Netflix or even Costco.

Sssshh! Costco is crowded already! Don’t go giving anyone ideas! 😉

“Lyft is awesome. It is 10x better than Uber.”

This is interesting. I always have an easier time finding available Uber rides from my house than I do Lyft.

@CC – I am almost 100% Lyft. Cheaper and better cars.

Great post Chris! I cancelled Lyft Pink auto renewal and I added some AMEX cards to my UBER wallet: BBP and Delta Reserve X3.

Thanks! I hope it helped!